IoT in Smart Utility and Energy Market Size (2023 – 2030)

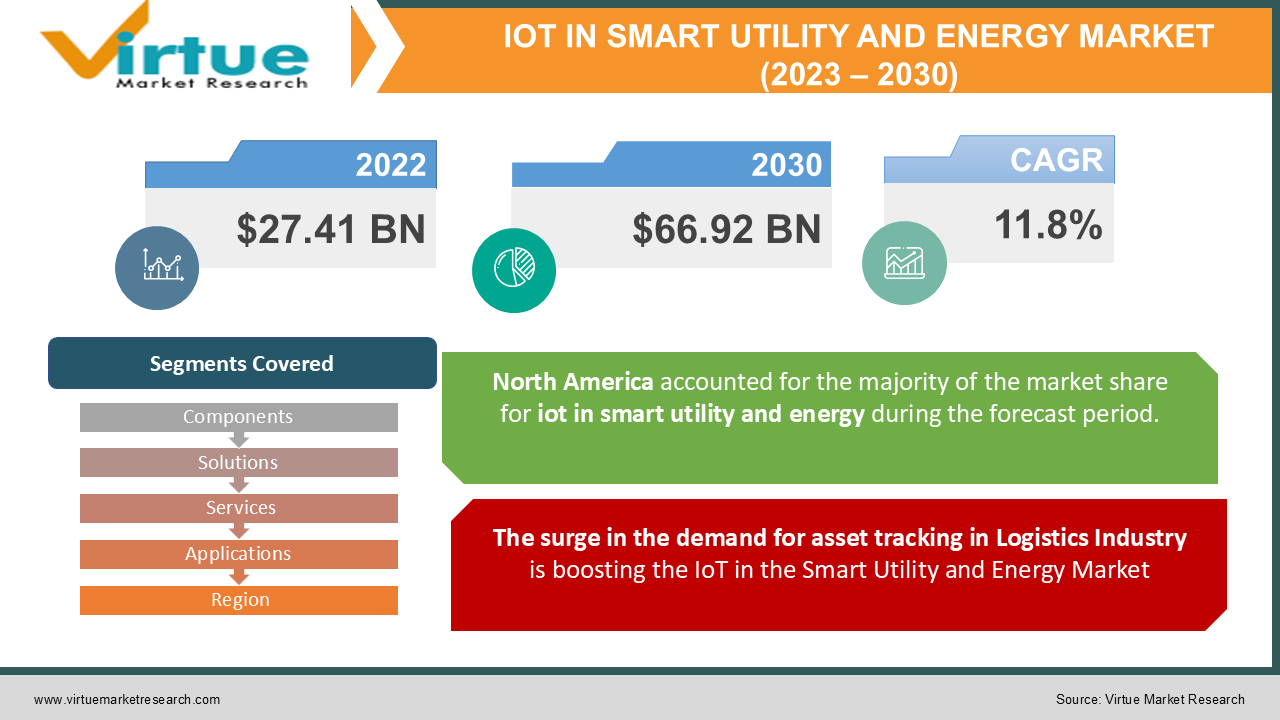

In 2022, the Global IoT in Smart Utility and Energy Market was valued at $27.41 Billion and is projected to reach a market size of $66.92 Billion by 2030. Over the forecast period of 2023-2030 market is projected to grow at a CAGR of 11.8%. The increased demand to reduce energy expenses and improve energy efficiency is driving market revenue growth. Concerns about climate change and rising oil and gas prices are pushing a greater emphasis on energy saving, which has resulted in a rise in the use of building energy management systems. Moreover, industries now are integrating the Internet of Things (IoT) in production activities as it improves operational efficiency. IoT uses technologies like AI/ML, and machine-to-machine (M2M) communication which has enabled high-speed data transmission and data analytics which has eventually resulted in better real-time control and assessment.

INDUSTRY OVERVIEW:

Industry 4.0, which includes the Internet of Things, is considered the next industrial revolution. The Internet of Things (IoT) is a concept that aims to provide enhanced solutions and services, increase productivity and efficiency, address crucial problems, and make better real-time decisions. Industries are incorporating the Internet of Things with energy and utility verticals to modernize operations. Internet of Things (IoT) has the major purpose to upgrade operational effectiveness and automate processes in industries. Internet Of Things refers to a combination of numerous techniques that allows devices and objects to interact with each other over a network. These interconnected devices provide real-time relatively rich data and analytics that make real-time controlling and monitoring very easy. This has proven very beneficial as it has increased productivity, and operational efficiency and has reduced complexity in the process.

