Ischemic Heart Disease Drugs Market Size (2024 – 2030)

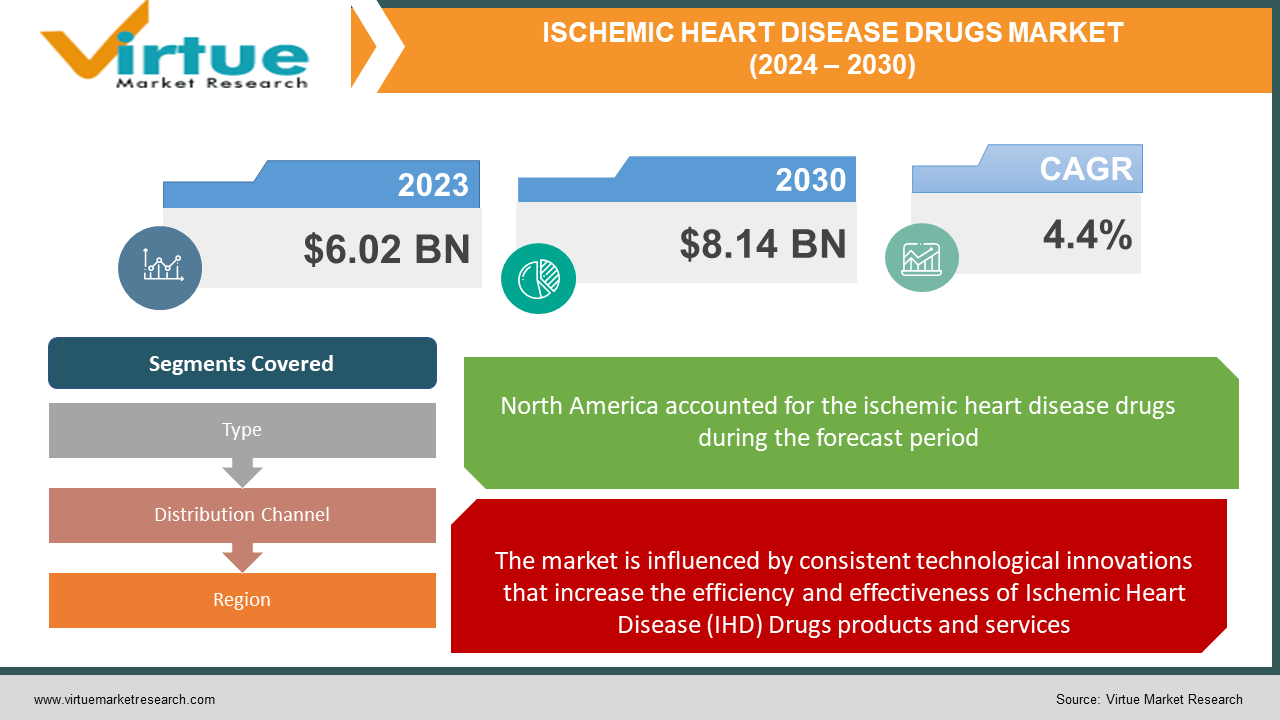

The Ischemic Heart Disease Drugs Market was valued at USD 6.02 billion in 2023 and is projected to reach a market size of USD 8.14 billion by the end of 2030. Over the forecast period of 2024-2030, the market is estimated to grow at a CAGR of 4.4%.

Ischemic Heart Disease (IHD), famously referred to as coronary heart disease, is a scenario characterized by damage to the heart muscle owing to reduced oxygen and blood supply. It comes from molecular changes in blood vessels or the sudden closure and narrowing of coronary arteries resulting from atheroma. IHD is particularly associated with chronic chest pain and discomfort, and if left uncured, it can be fatal. IHD drugs play a pivotal role in handling this condition, with numerous medications prescribed depending on the severity of the condition. These drugs involve cholesterol-modifying medications, aspirin to lower blood clotting, beta-blockers to reduce heart rate and blood pressure, calcium channel blockers, ranolazine, and antithrombotic agents.

