Lab on Chip Market Size (2024 – 2030)

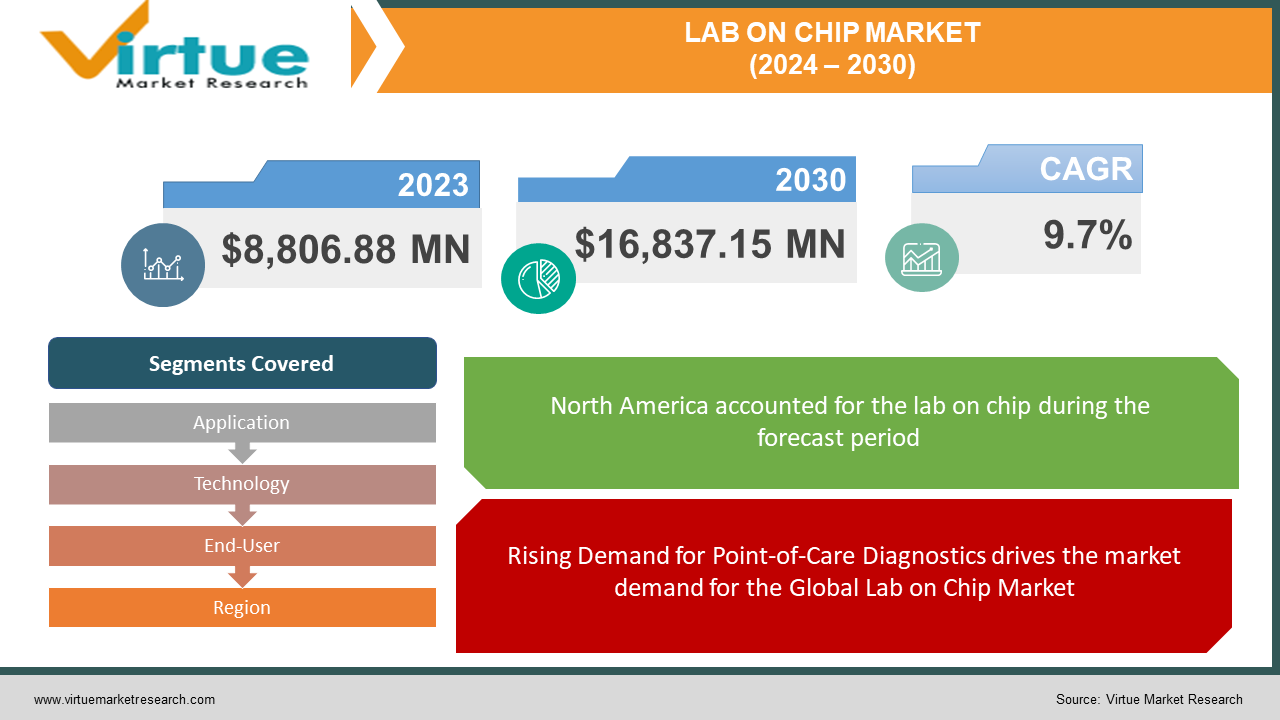

The Global Lab on Chip Market is valued at USD 8,806.88 million and is projected to reach a market size of USD 16,837.15 million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 9.7%.

The global lab-on-chip market is driven by long-term factors such as the demand for point-of-care diagnostics and short-term drivers like the increasing prevalence of chronic diseases. The COVID-19 pandemic has further accelerated the adoption of lab-on-chip technology, emphasizing its critical role in healthcare. With opportunities emerging from the integration of AI and the trend towards miniaturization and integration, the lab-on-chip industry is poised for continued growth and innovation in the years to come.

Key Market Insights:

One trend observed in the lab-on-chip industry is the miniaturization and integration of multiple functionalities onto a single chip. Advances in microfluidics, nanotechnology, and material science have enabled the development of lab-on-chip devices with enhanced capabilities and performance.

These miniaturized devices can perform various analytical tasks, such as sample preparation, mixing, separation, and detection, within a compact and portable platform. This trend towards miniaturization and integration not only improves the efficiency and accuracy of lab-on-chip devices but also reduces costs and enhances accessibility, making them suitable for a wide range of applications, including clinical diagnostics, environmental monitoring, and food safety testing.

An opportunity that holds promise for the lab-on-chip market is the integration of artificial intelligence (AI) and machine learning algorithms. By harnessing the power of AI, lab-on-chip devices can enhance data analysis, interpretation, and decision-making capabilities. This integration enables real-time monitoring, predictive analytics, and personalized healthcare solutions, thereby revolutionizing the way diseases are diagnosed and managed.

