Jigs & Fixtures Market Size (2024 – 2030)

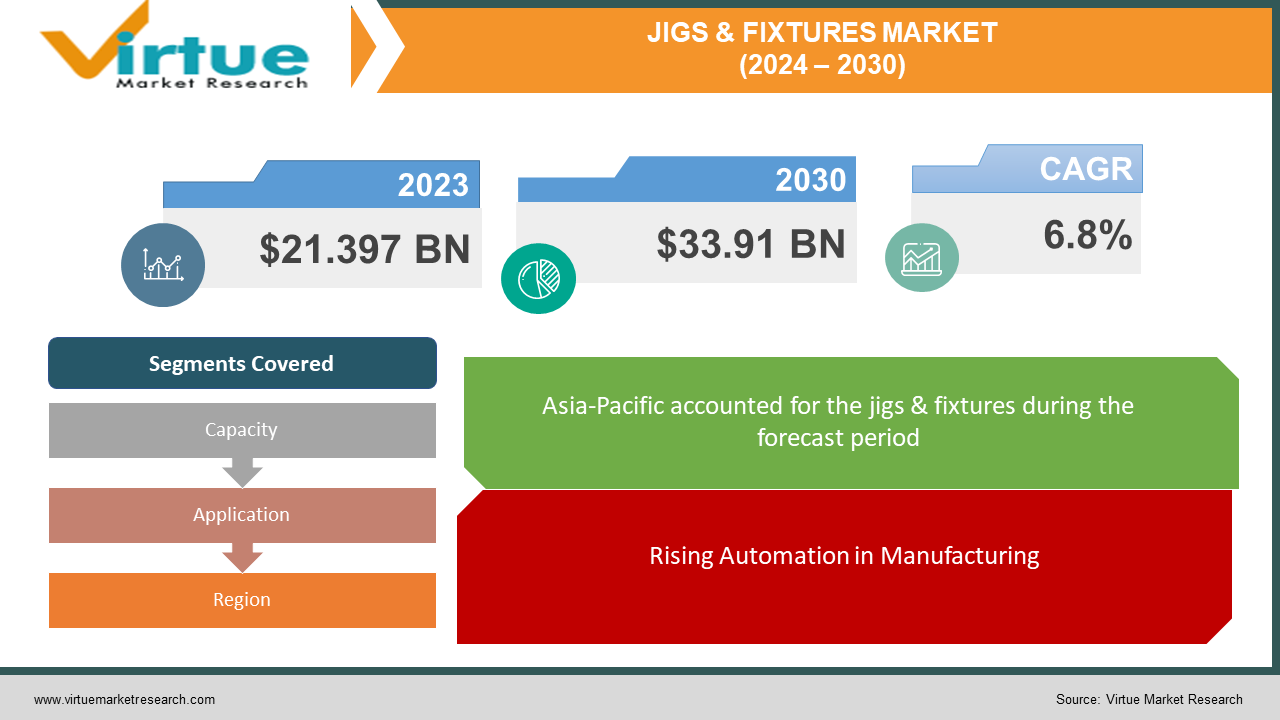

The Global Jigs & Fixtures Market was valued at USD 21.397 billion in 2023 and is projected to reach a market size of USD 33.91 billion by the end of 2030. Over the forecast period of 2024-2030, the market is expected to grow at a CAGR of 6.8%.

Key Market Insights:

The global jigs & fixtures market is witnessing growth driven by factors like increasing automation in manufacturing, rising demand for complex parts, and growing emphasis on product quality and consistency.

The market is witnessing a shift towards lightweight and durable materials for jigs & fixtures. This includes the increasing use of aluminum, composites, and engineering plastics, replacing traditional heavier materials like steel. These lighter materials offer advantages like improved portability, reduced cost, and better ergonomics for workers.

The Asia Pacific region is expected to be the fastest-growing market for jigs & fixtures, driven by factors like increasing industrialization, growing automotive and aerospace sectors, and government initiatives to promote manufacturing. China and India are expected to be the key contributors to regional growth.

Market Drivers:

Rising Automation in Manufacturing

The increasing adoption of automation in various industries, including automotive, aerospace, and electronics, is driving the demand for jigs & fixtures. These tools ensure accuracy, consistency, and repeatability in automated processes, leading to improved productivity and reduced costs.

Growing Demand for Complex Parts

The increasing demand for complex and intricate components in various sectors like aerospace, medical devices, and consumer electronics necessitates the use of specialized jigs & fixtures. These tools facilitate precise machining, assembly, and inspection of such intricate parts, ensuring their functionality and quality.

Emphasis on Quality and Consistency

Manufacturers are placing a greater emphasis on product quality and consistency, particularly in safety-critical industries like aerospace and medical devices. Jigs & fixtures offer a controlled and standardized approach to manufacturing, minimizing errors and ensuring consistent product quality throughout the production process.

Market Restraints and Challenges:

High Initial Investment Cost

Jigs & fixtures, particularly those designed for complex parts or requiring high-precision machining, can be expensive to design, manufacture, and maintain. This can be a significant barrier for small and medium-sized enterprises (SMEs) looking to adopt these tools.

