Lab-on-Chip Instruments Market Size (2024 – 2030)

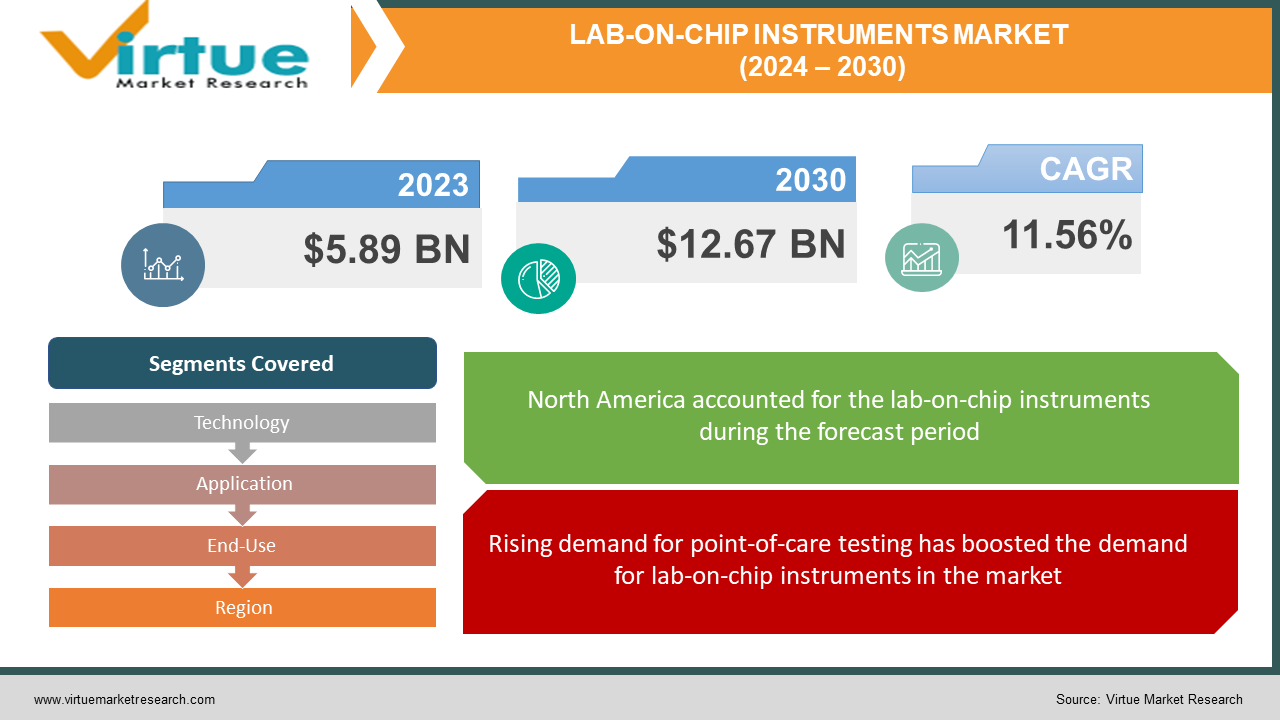

The Lab-on-Chip Instruments Market was valued at USD 5.89 billion in 2023 and is projected to reach a market size of USD 12.67 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 11.56%.

Lab-on-chip technology emerged in the early 1980s and 1990s, which was required to perform DNA analysis. Furthermore, these however included complex and big devices that required additional maintenance, resulting in increased costs. However, the advancement in nanotechnology and increased efforts in research & development of lab-on-chip instruments increased the demand for miniature, stable, and portable chip instruments that facilitated rapid testing, analysis of samples, and increased applicability in molecular biology, cell study, chemistry, and other fields. Furthermore, the future for lab-on-chip instruments holds positive with increasing advancements in biotechnology and rising trends in AI and machine learning integration in these chips, which can help in increased accuracy and efficiency in testing and monitoring.

