IT Outsourcing Market Size (2024 – 2030)

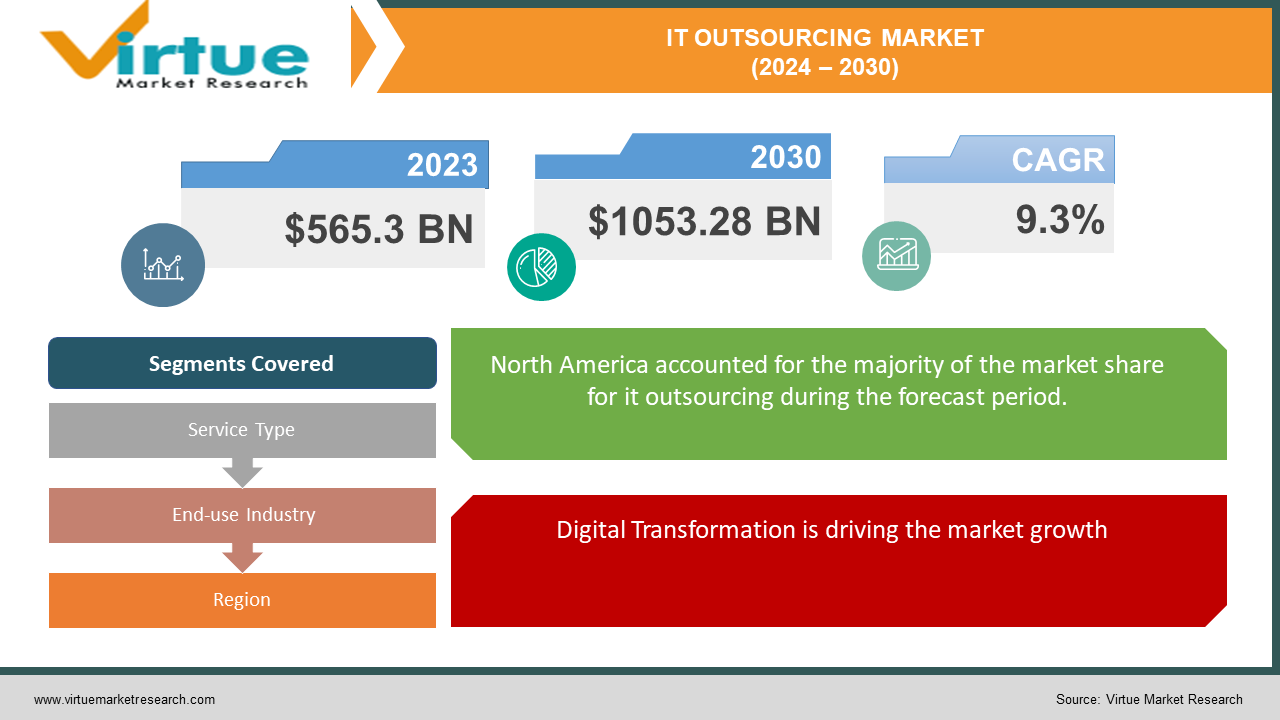

The Global IT Outsourcing Market was valued at USD 565.3 billion in 2023 and will grow at a CAGR of 9.3% from 2024 to 2030. The market is expected to reach USD 1053.28 billion by 2030.

The IT outsourcing market encompasses the practice of companies contracting with external service providers to manage and deliver their IT functions, services, and projects. Instead of relying solely on in-house resources, businesses can leverage the expertise and capabilities of specialized vendors to gain cost-efficiency, access specialized skills, and focus on core business activities. This market covers a wide range of IT services, including application development, infrastructure management, cloud computing, data center operations, and cybersecurity.

Key Market Insights:

IT outsourcing is no longer just about cost reduction; companies are using it to gain a competitive edge through access to specialized skills and innovation.

Organizations are increasingly outsourcing IT functions to focus on their core competencies and improve operational efficiency.

The rise of cloud computing has made it easier and more cost-effective to outsource IT services.

