Isolongifolene Ketone Market Size (2024 – 2030)

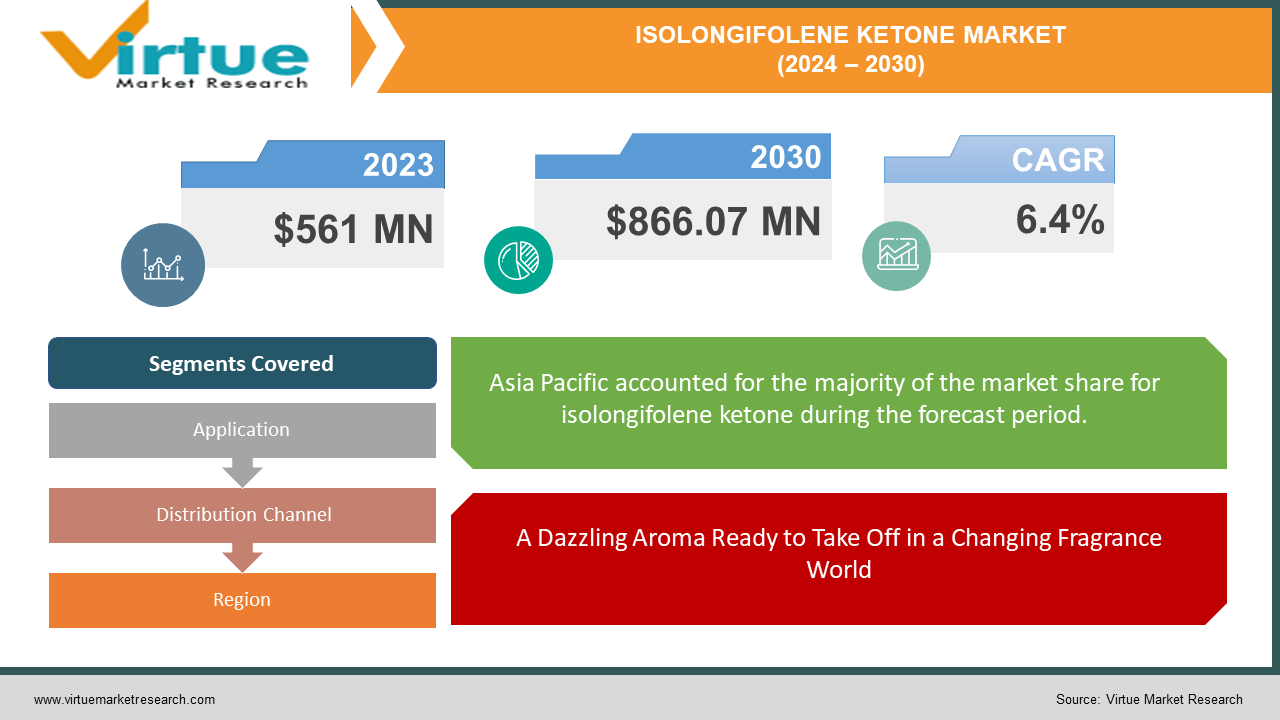

The Global Isolongifolene Ketone Market was valued at USD 561 million in 2023 and is projected to reach a market size of USD 866.07 million by 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6.4%.

The woodsy scent of isolongifolene ketones, also called isolongifolanone, makes it a highly sought-after synthetic fragrance ingredient. Instead of occurring naturally, it is made from other terpenes. It is valued by perfumers for its capacity to infuse perfumes, especially those belonging to the woody and oriental families, with complex notes of tobacco, incense, and cedar. There are a few reasons why isolongifolene ketone is becoming more popular. First, these kinds of perfumes are becoming more and more popular among consumers. Secondly, it can serve as a more cost-effective and environmentally friendly alternative to more expensive natural components like patchouli. And lastly, perfumers value its adaptability in crafting distinctive and elegant scents. Notwithstanding, the market encounters obstacles such as plausible legislative limitations and reliance on a steady supply chain.

Key Market Insights:

The market is moving towards woodsy and oriental scents, which is where Isolongifolene Ketone shines. According to a consumer poll, these fragrances are preferred by 63% of fragrance buyers, which bodes well for Isolongifolene Ketone's future growth. The move in the fragrance business towards more environmentally friendly components presents a chance for isolongifolene ketone. It can serve as a replacement for more expensive natural options like patchouli, potentially saving producers up to 40% on costs.Investment in R&D to streamline the manufacture of isolongifolene ketone guarantees a dependable supply chain and cost-effectiveness (with the potential to save up to 40%).The issue lies in the constantly changing regulatory environment. Isolongifolene ketone's use may be restricted if safety issues arise, which would affect market growth.