Key Market Insights:

The Lab-on-Chip Instruments market is extremely dynamic, driven by continuous and rapid technological advancements and strong competition among the major key players. The Lab-on-Chip Instruments Market is fuelled by endless innovation, resulting in the creation of powerful, compact, and energy-efficient chips to accommodate the diverse industries’ needs.

Noteworthy trends in the market include integrating AI, IoT, and 5G technologies, growing chip demand, and strong importance being given to improving performance and energy efficiency.

These trends augment the market’s evolution and influence its course toward more advanced and sustainable solutions.

Lab-on-Chip Instruments Market Drivers:

Rising demand for point-of-care testing has boosted the demand for lab-on-chip instruments in the market.

Point-of-care testing (POCT) is increasingly demanded by patients due to its accurate and rapid results delivery, which helps healthcare professionals in deciding the appropriate treatment for the disease. Moreover, POCT reduces treatment delays and eliminates additional laboratory costs, as these devices are compact and require no laboratory settings for performing and analyzing tests. Additionally, it is widely demanded by at-home care patients to receive immediate results without the need to visit a doctor. Moreover, technological advancements in POCT devices such as integration with smart devices such as mobile applications, tablets, and other IoT medical devices, enable healthcare professionals to gain detailed insights along with treatment recommendations. Additionally, it allows them to remotely monitor patient’s health from the app, especially elderly patients through integration with wearable devices.

The increase in global health problems has boosted the demand for lab-on-chip instruments in the market.

The rise in health problems has raised the demand for lab-on-chip instruments for analyzing, monitoring, and diagnosing patients. Furthermore, this also helps biotechnicians and pharmaceutical research institutes in the research and development of vaccines, medicines, and treatment procedures. Moreover, chronic disease outbreaks such as Ebola, zika virus, coronavirus, and others have increased the need for advanced lab-on-chip instruments that assist in studying these diseases, their potential mutations, and specific markers related to these diseases. Moreover, trends in healthcare analytics have led to the development of smart lab-on-chip instruments that possess advanced algorithms such as predictive analytics that help researchers forecast the impact of potential diseases and develop preventive treatment procedures

Lab-on-Chip Instruments Market Restraints and Challenges:

Complexity in handling advanced instruments, especially those equipped with smart capabilities can result in a decline in demand for lab-on-chip instruments in the market. Some instruments may require proper knowledge and handling, which requires appropriate training. However, in the absence of this faulty testing can result in inaccurate results and affect further treatment procedures.

Furthermore, the expensive costs of some advanced instruments can result in a decline in demand for lab-on-chip instruments in the market.

Lab-on-Chip Instruments Market Opportunities:

The Lab-on-Chip Instruments Market is anticipated to deliver lucrative opportunities for businesses, which include acquisitions, partnerships, collaborations, product launches, and agreements during the forecasted period. Furthermore, increasing demand for accurate, efficient, and faster result-delivering and monitoring instruments is predicted to develop the market for lab-on-chip instruments and enhance its future growth opportunities.

LAB-ON-CHIP INSTRUMENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

11.56% |

|

Segments Covered |

By Technology, Application, End-Use, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Abbot Laboratories, Danaher, Cherry Biotech, Atmo Diagnostics, Micronit, Lab Chip Technologies, Elvesys, Microfluidic Chip Shop, Unchained Labs, Molbio Diagnostics |

Lab-on-Chip Instruments Market Segmentation: By Technology

-

Microfluidic Chips

-

PCR Chips

-

Electrophoresis Chips

-

Others

In 2023, based on market segmentation by technology, microfluidic chips occupied the highest share of about 28% in the market. These instruments are relevant for controlling and manipulating small volumes of fluids such as reagents for biochemical reactions. Moreover, the chips consist of microchannels, reservoirs, and small chambers that are made from acrylic, glass, or silicon for laboratory-related operations. Furthermore, these chips are increasingly in demand due to their miniature size these chips help in studying small fluids and chemical reactions such as biochemical analysis, chemical synthesis, DN sequencing, and others. These chips find wide applications in molecular biology, cell biology, proteomics, and others.

