Global IPv6 Market (2023 - 2030)

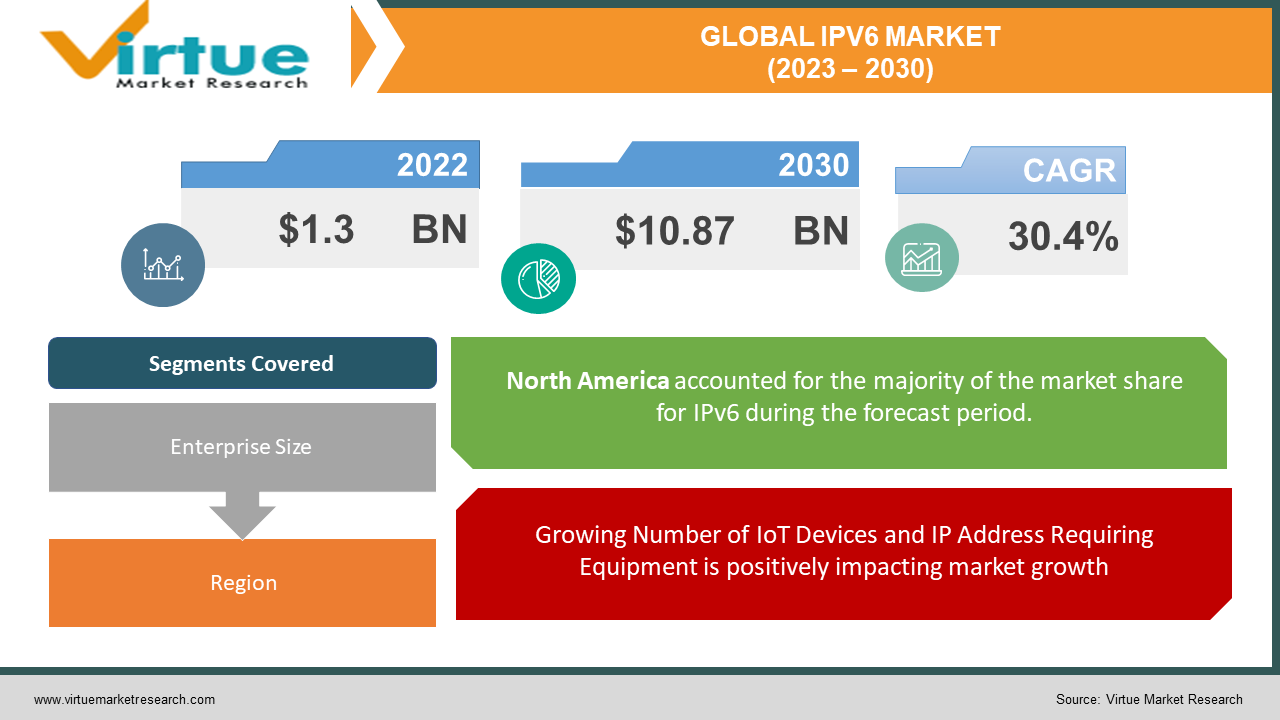

In 2022, the Global IPv6 Market was valued at USD 1.3 billion and is projected to reach a market size of USD 10.87 billion by 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 30.4%.

INDUSTRY OVERVIEW

The latest iteration of the Internet Protocol, known as IPv6, enables the location of connected devices by identifying them across a network. Regardless of the kind, every internet-connected device has a unique IP address that enables identification and facilitates communication. The more established IPv4 uses a 32-bit addressing method to handle the 4.3 billion devices that are linked to and interacting over the internet and has been in use for a very long period. However, it now appears that additional addresses are needed as a result of the internet's continued expansion into important regions and the strong sales of personal computers and mobile devices.

Adopting strategies that can help with the IP address shortage has become even more important given the Internet of Things (IoT) explosive expansion. In 1998, IPv6 was introduced because the Internet Engineering Task Force (IETF) had predicted this scenario around 20 years earlier. In comparison to IPv4, which utilizes a 32-bit addressing scheme, this most recent version of the Internet Protocol employs a 128-bit addressing system and can host about 3.403E+38 (or over 340 trillion) devices. Not only that, but this next-generation internet protocol has the potential to greatly boost security, improve performance, and increase packet processing efficiency. ISPs (Internet Service Providers) may easily reduce the size and increase the hierarchical structure of their routing tables. However, due to Network Address Translation (NAT), the use of IPv6 has been somewhat constrained. By translating the private IP address of such computers to a public IP address, NAT enables an enterprise machine with a private IP address to connect with machines with public IP addresses situated outside of their private network. Without NAT, businesses with thousands of internet-connected devices or systems would need a significant number of public IPv4 addresses to communicate with computers outside their network. Due to the restricted number of public IPv4 addresses, the NAT machine connects thousands of private address computers or machines to those on the public network. Packets initially arrive at the NAT machine, where the source and destination address of the packet are kept, when a privately addressed machine tries to connect with a machine on the public network. The packet's source address is then changed to the NAT device's public-facing address by the NAT machine. The destination is then reached by the packet. The IPv4 address exhaustion has been delayed by NAT, which has had some impact on this market's expansion. However, the market is growing strongly, as seen by the 32.40% predicted compound annual growth rate through the duration of the forecast period.

