Kitchen Towel Market size (2025-2030)

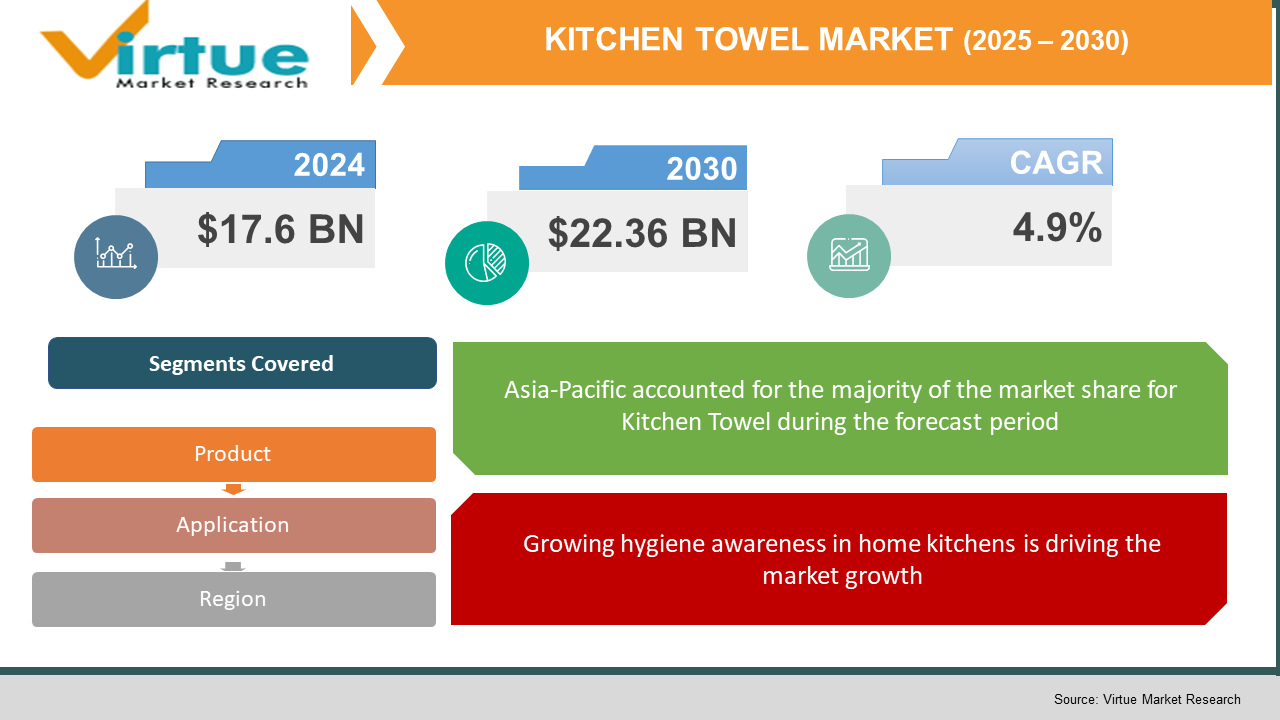

The Global Kitchen Towel Market was valued at USD 17.6 billion in 2024 and is projected to grow at a CAGR of 4.9% from 2025 to 2030. The market is expected to reach USD 22.36 billion by 2030.

Kitchen towels, typically made from paper or cloth, are widely used for cleaning, drying, and maintaining hygiene in kitchens. Their importance has grown significantly with increased attention to food safety, cleanliness, and household convenience. Consumers are increasingly choosing kitchen towels over traditional cloth wipes due to their disposability, absorbency, and hygiene benefits. As modern kitchens evolve, kitchen towels have become a staple item across homes and food-related businesses. Innovation in texture, material, and packaging is playing a major role in expanding market presence. Rising awareness around sanitation, growing urban populations, and the influence of western cooking habits are all contributing to the consistent growth of this market globally.

Key market insights:

Paper towels remain the dominant product, contributing more than 65% of global revenue due to their single-use hygiene advantage.

Cloth-based kitchen towels are gaining popularity in eco-conscious households aiming to reduce paper waste.

Residential users make up over 70% of the market, with higher demand coming from urban households and apartments.

North America currently leads in per capita usage of kitchen towels, with average households using multiple rolls per week.

Growing demand for decorative and reusable kitchen towels is driving innovation in patterns, textures, and fabric blends.

E-commerce platforms now account for over 30% of sales in urban regions, thanks to subscription models and bulk discounts.

Manufacturers are investing in biodegradable and recycled paper towels to meet sustainability goals and attract conscious consumers.

