Italy Cards and Payments Market Size (2024-2030)

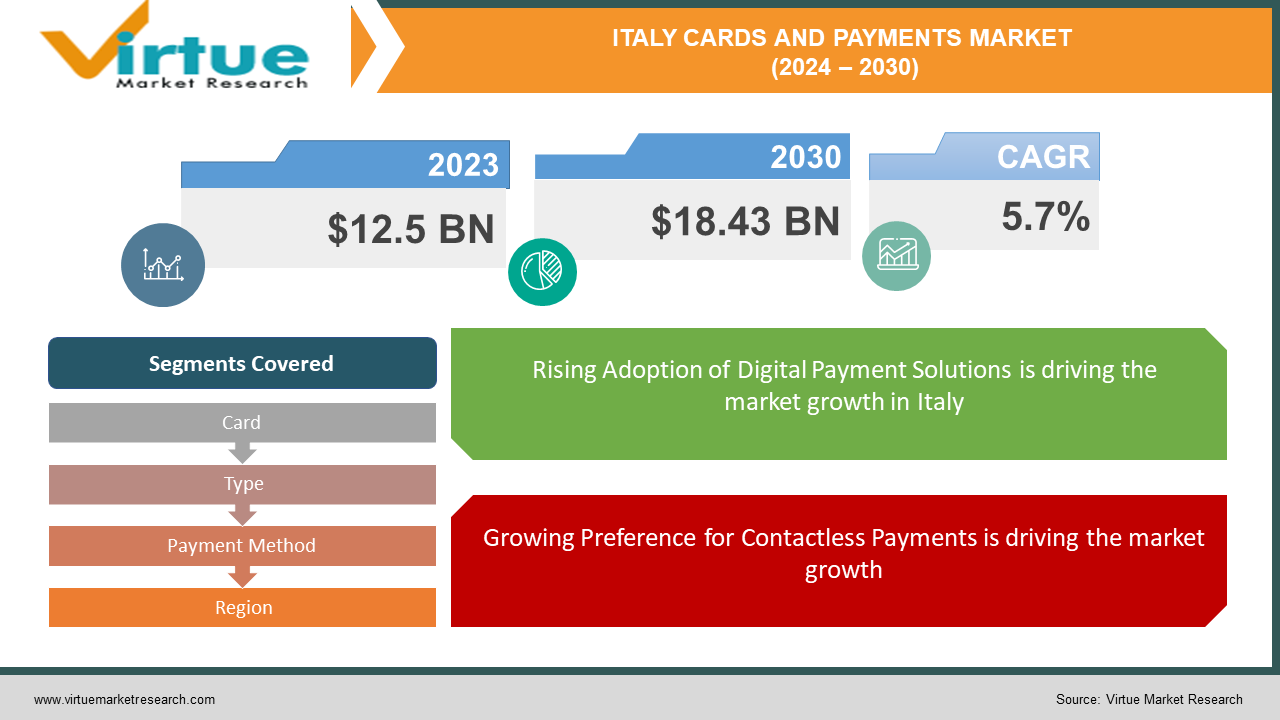

The Italy Cards and Payments Market was valued at USD 12.5 billion in 2023 and is projected to grow at a CAGR of 5.7% from 2024 to 2030. The market is expected to reach USD 18.43 billion by 2030.

Italy's card and payments market is in a state of flux. While cash remains king, with a high concentration of point-of-sale terminals, a shift towards digital payments is underway. This is driven by government initiatives promoting cashless transactions, the growing popularity of contactless payments, and the increasing adoption of alternative methods like digital wallets and buy-now-pay-later options. Though credit cards still hold a strong position, their share is declining as consumers embrace the convenience and security of digital alternatives. This trend is expected to accelerate in the coming years, fueled by a tech-savvy population and a regulatory environment that fosters innovation in the payments landscape.

Key Market Insights:

Debit cards dominate the market with a significant share due to their widespread use for daily transactions.

Mobile payment methods are gaining traction, particularly among younger consumers, due to their convenience and security.

According to a report by the Bank of Italy, the number of digital payment transactions in Italy increased by 20% in 2023 compared to the previous year. This trend is expected to continue as more consumers and businesses embrace digital payment solutions.

Furthermore, the increasing penetration of smartphones and internet connectivity in Italy is facilitating the adoption of digital payments. As of 2023, over 75% of Italians owned a smartphone, and internet penetration reached 83%, providing a solid foundation for the growth of digital payment solutions.

