Lab-on-Chip Services Market Size (2024 – 2030)

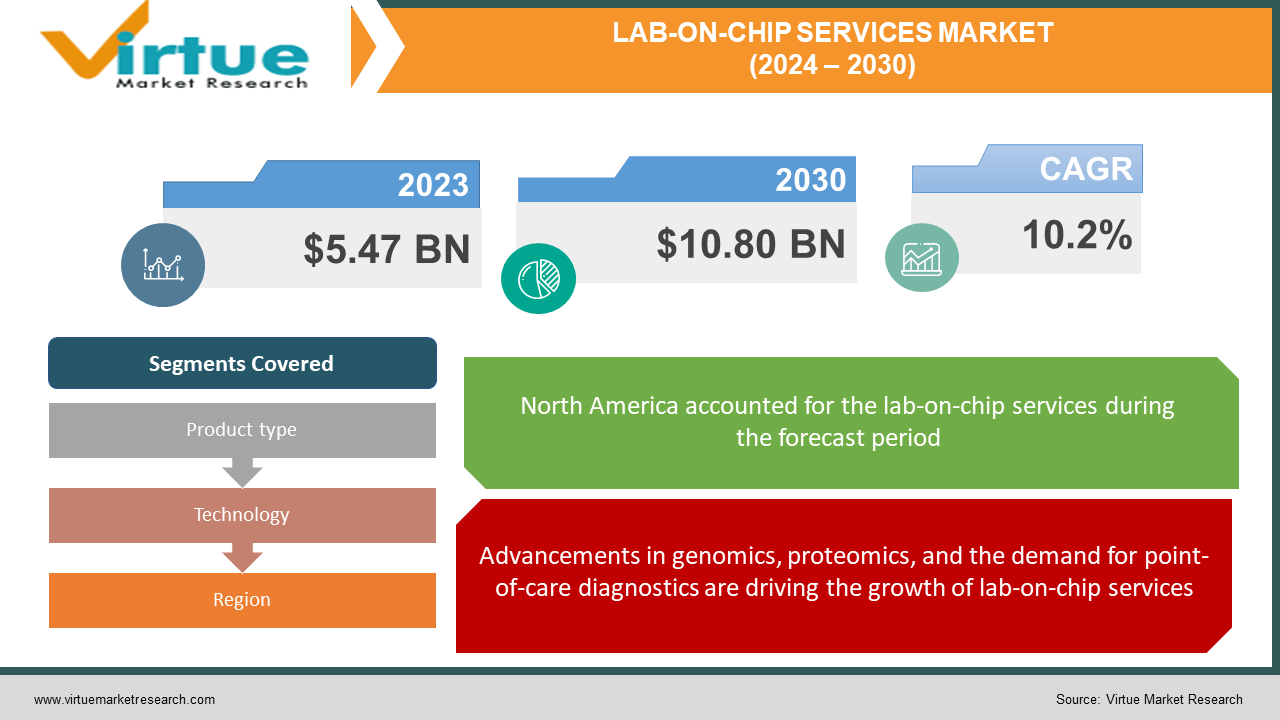

In 2023, The Lab-on-Chip Services Market was valued at $ 5.47 Billion, and is projected to reach a market size of $ 10.80 Billion by 2030. Over the forecast period of 2024-2030, market is projected to grow at a CAGR of 10.2%.

Lab-on-chip technology, often referred to as microfluidics, represents a groundbreaking advancement in the domains of diagnostics, drug discovery, and genomics and proteomics. It introduces a miniaturized platform where an array of complex laboratory functions can be seamlessly executed on a single microchip. This innovation has captured widespread attention and adoption across a range of industries, with particular relevance in healthcare and pharmaceuticals. Its ability to conduct precise and efficient tests, experiments, and analyses in a compact format not only enhances the speed and accuracy of research and diagnostics but also holds the promise of revolutionizing how we approach critical scientific and medical endeavors.

Key Market Insights:

The lab-on-chip services market is experiencing a continuous and substantial growth trajectory, propelled by several key factors. Firstly, the surging demand for point-of-care diagnostics has been a significant driver of this market. Lab-on-chip technology's ability to miniaturize and simplify complex laboratory procedures enables rapid and on-site testing, reducing the need for centralized laboratories and long waiting times. This has revolutionized the way healthcare professionals diagnose and monitor various medical conditions, making it particularly vital in scenarios where immediate results are critical, such as emergency care and remote healthcare settings.