Global Kitchen Towel Market Drivers

Growing hygiene awareness in home kitchens is driving the market growth

Across the globe, there is a noticeable shift in how consumers approach hygiene in domestic kitchens. This increased awareness is largely influenced by higher media exposure to food safety guidelines, frequent coverage of foodborne illnesses, and a growing desire for cleanliness in household cooking environments. Kitchen towels have become a simple yet crucial part of maintaining a hygienic space where food is prepared and served. Unlike sponges or reusable cloths, disposable kitchen towels provide a one-time-use solution that significantly lowers the risk of cross-contamination. The rise of health-conscious families, especially those with young children or elderly members, has increased the demand for hygiene-focused products. Kitchen towels are now used not only for drying dishes but also for cleaning spills, wiping surfaces, and covering food items. The convenience and cleanliness associated with disposable towels have resulted in a steady rise in their adoption in daily kitchen routines. As hygiene continues to take center stage in consumer preferences, the use of kitchen towels is expected to grow even further, making them a consistent staple in homes around the world.

Shift in consumer preference toward convenience is driving the market growth

Modern lifestyles have seen a dramatic change in recent years, characterized by fast-paced routines, dual-income households, and smaller family units. As a result, convenience has become a central consideration for household product choices. Kitchen towels cater perfectly to this preference due to their simplicity and multifunctionality. Consumers today are looking for products that are easy to use, require little to no maintenance, and offer effective performance. Kitchen towels, particularly paper-based versions, fit these criteria exceptionally well. They eliminate the need for washing, can be disposed of quickly after use, and serve a variety of tasks such as absorbing oil, cleaning counters, or drying hands. In urban areas, where time constraints are more prominent, kitchen towels have become a must-have product in modern kitchens. This growing demand for time-saving products that simplify domestic tasks without compromising on cleanliness or effectiveness is a major factor behind the increasing adoption of kitchen towels globally. Brands are also capitalizing on this trend by introducing pre-cut, textured, and scented options to further enhance user experience and reinforce the convenience factor.

Product innovation and material diversification is driving the market growth

One of the major drivers of growth in the kitchen towel market is innovation in product design and material composition. Traditional kitchen towels were mostly utilitarian, focused purely on function. However, in recent years, brands have realized that consumers are seeking more than just absorbency—they want products that align with their values, preferences, and home aesthetics. This has led to the rise of decorative cloth towels, ultra-absorbent eco-paper alternatives, and even hybrid versions that combine the durability of fabric with the disposability of paper. Innovations in packaging, such as compostable wrappers or compact rolls for space-saving, have added more appeal. Additionally, manufacturers are now experimenting with bamboo, organic cotton, and recycled pulp to address the increasing demand for environmentally friendly products. These innovations not only meet functional needs but also resonate with a growing segment of eco-aware consumers. Customization options, such as holiday-themed towels or branded prints, are also gaining popularity, particularly in retail and gifting segments. The ability to combine utility with visual appeal and environmental consciousness gives brands an edge in a highly competitive market and encourages repeat purchases from quality-focused buyers.

Global Kitchen Towel Market Challenges and Restraints

Environmental concerns over disposability is restricting the market growth

While paper kitchen towels offer superior convenience, they also present environmental challenges. Most of these products are not recyclable, especially after being used to clean up food or grease, and they end up in landfills. This has raised serious concerns among environmentally conscious consumers who are actively seeking ways to reduce their carbon footprint. The increasing awareness around deforestation and excessive water use in paper production further exacerbates the situation. Governments and environmental groups are urging both manufacturers and consumers to reconsider the heavy reliance on disposable paper products. Although eco-friendly alternatives are emerging, they often come at a premium price, limiting their accessibility. This tension between convenience and sustainability is one of the most pressing challenges facing the kitchen towel industry. As regulations around waste disposal and plastic-free packaging tighten in several countries, companies will need to accelerate their transition to greener practices and materials. Failure to adapt could result in reputational damage or loss of market share among the growing base of eco-conscious buyers.

Price sensitivity and raw material fluctuation is restricting the market growth

The kitchen towel market, while robust, is also susceptible to pricing pressures due to the cost-sensitive nature of its core consumer base. A significant portion of the market is composed of everyday users who view kitchen towels as basic household necessities. As a result, any increase in product prices—driven by changes in raw material costs, packaging, or transportation—can quickly affect demand. Paper products in particular are affected by fluctuations in pulp prices, energy costs, and supply chain disruptions. In periods of inflation or global supply instability, manufacturers may be forced to increase retail prices or reduce product size or quality to maintain margins. This can lead to reduced consumer satisfaction and greater competition from generic or private label alternatives. Additionally, cloth-based towels, though reusable, face challenges in markets where water scarcity and washing convenience are issues. Balancing cost-efficiency while delivering quality and sustainability is a tightrope walk for most brands in this sector. The challenge lies in maintaining affordability without compromising on essential product features or long-term environmental goals.