Italy Cards and Payments Market Drivers:

Rising Adoption of Digital Payment Solutions is driving the market growth

The increasing adoption of digital payment solutions is a significant driver for the Italy cards and payments market. As consumers become more tech-savvy, there is a growing preference for digital and contactless payment methods over traditional cash transactions. Digital wallets, mobile payment apps, and online banking services offer convenience, speed, and security, making them attractive alternatives to cash and checks. The convenience, security, and efficiency of digital payments are driving their adoption, contributing to the growth of the Italy cards and payments market.

Government Initiatives and Regulatory Support are driving the market growth

The Italian government's initiatives and regulatory support are playing a crucial role in driving the cards and payments market. The government has implemented various measures to promote cashless transactions and reduce the use of cash. One such initiative is the "Italia Cashless" plan, which aims to encourage the use of digital payments through incentives and rewards. Under this plan, consumers who use digital payment methods for their purchases can receive cashback and other benefits. Additionally, the government has introduced regulations to limit cash transactions and increase transparency in financial transactions. For example, the threshold for cash payments was reduced to €1,000 in 2022, down from €3,000, to encourage the use of electronic payment methods. These regulatory measures are aimed at combating tax evasion and money laundering while promoting the adoption of digital payments. Moreover, the European Union's Payment Services Directive 2 (PSD2), which came into effect in 2018, has facilitated the development of innovative payment solutions by promoting competition and transparency in the payments market. PSD2 allows third-party payment service providers to access bank account information, enabling the development of new payment services and fostering a more competitive payment ecosystem. The Italian government's initiatives and regulatory support are creating a favorable environment for the growth of the cards and payments market.

Growing Preference for Contactless Payments is driving the market growth

The growing preference for contactless payments is a significant driver for the Italy cards and payments market. Contactless payments offer a fast, convenient, and secure way to make transactions, making them increasingly popular among consumers and merchants. Contactless payment methods, such as near-field communication (NFC) enabled cards and mobile payment apps, allow users to make payments by simply tapping their card or smartphone on a payment terminal. This eliminates the need for physical contact and reduces transaction times, enhancing the overall customer experience. According to a survey by Mastercard, 78% of Italians preferred contactless payments for their daily transactions in 2023. Additionally, advancements in payment technology and infrastructure are driving the adoption of contactless payments. The widespread availability of NFC-enabled payment terminals and the integration of contactless payment features in smartphones and wearable devices are making it easier for consumers to adopt this payment method. The growing preference for contactless payments is contributing to the growth of the Italy cards and payments market.

Italy Cards and Payments Market Challenges and Restraints:

Security and Fraud Concerns are restricting the market growth

Security and fraud concerns are significant challenges for the Italy cards and payments market. While digital payment solutions offer convenience and efficiency, they also present new risks and vulnerabilities. Cybercriminals are constantly evolving their tactics to exploit weaknesses in payment systems and steal sensitive information. According to a report by the European Central Bank, card-not-present (CNP) fraud, which includes online and remote transactions, accounted for 76% of the total card fraud in Europe in 2022. This highlights the growing threat of cybercrime in the digital payments landscape. Additionally, phishing attacks, malware, and data breaches pose significant risks to consumers and businesses. To address these security concerns, payment service providers and financial institutions are investing in advanced security technologies, such as tokenization, encryption, and biometric authentication. These measures aim to protect sensitive information and prevent unauthorized access. However, ensuring the security of digital payment systems requires continuous efforts and collaboration among industry stakeholders, regulators, and consumers. Building consumer trust in the security of digital payment solutions is crucial for the sustained growth of the Italy cards and payments market.

Infrastructure and Technological Limitations are restricting the market growth

Infrastructure and technological limitations are significant challenges for the Italy cards and payments market. While urban areas in Italy have well-developed payment infrastructure, rural and remote regions often lack access to modern payment systems and digital connectivity. This digital divide can hinder the adoption of digital payment solutions in certain areas, limiting market growth. Additionally, some small businesses and merchants may be reluctant to invest in the necessary infrastructure, such as point-of-sale (POS) terminals and payment gateways, due to cost considerations. Technological limitations, such as network connectivity issues and compatibility problems, can also affect the performance and reliability of digital payment systems. For example, intermittent internet connectivity can disrupt online transactions and cause delays, frustrating consumers and merchants. Addressing these infrastructure and technological challenges requires coordinated efforts from the government, financial institutions, and technology providers. Investments in digital infrastructure, such as expanding broadband coverage and providing financial support to small businesses for payment system upgrades, are essential to overcoming these challenges and promoting the widespread adoption of digital payments in Italy.

