Italy Food Service Market Size (204-2030)

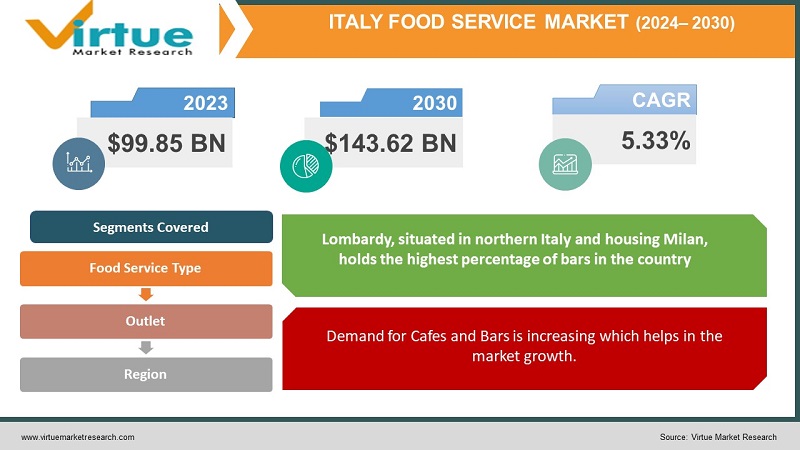

The Italy Food Service Market was valued at USD 99.85 billion in 2023. Over the forecast period of 2024-2030 it is projected to reach USD 143.62 billion by 2030, growing at a CAGR of 5.33%.

The provision of food service pertains to the preparation, management, packaging, and dissemination of food, beverages, and associated amenities within an establishment. This sector primarily encompasses various categories of enterprises, including but not limited to restaurants, coffee shops, bars, cafeterias, catering firms, and institutional food suppliers.

Key Market Insights:

The food service market in Italy is experiencing growth propelled by factors such as the continuous expansion of brand franchising, a heightened demand for healthier and superior-quality food, and the thriving digital commercialization landscape. Additionally, Italy, sustained by vibrant tourism, maintains its position as one of the largest foodservice markets in Europe.

A pivotal driver behind the flourishing food service market in Italy is the increasing consumer inclination towards convenient and on-the-go food options. Evolving food consumption patterns, coupled with the growing influence of both national and international cuisines on consumer habits, are anticipated to contribute to elevated spending on food services. Cafes and bars have gained popularity among millennial consumers as venues for socializing and commemorating special occasions with friends and family. Moreover, the swift expansion of infrastructure and urbanization has facilitated the recent penetration of chain foodservice.

Italy Food Service Market Drivers:

Demand for Cafes and Bars is increasing which helps in the market growth.

Cafes and bars represent one of the most rapidly expanding segments in the market, fueled by a continuous rise in preferences for coffee, soft drinks, and alcoholic beverages. The key drivers for the expansion of coffee chains, including cafes, are the escalating global exposure, the influence of western culture, and the establishment of well-known coffee brands. Additionally, the affordability of food products offered by cafes, ranging from cold to hot meals, enhances consumers' inclination to expend on such establishments. Notably, several companies are making strategic investments to establish their outlets in the country. A noteworthy example is the Starbucks Coffee Company, which inaugurated its first drive-thru in Italy at Erbusco in the northern Lombardia region in 2022.

As urbanization continues to grow, accompanied by an enhanced lifestyle, there is a noticeable shift in Italian preferences towards wine over other alcoholic beverages, consequently boosting the business of wine bars in the country. The increasing prevalence of chained cafes and bars, coupled with the rising trend of socializing at these establishments among millennials, constitutes significant factors contributing to the expansion of the cafes and bars segments. Moreover, consumer willingness to invest in unique flavors of beverages and desserts is driving the proliferation of specialty coffee shops throughout Italy.

Eating out frequently drives the market.

The upward trend in the frequency of Italians dining out has emerged as a substantial advantage for the food service sector in the country. According to the Federazione Italiana Pubblici Esercizi, out-of-home food consumption experienced a noteworthy surge, escalating from EUR 30,367 million in 2020 to EUR 57,626 million in 2022. Moreover, Italy boasts a higher density of catering enterprises per square kilometer compared to any other nation globally, indicative of a thriving food service market within the country.

In recent years, the market has observed a considerable infiltration of full-service restaurants (FSRs) with leading brands expanding their presence across significant regions of the country. FSRs stand out as one of the fastest-growing segments, driven by the growing consumer preference for convenient and engaging dining-out experiences. Factors such as the increasing population of working women, infrastructure development, and the expansion of the upper-middle-class demographic are pivotal in influencing the heightened expenditure on fine dining services.