Global Lab on Chip Market Drivers:

Rising Demand for Point-of-Care Diagnostics drives the market demand for the Global Lab on Chip Market.

Technological advancements and innovation are key drivers for the lab-on-chip market. The industry continually evolves with the introduction of novel materials, manufacturing techniques, and analytical methods that enhance the performance, functionality, and usability of lab-on-chip devices. For instance, advancements in microfluidics, nanotechnology, and sensor technologies enable the development of more sensitive, selective, and cost-effective lab-on-chip platforms. Moreover, the integration of emerging technologies such as artificial intelligence (AI) and machine learning further augments the capabilities of these devices, enabling real-time data analysis, predictive modeling, and decision support.

Technological Advancements and Innovation have boosted the market for the Lab on the on-chip market.

An opportunity for the lab-on-chip market lies in the expansion of applications beyond traditional healthcare settings. While healthcare remains a primary market segment, lab-on-chip technology finds increasing utilization in diverse fields such as environmental monitoring, food safety testing, pharmaceutical research, and forensic analysis. The versatility and adaptability of lab-on-chip devices make them valuable tools for various industries seeking rapid, on-site analysis of complex samples. By exploring and addressing the specific needs of these emerging applications, stakeholders can unlock new growth opportunities and expand the market reach of lab-on-chip technology.

Expansion of Applications beyond Healthcare drives the market demand for the Global Fruit lab on-chip market.

An opportunity for the lab-on-chip market lies in the expansion of applications beyond traditional healthcare settings. While healthcare remains a primary market segment, lab-on-chip technology finds increasing utilization in diverse fields such as environmental monitoring, food safety testing, pharmaceutical research, and forensic analysis. The versatility and adaptability of lab-on-chip devices make them valuable tools for various industries seeking rapid, on-site analysis of complex samples. By exploring and addressing the specific needs of these emerging applications, stakeholders can unlock new growth opportunities and expand the market reach of lab-on-chip technology.

Global Lab on Chip Market Restraints and Challenges:

One of the primary challenges in the adoption of lab-on-chip technology is the cost associated with device development, manufacturing, and deployment. Miniaturization and integration of multiple functionalities onto a single chip often require sophisticated fabrication techniques and specialized materials, resulting in higher production costs.

The lab-on-chip market is subject to stringent regulatory requirements and quality standards governing the development, manufacturing, and commercialization of medical devices and diagnostic assays. Obtaining regulatory approvals and certifications, such as FDA clearance in the United States or CE marking in Europe, is essential for market entry and product adoption. However, navigating the regulatory landscape can be time-consuming, resource-intensive, and fraught with uncertainties, particularly for novel technologies and applications.

Global Lab on Chip Market Opportunities:

The growing demand for point-of-care diagnostics represents a significant opportunity for the lab-on-chip market. Point-of-care testing enables rapid and decentralized diagnosis of diseases at or near the patient's location, facilitating timely intervention, treatment, and management of medical conditions.

Personalized medicine, also known as precision medicine, is a rapidly growing field that aims to tailor medical treatment and interventions to individual patients based on their unique genetic makeup, lifestyle factors, and disease characteristics. Lab-on-chip technology plays a pivotal role in personalized medicine by enabling rapid and accurate analysis of biomarkers, genetic variants, and molecular signatures associated with disease risk, progression, and response to therapy.

The rise of remote monitoring and telemedicine presents new opportunities for the lab-on-chip market. Remote monitoring technologies enable continuous monitoring of patient's health status and vital signs outside traditional healthcare settings, allowing for early detection of health issues, timely intervention, and remote consultation with healthcare providers.

LAB ON CHIP MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

9.7% |

|

Segments Covered |

By Application, Technology, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Agilent Technologies, Illumina, Inc., Roche Diagnostics, Thermo Fisher Scientific Inc., Fluidigm Corporation, Bio-Rad Laboratories, Inc., PerkinElmer, Inc., Cepheid (a Danaher Corporation company), Abbott Laboratories, BioMérieux SA |

Global Lab on Chip Market Segmentation: By Application

-

Clinical Diagnostics

-

Drug Discovery & Development.