Market Opportunities:

The Italy cards and payments market presents several significant opportunities for growth and expansion. One of the key opportunities lies in the growing popularity of mobile payments and digital wallets. With the increasing penetration of smartphones and the rise of tech-savvy consumers, mobile payment solutions are gaining traction in Italy. Digital wallets, such as Apple Pay, Google Wallet, and Samsung Pay, offer a convenient and secure way to make payments using smartphones and wearable devices. The integration of digital wallets with loyalty programs, rewards, and personalized offers further enhances their appeal to consumers. Additionally, the expanding e-commerce market in Italy presents new opportunities for digital payment solutions. As more consumers shop online, there is a growing demand for secure and efficient online payment methods. Payment service providers can capitalize on this trend by offering seamless and secure payment solutions for e-commerce platforms. Furthermore, the increasing adoption of contactless payments and the development of innovative payment technologies, such as biometric authentication and blockchain, present opportunities for market growth. The continuous advancements in payment technology, coupled with the changing consumer preferences and the supportive regulatory environment, create a favorable landscape for the growth of the Italy cards and payments market.

ITALY CARDS AND PAYMENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.7% |

|

Segments Covered |

By card, Type, payment method, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Italy |

|

Key Companies Profiled |

UniCredit S.p.A., Intesa Sanpaolo S.p.A., Poste Italiane S.p.A., Banco BPM S.p.A., Nexi Payments S.p.A., SIA S.p.A., Mastercard Inc., Visa Inc., American Express Company, and PayPal Holdings Inc. |

Italy Cards and Payments Market Segmentation

Italy Cards and Payments Market Segmentation by Card Type:

- Debit Cards

- Credit Cards

- Prepaid Cards

- Contactless Cards

Debit cards currently reign supreme. Cash remains the most used payment method overall, but debit cards are the preferred choice for digital transactions. This is likely because they offer a secure and convenient way to spend directly from your bank account, avoiding the potential debt pitfalls of credit cards. Prepaid cards also have a notable presence, particularly with the popular PostePay option. However, contactless cards, regardless of whether they are debit, credit, or prepaid, are experiencing a surge in popularity due to their speed and ease of use, suggesting a potential shift towards a more tap-and-go payment culture in Italy.

Italy Cards and Payments Market Segmentation by Payment Method:

- Online Payments

- Mobile Payments

- Point-of-Sale (POS) Payments

- Contactless Payments

In Italy, the dominance leans towards Point-of-Sale (POS) payments, but online and contactless payments are catching up rapidly. Traditionally, Italians have relied heavily on cash for everyday transactions, making POS payments king. However, a digital revolution is underway. Online payments are growing due to the increasing popularity of e-commerce, with options like PayPal leading the charge. Mobile payments are also on the rise, fueled by the convenience of using smartphones for purchases. The real game-changer though, is the rise of contactless payments. This technology, often integrated into debit, credit, and prepaid cards, allows for quick and easy transactions at POS terminals, potentially merging the convenience of mobile payments with the established infrastructure of POS systems. With its speed and hygiene benefits (especially relevant during the pandemic), contactless payments have the potential to become the dominant force shortly.

Regional Analysis:

Italy, in particular, faces the additional challenge of a historically strong cash preference. However, government initiatives and a growing comfort with digital options are rapidly changing the landscape. The increasing adoption of digital payment solutions, favorable government initiatives, and the growing preference for contactless payments are key drivers for the growth of the Italy cards and payments market.

COVID-19 Impact Analysis on the Italy Cards and Payments Market:

The COVID-19 pandemic had a profound impact on the Italy cards and payments market. The pandemic accelerated the shift towards digital and contactless payments as consumers sought safer and more hygienic payment methods to minimize physical contact. With lockdowns and social distancing measures in place, there was a significant increase in online shopping and e-commerce transactions. This surge in online activity drove the demand for secure and efficient digital payment solutions. According to a report by the Bank of Italy, online payment transactions in Italy increased by 30% in 2020 compared to the previous year. Additionally, the pandemic prompted businesses to adopt contactless payment systems to comply with health guidelines and enhance customer safety. Many retailers and service providers introduced contactless payment options, such as NFC-enabled cards and mobile payment apps, to accommodate the changing consumer preferences. The government's initiatives to promote digital payments and reduce cash usage further supported this transition. The long-term impact of COVID-19 on the Italy cards and payments market is expected to be positive, as the shift towards digital and contactless payments becomes more permanent, driving market growth in the coming years.

