Kale Greens Produce Market Size (2024 – 2030)

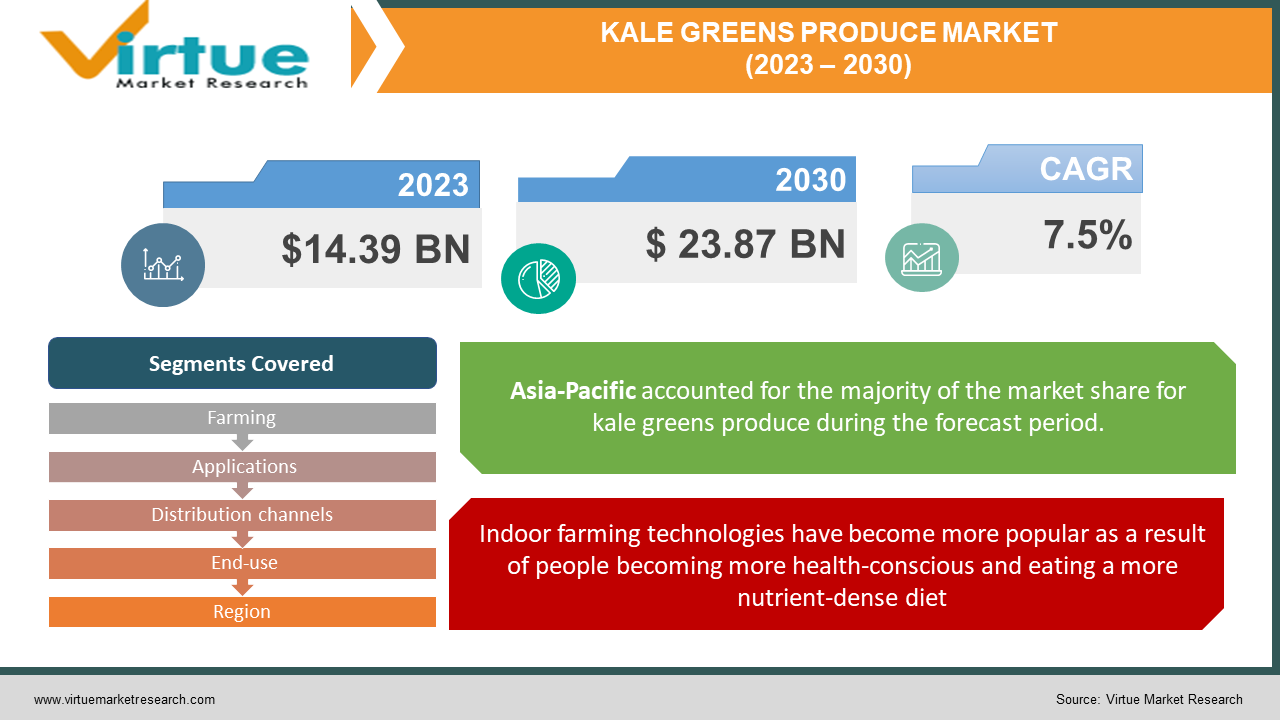

The Kale Green produce Market was valued at USD 14.39 billion in 2023 and is projected to reach a market size of USD 23.87 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7.5%.

Raw leafy greens, such as kale, are harvested before their cotyledon leaves fully form. They are used as a food supplement, a cosmetic enhancer, and to improve flavor and texture. A variety of cuisines can benefit from the sweetness and spiciness that microgreens bring. Unlike "baby greens," which are larger, microgreens are eaten as soon as they sprout instead of when the plant has flowered and produced many leaves. Kale microgreens are highly loved by both home cooks and chefs. It is also inexpensive and develops quickly. This is the reason it is so well-liked in the catering business, where it adds a citrus and spicy flavor to food. Throughout the forecast period, the kale microgreens market is expected to be driven by many factors, including rising expenditure on upscale meals, functional and nutritious foods, and the growth of indoor vertical and greenhouse farming.

Key Market Insights:

Throughout the projection period, the kale Microgreen market is expected to develop at a high rate due in part to the increased popularity of indoor vertical farming and greenhouse farming. Additionally, growing consumer awareness of the importance of eating fresh, high-quality food and expanding the use of microgreen kale in the personal care sector is anticipated to propel market expansion. However, the kale microgreen market's expansion is being constrained by hefty initial investments, high manufacturing costs, and a dearth of distribution channels.