Outsourcing can provide access to advanced security solutions and expertise to manage evolving cyber threats.

Regions like Asia-Pacific and Europe are experiencing significant growth, and North America's established infrastructure and strong outsourcing culture solidify its position as the leading market for IT outsourcing.

Global IT Outsourcing Market Drivers:

Access to Specialized Skills and Expertise is driving the market growth

One of the most compelling benefits of IT outsourcing is the access it provides to a vast pool of specialized skills and expertise. This is particularly valuable for companies struggling to find or retain talent in specific areas like cloud computing, cybersecurity, and data analytics. Outsourcing partners often have teams of highly trained professionals dedicated to these fields, allowing companies to tap into their knowledge and experience without the need for extensive in-house recruitment and training. This not only saves time and resources but also ensures access to the latest technologies and best practices, keeping companies at the forefront of technological advancements.

Digital Transformation is driving the market growth

The relentless march of digital transformation is a major driver of the IT outsourcing market. As businesses across industries strive to leverage technologies like cloud computing, artificial intelligence, and big data, they are increasingly turning to outsourced partners for support. These partners offer the expertise and resources needed to navigate the complexities of digital transformation, from implementing cloud infrastructure and migrating data to developing AI-powered applications and analyzing vast amounts of data. By outsourcing these tasks, companies can accelerate their digital journey, gain access to cutting-edge technology, and stay ahead of the competition. This reliance on external IT expertise is not only driving the growth of the outsourcing market but also transforming its role from a cost-saving measure to a strategic imperative for success in the digital age.

Focus on Core Business is driving the market growth

Outsourcing IT tasks can be a game-changer for businesses seeking to maximize their efficiency and productivity. By offloading IT responsibilities to external providers, companies free up valuable internal resources that can be refocused on their core business activities. This not only allows them to streamline operations and improve overall efficiency but also enables them to dedicate their best people to the areas that drive their competitive advantage. This can be particularly beneficial for smaller businesses or those with limited IT expertise, allowing them to access the skills and resources they need to thrive without having to build an expensive in-house IT team.

Global IT Outsourcing Market challenges and restraints:

Data Security and Privacy Concerns are restricting the market growth

One of the most significant challenges in IT outsourcing is the inherent risk associated with entrusting sensitive data to third-party providers. Data breaches, unauthorized access, and potential loss of intellectual property are major concerns that organizations must carefully consider. This is further compounded by increasingly stringent data privacy regulations like GDPR and CCPA, which add a layer of complexity and require robust security measures from both the outsourcing company and the provider. To mitigate these risks, organizations need to conduct thorough due diligence on potential partners, ensuring they have strong security protocols, encryption, and access controls in place. Additionally, clear and comprehensive contracts outlining data ownership, usage, and security responsibilities are crucial for protecting sensitive information and maintaining compliance with relevant regulations.

Communication and Cultural Differences is restricting the market growth

Bridging the communication gap is crucial for successful IT outsourcing. Time zone differences can lead to scheduling conflicts and delays, while language barriers can cause misunderstandings and misinterpretations of technical details. Additionally, cultural nuances can impact communication styles, decision-making processes, and expectations. To overcome these challenges, effective communication strategies and cultural sensitivity are essential. This includes establishing clear communication protocols, utilizing collaboration tools like video conferencing and project management platforms, and fostering a culture of open and honest communication. Regular meetings, documented processes, and cross-cultural training can further enhance understanding and collaboration. By prioritizing clear communication and cultural awareness, organizations can minimize misunderstandings and ensure successful partnerships in the IT outsourcing landscape.