COVID-19 IMPACT ON THE IPv6 MARKET

It is without a doubt advantageous for the Internet sector as a whole that IPv6 usage has increased as a result of the COVID-19 crisis. There is also a significant trend toward investing in cloud networking technologies and cloud-native apps as data centers and corporate headquarters become less accessible and remote working becomes a more common practice. In these tough times, the Enterprise may profit greatly from the scalability, flexibility, and agility of cloud technology. The shift to a remote workforce, on the other hand, has led to an increase in network demand globally.

MARKET DRIVERS:

Growing Number of IoT Devices and IP Address Requiring Equipment is positively impacting market growth

The need for internet service providers to assign IP addresses to these devices is rising as IoT devices are increasingly being adopted globally (ISPs). Due to the restrictions on the total number of IP address allocations that may be made in IPv4 address systems (almost 4.2 billion), ISPs are having trouble delivering enough IP addresses to their consumers, which is predicted to increase demand for the IPv6 market throughout the projected period.

Decreasing delegation of IPv4 technology is fueling the market expansion

The Asia-Pacific Network Information Centre (APNIC) reports that the number of IPv4 delegations dropped sharply from 444,000 in 2015 to 167,000 in 2019. Consumer demand for the deployment of a new internet protocol numbering scheme is increasing as IPv4 delegations decline. The cost of IPv4 is rising along with the demand for IP address allocations, which is on the rise. The North American Network Operators' Group asserted that limiting IPv4 availability will increase the cost of IPv4 systems while decreasing the cost of IPv6 systems. This hypothesis applies the Hotelling rule to the cost of IPv4 and IPv6 addresses. The IPv6 market is likely to expand throughout the course of the projection period as a result of IPv6's planned cost reduction and the IPv4 system's anticipated decline.

Enhanced Security is likely to propel market growth

The greater security provided by IPv6 also presents several business expansions prospects. IPv6 includes IPSec, which provides authentication, data integrity, and secrecy. Corporate firewalls usually block IPv4 ICMP packets due to the possibility that they contain malware, however, ICMPv6, which implements the Internet Control Message Protocol for IPv6, may be allowed since IPSec may be applied to the ICMPv6 packets.

MARKET RESTRAINTS:

Slower Acceptance of IPv6 is impeding market growth

Due to the time and effort required to switch from IPv4 to IPv6, which is still extensively used, the shift to IPv6 is proceeding slowly. The user must pay money to replace an IPV4 device to migrate to IPv6 because IPV4-running machines are unable to access IPV6. It follows that the slower adoption of IPv6 is anticipated to hinder market expansion throughout the anticipated term.

Drawbacks of IPv6 is stifling the market growth

It may be difficult to even understand IPv6 submission, let alone try to recall the IPv6 address. Furthermore, machines running IPv4 and IPv6 cannot directly interact with one another even under the most bizarre circumstances. Over the course of the projection period, it is anticipated that these IPv6 drawbacks would provide a substantial challenge to the industry.

High Deployment Costs are hampering the market growth

Most of the hardware used to access the internet globally is based on IPv4 technology and is not IPv6 compatible. The major change to IPv6 technology is likely to increase customer deployment costs, which is anticipated to operate as a barrier to the expansion of the IPv6 industry.

IPV6 MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

30.4% |

|

Segments Covered |

By Enterprise Size, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

NTT COMMUNICATIONS CORPORATION, KDDI CORPORATION , SOFTBANK CORP., RELIANCE JIO INFOCOMM LTD. , VERIZON , T‑MOBILE USA, INC. , AT&T INTELLECTUAL PROPERTY , TATA TELESERVICES LIMITED , CHINA TELECOM GLOBAL LIMITED, ALE INTERNATIONAL (U.S.), APPLE INC. , CISCO SYSTEMS INC. , D-LINK CORPORATION , HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP , HITACHI, LTD. , IBM, MATRIXSTREAM TECHNOLOGIES, INC., MICROSOFT, MICRO FOCUS |

This research report on the IPv6 market has been segmented and sub-segmented based on Enterprise Size and By Region.

IPv6 MARKET – BY ENTERPRISE SIZE

- SMEs

- Large Enterprises

Based on the enterprise size, the IPv6 market is segmented into SMEs and Large Enterprises. Among them, large enterprises dominated the market. By the end of this year, the business predicted that there will be 26.3 billion networked devices in use throughout the world. The Internet of Things has grown quickly throughout the world, which is largely responsible for this surge. It is well recognized that Internet of Things (IoT) technology has the power to profoundly alter how we interact with our environment. With the potential provided by the Internet of Things to monitor and manage physical items electronically, individuals may practically live their lives making decisions based on data. Benefits of this new method include improving quality of life, enhancing the effectiveness of systems and processes, and saving time for both individuals and enterprises. As sensors help end-users produce a growing number of physical assets, customers should expect to simplify anything from monitoring equipment across facilities to tracking ships at sea. The Internet of Things may play a significant role in improving the effectiveness and performance of machines, lengthening their lives, and assisting users in discovering ways that this equipment might be reconfigured to stretch their capabilities.

