Isocyanates Polyurethane Elastomers Market Size (2023 – 2030)

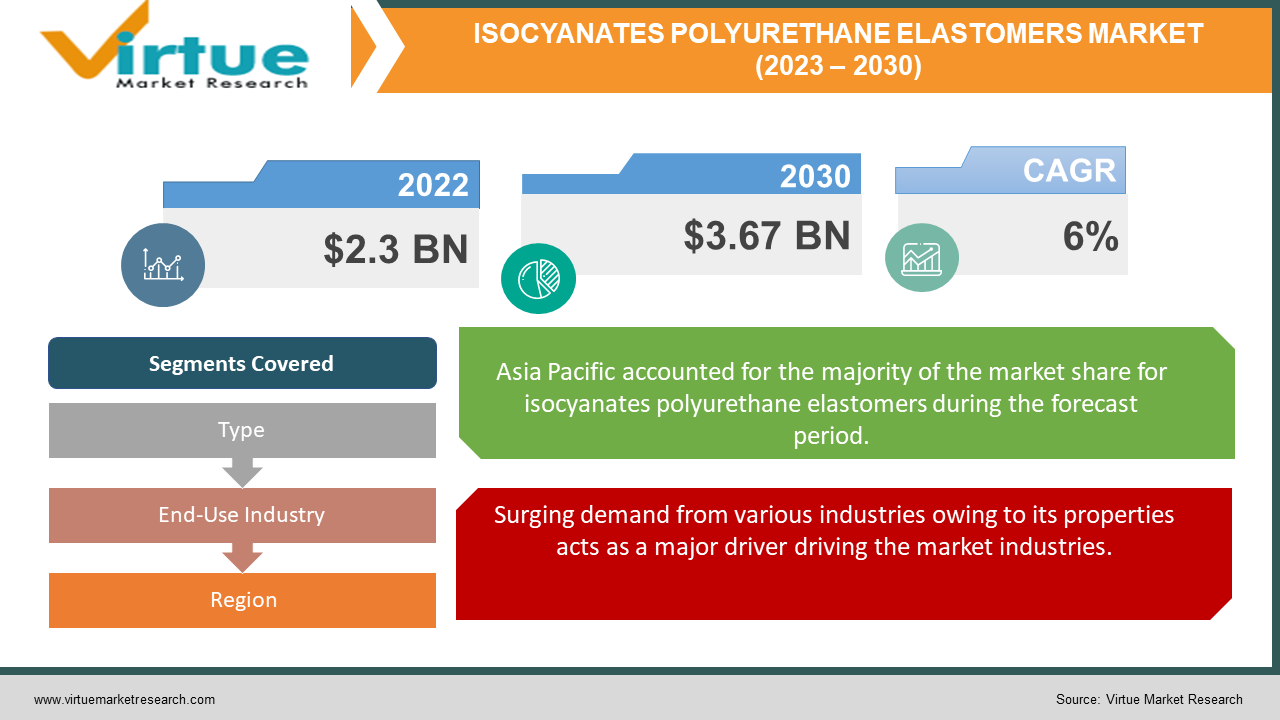

The Global Isocyanates Polyurethane Elastomers Market was valued at USD 2.3 billion and is projected to reach a market size of USD 3.67 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 6%.

The isocyanates polyurethane elastomers market has experienced significant growth over the years. It finds its applications in a wide range of industries because of the exceptional properties it offers propelling the demand. Recent trends and adaption towards sustainability, R&D activities, eco-friendly formulations, rising demand, advancements in industries, and developing economies are expected to boost the continuous growth of the industry thereby creating more career opportunities over the next decade. During the forecast period, this market is anticipated to show a notable growth.

Key Market Insights:

-

Ongoing R&D activities have significantly increased by 10-20% during the last decade.

-

Buildings insulated with polyurethane foam can cut energy usage for heating and cooling by up to 50%, according to the Polyurethane Foam Association.

-

There has been a significant increase in the number of companies that are adapting to low VOC-based compounds as well as water-based polyurethane elastomers from the past 5 years highlighting the idea of sustainability.

-

Few industries like automotive, building & construction, chemical, healthcare, etc. are facing environmental concerns of waste management and harmful emissions. As a result, larger firms and companies are heavily investing to develop suitable alternatives and energy-efficient solutions, and reducing costs by optimizing of manufacturing process, along with a focus on tackling recycling challenges.

Isocyanates Polyurethane Elastomers Market Drivers:

Surging demand from various industries owing to its properties acts as a major driver driving the market industries.

Isocyanates Polyurethane Elastomers have advantageous properties of chemical and temperature resistance, compatibility, flexibility, durability, high tensile strength, waterproofing, high load-bearing capacity, superior performance, lightweight, and adhesion. These factors make them favorable to be used in industries like building & construction, automotive, aerospace, renewable energy, healthcare, etc. Additionally, the rising demand for electric vehicles for an eco-friendly economy is further propelling the growth of the industry.

