Knowledge Management Market size (2022 – 2030)

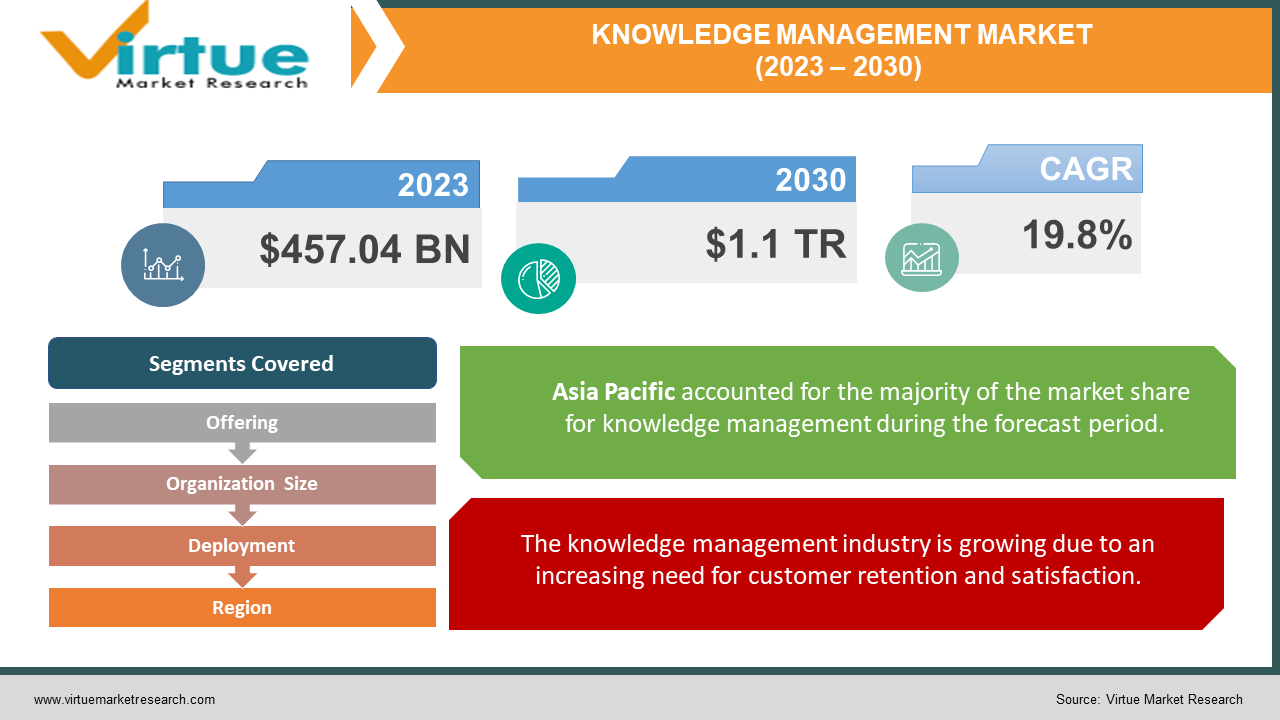

The Global market for Knowledge Management was valued at USD 457.04 billion and is projected to reach a market size of USD 1.1 trillion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 19.8%.

Market Overview

Knowledge management is the process of sharing, developing, managing, and applying information and knowledge about a certain company. In other words, knowledge management is the process of accomplishing corporate goals by maximizing the use of accessible information. Knowledge progress is made up of three primary components: knowledge generation, knowledge retention, and knowledge sharing. Getting the correct knowledge from the right person at the right time is what knowledge management is all about. Knowledge management solutions are being used by businesses to share data across the enterprise, allowing for better decision-making.

Reduced call handling time, enhanced governance, shorter training times, and more customer satisfaction are expected to drive the Knowledge Management Software Market in the coming years.

This growing tendency of companies to new technology and solutions has resulted in the development of various applications for knowledge management. With so many options, it can be challenging for businesses with limited resources and budgets to choose the best one. Knowledge management is an organizational process that collects, analyses, and shares information assets inside an organization to increase overall productivity, performance, and effectiveness.

After a detailed examination of the pandemic's commercial ramifications and the resulting economic crisis, the Mechanisms & Technologies segment's growth is revised to a revised 21.1 percent CAGR for the anticipated period. This market sector now holds 28.5 percent of the worldwide Knowledge Management market. A Knowledge Management System (KMS) is responsible for performing numerous KM responsibilities for an organization, such as the gathering, dissemination, analysis, and general management of knowledge or information, and delivering outcomes that enable the business to use it effectively and efficiently.

