Global Jam, Jelly, and Preserves Market (2024 - 2030)

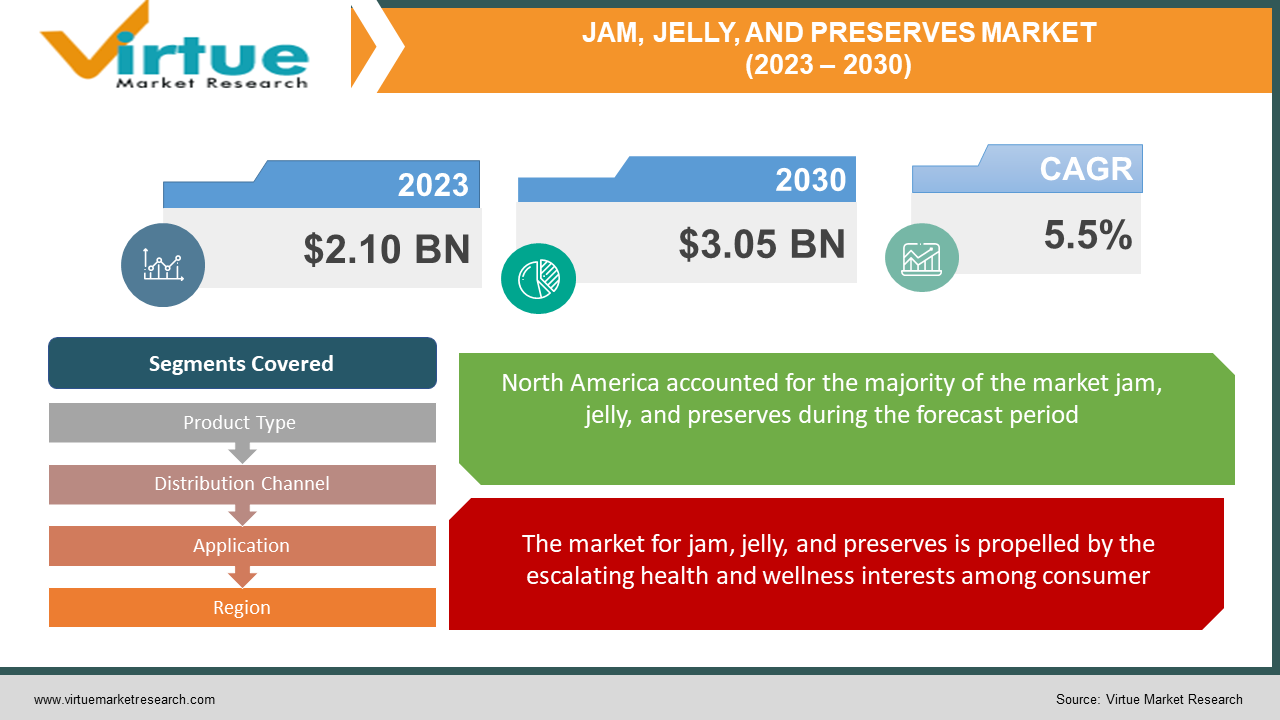

The valuation of the Global Jam, Jelly, and Preserves Market stood at USD 2.10 Billion in 2023, with projections indicating an expected growth to USD 3.05 Billion by 2030, maintaining a projected Compound Annual Growth Rate (CAGR) of 5.5% from 2024 to 2030.

Market Dynamics:

The segment of jam, jelly, and preserves within the food industry represents a diverse range of fruit-based spreads. Jams, jellies, and preserves, differentiated by texture and ingredients, have witnessed growth driven by the evolving preferences for convenient breakfast options and culinary applications. Health-conscious consumers are increasingly favoring reduced sugar and natural ingredient products. Global factors like changing dietary habits, urbanization, and the demand for clean-label products contribute to this market's competitive and evolving nature, offering opportunities for both established and emerging brands.

Key Market Insights:

North America's market growth is attributed to the rising demand for convenient food products, emphasizing ripe and semi-ripe fruits and exploring sugar alternatives like pectin. The region exhibits an inclination towards healthier, nutrition-rich, and organically produced options. Consumers' evolving tastes embrace non-traditional flavor combinations, further diversifying product offerings.