-

Life Sciences Research

-

Environmental Monitoring

-

Food Safety Testing

The largest segment in the lab-on-chip market is clinical diagnostics. Clinical diagnostics involve using lab-on-chip devices to swiftly identify diseases and health conditions in patients. These devices aid healthcare professionals in making quick and accurate diagnoses, which is crucial for timely treatment and management of various medical conditions. With the demand for rapid diagnostic solutions rising, especially in healthcare settings, the clinical diagnostics segment stands as the largest in the lab-on-chip market.

On the other hand, the fastest-growing segment in the lab-on-chip market is environmental monitoring. Environmental monitoring involves the use of lab-on-chip devices to detect and analyze pollutants, contaminants, and other environmental factors. These devices provide rapid, sensitive, and cost-effective solutions for assessing environmental quality and ensuring regulatory compliance. With increasing concerns about environmental pollution and the need for real-time monitoring solutions, the environmental monitoring segment is experiencing rapid growth in the lab-on-chip market.

Global Market Lab on Chip Market Segmentation: By Technology

-

Microfluidics

-

Electrochemical Biosensors

-

Optical Detection

-

PCR- Polymerase Chain Reaction

-

Nanotechnology

Among these technologies, microfluidics stands out as the largest segment in the lab-on-chip market. Microfluidics involves the precise manipulation and control of small volumes of fluids within microscale channels or chambers. Lab-on-chip devices utilizing microfluidic technology offer advantages such as rapid analysis, low sample volumes, and integration of multiple analytical functions onto a single platform. These devices find applications in clinical diagnostics, drug discovery, life sciences research, and environmental monitoring, driving the growth of the microfluidics segment in the lab-on-chip market.

On the other hand, nanotechnology emerges as the fastest-growing segment in the lab-on-chip market. Nanotechnology involves the manipulation and control of materials at the nanoscale to create novel functionalities and properties. Lab-on-chip devices incorporating nanotechnology offer enhanced sensitivity, selectivity, and performance, enabling applications such as biomolecular detection, disease diagnosis, and drug delivery. With ongoing advancements in nanomaterial synthesis, fabrication techniques, and device integration, the nanotechnology segment is experiencing rapid growth and innovation in the lab-on-chip market.

Lab on Chip Market Segmentation: By End-User

-

Hospitals & Clinics

-

Research Laboratories

-

Pharmaceutical & Biotechnology Companies

-

Environmental Testing Agencies

-

Food & Beverage Industry

Among these end-users, hospitals & clinics emerge as the largest segment in the lab-on-chip market. Hospitals and clinics utilize lab-on-chip devices for point-of-care diagnostics, patient monitoring, and disease management. These devices enable healthcare professionals to perform diagnostic tests rapidly and accurately, leading to timely interventions and improved patient outcomes. With the demand for rapid diagnostic solutions rising, especially in healthcare settings, the hospitals & clinics segment stands as the largest in the lab-on-chip market.

On the other hand, environmental testing agencies represent the fastest-growing segment in the lab-on-chip market. Environmental testing agencies utilize lab-on-chip devices for on-site analysis, real-time monitoring, and rapid detection of contaminants in environmental samples. These devices offer advantages such as portability, rapid analysis, and low sample volumes, making them ideal for environmental monitoring applications. With increasing concerns about environmental pollution and the need for effective monitoring solutions, the environmental testing agencies segment is experiencing rapid growth in the lab-on-chip market.

Lab on Chip Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Among these regions, North America emerges as the largest segment in the lab-on-chip market. North America is home to a robust healthcare infrastructure, leading research institutions, and a thriving biotechnology industry. With significant investments in research and development, coupled with favorable regulatory frameworks, North America remains at the forefront of lab-on-chip technology adoption and innovation.

On the other hand, the Asia-Pacific region represents the fastest-growing segment in the lab-on-chip market. Asia-Pacific is witnessing rapid economic growth, rising healthcare expenditure, and increasing demand for advanced medical technologies. Countries such as China, Japan, and India are investing heavily in healthcare infrastructure and research capabilities, driving the adoption of lab-on-chip devices in clinical diagnostics, drug discovery, and life sciences research.

COVID-19 Impact Analysis on Global Lab on Chip Market:

One significant impact of the pandemic on the lab-on-chip market is the increased demand for diagnostic testing solutions. As the virus spread rapidly worldwide, there was an urgent need for reliable and rapid diagnostic tests to detect COVID-19 infections. Lab-on-chip devices, with their ability to perform quick and accurate molecular and antigen tests, emerged as valuable tools in the fight against the pandemic. These devices enabled healthcare providers to conduct large-scale testing, screen for asymptomatic carriers, and track the spread of the virus more effectively.