Global Isolongifolene Ketone Market Drivers:

A Dazzling Aroma Ready to Take Off in a Changing Fragrance World

The fragrance business is transforming, and Isolongifolene Ketone is well-positioned to capitalize on this trend. Fragrances with woody and oriental notes are becoming more and more popular, which is an intriguing change in consumer preferences. Given that isolongifolene ketone is so good at duplicating these exact fragrance profiles, this offers it a fantastic chance. Isolongifolene Ketone is a synthetic fragrance element that has a complex perfume, unlike some others that resemble single notes. It can enhance aroma compositions with rich incense, smoky tobacco, and deep, evocative layers of cedarwood. One major factor driving the market ahead is the ideal match between what people want and what Isolongifolene Ketone gives. Envision an opulent scent that combines the comforting, earthy warmth of cedarwood with fascinating notes of tobacco and incense. The key ingredient that perfumers use to generate such alluring scents is isolongifolene ketone. Isolongifolene ketone demand is expected to soar as customers move more and more toward these complex and captivating fragrances.

Technological Developments May Release a Wave of Novel Olfactory Experiences

Innovations in technology could open new markets for isolongifolene ketone. Significant cost savings could result from production process optimization. This would make isolongifolene ketone a more appealing alternative for fragrance producers, not only luxury ones. What if this adaptable ingredient could be used by niche perfumers and smaller fragrance companies to create their unique scents? Its increased accessibility would encourage creativity and experimentation, which would result in a greater range of scents based on isolongifolene ketone being available on the market, thereby increasing its prominence and reach within the fragrance industry.

Global Isolongifolene Ketone Market Restraints and Challenges:

The extensive use of isolongifolene ketone in the global market may encounter several obstacles despite its aromatic qualities. If safety concerns are raised, the fragrance industry's regulatory regulations may prohibit its use. Its synthetic origin may also make it inappropriate for applications looking for entirely natural fragrances. The expense of the finished fragrance product may be affected by how cost-effective it is to separate this component from other terpenes. Finally, depending on production capacity and market demands, isolongifolene ketone itself may not be readily available.

Eco-awareness in the fragrance industry is growing, and isolongifolene ketone is growing right along with it. To create those earthy, woodsy tones, perfumers have historically used natural substances like patchouli. These organic components can be pricey, too, and the process of obtaining them can be harmful to the environment. One strong substitute is isolongifolene ketone. It may mimic patchouli's highly sought-after woodsy and oriental scent characteristics, and it can frequently do it for less money. For scent producers, this means lessening their impact on the environment and maybe increasing their revenue. Envision a world in which high-end scents are created with sustainability in mind. For producers looking for environmentally responsible solutions without compromising the intricacy or quality of their fragrances, isolongifolene ketone is a valuable tool. It is anticipated that the appeal of isolongifolene ketone as an ethical and affordable replacement will grow as the industry places a greater emphasis on sustainability.

Global Isolongifolene Ketone Market Opportunities:

Markets for isolongifolene ketone around the world offer promising prospects. Demand may be further increased by consumers' growing interest in woodsy and oriental scents, where isolongifolene ketone shines. With undertones of cedar, tobacco, and incense, its distinctive smell profile appeals to niche perfumers and fragrance companies looking for intricacy. Furthermore, producers may find it advantageous to use isolongifolene ketone as an affordable alternative to more expensive natural components like vetiver or patchouli. This indicates a bright future for this market, as does the possibility for perfumers to use isolongifolene ketone to develop novel aroma combinations.

ISOLONGIFOLENE KETONE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.4% |

|

Segments Covered |

By Application, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Lanxess AG, BASF SE, Kuraray Co., Ltd., Jiangsu Juming Chemical Technology Co., Ltd., Parchem Fine & Specialty Chemicals, Tokyo Chemical Industry Co., Ltd., Syntree, Simagchem Corporation, Chemsrc, Haihang Industry Co., Ltd. |

Global Isolongifolene Ketone Market Segmentation: By Application

-

Fragrances

-

Household Products

-

Industrial Applications

Since fragrances provide the perfect aroma profile for well-known perfumes, fragrances are probably the market leader in isolongifolene ketone. Demand for household items may be driven by their potential application in cleaning products, making them the second-best and fastest-growing category. Isolongifolene ketone's fragrance-oriented qualities imply a lesser role in comparison to perfumes and possibly even domestic products, even though it might find uses in industrial settings like soaps and candles. This division can be confirmed by looking through market research studies on isolongifolene ketone by application.

Global Isolongifolene Ketone Market Segmentation: By Distribution Channel

-

Direct Sales to Fragrance Houses

-

Sales Through Fragrance Ingredient Distributors

-

Online Marketplaces

Isolongifolene ketone distribution is probably dominated by direct sales to fragrance houses because of their large purchases and mutually beneficial relationships. Distributors of Fragrance Ingredients serve as an alternative channel, providing smaller firms with a greater assortment of ingredients and a bigger audience. Although established channels are probably favored at this point for quality assurance and experience, online marketplaces may see expansion in the future. This breakdown can be confirmed by looking through market research studies on the distribution of isolongifolene ketone.