Market Drivers:

The market for jam, jelly, and preserves is propelled by the escalating health and wellness interests among consumers.

Increased awareness regarding maintaining a healthy diet has led to a surge in the demand for products featuring reduced sugar content and natural ingredients. To meet the preferences of individuals seeking lower sugar intake, there's a notable interest in fruit spreads sweetened with alternatives like honey or fruit juices. Responding to this demand, manufacturers have introduced a diverse range of healthier products, targeting health-conscious consumers, thereby fostering growth within the market.

In parallel, the elevation in demand for jam, jelly, and preserves is spurred by the ongoing trend in flavor innovation and the introduction of premium selections.

Consumer inclinations toward distinct and exotic flavors have pushed manufacturers to innovate with an extensive array of flavor combinations, incorporating fruit blends, spices, and herbs. This wave of inventive flavors has broadened the market's appeal, attracting consumers seeking novel taste experiences. Moreover, there's a noticeable shift toward premium and artisanal products, emphasizing top-notch, locally sourced ingredients, and small-scale production methods. These premium offerings, often associated with higher price points, significantly contribute to revenue growth in the jam, jelly, and preserving market.

Market Restraints and Challenges:

Health concerns revolving around high sugar content pose challenges as consumers seek healthier options. Product reformulation for healthier alternatives without compromising taste and texture presents technical hurdles.

Intense competition and constant innovation are pivotal in a highly competitive market, with smaller artisanal producers challenging established brands. Maintaining market relevance and differentiation remain ongoing challenges.

Market Opportunities:

Opportunities arise from the growing demand for healthier and natural options, including low-sugar and organic alternatives. Culinary exploration and fusion of flavors open avenues for unique offerings. Online retail platforms offer smaller producers access to wider audiences, while investing in sustainable packaging further enhances growth prospects.

JAM, JELLY, AND PRESERVES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.5% |

|

Segments Covered |

By Product Type, Distribution Channel, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

The J.M. Smucker Company, Welch's, Conagra Brands, Bonne Maman, Sarabeth's, B&G Foods, Unilever,. St. Dalfour, Tiptree |

Jam, Jelly, and Preserves Market Segmentation - Product Type

-

Jams

-

Jellies

-

Preserves

-

Marmalades

-

Fruit spreads

-

Fruit butter

The jam, jelly, and preserves market encompass various segments: Jams, Jellies, Preserves, Marmalades, Fruit Spreads, and Fruit Butter. Jams, constituting 56% market share, stand as the largest segment, known for their versatility and wide-ranging appeal across traditional and contemporary tastes. Fruit Spreads, growing at 14.3%, represent the fastest-growing segment, driven by the demand for healthier options with higher fruit content and reduced sugar.

Jam, Jelly, and Preserves Market Segmentation - Distribution Channel

-

Supermarkets and hypermarkets

-

Convenience stores

-

Online retail

-

Specialty stores

-

Others

Distribution channels like Supermarkets & Hypermarkets dominate the market (68%), offering diverse brand selections and extensive shelf space. Online Retail is the fastest-growing segment (CAGR 20.9%), buoyed by the surge in e-commerce and consumer preference for doorstep deliveries.

Jam, Jelly, and Preserves Market Segmentation - Application

-

Breakfast condiments

-

Dessert toppings

-

Bakery and pastry fillings

-

Cooking ingredients

-

Snack applications

Breakfast Condiments hold the largest market share (79%), traditionally favored for their sweet and fruity accompaniments in morning meals. The Snack Applications segment experiences rapid growth due to the rising trend of convenient, on-the-go options.

Jam, Jelly, and Preserves Market Segmentation - Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America leads the market (40%) due to established market practices, diverse flavor preferences, and a focus on health-conscious choices. The Asia-Pacific region witnesses the fastest growth (CAGR 19.7%) attributed to changing dietary habits and an increasing urban population seeking convenient and indulgent dietary options.