Leafy greens like kale microgreens are edible. Its many health advantages make it simple to grow and consume. Nutrients include vitamins A, B6, C, E, and K, minerals, and carotenoids are abundant in kale microgreens. Throughout the projection period, the market will rise at a faster rate because of the rising demand for nutrient-dense foods and advancements in indoor vertical farming technology.

Kale Greens Produce Market Drivers:

Indoor farming technologies have become more popular as a result of people becoming more health-conscious and eating a more nutrient-dense diet.

People are consuming a more nutrient-dense diet because they are increasingly worried about their health, which has prompted the introduction of indoor farming technologies. Customers engage in indoor gardening not just in their homes but also in huge greenhouses. As a result, the kale market is probably going to expand during the coming years.

As a result of the growing use of covered cultivation, the market has grown somewhat. The output of greenhouse vegetables, particularly kale, has been steadily rising in Canada for the past few decades, and this expansion trend is expected to continue for some time to come. The industry for kale is expanding as a result of greenhouse technology's success. Consequently, as demand has grown, revenue has stayed consistent, which has aided in market expansion.

High-end recipes employ kale as a fresh flavoring ingredient. It's becoming one of the most widely used ingredients in upscale dining establishments.

Fine-dining recipes employ kale as a fresh flavoring. In upscale restaurants, it has grown to be one of the most sought-after ingredients. The National Restaurant Association predicts that kale will influence future vegetable purchase behaviors among consumers. Due to its versatility in recipes ranging from cooked greens to salads to juicing, kale is a great choice for cross-merchandising. Use croutons, salad dressing, sea salt, vinegar, and juicing supplies to cross-promote kale. Because it is traditionally served boiling green, ale is a filling side dish for winter meals. Kale is a healthier base for Christmas salads, so include it in your advertising. To attract health-conscious customers, highlight kale with other nutritious meals in your New Year's promotions.

There are many health advantages of kale, which is especially helpful in the modern world when people's physical and emotional well-being are negatively affecting their health.

Kale is a "powerhouse" vegetable high in nutrients, providing ≥10% of the daily required intake of 17 vital elements. It also has nutrients that can help with weight control, heart health, eye health, and other areas. Kale is one of the most nutrient-dense leafy greens available, full of vital vitamins and antioxidants. Vitamin C, found in kale, has been demonstrated to combat cancer. Moreover, it has a lot of vitamin A, which supports healthy skin and hair. Compared to beef, kale offers more iron per calorie. For the liver to function properly, iron is necessary. Omega-3 fatty acids, which have been demonstrated to lessen inflammation, are also present in kale. A portion of 3 1/2 ounces of kale has 53 calories and nearly double the recommended daily allowance of vitamins A and C.

Kale Greens Produce Market Restraints:

Grown both organically and non-organically, kale is a rare and luxurious vegetable with limited usage at home.

When it comes to residential use, kale is a rare and luxurious vegetable that can be cultivated both organically and artificially. Restaurants of a higher caliber also use it to present their food well and showcase their upscale menu items. Its lack of widespread knowledge among the general public may also limit its market demand, albeit the force may not be that great. An additional market constraint is shorter shelf lives. Kale green is harder to store because of its shorter shelf life.

KALE GREENS PRODUCE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

7.5% |

|

Segments Covered |

By Farming, Applications, Distribution channels, End-use, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

True Leaf Market Seed Comp, Farmbox Greens, AeroFarms, The Chef's Garden Inc.,Goodleaf Farms, Gotham Greens, Madar Farms, 2BFresh, Bowery Farming, Inc. |

Kale Greens Produce Market Segmentation: By Farming

-

Indoor vertical farming

-

Commercial Greenhouse

-

Others

The market for kale microgreens is expected to increase during the projected period due in large part to the increasing popularity of indoor vertical farming and greenhouse farming. The market is anticipated to develop as a result of growing consumer awareness of the importance of eating fresh, high-quality food and the use of kale microgreens in the personal care sector. However, the market for microgreen kale is growing slowly because of large initial investments, high production costs, and a lack of distribution channels.