PCR chips are the fastest-growing segment during the forecast period. PCR or (polymerase chain reaction) chips are miniature fluidic devices that are extensively used in molecular biology for analyzing and amplifying DNA fragments. Moreover, it helps in copying DNA sequences for further study of the DNA structure. Furthermore, their miniature size and rapid temperature cycling a contributing factors towards their growth in the market, and hence find increased applications in genomics, forensics, food safety & processing, and others.

Lab-on-Chip Instruments Market Segmentation: By Application

-

Drug Discovery

-

Proteomics

-

Genomics

-

Point of Care Diagnostics

-

Others

In 2023, based on market segmentation by application, drug discovery occupied the highest share of about 35% in the market. Lab-on-chip instruments are widely used for drug discovery, as they help in analyzing and studying small and complex structures easily. Furthermore, they help in identifying new diseases, predicting the spread of the diseases, and potential drug solutions for treating the disease. These can include choosing a specific compound and analyzing its interaction with existing drugs and new formulations. Additionally, these instruments help in studying vitro and in vivo models. Further, studies based on gathered data help researchers in performing clinical trials of drugs.

Point-of-Care Diagnostics is the fastest-growing segment during the forecast period. Lab-on-chip instruments avail immediate testing of diseases or reactions at the source in emergency cases. These include testing of infectious diseases in ambulances, clinics, hospitals in remote regions, and others. Moreover, the compact and portable structure of lab-on-chip instruments has made it easier for healthcare professionals to perform tests without a laboratory setting. Furthermore, advancements in technology and increasing demand for telemedicine have led to the development of lab-on-chip instruments with smart integrations such as mobile-app integration that allow medical professionals to perform tests and remotely monitor patient’s situations.

Lab-on-Chip Instruments Market Segmentation: By End-Use

-

Hospitals & Clinics

-

Biotechnology & Pharmaceutical Companies

-

Forensic Laboratories

-

Academic & Research Institutes

-

Others

In 2023, based on market segmentation by end-use, hospitals & clinics occupied the highest share of about 37% in the market. Hospitals & clinics are the prime users of lab-on-chip instruments, as they require immediate testing of diseases at source. Additionally, these instruments help in on-site diagnosing of new diseases, point-of-care testing for infectious diseases such as during COVID-19, and help in monitoring patient’s health through integration with smart technologies.

Forensic laboratories are the fastest-growing segment during the forecast period. Lab-on-chip instruments are widely used for forensic analysis, as they help in providing accurate and rapid test reports such as DNA analysis, which include DNA amplifying, sequencing, and others; these instruments also help in performing and analyzing blood tests, their types, and other materials present in it, which can help in analyzing crime scenes. Apart from this, Lab-on-chip instruments help researchers and technicians in testing and assessing toxicity levels in the body such as inspection of toxic substances that entered into the body through food poisoning or from intoxication of substances.

Lab-on-Chip Instruments Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle-East & Africa

In 2023, based on market segmentation by region, North America occupied the highest share of about 33% in the market. Prevalence of technological advancements in healthcare and medical settings, academic & research institutes, and continuous research and development in lab-on-chip technologies have contributed to the demand for lab-on-chip instruments in the region.

Asia-Pacific witnessed the fastest growth during the forecast period. Increased government support to the healthcare sector in the form of grants, the opening of scientific research laboratories, and others; and the fast-booming biopharmaceutical industry in countries such as India, China, Japan, and others have contributed to the demand for lab-on-chip instruments in the region.