Secondly, the rise of precision medicine has further fueled the adoption of lab-on-chip services. By enabling the analysis of individual patient's genetic and molecular profiles, this technology facilitates tailored treatment strategies, optimizing patient outcomes. It has become an indispensable tool in the quest for personalized healthcare solutions, where therapies are customized based on a patient's unique genetic makeup.

Moreover, advancements in genomics and proteomics research have benefited immensely from lab-on-chip technology. The miniaturized platform streamlines research processes, enabling high-throughput analysis and reducing the time and cost associated with large-scale experiments. This, in turn, has accelerated scientific discoveries and our understanding of diseases, opening new possibilities for drug development and disease management.

Lab-on-Chip Services Market Drivers:

Advancements in genomics, proteomics, and the demand for point-of-care diagnostics are driving the growth of lab-on-chip services.

Advancements in genomics and proteomics research, accompanied by the expanding realm of personalized medicine, are driving the demand for lab-on-chip services. These technologies empower researchers to conduct high-throughput DNA sequencing, gene expression analysis, and protein profiling with remarkable efficiency, propelling scientific discoveries and the customization of medical treatments based on individual genetic profiles. Simultaneously, the need for rapid and on-site diagnostics is spurring the adoption of lab-on-chip services, which offer user-friendly platforms for healthcare professionals to perform a range of tests at the patient's bedside, reducing turnaround times and elevating patient care. These dual forces make lab-on-chip services an indispensable component in the fields of research, diagnostics, and personalized healthcare.

The drug discovery, enabling high-throughput compound screening, biomarker identification, and cell-based assays, significantly expedited the drug development process for pharmaceutical companies.

Lab-on-chip technology has emerged as a game-changer in the realm of drug discovery. Pharmaceutical companies are harnessing the capabilities of these microchips to significantly accelerate and streamline the drug development process. This innovative technology enables high-throughput screening of potential drug compounds, expediting the identification of promising candidates for further study. Moreover, lab-on-chip platforms are instrumental in biomarker identification, facilitating the selection of precise indicators that guide drug efficacy assessments and patient responses. Additionally, cell-based assays carried out on these microchips provide an efficient and versatile means of evaluating the effects of various drug candidates on biological systems. Ultimately, lab-on-chip technology is revolutionizing the pharmaceutical industry by enhancing efficiency, reducing costs, and increasing the pace of drug discovery and development, which is particularly crucial in addressing emerging health challenges and enhancing patient care.

The increasing government support through funding, regulation, and collaborations plays a crucial role in advancing research, innovation, and market growth in the lab-on-chip services industry.

Government support plays a vital role in bolstering the lab-on-chip services market. Governments often contribute to the growth of this sector through funding initiatives for research and development, particularly in areas related to health and diagnostics. Grants, subsidies, and research incentives can help stimulate innovation and advancements in lab-on-chip technology, ensuring it remains at the forefront of scientific and medical progress. Furthermore, regulatory frameworks established by governments are essential for ensuring the safety and quality of lab-on-chip products, instilling trust in both consumers and industry stakeholders. Government agencies also often collaborate with the private sector to promote the adoption of lab-on-chip solutions in healthcare and research, which can lead to widespread acceptance and utilization of this transformative technology. Overall, government support is instrumental in driving research, innovation, and market growth in the lab-on-chip services industry.

Lab-on-Chip Services Market Restraints and Challenges:

The manufacturing complexities, regulatory hurdles, customization demands, and intellectual property concerns, while daunting, can also spur innovation and collaboration.

The lab-on-chip services market, while experiencing remarkable growth and innovation, encounters several significant challenges. Miniaturization and integration bring complexities such as the need for precise manufacturing processes, which can increase production costs. Ensuring the quality and consistency of lab-on-chip products can be a challenge, particularly when striving for mass production. Additionally, customization, while offering growth opportunities, can be resource-intensive and time-consuming. Regulatory compliance is another hurdle, as the stringent requirements to ensure safety and accuracy often lead to lengthy approval processes. The diversity of applications across different industries requires addressing specific needs, potentially limiting the scalability of lab-on-chip services. Furthermore, intellectual property concerns and the protection of proprietary technologies can impact collaboration and open innovation in the field. These challenges, while daunting, also represent opportunities for innovative solutions and collaboration among stakeholders in the lab-on-chip services market.