COVID-19 Impact Analysis:

The pandemic resulted in varied impacts, witnessing a surge in demand alongside disruptions in supply chains and consumer price sensitivity. The market adapted to consumer preferences for healthier options and demonstrated resilience amid challenges.

Latest Trends/Developments:

A prominent trend is the demand for healthier options, driving manufacturers to introduce reduced sugar variants, organic products, and functional ingredients like chia seeds and superfoods. Another significant development is the focus on sustainable packaging solutions in response to consumers' increasing environmental consciousness.

Major Players:

-

The J.M. Smucker Company

-

Welch's

-

Conagra Brands

-

Bonne Maman

-

Sarabeth's

-

B&G Foods

-

Unilever

-

St. Dalfour

-

Tiptree

Chapter 1. Global Jam, Jelly and Preserves Market – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Global Jam, Jelly and Preserves Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Global Jam, Jelly and Preserves Market – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Global Jam, Jelly and Preserves Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Global Jam, Jelly and Preserves Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global Jam, Jelly and Preserves Market – By Product Type

6.1. Jams

6.2. Jellies

6.3. Preserves

6.4. Marmalades

6.5. Fruit spreads

6.6. Fruit butter

Chapter 7. Global Jam, Jelly and Preserves Market – By Distribution Channel

7.1. Supermarkets and hypermarkets

7.2. Convenience stores

7.3. Online retail

7.4. Specialty stores

7.5. Others

Chapter 8. Global Jam, Jelly and Preserves Market – By Application

8.1. Breakfast condiments

8.2. Dessert toppings

8.3. Bakery and pastry fillings

8.4. Cooking ingredients

8.5. Snack applications

Chapter 9. Global Jam, Jelly and Preserves Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By Product Type

9.1.3. By Application

9.1.4. By Distribution Channel

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By Product Type

9.2.3. By Application

9.2.4. By Distribution Channel

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.1. By Country

9.3.1.1. China

9.3.1.2. Japan

9.3.1.3. South Korea

9.3.1.4. India

9.3.1.5. Australia & New Zealand

9.3.1 .6. Rest of Asia-Pacific

9.3.2. By Product Type

9.3.3. By Application

9.3.4. By Distribution Channel

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.1. By Country

9.4.1.3. Brazil

9.4.1.2. Argentina

9.4.1.3. Colombia

9.4.1.4. Chile

9.4.1.5. Rest of South America

9.4.2. By Product Type

9.4.3. By Application

9.4.4. By Distribution Channel

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.1. By Country

9.5.1.4. United Arab Emirates (UAE)

9.5.1.2. Saudi Arabia

9.5.1.3. Qatar

9.5.1.4. Israel

9.5.1.5. South Africa

9.5.1.6. Nigeria

9.5.1.7. Kenya

9.5.1.8. Egypt

9.5.1.9. Rest of MEA

9.5.2. By Product Type

9.5.3. By Application

9.5.4. By Distribution Channel

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Global Jam, Jelly and Preserves Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1. The J.M. Smucker Company

10.2. Welch's

10.3. Conagra Brands

10.4. Bonne Maman

10.5. Sarabeth's

10.6. B&G Foods

10.7. Unilever

10.8. St. Dalfour

10.9. Tiptree

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Jam, Jelly, and Preserves Market marked a valuation of USD 2.10 Billion in 2023 and is anticipated to attain USD 3.05 Billion by the culmination of 2030, exhibiting a growth rate of 5.5% between 2024 and 2030.

Rising health and wellness trends among consumers, along with advancements in flavor innovation and premium product offerings, significantly propel the Jam, Jelly, and Preserves market.

The Global Jam, Jelly, and Preserves Market segments encompass a variety of products, including Jams, Jellies, Preserves, Marmalades, Fruit Spreads, and Fruit Butter.

The North American region stands as the most dominant within the Global Jam, Jelly, and Preserves Market.

The Global Jam, Jelly, and Preserves Market is steered by prominent entities such as The J.M. Smucker Company, Welch's, Conagra Brands, and Bonne Maman, among other influential players.