Kale Greens Produce Market Segmentation: By Applications

-

Personal care Industry

-

Restaurants

-

Aquaponics

Kale leaf extracts find usage in the personal care business. Because kale leaf extracts have anti-inflammatory and antioxidant qualities, several cosmetic companies use them in a range of products. Both the growth of the aquaponics sector and the rise in demand for organic vegetables will be advantageous to the kale microgreens market. Chefs are finding kale to be a new gourmet ingredient that can be added to salads or used as an edible garnish to add some zing to a variety of recipes. Microgreens made from kale are a favorite among both home cooks and chefs. It is also fairly priced and develops quickly. This is the reason it is so well-liked in the catering business, where it adds a citrus and spicy flavor to food.

Kale Greens Produce Market Segmentation: By Distribution channels

-

Retail stores

-

Farmer’s Market

-

Grocery stores

-

Online

The application-based segments of the global kale market are divided into franchised stores, internet retailers, supermarkets, and shopping centers. Supermarkets and shopping centers make up the largest application segment, and they are anticipated to expand faster than other applications over the projection period. By 2030, online retailers are predicted to have a sizable portion of the industry due to their rapid growth. For the duration of the projection, franchised stores are anticipated to expand faster than the other application categories. This is a result of both the growing demand for functional foods in this market sector and the growing popularity of healthy eating among consumers. Throughout the forecast period, the online shop segment is anticipated to develop at the fastest rate. This is because people are becoming more aware of the benefits of eating healthily and because there is a growing market for functional foods. The rising global adoption of smartphones and internet access is another factor contributing to the expansion of online retailers.

Kale Greens Produce Market Segmentation: By End-use

-

Residential

-

Commercial

As for the commercial Fine-dining recipes employ kale as a fresh flavoring. In upscale restaurants, it has grown to be one of the most sought-after ingredients. The National Restaurant Association predicts that kale will influence future vegetable purchase behaviors among consumers. Of the chefs surveyed, 51% predicted that kale would be a popular trend in restaurants this year. Cherry Lane Farm started supplying kale to Iowan chefs in 2016, and as of right present, it supplies more than 14 US eateries. Demand is expected to rise due to the growing acceptance of microgreens in the food industry and an increase in supply for the lodging industry.

Kale is a "powerhouse" vegetable high in nutrients, providing ≥10% of the daily required intake of 17 vital elements. It also has nutrients that can help with weight control, heart health, eye health, and other areas. Kale is one of the most nutrient-dense leafy greens available, full of vital vitamins and antioxidants. Vitamin C, found in kale, has been demonstrated to combat cancer. Moreover, it has a lot of vitamin A, which supports healthy skin and hair.

Kale Greens Produce Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The Kale green market research encompasses several significant regions, namely Asia Pacific, North America, Europe, Latin America, and the rest of the world. The market for kale microgreens was led by North America holding a market share of around 30%, and this trend is anticipated to continue for the duration of the projected period. Throughout the projected period, the United States is anticipated to maintain its significant market share in North America. Due to factors including the increasing advancement of indoor vertical farming technology, Europe is anticipated to expand at the greatest compound annual growth rate (CAGR) during the projection period.

Globally, there is a huge need for leafy crops grown vertically. In 2019, the market income shares of all leafy vegetables—lettuce, spinach, kale, rocket, chard, chives, and mint—accounted for more than 30% of all crops. According to projections, the segment with the largest CAGR during the forecast period will be lettuce. The ability to economically grow lettuce in both large- and small-scale vertical farms for the general public is credited with the increase. Additionally, in the regulated atmosphere of indoor vertical farms, the cultivation period for all leafy crops is relatively short. Because of this, farmers can draw in customers by offering such leafy vegetables at a lower average price in the market.

COVID-19 Impact Analysis on the Kale Greens Produce Market:

The growth of the kale microgreens industry has slowed because of the COVID-19 epidemic. Due to a disrupted supply chain and the closure of restaurants and grocery stores, which are essential hubs for the distribution of kale and end users, sales of microgreens have drastically decreased. The COVID-19 epidemic has made people more health-sensitive, which has altered their purchasing behavior. Customers are requesting more kale since it strengthens the immune system. As global constraints start to loosen, producers now have the chance to match customer demand and seize a sizable share of the market.