Market opportunities

The kitchen towel market holds a wide range of opportunities that manufacturers and retailers can tap into by leveraging innovation, localization, and sustainability. One significant opportunity lies in the rising demand for environmentally friendly products. Consumers across all demographics are becoming more eco-aware, and there is a growing segment willing to pay a premium for biodegradable, compostable, or recycled kitchen towels. Brands that can offer strong environmental credentials without sacrificing performance will likely experience steady growth in the coming years. There is also an emerging market for hybrid products that blend the reusability of cloth towels with the absorbency and softness of paper. Another key opportunity exists in the branding and personalization of kitchen towels. From festive prints to customized corporate giveaways, kitchen towels are being viewed as both practical and decorative. This creates a unique space for value-added products that can serve dual purposes. In addition, the expansion of e-commerce and subscription-based home delivery services opens new doors for kitchen towel brands to build customer loyalty and encourage repeat purchases through convenient digital platforms. Developing regions present another promising growth area. As urbanization and modernization spread through Asia, Africa, and South America, demand for modern hygiene products like kitchen towels is expected to rise. Companies can focus on creating region-specific variants that cater to local tastes and household dynamics, such as multi-purpose towels that double as napkins or cleaning wipes..

KITCHEN TOWEL MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

4.9% |

|

Segments Covered |

By Product, Type, Consumption, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Kimberly-Clark, Procter & Gamble, Georgia-Pacific, SCA, Marcal Paper |

Kitchen Towel Market Segmentation

Kitchen Towel Market segmentation By Product:

• Paper kitchen towels

• Cloth kitchen towels

• Bamboo fiber towels

• Reusable hybrid towels

• Decorative or designer towels

Paper kitchen towels remain the most dominant segment in the market due to their practicality, hygiene benefits, and disposability. These towels are widely used in both homes and small commercial kitchens for their convenience in cleaning spills, absorbing grease, and wiping surfaces. Consumers appreciate their ease of use and lack of need for washing, which fits well with busy lifestyles. Although cloth and reusable options are gaining momentum, especially in eco-conscious circles, paper towels continue to lead in volume and revenue due to their affordability and widespread availability.

Kitchen Towel Market segmentation By Application:

• Residential

• Commercial kitchens

• Hospitality and food services

• Catering and event services

• Institutional use (schools, hospitals)

The residential segment holds the largest share of the kitchen towel market. Kitchen towels are an essential part of daily home cleaning and food preparation, making them a must-have item in households around the world. Increased focus on cleanliness, home cooking trends, and aesthetic kitchen setups contribute to their widespread use in the home segment. Consumers often buy them in multipacks for daily use, which sustains high repeat purchase rates. While commercial use is important, the sheer volume and frequency of residential consumption keep this segment in the lead.

Kitchen Towel Market Regional segmentation

• North America

• Europe

• Asia-Pacific

• South America

• Middle East and Africa

The Asia-Pacific region has emerged as the dominant force in the kitchen towel market and is expected to continue leading through 2030. Several factors contribute to this region’s dominance. Firstly, rapid urbanization and rising incomes have led to an increase in modern housing units where western kitchen practices are being adopted. Consumers are shifting from traditional cleaning cloths to disposable kitchen towels for better hygiene and convenience. The growing influence of global lifestyle trends, including increased home cooking and attention to kitchen decor, is also driving adoption. Moreover, awareness about food safety and cleanliness is rising due to educational campaigns and exposure to international media. The sheer size of the population in countries like China and India, combined with an expanding middle class, provides a large customer base. Multinational and regional manufacturers are increasingly setting up operations in Asia-Pacific to serve this high-potential market cost-effectively. Local production lowers retail prices and improves availability, making kitchen towels more accessible to a broader population. Additionally, innovations in smaller roll sizes and affordable multipacks are tailored specifically to regional preferences and budget sensitivities.