Key Market Insights:

-

The enhancing number of entries in hospitals, as well as in critical care units due to Cardio Vascular Diseases (CVDs), are also generating demand for the development of cardiovascular drugs for treatment. For example, according to the data confirmed by the British Heart Foundation (BHF) in April 2023, nearly 11,39,140 inpatient entries for heart and circulatory conditions were there in the National Health Service hospitals in the United Kingdom, among which 2,73,991 admissions were for IHD, and 1,14,452 number of admissions were there for failure of heart during 2021-2022 period.

-

Jardiance (empagliflozin) 10 mg was certified by the Food and Drug Administration (FDA) to mitigate the risk of cardiovascular death plus hospitalization for failure of the heart in adults with heart failure with lowered ejection fraction (HFrEF). Hence, owing to escalating hospital admissions and growth in product approvals, the researched market is estimated to develop majorly during the future period.

-

Frequent product approvals are also estimated to be dedicated to market development globally. For example, in February 2022, the FDA widened its approval of empagliflozin (Jardiance) for usage in adults with heart failure (HF), irrespective of ejection fraction, to lower the risk of cardiovascular failure and HF hospitalization. The treatment was approved in August 2021 to lower the risk of cardiovascular failure and HF hospitalization in adults with HF with mitigated ejection fraction (HFrEF).

Ischemic Heart Disease Drugs Market Drivers:

Technological developments - The market is influenced by consistent technological innovations that increase the efficiency and effectiveness of Ischemic Heart Disease (IHD) Drugs products and services. This involves advancements in materials, manufacturing techniques, and digital technologies.

Growing Population - Elements such as an increase in population, urbanization, and altering consumer choices escalate the demand for Ischemic Heart Disease (IHD) Drugs products, and services.

Support from government - Helpful government policies, regulations, and incentives that encourage the usage of Ischemic Heart Disease (IHD) Drugs, like subsidies for renewable energy assignments and carbon pricing techniques, encourage market growth.

Environmental Awareness - Accelerating awareness about environmental sustainability and the requirement to lower carbon emissions is propelling the deployment of Ischemic Heart Disease (IHD) Drug solutions, especially those that are green and renewable.

Reduction in Costs - Systematic cost reductions in the manufacture and installation of Ischemic Heart Disease (IHD) Drug solutions, driven by economies of scale, technological developments, and enhanced competition, are making these solutions more cost-friendly and accessible.

Ischemic Heart Disease Drugs Market Restraints and Challenges:

High Capital Investment- The high initial deployment needed for the development and set of Ischemic Heart Disease (IHD) Drug solutions, particularly for large-scale projects, can be a major barrier to market development.

Intermittency and Dependability - The intermittency and reliability of a few Ischemic Heart Disease (IHD) Drug solutions, such as solar and wind energy, can be a restraint, especially in places with inconsistent weather conditions.

Infrastructure Limitation - The demand for key infrastructure investments, such as grid upgrades and storage options, to encourage the integration of Ischemic Heart Disease (IHD) Drug solutions into current energy systems can be a limit.

Uncertainty in Policy - Uncertainty around government rules and policies, such as alterations in subsidies or tax incentives, can generate instability for investors and low-paced market growth.

Competing Technologies - Competing advancements in tech, such as fossil fuels and nuclear energy, can pose a threat to the adoption of Ischemic Heart Disease (IHD) Drug solutions, especially in regions where these technologies are well-installed and subsidized.

Ischemic Heart Disease Drugs Market Opportunities

Escalating requirement for advanced and effective drugs

Other significant driving factors are the greater prevalence of cardiovascular diseases (CVD) globally and the rising demand for more effective therapeutics. Cardiovascular therapeutics have gone through key R&D innovations since the time they were initially launched to the general audience. A number of novel treatments have since been introduced in the global market and have been greatly successful. The worldwide cardiovascular drug market may be taken to be overcrowded owing to the existence of several major competitors and escalating influences of the comparatively affordable generics. However, the nature of cardiovascular conditions renders them almost untreatable and the increasing prevalence is further worsening the cure outlook for patients. This has led to the growth of a huge unmet treatment demand in the market and is expected to be one of the other primary driving elements in the global market.