The demand for produce raised vertically has increased in part due to the COVID-19 pandemic outbreak. Global supply networks have seen significant disruptions ever since the COVID-19 epidemic. The crops cultivated in the fields using conventional farming methods are thereby becoming garbage. Customers are choosing to purchase food raised vertically because of the associated benefits of freshness, safety, and reduced human contact during the crop-growing and harvesting processes on these farms.

Key Players:

-

True Leaf Market Seed Comp

-

Farmbox Greens

-

AeroFarms

-

The Chef's Garden Inc.

-

Goodleaf Farms

-

Gotham Greens

-

Madar Farms

-

2BFresh

-

Bowery Farming, Inc.

Chapter 1. Kale Greens Produce Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Kale Greens Produce Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Kale Greens Produce Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Kale Greens Produce Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Kale Greens Produce Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Kale Greens Produce Market – By source

6.1 Introduction/Key Findings

6.2 Plant-based Amino acid

6.3 Animal-based Amino acid

6.4 Chemical synthesis

6.5 Y-O-Y Growth trend Analysis By source

6.6 Absolute $ Opportunity Analysis By source, 2024-2030

Chapter 7. Kale Greens Produce Market – By Type

7.1 Introduction/Key Findings

7.2 Essential amino acid

7.3 Non-essential amino acid

7.4 Y-O-Y Growth trend Analysis By Type

7.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 8. Kale Greens Produce Market – By Application

8.1 Introduction/Key Findings

8.2 Health-care products

8.3 Medicine

8.4 Others

8.5 Y-O-Y Growth trend Analysis By Application

8.6 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. Kale Greens Produce Market – By Component

9.1 Introduction/Key Findings

9.2 Lysine

9.3 Glutamic acid

9.4 Valine

9.5 Leucine

9.6 Isoleucine Y-O-Y Growth trend Analysis By Component

9.7 Absolute $ Opportunity Analysis By Component, 2024-2030

Chapter 10. Kale Greens Produce Market , By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.1.4 By source

10.1.1.5 By Component

10.1.2 By Application

10.2 By Type

10.2.1 Countries & Segments - Market Attractiveness Analysis

10.3 Europe

10.3.1 By Country

10.3.1.1 U.K

10.3.1.2 Germany

10.3.1.3 France

10.3.1.4 Italy

10.3.1.5 Spain

10.3.1.6 Rest of Europe

10.3.2 By source

10.3.3 By Type

10.3.4 By Application

10.3.5 By Component

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 Asia Pacific

10.4.1 By Country

10.4.1.1 China

10.4.1.2 Japan

10.4.1.3 South Korea

10.4.1.4 India

10.4.1.5 Australia & New Zealand

10.4.1.6 Rest of Asia-Pacific

10.4.2 By source

10.4.3 By Type

10.4.4 By Application

10.4.5 By Component

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 South America

10.5.1 By Country

10.5.1.1 Brazil

10.5.1.2 Argentina

10.5.1.3 Colombia

10.5.1.4 Chile

10.5.1.5 Rest of South America

10.5.2 By source

10.5.3 By Type

10.5.4 By Application

10.5.5 By Component

10.5.6 Countries & Segments - Market Attractiveness Analysis

10.6 Middle East & Africa

10.6.1 By Country

10.6.1.1 United Arab Emirates (UAE)

10.6.1.2 Saudi Arabia

10.6.1.3 Qatar

10.6.1.4 Israel

10.6.1.5 South Africa

10.6.1.6 Nigeria

10.6.1.7 Kenya

10.6.1.8 Egypt

10.6.1.9 Rest of MEA

10.6.2 By source

10.6.3 By Type

10.6.4 By Application

10.6.5 By Component

10.6.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Kale Greens Produce Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Ajinomoto Co., Inc.

11.2 KYOWA HAKKO BIO CO., LTD.

11.3 AMINO GmbH

11.4 Bill Barr & Company

11.5 IRIS BIOTECH GMBH

11.6 BI Nutraceuticals

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Kale Green produce Market was valued at USD 14.39 billion in 2023.

The key market restraints are the short shelf life and luxury status of Kale Green.

Kale is a "powerhouse" vegetable high in nutrients, providing ≥10% of the daily required intake of 17 vital elements.

The top 5 key players are Leaf Market Seed Comp, Farmbox Greens, AeroFarms, The Chef's Garden Inc., and Goodleaf Farms.

Over 2024-2030, the market is projected to grow at a CAGR of 7.5 %.