Latest Trends/Developments:

The Italy cards and payments market is witnessing several notable trends and developments. One of the significant trends is the rise of mobile payments and digital wallets. With the increasing penetration of smartphones and the growing preference for convenient and secure payment methods, mobile payment solutions are gaining popularity among consumers. Digital wallets, such as Apple Pay, Google Wallet, and Samsung Pay, offer a seamless payment experience by allowing users to make transactions using their smartphones and wearable devices. Additionally, there is a growing trend towards contactless payments. The COVID-19 pandemic accelerated the adoption of contactless payment methods, as consumers sought safer and more hygienic options. Contactless payments, enabled by NFC technology, provide a quick and secure way to make transactions by simply tapping a card or smartphone on a payment terminal. Another notable trend is the integration of artificial intelligence (AI) and machine learning (ML) in payment systems. AI and ML technologies are being used to enhance security, detect fraudulent activities, and provide personalized payment experiences. For example, AI-powered fraud detection systems can analyze transaction patterns and identify suspicious activities in real time, reducing the risk of fraud. Furthermore, the development of blockchain technology is gaining traction in the payments industry. Blockchain offers a decentralized and transparent way to process transactions, ensuring security and reducing the risk of fraud. These trends and developments are driving innovation and growth in the Italy cards and payments market.

Key Players:

- UniCredit S.p.A.

- Intesa Sanpaolo S.p.A.

- Poste Italiane S.p.A.

- Banco BPM S.p.A.

- Nexi Payments S.p.A.

- SIA S.p.A.

- Mastercard Inc.

- Visa Inc.

- American Express Company

- PayPal Holdings Inc.

Chapter 1. Italy Cards and Payments Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Source

1.5. Secondary Source

Chapter 2. Italy Cards and Payments Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Italy Cards and Payments Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Italy Cards and Payments Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Italy Cards and Payments Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Italy Cards and Payments Market– By Card Type

6.1. Introduction/Key Findings

6.2. Debit Cards

6.3. Credit Cards

6.4. Prepaid Cards

6.5. Contactless Cards

6.6. Y-O-Y Growth trend Analysis By Card Type

6.7. Absolute $ Opportunity Analysis By Card Type, 2024-2030

Chapter 7. Italy Cards and Payments Market– By Payment Method

7.1. Introduction/Key Findings

7.2 Online Payments

7.3. Mobile Payments

7.4. Point-of-Sale (POS) Payments

7.5. Contactless Payments

7.6. Y-O-Y Growth trend Analysis By Payment Method

7.7. Absolute $ Opportunity Analysis By Payment Method , 2024-2030

Chapter 8. Italy Cards and Payments Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Italy

8.1.1. By Country

8.1.1.1. Italy

8.1.2. By Card Type

8.1.3. By Payment Method

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Italy Cards and Payments Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. UniCredit S.p.A.

9.2. Intesa Sanpaolo S.p.A.

9.3. Poste Italiane S.p.A.

9.4. Banco BPM S.p.A.

9.5. Nexi Payments S.p.A.

9.6. SIA S.p.A.

9.7. Mastercard Inc.

9.8. Visa Inc.

9.9. American Express Company

9.10. PayPal Holdings Inc.

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The Italy Cards and Payments Market was valued at USD 12.5 billion in 2023 and is projected to grow at a CAGR of 5.7% from 2024 to 2030.

The market is driven by the rising adoption of digital payment solutions, government initiatives and regulatory support, and the growing preference for contactless payments.

The market is segmented by card type into debit cards, credit cards, prepaid cards, and contactless cards. It is also segmented by payment method into online payments, mobile payments, point-of-sale (POS) payments, and contactless payments.

Security and fraud concerns are challenges for the Italy cards and payments market.

Leading players in the market include UniCredit S.p.A., Intesa Sanpaolo S.p.A., Poste Italiane S.p.A., Banco BPM S.p.A., Nexi Payments S.p.A., SIA S.p.A., Mastercard Inc., Visa Inc., American Express Company, and PayPal Holdings Inc.