ISCHEMIC HEART DISEASE DRUGS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.4% |

|

Segments Covered |

By Type, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

AstraZeneca, Bayer, Eli Lilly, Novartis, Pfizer Sanofi, Amgen Inc. , Gilead Sciences, Inc, GlaxoSmithKline plc., Teva Pharmaceutical Industries Ltd, Cardurion Pharmaceuticals, Cardior Pharmaceuticals, Actelion Pharmaceuticals Ltd, Boehringer Ingelheim International GmbH, Bristol-Myers Squibb Company |

Ischemic Heart Disease Drugs Market Segmentation: By Type

-

Anti-dyslipidemic Drugs

-

Calcium Channel Blockers

-

Beta-blockers

-

ACE Inhibitors

-

ARBs

Antihyperlipidemic are also known as hypolipidemic drugs, also referred to as lipid-lowering drugs that lower the level of lipids and lipoproteins in the blood. Lipoproteins bind cholesterol and can collect in blood vessels. A group of medications that alter the movement of calcium via calcium channels are known as Calcium channel blockers (CCB), calcium channel antagonists, or calcium antagonists. One of the common medications to lower hypertension in patients is Calcium channel blockers and drugs that reduce blood pressure are Beta Blockers. They also may be known as beta-adrenergic blocking agents. The medicines restrict the impact of the hormone epinephrine, also called adrenaline. Beta-blockers cause the heart to beat more slowly and with reduced force. ACE inhibitors are a medication class utilized to cure and handle hypertension, a major risk factor for coronary disease, heart failure, stroke, and several other cardiovascular conditions.

Ischemic Heart Disease Drugs Market Segmentation: By Distribution Channel

-

Hospital Pharmacies

-

Retail Pharmacies

-

Online Pharmacies

-

Others

Based on distribution channels, the market for IHD drugs can be divided into hospital pharmacies, retail pharmacies, online pharmacies, and others. The hospital pharmacies segment is expected to have the major share because these medications are often prescribed post diagnosis which often take place at these institutions.

The retail pharmacies segment is expected to be the fastest growing segment because, in cases of re-filling prescriptions, these institutions can offer more efficient facilities. The online pharmacies segment is also gaining traction owing to the rising usage of online pharmacy facilities, which are earning popularity due to their comfort and convenience.

Ischemic Heart Disease Drugs Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America generated higher revenue in 2023 and is expected to emerge dominant in the world market during the future period. The high prevalence of Ischemic Heart Diseases, combined with the new product introduction across the region, will influence the IHD drugs market development in the region. Besides this, the escalating research and development launches, coupled with rising awareness and the high existence of risk factors such as diabetes in the general audience, are estimated to propel the market in North America during the forecast period.

Asia Pacific is anticipated to experience the fastest growth in market value. Owing to the rising disposable incomes across the region, there is a higher awareness concerning IHD. The escalating prevalence of Ischemic Heart diseases from the primary countries in the region and the accelerating status of IHD as the leading cause of mortality is also expected to influence the IHD therapeutics market development across the region.

COVID-19 Impact Analysis on the Ischemic Heart Disease Drugs Market:

The COVID-19 pandemic negatively affected healthcare systems worldwide and resulted in the disruption of usual care in various healthcare facilities, exposing weak patients with Ischemic Heart Diseases to major risks. However, the requirement for cardiovascular drugs escalated during the pandemic due to the enhanced risk of infection among IHD. Many research also suggested the efficiency of IHD drugs among COVID-19-infected individuals. For example, according to a research article published in the British Journal of Clinical Pharmacology in June 2021, the relationship between COVID-19 and IHD drugs is significant because patients who are more likely to contract SARS-CoV-2 infection may be taking IHD medications which may reduce the IHD damage brought on by COVID-19.