Italy Food Service Market Restraints and Challenges:

Increasing supply chain costs hinder the market.

The food service market grapples with several challenges in effectively managing food supply chains, encompassing issues such as food safety and a notable absence of traceability. One prominent challenge lies in the escalating costs associated with food supply chains. Managing these costs is a complex endeavor, involving not only the expenses related to the provision of food but also encompassing considerations for energy, fuel, workforce, and the incorporation of new technologies. Additionally, vigilance over operating expenses presents another area of concern within the industry.

Italy Food Service Market Opportunities:

The food service market in Italy exhibits a high degree of fragmentation, primarily attributed to the prevalence of numerous small-scale players. Notably, there is a rising trend in the popularity of American-style fast food chains and salad bars within the Italian market. This shift towards more convenient dining options has prompted Italian importers to actively seek U.S. food products tailored to meet the demands of self-service eateries.

ITALY FOOD SERVICE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.33% |

|

Segments Covered |

By Food service type, outlet, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Italy |

|

Key Companies Profiled |

Caffè Pascucci, Alice Pizza SpA , Massimo Zanetti Beverage Group, Camst Group,Starhotels SpA, Cigierre, Lagardère Group, Illycaffè, Yum! Brands Inc., QSR Platform Holding SCA |

Italy Food Service Market Segmentation:

Italy Food Service By Food Service Type:

- Cafes & Bars

- Cloud Kitchen

- Full-Service Restaurants

- Quick Service Restaurants

Cafes and bars emerge as one of the fastest-growing segments in the market, fueled by an increasing preference for coffee, soft drinks, and alcoholic beverages. The affordability of food products ranging from cold to hot meals in cafes contributes to heightened consumer willingness to spend. Notably, numerous companies are making strategic investments to establish their outlets in the country, exemplified by the opening of Starbucks Coffee Company's first drive-thru in Italy at Erbusco in the northern Lombardia region in 2022. As of 2022, bars and pubs constituted over 74% of the outlets, while cafes represented nearly 25%, with Italy boasting approximately 64,200 cafes and 560 specialty coffee shops. Cloud kitchens are anticipated to witness a Compound Annual Growth Rate (CAGR) of 1.23% in terms of outlets during the forecast period, currently representing 0.11% of the total foodservice outlets in Italy. The growing online delivery market is expected to significantly boost the number of cloud kitchens in the future.

In 2023, the number of quick-service restaurant outlets in Italy declined by 4.90%, primarily due to operational restrictions imposed by the pandemic. Popular dishes such as pizza, pasta, noodles, burgers, and sushi dominate the Italian market, with fast-food brands specializing in these items holding a substantial presence. Pizza, in particular, commands a significant share of the Italian restaurant landscape, with approximately 40,000 establishments (comprising both QSR and FSR) offering various types of pizza. Among these, bar pizzerias accounted for 36,300 establishments in 2022.

The demand for full-service restaurants (FSR) is anticipated to rise in Italy, driven by the increasing number of tourists eager to explore local cuisine. FSR establishments, staffed with professionally trained chefs, offer innovative menus, international cuisine, and proprietary recipes, catering to the preferences of both tourists and health-conscious individuals.

Italy Food Service By Outlet:

- Chained Outlets

- Independent Outlets

Consumers display a preference for chained foodservice outlets due to the appeal of standardized menus incorporating regional customizations, quality assurance, and affordability. Concurrently, the independent outlets sector is experiencing rapid growth within the market.

In the Italian culinary landscape, there are three distinct types of restaurants: trattorias, osterias, and ristorantes. Each category serves a specific purpose, offering menus that vary accordingly. Trattorias, characterized by their smaller size, specialize in traditional Italian cuisine, providing a more casual dining experience compared to a standard restaurant. Typically, family-run, trattorias feature lower prices, making them a popular choice among tourists seeking an authentic experience of traditional Italian food.

Italy Food Service Market Segmentation- By Region

Lombardy, situated in northern Italy and housing Milan, holds the highest percentage of bars in the country, accounting for 17.21%. The region is celebrated for its lively nightlife and diverse culinary offerings. Following closely, Lazio, incorporating Rome, secures the second position with 10.53% of the bars, trailed by Emilia-Romagna (9.19%), Campania (8.9%), and Veneto (8.55%). These regions are not only distinguished for their vibrant cultural scenes but also for their rich culinary traditions.