COVID-19 Impact Analysis on the Kitchen Towel Market

The COVID-19 pandemic had a profound impact on the kitchen towel market, altering both supply chains and consumer behavior. In the early months of the pandemic, there was a surge in demand for hygiene products, including kitchen towels. Panic buying and stockpiling led to temporary shortages, especially in paper-based kitchen towel segments. Consumers were highly focused on cleanliness, disinfecting surfaces frequently, and maintaining strict kitchen hygiene, which contributed to a sharp rise in usage. Kitchen towels, being disposable and safe for single use, were seen as essential items during this time. On the supply side, disruptions in manufacturing and transportation led to delayed shipments and limited availability in some regions. Many companies faced challenges in sourcing raw materials such as wood pulp and packaging components. These supply constraints led to price volatility, particularly in the paper towel segment. Some manufacturers also had to limit their product variety to focus on high-demand SKUs, reducing innovation temporarily. However, as the initial panic subsided, consumer behavior began to normalize but with a new baseline of elevated hygiene awareness. The habit of using kitchen towels for more than just spill-cleaning persisted, with people now using them for food handling, covering items, and regular disinfecting. This shift helped sustain strong demand even after restrictions eased. Additionally, increased online shopping accelerated the shift to digital platforms for household essentials, which benefited kitchen towel brands with strong e-commerce presence. With growing concern over excessive waste from disposable products, consumers began seeking out reusable or biodegradable options, leading to a small but growing shift toward sustainable kitchen towels. Overall, COVID-19 accelerated consumer education around hygiene, boosted trial and adoption of kitchen towels, and created opportunities for brands to innovate and connect with a more health-conscious audience.

Latest trends/Developments

One of the most notable trends is the growing demand for eco-friendly kitchen towels. Consumers are increasingly looking for biodegradable, compostable, or reusable options made from materials like bamboo, organic cotton, or recycled paper. Brands are responding by launching green product lines and eliminating plastic packaging in favor of paper wraps or compostable materials. Design and aesthetics are also becoming important. Kitchen towels are no longer just functional items; they are seen as part of kitchen decor. Consumers are purchasing printed, embroidered, or themed towels to match their kitchen style or celebrate holidays. This has led to the rise of decorative kitchen towels that serve both functional and visual purposes. Digital transformation is reshaping distribution as well. E-commerce platforms and subscription services are gaining popularity, offering consumers the ability to schedule regular deliveries of their preferred kitchen towel brands. Retailers are using AI and data analytics to recommend bundle packs, offer discounts, and track consumer preferences. Another emerging trend is the customization of kitchen towels for gifting or branding purposes. Businesses and hospitality providers are using branded kitchen towels as promotional items, while consumers are purchasing personalized towels for special occasions like housewarmings or weddings. On the technological front, innovation in absorption technology and strength is improving product performance. Hybrid towels that combine the reusability of fabric with the absorbency of paper are also gaining ground.

Key Players:

- Kimberly-Clark

- Procter & Gamble

- Georgia-Pacific

- SCA

- Marcal Paper

- Renova

- Seventh Generation

- Essity

- Presto!

- Tork

Chapter 1. Kitchen Towel Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary source

1.5. Secondary source

Chapter 2. KITCHEN TOWEL MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. KITCHEN TOWEL MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. KITCHEN TOWEL MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. KITCHEN TOWEL MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. KITCHEN TOWEL MARKET – By Product

6.1 Introduction/Key Findings

6.2 Paper kitchen towels

6.3 Cloth kitchen towels

6.4 Bamboo fiber towels

6.5 Reusable hybrid towels

6.6 Decorative or designer towels

6.7 Y-O-Y Growth trend Analysis By Product

6.8 Absolute $ Opportunity Analysis By Product , 2025-2030

Chapter 7. KITCHEN TOWEL MARKET – By Application

7.1 Introduction/Key Findings

7.2 Residential

7.3 Commercial kitchens

7.4 Hospitality and food services

7.5 Catering and event services

7.6 Institutional use (schools, hospitals)

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. KITCHEN TOWEL MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Product

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Product

8.2.3. By Application

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Product

8.3.3. By Application

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Product

8.4.3. By Application

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Product

8.5.3. By Application

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. KITCHEN TOWEL MARKET – Company Profiles – (Overview, Product Type , Portfolio, Financials, Strategies & Developments)

9.1 Kimberly-Clark

9.2 Procter & Gamble

9.3 Georgia-Pacific

9.4 SCA

9.5 Marcal Paper

9.6 Renova

9.7 Seventh Generation

9.8 Essity

9.9 Presto!

9.10 Tork

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market was valued at USD 17.6 billion in 2024 and is projected to reach USD 22.36 billion by 2030

Key drivers include hygiene awareness, convenience-oriented lifestyles, and innovation in eco-friendly materials.

The market is segmented by product (e.g., paper, cloth, bamboo) and by application (residential, commercial, institutional).

Asia-Pacific is the dominant region due to urbanization, rising income, and changing hygiene habits.

Leading players include Kimberly-Clark, Procter & Gamble, Georgia-Pacific, SCA, Marcal Paper, and others.