Latest Trends:

Escalated awareness and innovation of New Drugs

One of the significant drivers for global IHD drug market development is the accelerated awareness associated with heart health and the corresponding rise in product launches. Cardiovascular treatment through therapeutics constitutes a multi-faceted approach that may result in the use of several varieties of medications. Numerous key market leaders have launched several advanced drugs addressing the diverse treatment demands of cardiovascular diseases. For example, the launch of a cardiovascular drug called Eliquis (apixaban) by Bristol-Myers Squibb Company and Pfizer Inc., is the cardiovascular drug.

Key Players:

-

AstraZeneca

-

Bayer

-

Eli Lilly

-

Novartis

-

Pfizer

-

Sanofi

-

Amgen Inc.

-

Gilead Sciences, Inc

-

GlaxoSmithKline plc.,

-

Teva Pharmaceutical Industries Ltd

-

Cardurion Pharmaceuticals,

-

Cardior Pharmaceuticals

-

Actelion Pharmaceuticals Ltd

-

Boehringer Ingelheim International GmbH

-

Bristol-Myers Squibb Company

Recent Developments

-

The Food and Drug Administration (FDA) made it official about the approval of the extra disease indication of the mitigation of venous thromboembolism (VTE) in hospitalized acutely sick medical patients at risk for thromboembolic complications but not at great risk of bleeding for Janssen Pharmaceuticals, Inc.’s product offering of rivaroxaban (Xarelto)

-

Blackstone’s Life Sciences and Novartis AG confirmed the introduction of Anthos Therapeutics for the development of cardiovascular drugs.

-

Natco Pharma from India initiated the launch of valsartan-sacubitril, a cardiovascular drug for the cure of congestive heart failure. The patent in India for valsartan-sacubitril called Vymada is held by Novartis AG.

Chapter 1. ISCHEMIC HEART DISEASE DRUGS MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. ISCHEMIC HEART DISEASE DRUGS MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. ISCHEMIC HEART DISEASE DRUGS MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. ISCHEMIC HEART DISEASE DRUGS MARKET - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. ISCHEMIC HEART DISEASE DRUGS MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. ISCHEMIC HEART DISEASE DRUGS MARKET – By Type

6.1 Introduction/Key Findings

6.2 Anti-dyslipidemic Drugs

6.3 Calcium Channel Blockers

6.4 Beta-blockers

6.5 ACE Inhibitors

6.6 ARBs

6.7 Y-O-Y Growth trend Analysis By Type

6.8 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. ISCHEMIC HEART DISEASE DRUGS MARKET – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Hospital Pharmacies

7.3 Retail Pharmacies

7.4 Online Pharmacies

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Distribution Channel

7.7 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. ISCHEMIC HEART DISEASE DRUGS MARKET , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. ISCHEMIC HEART DISEASE DRUGS MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 AstraZeneca

9.2 Bayer

9.3 Eli Lilly

9.4 Novartis

9.5 Pfizer

9.6 Sanofi

9.7 Amgen Inc.

9.8 Gilead Sciences, Inc

9.9 GlaxoSmithKline plc.,

9.10 Teva Pharmaceutical Industries Ltd

9.11 Cardurion Pharmaceuticals,

9.12 Cardior Pharmaceuticals

9.13 Actelion Pharmaceuticals Ltd

9.14 Boehringer Ingelheim International GmbH

9.15 Bristol-Myers Squibb Company

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Ischemic Heart Disease Drugs Market was valued at USD 6.02 billion in 2023 and is projected to reach a market size of USD 8.14 billion by the end of 2030. Over the forecast period of 2024-2030, the market is estimated to grow at a CAGR of 4.4%

The heightened health awareness and ethical consumption among consumers is propelling the Ischemic Heart Disease Drugs Market.

The Ischemic Heart Disease Drugs Market is segmented based on Product type, Form, Application, Distribution Channel, and Region.

Asia-Pacific is the most dominant region for the Ischemic Heart Disease Drugs Market.

Frontier Co-op, Simply Organic, Spicely Organic, Starwest Botanicals, and The Spice Hunter are a few of the key players operating in the Ischemic Heart Disease Drugs Market.