Skilled Workforce Shortage

The effective utilization of jigs & fixtures requires skilled workers who can operate, maintain, and program them. However, there is a growing shortage of skilled labor in many manufacturing sectors, which can hinder the widespread adoption of these tools.

Technological Disruption

The emergence of advanced technologies like additive manufacturing (3D printing) and robotics poses a potential challenge to the traditional jigs & fixtures market. These technologies offer increased flexibility, customization, and automation capabilities, potentially leading to a shift in how manufacturing processes are designed and executed.

Market Opportunities:

Customization and On-Demand Manufacturing

The growing demand for customized and low-volume production runs presents an opportunity for jigs & fixture manufacturers to offer on-demand design and manufacturing services. This could involve utilizing advanced technologies like 3D printing and CNC machining to quickly create customized jigs & fixtures for specific production needs, catering to a wider range of clients.

Focus on Sustainability

The increasing focus on environmental sustainability in manufacturing is creating an opportunity for jigs & fixture manufacturers to develop eco-friendly and sustainable solutions. This could involve using lightweight and recyclable materials, optimizing designs to reduce material waste, and implementing energy-efficient manufacturing processes. By focusing on sustainability, companies can not only contribute to environmental protection but also cater to the growing demand for eco-conscious products and processes.

JIGS & FIXTURES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.8% |

|

Segments Covered |

By Capacity, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Kennametal Inc., Sandvik AB, HAAS Automation, Inc., Röders GmbH & Co. KG, IMI Norgren Ltd, Carr Lane Manufacturing Co., MISUMI Group Index Co., Ltd., Lang Tools Company, CH Tooling ,GS Precision |

Jigs & Fixtures Market Segmentation: By Capacity

-

Small

-

Medium

-

Large

The medium-capacity segment currently holds the largest market share. This is primarily driven by its versatility and applicability across a wide range of industries like automotive, electronics, and machinery. The medium-capacity segment accounted for over 45% of the global Jigs & Fixtures market in 2023. This segment is expected to maintain its dominance due to the rising demand for moderately complex parts and the increasing adoption of automation in various manufacturing processes.

While the medium-capacity segment currently dominates, the small-capacity and large-capacity segments are expected to witness significant growth in the coming years. Small-Capacity segment caters to the demand for jigs & fixtures for miniature and intricate parts, particularly in sectors like electronics and medical devices. The increasing miniaturization of components is driving the growth of this segment.

Large-Capacity: This segment focuses on jigs & fixtures for handling large and bulky parts, often used in industries like aerospace, shipbuilding, and construction. The growing demand for large-scale infrastructure projects is expected to propel this segment's growth.

Jigs & Fixtures Market Segmentation: By Application

-

Manufacturing

-

Automotive

-

Other Applications

The manufacturing sector accounts for the largest share of the Jigs & Fixtures market, driven by its widespread application across various sub-sectors like metalworking, plastics processing, and woodworking. The manufacturing segment held around 68% of the global Jigs & Fixtures market in 2023. The increasing automation and adoption of lean manufacturing principles in the manufacturing sector are expected to further drive the demand for jigs & fixtures, ensuring consistency and efficiency in production processes.

While the manufacturing sector remains dominant, the automotive and other applications segments are witnessing significant growth potential. The growing demand for lightweight and complex car parts necessitates the use of specialized jigs & fixtures, propelling the segment's growth. Other Applications segment encompasses various industries like aerospace, construction, and electronics. The increasing demand for precision and quality control in these sectors is driving the adoption of jigs & fixtures, leading to segment growth.

Jigs & Fixtures Market Segmentation: By Region

-

Asia-Pacific

-

North America

-

Europe

-

South America

-

Middle East and Africa

The Asia-Pacific region currently holds the largest market share, accounting for over 45% of the global market. This dominance is attributed to factors like rapid industrialization, growing automotive and electronics sectors, and government initiatives promoting manufacturing in the region. Countries like China and India are key contributors to this segment's growth.

North America and Europe are considered established markets with a strong presence of leading jigs & fixture manufacturers and technological advancements. However, these regions are expected to experience slower growth compared to Asia-Pacific due to maturing markets and increasing adoption of automation.

The South America and Middle East & Africa regions are considered emerging markets with promising growth potential. Factors like growing infrastructure projects, increasing foreign investments, and rising demand for manufactured goods are driving the market expansion in these regions.

COVID-19 Impact Analysis on the Global Jigs & Fixtures Market:

The COVID-19 pandemic caused a temporary disruption to the Jigs & Fixtures market. In the initial stages, global lockdowns and restrictions on manufacturing activities led to a decline in demand. This was due to several factors:

Production Slowdown: Many manufacturing facilities were forced to shut down or operate at reduced capacity, leading to a decreased need for jigs & fixtures.

Supply Chain Disruptions: Disruptions in global supply chains hampered the availability of raw materials and components needed to manufacture jigs & fixtures.

Investment Delays: Economic uncertainty caused businesses to delay investments in new equipment, including jigs & fixtures.