Covid-19 Impact on Knowledge Management Market

The COVID-19 pandemic and the resulting remote working phenomenon have given knowledge management solutions a substantial boost around the world. With remote working becoming more common, the demand for knowledge management systems is projected to grow. Despite the COVID-19 curve flattening and mass immunization programs still a long way off, most businesses are projected to stick with the work-from-home strategy for the foreseeable future. The KM systems are ideal for organizations that may be forced to work with employees from other departments in the absence of relevant staff (either due to layoff or COVID-19-related absenteeism). The pandemic also prompted numerous firms to adopt cloud-based software that allows them to be more flexible, giving those that had such technologies in place an advantage over those who transitioned later. Cloud-based knowledge management systems would enable firms to develop and exchange information in real-time with employees, allowing for greater customer service. Furthermore, as firms collect larger amounts of data, demand for knowledge management solutions is projected to rise.

MARKET DRIVERS

The knowledge management industry is growing due to an increasing need for customer retention and satisfaction.

Customer-oriented business techniques are one of the most significant competencies in businesses for assisting in the transformation of their environments to a customer-centric environment. Through knowledge management, businesses may deepen their relationships with their most important clients, resulting in loyal customers and competitive advantage. Organizations can utilize knowledge management and customer relationship management knowledge to come up with fresh ideas and deliver improved and innovative services (CRM). Customer knowledge, as part of the relationship between knowledge management and customer relationship management (CRM), could help businesses customize their products and services, as well as their entire customer relationship, to improve customer satisfaction and, ultimately, economic profitability.

Advances in technology are propelling the knowledge management industry forward

The birth and subsequent evolution of information systems opened up the possibility of gradually integrating knowledge management procedures. Data capture, storage, mining, analytics, and visualization are all made possible by digital technologies. Digital technologies that enable connectivity to improve and convey the value generated by such technologies to companies and customers. Furthermore, digital technology improvements in knowledge management look at how new and evolving digital technologies can help with knowledge management procedures both inside and outside of companies.

MARKET RESTRAINTS

The market's expansion is being hampered by a lack of awareness among small businesses.

Small firms frequently find it difficult to consider making a large financial commitment in an area that is not considered a vital component of their operations. They are nonetheless hopeful about the future potential of ICT. Knowledge management is not considered a business essential or even a priority in SMEs. SMEs struggle to develop their company value since they cannot afford to invest in knowledge management and information technology.

Regulatory Compliance and Data Privacy Concerns are increasing hence limiting market growth

The growing use of digital platforms has created worries about data security and privacy. The impact of rising cybercrime and data theft on the consumer experience is significant. While leveraging client data, customer experience solution providers must adhere to regulatory compliance. Government policies like these are likely to stifle market expansion.

This research report based on the knowledge management market is segmented and sub-segmented by Offering, organization size, deployment, and region.

Knowledge Management Market - By Offering

- Knowledge Management Process

- knowledge Management Systems

- Knowledge Management Mechanisms and Technologies

- Knowledge Management Infrastructure

Knowledge management processes, knowledge management systems, knowledge management processes and technologies, and knowledge management infrastructure have been classified by offering. From 2023 - 2030, the knowledge management process segment is predicted to grow at the fastest rate of 24.6 percent. The growing requirement to train staff and deliver the best possible service to clients is propelling the knowledge management process segment forward. The knowledge management method aids in the understanding of an organization's flow, as well as the achievement of the company's objectives and the reduction of training costs. The knowledge management process segment is estimated to reach USD 258,900 million by 2030 as a result of these factors.

Knowledge Management Market - By Organization Size

- Small and Medium Enterprises

- Large Enterprises

Based on organization size, the market is segmented into Small and Medium Enterprises and large enterprises. Small and medium businesses are predicted to develop at the fastest rate, with a CAGR of roughly 22.8 percent over the forecast period. Knowledge management solutions are in high demand in SMEs due to increased industrialization, increased competitiveness, and changing organizational structures. In addition, rising stock market trading activity and increased use of virtual currencies are likely to strengthen the knowledge management sector in the future years.

Knowledge Management Market - By Deployment

- Cloud

- On-premise

The market is divided into two categories based on deployment: cloud and on-premises. Customers can choose between cloud and on-premises solutions from market leaders. During the years 2023 - 2030, on premise solutions are predicted to increase at the quickest rate. Due to expanding regulatory compliances such as GDPR and CCPA, as well as revised needs, on-premises-based solutions are becoming more popular.

The adoption of cloud-based solutions is fuelled by SMEs' increasing use of cloud technologies.

Similarly, the increasing use of cloud-based consumer experience solutions across industry verticals such as BFSI, healthcare, retail, government, and others is predicted to drive demand, with the category rising at the fastest CAGR over the projection period.