Market Opportunities:

The IT outsourcing market presents a plethora of exciting opportunities for both businesses and service providers. As the need for specialized skills and cost-effective solutions continues to grow, several factors are creating a fertile ground for innovation and expansion. The increasing adoption of cloud computing is paving the way for more flexible and scalable outsourcing models. This allows businesses to access a wider range of services and expertise without significant upfront investments in infrastructure. Additionally, the rise of automation and artificial intelligence (AI) is transforming the IT landscape, enabling providers to offer more efficient and cost-effective solutions. For instance, AI-powered tools can automate routine tasks, freeing up human resources for more strategic initiatives. Furthermore, the growing focus on cybersecurity is creating new opportunities for specialized IT outsourcing services. As businesses grapple with increasingly sophisticated cyber threats, they are increasingly seeking the expertise of providers who can offer robust security solutions and ongoing threat monitoring. This presents a significant opportunity for providers to develop and offer advanced security services tailored to specific industry needs. The evolving regulatory landscape around data privacy is driving the need for compliant and secure outsourcing practices. This creates opportunities for providers who can demonstrate their commitment to data security and compliance with regulations like GDPR and CCPA. By offering comprehensive data protection solutions and transparent data governance practices, providers can attract businesses seeking secure and compliant outsourcing partnerships.

IT OUTSOURCING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

9.3% |

|

Segments Covered |

By Service Type, End-use Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Accenture, Cognizant, IBM, Infosys, Tata Consultancy Services (TCS), Wipro, Capgemini, DXC Technology, HCL Technologies, NTT DATA, Teleperformance, Tech Mahindra |

IT Outsourcing Market Segmentation - By Service Type

-

Application Development & Maintenance

-

System Administration & Network Management

-

Cloud Services

-

IT Security

-

Help Desk & Support

Application Development & Maintenance reigns supreme in the IT outsourcing landscape. This is driven by the increasing need for organizations to adapt to evolving technologies, develop new applications, and maintain existing software. Outsourcing allows companies to access specialized skills, accelerate development cycles, and gain cost-effectiveness, making it a strategic choice for staying competitive in the digital age.

IT Outsourcing Market Segmentation - By End-use Industry

-

BFSI (Banking, Financial Services, and Insurance)

-

Healthcare

-

Retail & E-commerce

-

Manufacturing

-

Telecommunications & Media

-

Government

The BFSI (Banking, Financial Services, and Insurance) industry reigns supreme as the most dominant end-user in the IT outsourcing market. This sector's inherent need for robust IT infrastructure, stringent security measures, and compliance requirements drives its extensive adoption of outsourcing solutions. From managing complex financial transactions to ensuring data security, BFSI organizations leverage IT outsourcing to gain access to specialized skills, improve operational efficiency, and stay ahead of the ever-evolving technological landscape.

IT Outsourcing Market Segmentation - Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America holds the dominant position due to several factors. The region boasts a strong presence of established technology companies, a mature IT infrastructure, and a large pool of skilled IT professionals. Additionally, North American businesses have a long history of outsourcing IT services, leading to a well-developed ecosystem of service providers. While other regions like Asia-Pacific and Europe are experiencing significant growth, North America's established infrastructure and strong outsourcing culture solidify its position as the leading market for IT outsourcing.

COVID-19 Impact Analysis on the Global IT Outsourcing Market

The COVID-19 pandemic significantly impacted the global IT outsourcing market, causing both initial disruptions and long-term shifts. While the initial wave of lockdowns and economic uncertainty led to a temporary decline in IT spending and project delays, the pandemic ultimately accelerated the adoption of digital technologies and remote work practices, ultimately driving the growth of the IT outsourcing market in the long run.

One of the immediate impacts of the pandemic was the disruption of existing IT outsourcing operations. Travel restrictions and lockdowns hindered collaboration and project execution, leading to delays and uncertainties. Additionally, some businesses were forced to cut IT budgets due to economic pressures, temporarily impacting the demand for outsourcing services.

However, the pandemic also highlighted the importance of digital transformation and remote work capabilities. Businesses increasingly turned to IT outsourcing providers to help them adapt to the changing environment. This led to a surge in demand for services like cloud computing, remote infrastructure management, and cybersecurity solutions.