Global Isolongifolene Ketone Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia Pacific may currently hold the biggest market share for isolongifolene ketone due to the region's developing fragrance sector and vast customer base, despite the difficulty in identifying a regional leader due to data paucity. While established markets like North America and Europe may have a sizable share but grow more slowly than emerging regions, the Middle East and Africa, with its expanding middle class and growing fragrance sector, has the potential for the quickest development. A better understanding of the global distribution of isolongifolene ketone can be obtained by consulting specialized regional market research studies.

COVID-19 Impact Analysis on the Global Isolongifolene Ketone Market:

The worldwide supply chain experienced considerable interruptions because of the pandemic. Travel bans and lockdowns made it more difficult for commodities to move, which could have led to an Isolongifolene Ketone scarcity. Price variations might have resulted from this, which would have given suppliers and manufacturers anxiety. Furthermore, it's possible that COVID-19's economic crisis reduced consumer expenditure on upscale products like fragrances and perfumes. This could have consequently resulted in a decline in the market for isolongifolene ketone, a crucial component of these goods. The pandemic-induced surge in e-commerce presented a possible bright spot. Fragrance sales on e-commerce platforms may have increased as consumers stayed at home and turned to online shopping. If isolongifolene ketone is found in scents that are sold online, this could have helped it.

Recent Trends and Developments in the Global Isolongifolene Ketone Market:

The market for isolongifolene ketone is an intriguing one, and current trends point to both successes and setbacks. Positively, consumer tastes are shifting in favor of woody scents, which is Isolongifolene Ketone's area of expertise and could increase demand. Additionally, its capacity to serve as a sustainable replacement for more expensive natural compounds like patchouli is drawing eco-aware manufacturers. Perfumers are also always coming up with new ideas, and isolongifolene ketone's distinct character, which combines notes of incense, tobacco, and cedar, encourages experimentation with fragrance creation. Technological developments that lower production costs have the potential to expand their application. The path isn't without challenges, though. Its use can be restricted by regulations if safety issues surface. Moreover, as demonstrated by COVID-19, disruptions in the global supply chain can result in shortages and price swings.

Key Players:

-

Lanxess AG

-

BASF SE

-

Kuraray Co., Ltd.

-

Jiangsu Juming Chemical Technology Co., Ltd.

-

Parchem Fine & Specialty Chemicals

-

Tokyo Chemical Industry Co., Ltd.

-

Syntree

-

Simagchem Corporation

-

Chemsrc

-

Haihang Industry Co., Ltd.

Chapter 1. Isolongifolene Ketone Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Isolongifolene Ketone Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Isolongifolene Ketone Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Isolongifolene Ketone Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Isolongifolene Ketone Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Isolongifolene Ketone Market – By Distribution Channel

6.1 Introduction/Key Findings

6.2 Direct Sales to Fragrance Houses

6.3 Sales Through Fragrance Ingredient Distributors

6.4 Online Marketplaces

6.5 Y-O-Y Growth trend Analysis By Distribution Channel

6.6 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 7. Isolongifolene Ketone Market – By Application

7.1 Introduction/Key Findings

7.2 Fragrances

7.3 Household Products

7.4 Industrial Applications

7.5 Y-O-Y Growth trend Analysis By Application

7.6 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Isolongifolene Ketone Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Distribution Channel

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Distribution Channel

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Distribution Channel

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Distribution Channel

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Distribution Channel

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Isolongifolene Ketone Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Lanxess AG

9.2 BASF SE

9.3 Kuraray Co., Ltd.

9.4 Jiangsu Juming Chemical Technology Co., Ltd.

9.5 Parchem Fine & Specialty Chemicals

9.6 Tokyo Chemical Industry Co., Ltd.

9.7 Syntree

9.8 Simagchem Corporation

9.9 Chemsrc

9.10 Haihang Industry Co., Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Isolongifolene Ketone Market size is valued at USD 561 million in 2023.

The worldwide Global Isolongifolene Ketone Market growth is estimated to be 6.4% from 2024 to 2030.

The Global Isolongifolene Ketone Market is segmented By Application (Fragrances, Household Products, Industrial Applications); By Distribution Channel (Direct Sales to Fragrance Houses, Sales Through Fragrance Ingredient Distributors, Online Marketplaces), and by region.

Isolongifolene Ketone appears to have a promising future. Isolongifolene ketone has the potential to be used by perfumers to generate unique smells, and it is becoming more and more popular as a sustainable alternative to woody fragrances.

There were conflicting effects of the COVID-19 pandemic on the market for isolongifolene ketone. Although supply chain disruptions and a decline in the demand for fragrances presented difficulties, a greater emphasis on hygiene may have led to a rise in its usage in cleaning products.