COVID-19 Impact Analysis on the Lab-on-Chip Instruments Market:

The pandemic had a positive impact on the lab-on-chip instruments market. Lab-on-chip instruments were increasingly demanded in hospitals during the pandemic. These include the use of point-of-care diagnostics devices for testing, analyzing, and monitoring the impact of the virus on the patients’ bodies. Furthermore, researchers used these instruments to understand the virus outbreak which helped them in the development of vaccines. However, due to supply chain disruptions, there was a slowdown in the distribution of lab-on-chip instruments to hospitals, which resulted in delays in diagnosis and treatment. However, this disadvantage was gradually offset by the increased use of telemedicine and telemonitoring, which allowed healthcare professionals to remotely monitor patients, and interact with individuals at home for remote consulting and testing, thereby reducing treatment delays amidst a shortage of healthcare services during the pandemic.

Latest Developments:

The market for lab-on-chip instruments is witnessing an upward trend on account of product launches, innovations in testing technologies, and rising demand for point-of-care technologies in the market.

In June 2023, Sciex launched a fully integrated microfluidic chip-based platform for drug and therapeutic development purposes. Furthermore, it is equipped with imaged capillary isoelectric focusing separation and UV detection for enhanced efficiency.

Key Players:

-

Abbot Laboratories

-

Danaher

-

Cherry Biotech

-

Atmo Diagnostics

-

Micronit

-

Lab Chip Technologies

-

Elvesys

-

Microfluidic Chip Shop

-

Unchained Labs

-

Molbio Diagnostics

Chapter 1. Lab-on-Chip Instruments Market– Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Lab-on-Chip Instruments Market– Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Lab-on-Chip Instruments Market– Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Lab-on-Chip Instruments Market- Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Lab-on-Chip Instruments Market– Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Lab-on-Chip Instruments Market– By End-Use

6.1 Introduction/Key Findings

6.2 Hospitals & Clinics

6.3 Biotechnology & Pharmaceutical Companies

6.4 Forensic Laboratories

6.5 Academic & Research Institutes

6.6 Others

6.7 Y-O-Y Growth trend Analysis By End-Use

6.8 Absolute $ Opportunity Analysis By End-Use, 2024-2030

Chapter 7. Lab-on-Chip Instruments Market– By Application

7.1 Introduction/Key Findings

7.2 Drug Discovery

7.3 Proteomics

7.4 Genomics

7.5 Point of Care Diagnostics

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Lab-on-Chip Instruments Market– By Technology

8.1 Introduction/Key Findings

8.2 Microfluidic Chips

8.3 PCR Chips

8.4 Electrophoresis Chips

8.5 Others

8.6 Y-O-Y Growth trend Analysis By Technology

8.7 Absolute $ Opportunity Analysis By Technology, 2024-2030

Chapter 9. Lab-on-Chip Instruments Market, By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By End-Use

9.1.3 By Application

9.1.4 By Technology

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By End-Use

9.2.3 By Application

9.2.4 By Technology

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By End-Use

9.3.3 By Application

9.3.4 By Technology

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By End-Use

9.4.3 By Application

9.4.4 By Technology

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By End-Use

9.5.3 By Application

9.5.4 By Technology

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Lab-on-Chip Instruments Market– Company Profiles – (Overview, By End-Use Portfolio, Financials, Strategies & Developments)

10.1 Abbot Laboratories

10.2 Danaher

10.3 Cherry Biotech

10.4 Atmo Diagnostics

10.5 Micronit

10.6 Lab Chip Technologies

10.7 Elvesys

10.8 Microfluidic Chip Shop

10.9 Unchained Labs

10.10 Molbio Diagnostics

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Lab-on-Chip Instruments Market was valued at USD 5.89 billion in 2023 and is projected to reach a market size of USD 12.67 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 11.56%.

Rising demand for point-of-care testing and an increase in global health problems are the market drivers of the Lab-on-Chip Instruments market.

Drug Discovery, Proteomics, Genomics, Point of Care Diagnostics, and Others, are the segments under the Lab-on-Chip Instruments Market by application.

North America is the most dominant region for the Lab-on-Chip Instruments Market.

Asia-Pacific is the fastest-growing region in the Lab-on-Chip Instruments Market.