Lab-on-Chip Services Market Opportunities:

The continuous miniaturization of laboratory processes and the consolidation of multiple functions into a single microchip represent a profound driver for innovation and cost reduction in the lab-on-chip services market. This trend not only enhances efficiency and accuracy but also has the potential to unlock new applications and markets for these services. By shrinking complex laboratory procedures into compact, integrated systems, lab-on-chip technology is well-positioned to address emerging demands in research and diagnostics. Moreover, customization is another pivotal growth opportunity. As research and diagnostic needs become increasingly specialized, the ability to provide tailored lab-on-chip solutions that cater to specific requirements holds great potential. Service providers offering customizable chips and services are likely to gain a competitive advantage by meeting the evolving and diverse needs of their clients, underscoring the adaptability and versatility of lab-on-chip technology in driving industry growth and innovation.

LAB-ON-CHIP SERVICES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

10.2% |

|

Segments Covered |

By Product type, Technology, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Agilent Technologies, Danaher Corporation, PerkinElmer, Thermo Fisher Scientific, Illumina, Roche, Bio-Rad Laboratories, Fluidigm Corporation, Abbott Laboratories, Cepheid |

Lab-on-Chip Services Market Segmentation: By Product Type

-

Reagents & Consumables

-

Software

-

IV Needles

In the lab-on-chip services market, reagents and consumables are the dominant segment, capturing the largest market share of around 34%. These components are fundamental to the proper functioning of lab-on-chip technologies, as they encompass a wide range of materials, chemicals, and consumables required for conducting various laboratory processes. Reagents and consumables are crucial in supporting diverse applications, from DNA analysis to protein assays and point-of-care diagnostics. Their significance lies in enabling the precise and efficient execution of laboratory procedures on microchips, making them indispensable to the functionality of lab-on-chip systems. The software segment is experiencing rapid growth and is poised to play an increasingly pivotal role in the lab-on-chip services market. The expansion of this segment is driven by the growing importance of data management, analysis, and interpretation in lab-on-chip applications. Lab-on-chip technology generates copious amounts of data, and the demand for real-time analytics and data-driven insights is escalating, especially in fields like genomics, proteomics, and drug discovery. Lab-on-chip software solutions are designed to streamline data handling, enhance experimental control, and provide valuable insights, ultimately accelerating research, diagnostics, and drug development processes. This increased reliance on software for data management and analysis positions it as a primary driver of growth in the lab-on-chip services market.

Lab-on-Chip Services Market Segmentation: By Technology

-

Microarrays

-

Microfluidics

-

Tissue Biochip

-

Others

Among the various technologies in the lab-on-chip services market, microfluidics currently holds the largest market share. Microfluidics technology enables the precise control and manipulation of small volumes of fluids on microchips, making it a cornerstone of lab-on-chip systems. It is widely employed in applications like point-of-care diagnostics, cell sorting, and drug discovery due to its versatility and efficiency in handling complex biochemical processes within miniature devices. On the other hand, the microarrays segment is witnessing the fastest growth. Microarray-based lab-on-chip technology offers high-throughput capabilities, enabling the simultaneous analysis of a multitude of biomolecules, genes, or proteins, which is particularly valuable in genomics and proteomics research. The rapid advancements in microarray technology, combined with its broad applications in research and diagnostics, contribute to its robust growth in the lab-on-chip services market.

Lab-on-Chip Services Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America currently holds the largest market share. This can be attributed to the region's robust investment in research and development, well-established healthcare infrastructure, and a strong presence of pharmaceutical and biotechnology companies. Moreover, North America leads in the adoption of advanced diagnostic and research technologies, which significantly contributes to the market's growth. On the other hand, the Asia-Pacific region is experiencing the fastest growth in the lab-on-chip services market. The region's rapid economic development, coupled with a growing emphasis on healthcare and life sciences research, has propelled the adoption of lab-on-chip technologies. Additionally, the vast population in the Asia-Pacific region and increasing healthcare expenditure foster demand for efficient and cost-effective diagnostic solutions, driving the market's rapid expansion in this area.

COVID-19 Impact Analysis on the Global Lab-on-Chip Services Market:

The COVID-19 pandemic has been a catalyst for the swift integration of lab-on-chip technology in diagnostics and research. The urgent need for rapid and precise testing, particularly in the context of the pandemic, underscored the remarkable capabilities of lab-on-chip services. Consequently, the market has seen a surge in attention and investments, with heightened interest from healthcare institutions, governments, and the private sector. This accelerated adoption of lab-on-chip technology is expected to have a lasting impact, not only in addressing the current crisis but also in shaping the future of diagnostics and research, as it highlights the efficiency and adaptability of these microchip-based solutions in healthcare and life sciences.