The Internet of Things (IoT) is a new trend in all industries, and the utility and energy sectors are investing in this technology to enhance operations and the overall experience of their consumers. IoT has the potential to automate complicated processes. There are multiple benefits of using IoT in the energy and utility sector, it can help in automating many processes. It can ensure the safety of workers, reduce operating expenses and increase output. Furthermore, IoT is aiding the industries with predictive and prescriptive analytical solutions by using advanced techniques like AI and Machine Learning, thereby creating solutions in areas such as asset management, remote servicing, operational intelligence, and predictive maintenance. Increasing integration of digitalization in operational processes and industrial control systems including human-machine interfaces (HMIs), supervisory control and data acquisition (SCADA) systems, distributed control systems (DCSs), and programmable logic controllers (PLCs) to optimize the processes leveraging smart sensors, remote access and control are acting as prominent factors towards the growth of the market. However, a major concern that surrounds IoT is the security and privacy of the data that could hamper the adoption of this technology.

COVID-19 IMPACT ON IOT IN THE SMART UTILITY AND ENERGY MARKET:

Due to the lockdown imposed by the government of several countries, the manufacturing operations remained suspended across many manufacturing hubs that causing a slowdown in production. This has affected the Industrial IoT industries severely. The supply chain disruptions caused difficulty in the procurement of raw materials, shortage of labor, and also price rise due to an increase in demand has affected the industry negatively. Although with remote working policies adopted by companies have created a demand for transparency in operations. The use of IoT and smart connected devices are going to play a vital role in providing operational visibility at an organizational level. Many industries and businesses are incorporating IoT techniques for remote working and automating their business activities accordingly. All these factors are working as proponents for the growth of the (IoT) in the utility and Energy market growth during the forecast period.

MARKET DRIVERS:

The surge in the demand for asset tracking in Logistics Industry is boosting the IoT in the Smart Utility and Energy Market:

With the combination of software and hardware enabling the capture of data within, and automation of, industrial processes IoT has revolutionized the supply chain management industry. Asset tracking sensors are now being used by the logistics company to ensure the complete integrity and quality of the product which is fueling the growth of the Internet of Things Market (IoT) in the smart energy and utility market. Delivery, scheduling, and placement have been incredibly optimized and enhanced and are being automated by using IoT in transportation and logistics increasing productivity. With the enhancement in the adoption of SCADA, hand-held scanners, bar codes, RFID tags, and other data monitoring and data acquisition systems in freight operation, warehousing, and last-mile delivery to get real-time visibility on the movement of goods is augmenting the market.

Climate Change propelling the adoption of Energy Management Systems which is eventually propelling the IoT in smart utility and energy market growth:

Energy management systems are predicted to become more popular and adopted at a higher scale as requirements to decrease the environmental impact of carbon dioxide emissions and fossil fuel usage become more rigorous. Energy management systems are also being deployed across the industrial and commercial sectors in several nations due to regulations. Other significant drivers driving global demand for and implementation of energy management systems include the need to reduce electricity generation from nonrenewable natural resources as well as total energy usage. Increasing investments by leading market participants in energy management systems for quick innovation and technological improvements are likely to promote market growth over the forecast period.

MARKET RESTRAINTS:

Security and Privacy Issues related to the implementation of the IoT services are a major reason hampering the market growth:

The increase in the digitalization of processes also poses security and privacy issues. The business has confidential data with them and alarming growth in the number of cyber-attacks, data leakage, and false data injection in various industry verticals are hampering the adoption. However, significant investments in cyber security are set to offset this challenge and promote healthy growth during the later stages of the forecast period 2023 - 2030.

IOT IN SMART UTILITY AND ENERGY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

11.8% |

|

Segments Covered |

By Components, Solutions, Services, Applications and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

General Electric Digital (U.S.), ABB Ltd. (Switzerland), Siemens AG (Germany), IBM Corporation (U.S.), and Huawei Technologies Co. Ltd (China), Cisco Systems, Inc. (U.S.), HCL Technologies (India), Intel Corporation (U.S.), Dassault Systemes (France), Robert Bosch GmbH (Germany) and Schneider Electric SE Vodafone (UK), Telit (UK), and Landis Gyr (Switzerland) |

This research report IoT in Smart Utility and Energy Market has been segmented and sub-segmented based on Components, By Solutions, By Services, By Applications, and By Region.