Growing awareness of the need to implement sustainable and eco-friendly solutions is driving market expansion.

There has been a lot of research and development activity towards the construction of environmentally friendly, sustainable, and bio-based products. Materials with a lower carbon impact, increased efficiency, and recycling capabilities are being developed. These environmentally friendly options are expected to aid in market expansion. This trend towards greener options will allow the isocyanates polyurethane elastomers market to benefit from rising demand for eco-conscious materials and technologies, as sustainability is becoming a prominent driver in a variety of industries.

Isocyanates Polyurethane Elastomers Market Restraints and Challenges:

Health issues, high costs, environmental concerns, and adhering to standards are the major barriers the market is currently facing.

Isocyanates are very irritating to the mucous membranes of the eyes, as well as the gastrointestinal and respiratory systems. Direct skin contact might also result in significant irritation. Isocyanates can also sensitize employees, putting them vulnerable to severe asthma episodes if exposed again. Workers may also become so sensitive to isocyanates that they are unable to work in the presence of the chemicals. Secondly, increased costs can have a major impact on the industry. Production processes and raw materials consume a lot of finances which can demotivate small firms and companies. Constant fluctuation and instability can hamper the growth rate. Thirdly, tackling environmental issues becomes a major concern. This can result in pollution and other environmental issues. Garbage and finding waste management solutions may be a hindrance to progress. Furthermore, adherence to rules, regulations, and certifications can have a negative impact.

Isocyanates Polyurethane Elastomers Market Opportunities:

The healthcare and medical sector provides the market with an ample number of opportunities. They are used for drug delivery, implants, and medical devices because of their flexibility and biocompatibility. Growing demand for minimally invasive procedures further helps in the expansion. Secondly, they are increasingly being used in the automotive industry, particularly for electric vehicles. They help in critical performance. Furthermore, a focus on developing recycling technologies and reducing environmental impact is expected to cause promising growth. In the coming years, with an increased focus on R&D, Government initiatives, investments, and funds this market is anticipated to show significant growth.

ISOCYANATES POLYURETHANE ELASTOMERS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

6% |

|

Segments Covered |

By Type, End-Use Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BASF SE, The Dow Chemical Company (Dow) Covestro AG, Huntsman Corporation Wanhua Chemical Group, Bayer AG, LANXESS AG, Mitsui Chemicals, Inc., Hexion Inc., Recticel NV/SA |

Isocyanates Polyurethane Elastomers Market Segmentation: By Type

-

Thermoset PU Elastomer

-

Thermoplastic PU Elastomer

Based on type, thermoset polyurethane elastomer is the largest growing segment. This is because of factors like flexibility, elasticity, abrasion resistance, high load-bearing capacity, and strength it offers. This makes them suitable to be used in various industries like transportation, construction, and the automotive sector. Furthermore, thermoset polyurethane elastomer does not distort when heated. Hence, they are employed in the fabrication of permanent components. They hold a market share of around 60-70%. Thermoplastic polyurethane elastomer is the fastest growing type holding around 30-40% market share. They exhibit properties like simplicity, cost-effectiveness, tensile strength, and chemical resistance. Furthermore, their capacity to be melted and molded repeatedly makes them an apt choice to be used in footwear, textiles, and the electronic industry.

Isocyanates Polyurethane Elastomers Market Segmentation: By End-Use Industry

-

Automotive

-

Aerospace

-

Healthcare

-

Construction

-

Consumer Goods

-

Footwear

-

Others

Based on the end-use industry automotive sector is the largest growing because isocyanate polyurethane elastomers are largely utilized for creating wheels, automobile suspension blushing, gears, interiors, and many other elements of cars owing to long-lasting performance, high-performance material, safety as well as emissions control and many such advantages. The healthcare industry is one of the fastest-growing end-users. These materials are used in orthopedic implants, prosthetics, manufacturing of medical devices, and play a role in the delivery of drugs. With a growing emphasis on a stronger and better healthcare system for the public, this market is anticipated to show significant growth.

Isocyanates Polyurethane Elastomers Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Based on regions, Asia Pacific is the largest growing. According to a report, it is estimated to hold a total share of 35% by 2035. Huge investments in research and development are having a significant impact. Furthermore, increased demand, new business establishments, industrialization, rising incomes, and government initiatives and plans are propelling the economy forward. Additionally, end-use sectors such as vehicles, electronics, buildings, and construction contribute to the increased revenue generation. China, Japan, India, and South Korea are amongst the world's biggest economies. North America is the fastest growing region holding about 25% of the total market share. This is because of the established economy, technical improvements, important players' presence, investments, and cash. Furthermore, demand from end-user sectors, particularly footwear and automotive is a primary driver of the market's large share. The regions at the forefront are the United States and Canada. However, Europe is another significant player holding a very close share as that of North America. Its total share is around 20-25%. Germany, France, and the United Kingdom are the major countries holding significant profits.