Knowledge Management Market - By Region

The market has been divided into five regions: North America, Europe, Asia-Pacific, the Middle East, Africa, and South America. Because of its robust infrastructure and early adoption of new technology, North America is projected to have a considerable market share. Because of increased demand in many sectors and widespread acceptance of diverse management software, North America dominates the knowledge management software industry. A helpful and superior infrastructure, as well as a high tendency to learn new technologies and incorporate them into the system, are boosting the regional market.

Germany is estimated to develop at a 17.7% CAGR within Europe, while the rest of the European market (as defined in the study) will reach US$219.1 billion by the end of the analysis period. Global corporations are investing heavily in developing new ideas and tactics for competing successfully in a knowledge-based market. In North America and Europe, such inventive approaches are common, leading to the development of knowledge-intensive products and services.

China, Japan, India, Singapore, and Australia are among the potential countries in the Asia Pacific area, with strong growth rates projected in the knowledge management market. The Asia Pacific region is rapidly embracing new technologies, which is projected to drive the knowledge management industry forward.

Knowledge management market by company

Because of the growing requirement for customer retention and satisfaction, the global market for knowledge management software is estimated to increase significantly over the forecast period. In the knowledge management software industry, there are various domestic, regional, and worldwide firms competing for a major portion of the entire market. Freshworks Inc., Atlassian Corporation Plc, Exo Platform, Bitrix24 Inc., ProProfs, IBM Corporation, SAP SE, Zoho Corporation Pvt Ltd., Oracle Corporation, Capgemini SE, SkyPrep Inc., Lucidea, Again Corporation, Upland Software Inc., and Zendesk Inc. are some of these companies. MRFR examined five of the leading players in the knowledge management software market. Atlassian Corporation, IBM Corporation, Oracle Corporation, SAP SE, Capgemini SE

These companies are focused on innovation and invest in R&D to provide a cost-effective product portfolio. There have been recent mergers and acquisitions among the major companies, a technique used by businesses to expand their consumer base.

NOTABLE HAPPENING IN THE KNOWLEDGE MANAGEMENT MARKET IN THE RECENT PAST

PRODUCT LAUNCH

In 2021 September- Watson, a division of IBM Corporation, has developed Al-based intelligent Watson Assistance, which includes automation tools to assist organizations to revolutionize their customer care. It uses advanced analytics technologies to handle consumer issues with increased phone volumes.

MERGERS AND ACQUISITIONS

In June 2021, Panviva Pty Ltd, a cloud-based enterprise knowledge management solution, was bought by Upland Software, Inc. Upland has strengthened its position in the knowledge management market by acquiring Panviva, giving customers a new approach to boost contact center productivity in regulated industries including utilities, healthcare, and financial services.

In October 2020, BMC announced today the purchase of ComAround, a worldwide software firm that helps revolutionize the customer experience through self-service and AI and NLP-based advanced knowledge management technology. Using their respective industry leadership and experience in self-service, ITSM, and AI, BMC and ComAround will partner to develop NLP-based full-context-search knowledge management solutions.

Chapter 1. Knowledge management market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2.Knowledge management market – Executive Summary

2.1. Market Size & Forecast – (2022 – 2026) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-16 Impact Analysis

2.3.1. Impact during 2022 - 2026

2.3.2. Impact on Supply – Demand

Chapter 3.Knowledge management market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4.Knowledge management market - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Knowledge management market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6.Knowledge management market – By Offering

6.1. Knowledge Management Process

6.2. knowledge Management Systems

6.3. Knowledge Management Mechanisms and Technologies

6.4. Knowledge Management Infrastructure

Chapter 7.Knowledge management market – By Organization Size

7.1. Small and Medium Enterprises

7.2. Large Enterprises

Chapter 8.Knowledge management market – By Deployment

8.1. Cloud

8.2. On-premise

Chapter 9. Knowledge management market – By Region

9.1. North America

9.2. Europe

9.3. The Asia Pacific

9.4. Latin America

9.5. The Middle East

9.6. Africa

Chapter 10.Knowledge management market – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

10.1. Freshworks Inc

10.2. Atlassian Corporation Plc

10.3. Exo Platform

10.4. Bitrix24 Inc

10.5. ProProfs

10.6. IBM Corporation

10.7. SAP SE

10.8. Zoho Corporation Pvt Ltd

10.9. Oracle Corporation

10.10. Capgemini SE

10.11. SkyPrep Inc

10.12. Lucidea

10.13. Again Corporation

10.14. Upland Software Inc

10.15. Zendesk Inc

Download Sample

Choose License Type

2500

4250

5250

6900