Latest Trends/ Developments:

The lab-on-chip services market is marked by a dynamic landscape shaped by continual research and development endeavors, primarily aimed at advancing the capabilities of microfluidic platforms. As technology evolves, there is a concerted effort to make lab-on-chip systems more sophisticated, user-friendly, and adaptable to diverse applications in diagnostics, genomics, and drug discovery. This ongoing innovation encompasses the refinement of chip design, materials, and manufacturing processes to enhance precision, efficiency, and the seamless integration of multiple functions on a single microchip.

Collaborations are a driving force behind the market's progress, with partnerships forming between academic institutions, healthcare providers, and technology companies. These alliances foster the exchange of expertise, resources, and novel ideas, which are instrumental in propelling the field forward. This collaborative approach not only accelerates research and development but also facilitates the translation of lab-on-chip innovations into practical applications in healthcare, diagnostics, and life sciences.

Moreover, the integration of artificial intelligence (AI) and machine learning (ML) into lab-on-chip processes is ushering in a new era of data analysis and interpretation. AI and ML algorithms are enabling researchers and healthcare professionals to extract valuable insights from the vast amounts of data generated by lab-on-chip technologies. This data-driven approach is enhancing the accuracy and speed of diagnostics, genomics research, and drug development. The combination of AI and lab-on-chip technology offers the potential for highly efficient and personalized healthcare solutions, making it a notable area of development in the market.

Key Players:

-

Agilent Technologies

-

Danaher Corporation

-

PerkinElmer

-

Thermo Fisher Scientific

-

Illumina

-

Roche

-

Bio-Rad Laboratories

-

Fluidigm Corporation

-

Abbott Laboratories

-

Cepheid

-

In December 2021, Illumina announced the acquisition of GRAIL, a healthcare company focused on multi-cancer early detection. This strategic move is expected to further the development of lab-on-chip technologies for early cancer diagnosis.

-

In November 2021, Danaher Corporation announced the acquisition of Beckman Coulter Life Sciences, a leading provider of liquid handling automation and genomic research solutions, strengthening its position in the lab-on-chip and genomics market.

Chapter 1. Lab-on-Chip Services Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Lab-on-Chip Services Market – Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Lab-on-Chip Services Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Lab-on-Chip Services Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Lab-on-Chip Services Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Lab-on-Chip Services Market – By Product Type

6.1 Introduction/Key Findings

6.2 Reagents & Consumables

6.3 Software

6.4 IV Needles

6.5 Y-O-Y Growth trend Analysis By Product Type

6.6 Absolute $ Opportunity Analysis By Product Type, 2023-2030

Chapter 7. Lab-on-Chip Services Market – By Technology

7.1 Introduction/Key Findings

7.2 Microarrays

7.3 Microfluidics

7.4 Tissue Biochip

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Technology

7.7 Absolute $ Opportunity Analysis By Technology, 2023-2030

Chapter 8. Lab-on-Chip Services Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.1.4 By Product Type

8.1.2 By Technology

8.1.3 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product Type

8.2.3 By Technology

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product Type

8.3.3 By Technology

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product Type

8.4.3 By Technology

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product Type

8.5.3 By Technology

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Lab-on-Chip Services Market – Company Profiles – (Overview, Lab-on-Chip Services Market Portfolio, Financials, Strategies & Developments)

9.1 Agilent Technologies

9.2 Danaher Corporation

9.3 PerkinElmer

9.4 Thermo Fisher Scientific

9.5 Illumina

9.6 Roche

9.7 Bio-Rad Laboratories

9.8 Fluidigm Corporation

9.9 Abbott Laboratories

9.10 Cepheid

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Lab-on-Chip Services Market was valued at USD 4.5 billion and is projected to reach a market size of USD 9.72 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 10.2%.

The key drivers include advancements in genomics and proteomics, the demand for point-of-care diagnostics, and the application of lab-on-chip technology in drug discovery.

Diagnostics accounted for the largest share of the lab-on-chip services market in 2022, driven by the need for rapid and accurate diagnostics.

Key players in the market include Agilent Technologies, Danaher Corporation, PerkinElmer, Thermo Fisher Scientific, and Illumina, among others.

Asia-Pacific is expected to witness the fastest CAGR of about 11.5% during the forecast period, driven by increasing healthcare expenditure and growing research capabilities.