COVID-19 Impact Analysis on the Global Isocyanates Polyurethane Elastomers Market:

The introduction of the COVID-19 hurt the market. It led to stronger restrictions in practically all areas to prevent the virus from spreading. The new normal was lockdowns, social isolation, and mobility restrictions. This disrupted the supply chain, manufacturing schedules, logistics, and import-export commerce, resulting in an economic downturn. Approximately 85% of businesses experienced supply chain interruption. The closure of industry and industrial plants was a setback. Furthermore, a scarcity of personnel hampered the completion of numerous activities. However, following the outbreak, the business is gradually picking up with regulation relaxations and lockdowns being lifted.

Latest Trends/ Developments:

The companies in this market are motivated to achieve a higher market share by implementing different strategies, such as acquisitions, partnerships, and investments. Companies are also spending heftily on the development of improved products and greener alternatives alongside maintaining competitive pricing. This has further resulted in increased government engagement and further enlargement.

Because of the benefits of isocyanate polyurethane elastomers, several sectors such as oil & and gas, renewable energy, and 3D printing have begun to increase their usage. The demand for developing sustainable alternatives with little or no environmental effect is expected to extend the applications. Furthermore, emphasis is being placed on R&D initiatives to broaden human understanding.

Key Players:

-

BASF SE

-

The Dow Chemical Company (Dow)

-

Covestro AG

-

Huntsman Corporation

-

Wanhua Chemical Group

-

Bayer AG

-

LANXESS AG

-

Mitsui Chemicals, Inc.

-

Hexion Inc.

-

Recticel NV/SA

In August 2020, Covestro announced to buying of Royal DSM's Resins & Functional Materials division. This acquisition sought to boost Covestro's position in high-performance resins and materials, which benefitted the polyurethane industry as well.

In January 2020, BASF, a multinational chemical corporation, finalized its acquisition of Solvay's polyamide division. While this transaction focused mostly on polyamide goods, it represented growing consolidation and strategic maneuvers in the larger chemical and polymer sector, which includes polyurethane elastomers. The deal expands BASF's polyamide capabilities by introducing new and well-known products.

Chapter 1. Isocyanates Polyurethane Elastomers Market– Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Isocyanates Polyurethane Elastomers Market– Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Isocyanates Polyurethane Elastomers Market– Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Isocyanates Polyurethane Elastomers Market- Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Isocyanates Polyurethane Elastomers Market– Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Isocyanates Polyurethane Elastomers Market– By Type

6.1 Introduction/Key Findings

6.2 Thermoset PU Elastomer

6.3 Thermoplastic PU Elastomer

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis by Type, 2023-2030

Chapter 7. Isocyanates Polyurethane Elastomers Market– By END-USE INDUSTRY

7.1 Introduction/Key Findings

7.2 Automotive

7.3 Aerospace

7.4 Healthcare

7.5 Construction

7.6 Consumer Goods

7.7 Footwear

7.8 Others

7.9 Y-O-Y Growth trend Analysis By END-USE INDUSTRY

7.10 Absolute $ Opportunity Analysis By END-USE INDUSTRY, 2023-2030

Chapter 8. Isocyanates Polyurethane Elastomers Market, By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By END-USE INDUSTRY

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By END-USE INDUSTRY

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By END-USE INDUSTRY

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By END-USE INDUSTRY

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By END-USE INDUSTRY

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Isocyanates Polyurethane Elastomers Market– Company Profiles – (Overview, Isocyanates Polyurethane Elastomers Market Portfolio, Financials, Strategies & Developments)

9.1 BASF SE

9.2 The Dow Chemical Company (Dow)

9.3 Covestro AG

9.4 Huntsman Corporation

9.5 Wanhua Chemical Group

9.6 Bayer AG

9.7 LANXESS AG

9.8 Mitsui Chemicals, Inc.

9.9 Hexion Inc.

9.10 Recticel NV/SA

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Isocyanates Polyurethane Elastomers Market was valued at USD 2.3 billion and is projected to reach a market size of USD 3.67 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 6%.

Surging demand from various industries owing to its properties and growing awareness of the need to implement sustainable and eco-friendly solutions are the major drivers in the Global Isocyanates Polyurethane Elastomers Market.

Based on the end-use industry, the Global Isocyanates Polyurethane Elastomers Market is segmented into Automotive, Aerospace, Healthcare, Construction, Consumer Goods, Footwear, and Others.

Asia Pacific is the most dominant region for the Global Isocyanates Polyurethane Elastomers Market.

BASF SE, The Dow Chemical Company (Dow), and Covestro AG are the key players operating in the Global Isocyanates Polyurethane Elastomers Market.