However, the impact of COVID-19 was relatively short-lived. As economies reopened and manufacturing activities resumed, the demand for jigs & fixtures rebounded. Some analysts believe that the pandemic may have had a long-term positive impact on the market. The increased focus on automation and production efficiency in the post-pandemic era could lead to a growing need for jigs & fixtures as manufacturers strive to optimize their processes.

Latest Trends/Developments:

Integration of Additive Manufacturing (3D Printing)

The growing adoption of 3D printing technology is impacting the Jigs & Fixtures. 3D printing allows for the quick and cost-effective creation of customized jigs & fixtures, catering to specific needs and complex parts, without the need for traditional manufacturing methods. 3D printing enables the creation of jigs & fixtures with intricate geometries and lighter weight, offering advantages like improved ergonomics and reduced costs compared to traditional materials.

Rise of Smart Jigs & Fixtures

The integration of sensors and connectivity features into jigs & fixtures is creating a new trend of smart jigs & fixtures. These tools can collect real-time data on factors like temperature, pressure, and vibration during the manufacturing process. They can monitor performance and detect potential issues, enabling predictive maintenance and improved process control. They can communicate with other machines and systems within a smart factory environment, facilitating data-driven decision-making and automation.

Focus on Sustainability

Manufacturers are increasingly focusing on eco-friendly practices throughout their supply chains, including the jigs & fixtures they use. This trend is driving the development of Jigs & fixtures made from recycled or sustainable materials to reduce environmental impact. Design optimization to minimize material waste and energy consumption during the manufacturing process of jigs & fixtures themselves. Reusable and adaptable jigs & fixtures that can be used for multiple production runs, reducing the need for creating new ones for each project.

Key Players:

-

Kennametal Inc.

-

Sandvik AB

-

HAAS Automation, Inc.

-

Röders GmbH & Co. KG

-

IMI Norgren Ltd

-

Carr Lane Manufacturing Co.

-

MISUMI Group Index Co., Ltd.

-

Lang Tools Company

-

CH Tooling

-

GS Precision

Collaborative Robot (Cobot) Integration: In February 2024, Universal Robots announced a collaboration with Fixture Laser Cutting to develop a cobot-assisted solution for on-demand jig and fixture creation. This integration leverages the flexibility of cobots with the precision laser cutting capabilities of Fixtur's systems, allowing manufacturers to create customized jigs & fixtures quickly and efficiently within their production lines.

AI-Powered Jigs & Fixtures: In January 2024, Siemens unveiled its MindSphere platform integration with Trumpf's TruLaser Center 7030 machine. This integration enables AI-powered optimization of jigs & fixtures, allowing manufacturers to design and manufacture jigs with minimal material waste and optimized production processes.

Sustainable Material Advancements: In December 2023, Henkel announced the development of Loctite 3D 8300, a bio-based resin specifically designed for 3D printing jigs & fixtures. This material offers a sustainable alternative to traditional plastics, promoting eco-friendly practices in the Jigs & Fixtures market.

Chapter 1. Jigs & Fixtures Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Jigs & Fixtures Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Jigs & Fixtures Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Jigs & Fixtures Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Jigs & Fixtures Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Jigs & Fixtures Market – By Capacity

6.1 Introduction/Key Findings

6.2 Small

6.3 Medium

6.4 Large

6.5 Y-O-Y Growth trend Analysis By Capacity

6.6 Absolute $ Opportunity Analysis By Capacity, 2024-2030

Chapter 7. Jigs & Fixtures Market – By Application

7.1 Introduction/Key Findings

7.2 Manufacturing

7.3 Automotive

7.4 Other Applications

7.5 Y-O-Y Growth trend Analysis By Application

7.6 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Jigs & Fixtures Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Capacity

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Capacity

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Capacity

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Capacity

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Capacity

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Jigs & Fixtures Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Kennametal Inc.

9.2 Sandvik AB

9.3 HAAS Automation, Inc.

9.4 Röders GmbH & Co. KG

9.5 IMI Norgren Ltd

9.6 Carr Lane Manufacturing Co.

9.7 MISUMI Group Index Co., Ltd.

9.8 Lang Tools Company

9.9 CH Tooling

9.10 GS Precision

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Jigs & Fixtures Market was valued at USD 21.397 billion in 2023 and is projected to reach a market size of USD 33.91 billion by the end of 2030. Over the forecast period of 2024-2030, the market is expected to grow at a CAGR of 6.8%.

Key drivers include the Rising Automation in Manufacturing, Growing Demand for Complex Parts, and Emphasis on Quality and Consistency.

Manufacturing, Automotive Industries are end users of the Global Jigs & Fixtures Market.

Asia-Pacific dominates the market with a significant share of over 45%.

Kennametal Inc., Sandvik AB, HAAS Automation, Inc., Röders GmbH & Co. KG, IMI Norgren Ltd, Carr Lane Manufacturing Co., MISUMI Group Index Co., Ltd., Lang Tools Company, CH Tooling, and GS Precision are some leading players in the Global Jigs & Fixtures Market.