Furthermore, the pandemic has driven a shift towards a more flexible and agile approach to IT outsourcing. Businesses are increasingly adopting multi-sourcing strategies, partnering with multiple providers to access specialized skills and mitigate risks. Additionally, the rise of cloud-based solutions and automation tools has facilitated more efficient and cost-effective outsourcing models.

Latest trends/Developments

The IT outsourcing landscape is undergoing exciting transformations, with new trends shaping the future of the market. A significant shift is the focus on strategic partnerships over transactional outsourcing. Companies are seeking vendors with deep expertise in specific areas like AI, cloud computing, and data analytics to drive innovation and competitive advantage. This necessitates a move from cost-cutting to value-driven partnerships, where outsourcing becomes an integral part of the business strategy. Emerging technologies like AI, machine learning, and robotic process automation (RPA) are driving new outsourcing opportunities. Companies are increasingly relying on external partners to develop and implement these technologies, leveraging their specialized skills and resources. Additionally, cloud-based solutions are fueling the market, as businesses seek flexible and scalable IT infrastructure. Outsourcing cloud management and development tasks allows them to optimize costs and focus on core business activities. Another key trend is the growing emphasis on data security and compliance. With stringent regulations like GDPR and CCPA, companies are turning to outsourcing partners with robust security protocols and expertise in data protection. This ensures compliance and minimizes risks associated with sensitive data handling. The nearshore outsourcing model is gaining traction, offering a balance between cost, cultural alignment, and time zone proximity. This model allows companies to access skilled talent in geographically closer locations, facilitating better communication and collaboration.

Key Players:

-

Accenture

-

Cognizant

-

IBM

-

Infosys

-

Tata Consultancy Services (TCS)

-

Wipro

-

Capgemini

-

DXC Technology

-

HCL Technologies

-

NTT DATA

-

Teleperformance

-

Tech Mahindra

Chapter 1. IT Outsourcing Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. IT Outsourcing Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. IT Outsourcing Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. IT Outsourcing Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. IT Outsourcing Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. IT Outsourcing Market – By Service Type

6.1 Introduction/Key Findings

6.2 Application Development & Maintenance

6.3 System Administration & Network Management

6.4 Cloud Services

6.5 IT Security

6.6 Help Desk & Support

6.7 Y-O-Y Growth trend Analysis By Service Type

6.8 Absolute $ Opportunity Analysis By Service Type, 2024-2030

Chapter 7. IT Outsourcing Market – By End-use Industry

7.1 Introduction/Key Findings

7.2 BFSI (Banking, Financial Services, and Insurance)

7.3 Healthcare

7.4 Retail & E-commerce

7.5 Manufacturing

7.6 Telecommunications & Media

7.7 Government

7.8 Y-O-Y Growth trend Analysis By End-use Industry

7.9 Absolute $ Opportunity Analysis By End-use Industry, 2024-2030

Chapter 8. IT Outsourcing Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Service Type

8.1.3 By End-use Industry

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Service Type

8.2.3 By End-use Industry

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Service Type

8.3.3 By End-use Industry

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Service Type

8.4.3 By End-use Industry

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Service Type

8.5.3 By End-use Industry

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. IT Outsourcing Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Accenture

9.2 Cognizant

9.3 IBM

9.4 Infosys

9.5 Tata Consultancy Services (TCS)

9.6 Wipro

9.7 Capgemini

9.8 DXC Technology

9.9 HCL Technologies

9.10 NTT DATA

9.11 Teleperformance

9.12 Tech Mahindra

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global IT Outsourcing Market was valued at USD 1.07 billion in 2023 and will grow at a CAGR of 12% from 2024 to 2030. The market is expected to reach USD 2.37 billion by 2030.

Access to Specialized Skills and Expertise and focus on Core Business are the reasons that are driving the market.

Based on end-user it is divided into five segments – BFSI (Banking, Financial Services, and Insurance), Healthcare, Retail & E-commerce, Manufacturing, Telecommunications & Media, Government

North America is the most dominant region for the IT Outsourcing Market.

Accenture, Cognizant, IBM, Infosys, Tata Consultancy Services (TCS), Wipro