IoT IN SMART UTILITY AND ENERGY MARKET- BY COMPONENTS

-

Platform

-

Solutions

-

Services

Based on components, the IoT in the Smart Utility and Energy Market is segmented into Platforms, Solutions, and Services. Among these, the solution segment dominated the market share in 2021 and is projected to expand with a healthy CAGR over the forecast period. IoT technology solutions assist utilities in integrating a variety of business operations, accelerating the utility and energy industry's growth. With minimal infrastructure expenditure, integrating technology with current processes is projected to improve the overall operational efficiency of firms. Energy generation & transmission, infrastructure management, asset management, workforce management, security, energy management, consumer side analysis, and remote surveillance and monitoring are all examples of where IoT technology is being used in the energy and utility sector. In the energy and utility industry, IoT solutions improve analytics-based decision-making by reducing market risks and vulnerabilities with the use of effective tools and methodologies. Furthermore, IoT technologies have allowed energy businesses to remotely control and monitor their assets' performance. This reduces service outages, offers a consistent experience for customers, and improves the organization's overall operating efficiency.

IoT IN SMART UTILITY AND ENERGY MARKET- BY SOLUTION

-

Asset Monitoring Management

-

Safety & Security

-

Supervisory Control and Data Acquisition (SCADA)

-

Connected Logistics

-

Energy Management

-

Mobile Workforce Management

-

Others

Based on Solutions, the IoT in the Smart Utility and Energy Market is segmented into Asset Monitoring Management, Safety & Security, Supervisory Control and Data Acquisition (SCADA), Connected Logistics, Energy Management, and Mobile Workforce Management among others. Among these, the Energy management category and connected Logistics category contributed significantly to the market development. The energy management market was worth USD 19 billion in 2021 and is projected to reach USD 27 billion by 2030. The increased demand to reduce energy expenses and improve energy efficiency is driving market revenue growth. Concerns about climate change and rising fossil fuel prices are pushing a greater emphasis on energy saving, which has resulted in a rise in the use of energy management systems. Demand for energy conservation systems is increasing as the need to minimize reliance on fossil fuels grows due to natural resource depletion. By enabling real-time control and monitoring of a wide range of connected systems, energy management systems enable the maintenance of a comfortable and energy-efficient environment within a facility and thus driving the segment growth.

The connected logistics segment was valued at USD 20.47 billion in 2021 and is estimated to reach USD 35.6 billion by 2030, registering a CAGR of 10.6% during the forecast period of 2022 – 2030. The advancement in technologies like high-definition mapping, sensor processing technologies adaptive algorithms, and vehicle-to-vehicle communication technologies have played a vital role in vehicle tracking, safety management, predictive maintenance, etc. The logistics companies are putting a strong emphasis on asset management and are thereby using automation techniques for smart transportation. Smart tracking solutions like Bluetooth tags and beacons have replaced the conventional RFID tags, which has helped in a better and wide range of functionalities. Furthermore, the integration of IoT in vehicles will aid in connectivity and monitoring of various business activities that would eventually help in promoting efficiency.

IoT IN SMART UTILITY AND ENERGY MARKET- BY SERVICES

-

Consulting

-

Integration and Deployment

-

Support and Maintenance

Based on Services, the IoT in the Smart Utility and Energy Market is segmented into Consulting, integration & Deployment, and Support & Maintenance. Among these, the integration & Deployment category was a major contributor to market development. Enterprises use integration and deployment services to connect IoT devices to IoT solutions and implement them into existing/desired IT infrastructure. By connecting enterprise IT solutions with business imperatives, these services increase company flexibility and operational efficiencies. The key motivation for businesses to use system integration services is to boost overall efficiency and quality of operations. The purpose of adopting these services is to integrate disparate IT systems inside a business to speed up information flow and save operating expenses.