Furthermore, the pandemic accelerated the adoption of point-of-care testing solutions, including lab-on-chip devices, to decentralize testing and reduce reliance on centralized laboratory facilities. Point-of-care testing became essential for diagnosing COVID-19 infections in community settings, remote areas, and healthcare facilities with limited resources. Lab-on-chip technology, with its portability, automation, and rapid turnaround time, played a crucial role in expanding access to testing and improving patient outcomes during the pandemic.

Latest Trends/ Developments:

There is a growing trend toward integrating AI and ML algorithms into lab-on-chip devices to enhance data analysis and interpretation. AI-powered lab-on-chip platforms enable intelligent pattern recognition, predictive modeling, and decision-making, improving the accuracy and efficiency of diagnostic testing.

Lab-on-chip technology is expanding beyond traditional healthcare applications to address challenges in diverse sectors such as environmental monitoring, food safety testing, agriculture, and veterinary diagnostics.

Emerging economies in regions such as Asia-Pacific, Latin America, and Africa present untapped opportunities for market expansion and growth in the lab-on-chip market. Rising healthcare spending, increasing disease burden, and government initiatives to improve healthcare infrastructure are driving demand for advanced diagnostic solutions, creating new opportunities for industry players.

Key Players:

-

Agilent Technologies

-

Illumina, Inc.

-

Roche Diagnostics

-

Thermo Fisher Scientific Inc.

-

Fluidigm Corporation

-

Bio-Rad Laboratories, Inc.

-

PerkinElmer, Inc.

-

Cepheid (a Danaher Corporation company)

-

Abbott Laboratories

-

BioMérieux SA

Chapter 1. Lab on Chip Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Lab on Chip Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Lab on Chip Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Lab on Chip Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Lab on Chip Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Lab on Chip Market – By Application

6.1 Introduction/Key Findings

6.2 Clinical Diagnostics

6.3 Drug Discovery & Development.

6.4 Life Sciences Research

6.5 Environmental Monitoring

6.6 Food Safety Testing

6.7 Y-O-Y Growth trend Analysis By Application

6.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 7. Lab on Chip Market – By Technology

7.1 Introduction/Key Findings

7.2 Microfluidics

7.3 Electrochemical Biosensors

7.4 Optical Detection

7.5 PCR- Polymerase Chain Reaction

7.6 Nanotechnology

7.7 Y-O-Y Growth trend Analysis By Technology

7.8 Absolute $ Opportunity Analysis By Technology, 2024-2030

Chapter 8. Lab on Chip Market – By End-User

8.1 Introduction/Key Findings

8.2 Hospitals & Clinics

8.3 Research Laboratories

8.4 Pharmaceutical & Biotechnology Companies

8.5 Environmental Testing Agencies

8.6 Food & Beverage Industry

8.7 Y-O-Y Growth trend Analysis By End-User

8.8 Absolute $ Opportunity Analysis By End-User , 2024-2030

Chapter 9. Lab on Chip Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Application

9.1.3 By Technology

9.1.4 By End-User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Application

9.2.3 By Technology

9.2.4 By End-User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Application

9.3.3 By Technology

9.3.4 By End-User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Application

9.4.3 By Technology

9.4.4 By End-User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Application

9.5.3 By Technology

9.5.4 By End-User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Lab on Chip Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Agilent Technologies

10.2 Illumina, Inc.

10.3 Roche Diagnostics

10.4 Thermo Fisher Scientific Inc.

10.5 Fluidigm Corporation

10.6 Bio-Rad Laboratories, Inc.

10.7 PerkinElmer, Inc.

10.8 Cepheid (a Danaher Corporation company)

10.9 Abbott Laboratories

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Lab on Chip Market is valued at USD 8,806.88 million and is projected to reach a market size of USD 16,837.15 million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 9.7%.

Rising Demand for Point-of-Care Diagnostics, Technological Advancements, Innovation, and Expansion of Applications beyond Healthcare are the market drivers of the Global Lab on Chip Market drivers.

Microfluidics, Electrochemical Biosensors, Optical Detection, PCR- Polymerase Chain Reaction, and Nanotechnology are the segments under the Global Lab on Chip Market by technology.

North America is the most dominant region for the Global Lab in the lab-on-chip market.

Asia-Pacific is the fastest-growing region in the Global Lab on Chip Market.