IPv6 MARKET - BY REGION

- North America

- Europe

- The Asia Pacific

- Latin America

- The Middle East

- Africa

By region, the IPv6 market is grouped into North America, Europe, Asia Pacific, Latin America, The Middle East and Africa. A sizeable portion of this industry is dominated by North America and Europe, which are well-known for being early adopters of new technology. These areas are anticipated to see market expansion as a result of the existence of a sizable number of industry competitors and cutting-edge infrastructure. The Asia Pacific IPv6 market, on the other hand, is anticipated to experience substantial expansion over the anticipated period. This regional market is anticipated to experience exceptional expansion over the course of our forecast timeframe because of the presence of nations like China and South Korea, which have historically been among the largest producers of ICT equipment internationally. India and Japan have also been important IPv6 markets. Investments in IPv6 are anticipated to stay positive in all of these nations as they each have a significant presence in the global ICT scene. A sizable portion of this industry is also accounted for by other geographical areas including South America, the Middle East, and Africa. However, it is anticipated that overall market growth would be slower than in the other three areas. Because of the unique coronavirus illness epidemic that has spread over all of these locations, we anticipate some disruptive developments in the worldwide IPv6 market. Governments were forced to enact statewide lockdowns to slow the disease's growth as a result of the abrupt surge in the virus's spread throughout all of these areas. Many businesses adopted a work-from-home policy for the benefit of their staff. The demand for various mobile computing devices and other gadgets that rely on the internet to operate increased as a result of these causes. Investments in IPv6 have increased somewhat as a result of numerous ISPs continuing to move toward this protocol. However, the flow of investments towards IPv6 was somewhat impacted by concerns over the pandemic's duration and financial flow during it. However, it is anticipated that overall market investments would continue to be strong this year. As the negative impacts of this pandemic are anticipated to subside by next year, strong market growth is anticipated through 2030.

IPv6 MARKET - BY COMPANIES

Some of the major players operating in the IPv6 market include:

- NTT COMMUNICATIONS CORPORATION

- KDDI CORPORATION

- SOFTBANK CORP.

- RELIANCE JIO INFOCOMM LTD.

- VERIZON

- T‑MOBILE USA, INC.

- AT&T INTELLECTUAL PROPERTY

- TATA TELESERVICES LIMITED

- CHINA TELECOM GLOBAL LIMITED

- ALE INTERNATIONAL (U.S.)

- APPLE INC.

- CISCO SYSTEMS INC.

- D-LINK CORPORATION

- HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP

- HITACHI, LTD.

- IBM

- MATRIXSTREAM TECHNOLOGIES, INC.

- MICROSOFT

- MICRO FOCUS

NOTABLE HAPPENING IN THE IPv6 MARKET

- EXPANSION- Pv6 is becoming more and more commonplace worldwide. Jean-Charles Bisecco, an expert at the French regulator ARCEP and a member of the IPv6 Task Force, provided a profile of the IPv6 development environment in France. Bisecco claims that a variety of variables, such as law, network conditions, and service development, have an impact on IPv6 adoption. In France, IPv6 adoption is currently rising. As a consequence of rules and regulations, it is anticipated that by 2024, more than two-thirds of terminals would use IPv6, and more than 90% of operator fixed networks will utilise IPv6.

- EXPANSION - The international testing facility EANTC believes that SRv6 has a promising future. Following the completion of a multi-vendor SRv6 joint test by the organisation, which fully validates SRv6's operability in large-scale networking, Rossenhövel now believes that SRv6 is "ready for prime time."

Chapter 1. IPV6 MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. IPV6 MARKET – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. IPV6 MARKET – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. IPV6 MARKET - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. IPV6 MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. IPV6 MARKET – BY ENTERPRISE SIZE

6.1. SMEs

6.2. Large Enterprises

Chapter 7. IPV6 MARKET – By Region

7.1. North America

7.2. Europe

7.3. The Asia Pacific

7.4. Latin America

7.5. Middle-East and Africa

Chapter 8. IPV6 MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

8.1. NTT COMMUNICATIONS CORPORATION

8.2. KDDI CORPORATION

8.3. SOFTBANK CORP.

8.4. RELIANCE JIO INFOCOMM LTD.

8.5. VERIZON

8.6. T‑MOBILE USA, INC.

8.7. AT&T INTELLECTUAL PROPERTY

8.8. TATA TELESERVICES LIMITED

8.9. CHINA TELECOM GLOBAL LIMITED

8.10. ALE INTERNATIONAL (U.S.)

8.11. APPLE INC.

8.12. CISCO SYSTEMS INC.

8.13. D-LINK CORPORATION

8.14. HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP

8.15. HITACHI, LTD.

8.16. IBM

8.17. MATRIXSTREAM TECHNOLOGIES, INC.

8.18. MICROSOFT

8.19. MICRO FOCUS

Download Sample

Choose License Type

2500

4250

5250

6900