COVID-19 Pandemic: Impact Analysis

The heightened demand and various repercussions of COVID-19 are instigating significant transformations in the food and beverage supply chain, as well as in the design and operation of food and beverage processing plants. In response, several food and beverage companies in Italy are expanding their production capacities and investing in new automation equipment. These strategic measures aim to enhance production flexibility, allowing adaptation to potential fluctuations in demand over the upcoming years.

Data from the Italian National Institute of Statistics indicates that the food and beverage industry has ramped up production to meet the rising demand from end consumers. The latter, compelled to dine at home due to the health emergency, has witnessed a resurgence in cooking activities. Notably, contrary to the general trend, the turnover of the food and beverage sector in Italy has experienced a notable growth of 3.1%.

Latest Trends/ Developments:

- December 2022: KFC unveiled its latest outlet in Sestu, located at the La Corte del Sole shopping center. The company disclosed an investment of USD 21.81 million for the expansion of its restaurant network in Italy, with plans to launch 25 new outlets in 2022.

- November 2022: Lagardère Travel Retail finalized an agreement to acquire full ownership of Marché International AG, the holding company overseeing the Marché Group.

- November 2022: The Italian government earmarked a budget of EUR 2 million ($2.1 million) for the years 2022 and 2023 to compensate for lost teaching hours during the pandemic. Schools have the opportunity to seek funding for initiatives such as free cultural and sporting activities, summer camps, and additional learning support for students.

- In 2022, Roadhouse Grill introduced new appetizers, including crispy spicy chicken and bunmeat, as part of its menu innovation. The bunmeat offerings featured options such as a potato bun with brisket, a fried chicken burger, and a Philly cheese steak, aligning with the brand's objective of combining inventive dining experiences with traditional American flavors.

Key Players:

These are top 10 players in the Italy Food Service Market: -

- Caffè Pascucci

- Alice Pizza SpA

- Massimo Zanetti Beverage Group

- Camst Group,

- Starhotels SpA

- Cigierre

- Lagardère Group

- Illycaffè

- Yum! Brands Inc.

- QSR Platform Holding SCA

Chapter 1. Italy Food Service Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Food Service Type of Material s

1.5. Secondary Food Service Type of Material s

Chapter 2. Italy Food Service Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Italy Food Service Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Italy Food Service Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Italy Food Service Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Italy Food Service Market– By Food Service Type

6.1. Introduction/Key Findings

6.2. Cafes & Bars

6.3. Cloud Kitchen

6.4. Full-Service Restaurants

6.5. Quick Service Restaurants

6.6. Y-O-Y Growth trend Analysis By Food Service Type

6.7. Absolute $ Opportunity Analysis By Food Service Type , 2024-2030

Chapter 7. Italy Food Service Market– By Outlet

7.1. Introduction/Key Findings

7.2 Chained Outlets

7.3. Independent Outlets

7.4. Y-O-Y Growth trend Analysis By Outlet

7.5. Absolute $ Opportunity Analysis By Outlet , 2024-2030

Chapter 8. Italy Food Service Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Europe

8.1.1. By Country

8.1.1.1. Italy

8.1.2. By Food Service Type

8.1.3. By Outlet

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Italy Food Service Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Caffè Pascucci

9.2. Alice Pizza SpA

9.3. Massimo Zanetti Beverage Group

9.4. Camst Group,

9.5. Starhotels SpA

9.6. Cigierre

9.7. Lagardère Group

9.8. Illycaffè

9.9. Yum! Brands Inc.

9.10. QSR Platform Holding SCA

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The food service market in Italy is experiencing growth propelled by factors such as the continuous expansion of brand franchising, a heightened demand for healthier and superior-quality food, and the thriving digital commercialization landscape.

The top players operating in the Italy Food Service Market are - Caffè Pascucci, Alice Pizza SpA, Massimo Zanetti Beverage Group, Camst Group, Starhotels SpA, Cigierre, Lagardère Group, Illycaffè, Yum! Brands Inc., QSR Platform Holding SCA

The heightened demand and various repercussions of COVID-19 are instigating significant transformations in the food and beverage supply chain, as well as in the design and operation of food and beverage processing plants.

December 2022: KFC unveiled its latest outlet in Sestu, located at the La Corte del Sole shopping center. The company disclosed an investment of USD 21.81 million for the expansion of its restaurant network in Italy, with plans to launch 25 new outlets in 2022.

Lombardy, situated in northern Italy and housing Milan, holds the highest percentage of bars in the country, accounting for 17.21%.