IoT IN THE SMART UTILITY AND ENERGY MARKET- BY APPLICATION

-

Water and Wastewater Management

-

Oil & Gas Management

-

Electricity Grid Management

-

Coal Mining

-

Others

Based on applications, IoT services are widely used in Water and Wastewater Management, Oil & Gas Management, Electricity Grid Management, and coal mining among others. Among these, the Electricity Grid Management category is estimated to hold the largest market share in the IoT in the Smart Utility and Energy market. The effective administration and supply of power to its final consumers is primarily the responsibility of an electric grid. In comparison to a conventional grid, the use of network capabilities and computational intelligence can result in a smart, automated, and modern grid. Smart sensors, receivers, smart meters, and energy boxes all connect with one other in a grid with IoT capabilities. In a conventional electrical grid, consumers notified utility providers when there was a power outage. Due to the availability of Internet Protocol (IP) addresses and two-way communication across all components, the Advanced Metering Infrastructure (AMI) is now in place. This results in a faster reaction time and real-time info about maintenance concerns, enabling enhanced power distribution management. All tasks relating to power transmission, outage management, demand response management, and equipment maintenance are included in electricity grid management. Utility IoT solutions aid in the smooth administration of all of these processes and as a result businesses are widely adopting these solutions which in turn is driving the market growth.

The Oil & gas management segment is also poised to grow significantly over the forecast period. To fulfill their day-to-day operational requirements, companies engaged in oil and gas exploration and refining require a significant amount of money. To be competitive, energy businesses are always developing new technologies and improving their processes. The adoption of IoT technologies is projected to increase the oil and gas sector's operational efficiency, allowing enterprises in this field to endure the recent decline in oil prices. Remote monitoring of oil rigs and pipeline integrity can both benefit from IoT technology. As a result, IoT solutions aid in the detection of possible mishaps, allowing them to be avoided. Remote monitoring of operations and better end-to-end processes are possible with IoT-enabled sensors and devices in oil and gas plants and thus having a positive influence on the IoT in Smart Utility and Energy Market growth.

IoT IN SMART UTILITY AND ENERGY MARKET- BY REGION

-

North America

-

Europe

-

The Asia Pacific

-

Latin America

-

The Middle East and Africa

By region, IoT in the Smart Utility and Energy Market is grouped into North America, Europe, Asia Pacific, Latin America, The Middle East, and Africa. North American region contributed the maximum to the growth of the IoT in the Smart Utility and Energy Market followed by Europe and the Asia Pacific. Europe is also projected to witness fast growth during the forecast period due to initiatives taken by governments in the respective region. North America emerged as the market leader in the Internet of Things (IoT) market, registering a market share of 31% in 2020. It is estimated to remain the dominant region and grow with a CAGR of 19.56% during the forecast period. North America has been at the forefront of smart grid deployment, with a considerable percentage of the region's major institutions either completely implemented or in the planning phases of full-scale rollouts. Large investor-owned utility companies in the United States that have yet to roll out smart meters for their consumers are projected to generate sustained expansion in North America in the coming years. Furthermore, a significant number of small cooperative and municipal utilities are projected to play a key role in expanding the adoption.

Due to rapid urbanization, improved disposable income, and a shift toward digitalization Asia Pacific is also poised to be one of the fastest-growing markets with a CAGR of 24.67% during the forecast period. The region is increasingly witnessing a strong adoption of advanced factory automation solutions, typically in Japan, China, and Taiwan. Manufacturing organizations across the region are gradually realizing the benefits associated with the implementation of robot arm technology and are moving towards modernizing the factories.

IoT IN SMART UTILITY AND ENERGY MARKET- BY COMPANIES

Some of the prominent players in the market are:

- General Electric Digital (U.S.)

- ABB Ltd. (Switzerland)

- Siemens AG (Germany)

- IBM Corporation (U.S.)

- Huawei Technologies Co. Ltd (China)

- Cisco Systems, Inc. (U.S.)

- HCL Technologies (India)

- Intel Corporation (U.S.)

- Dassault Systemes (France)

- Robert Bosch GmbH (Germany)

- Schneider Electric SE Vodafone (UK)

- Telit (UK)

- Landis Gyr (Switzerland)

The presence of so many large corporations in this space, makes this industry fragmented and highly competitive. Companies like General Electric, IBM, and others have been able to position themselves as market leaders. The key market players are focusing on adopting low-cost strategies making it difficult for new players to make an impact on the market. However, venture capitalists are showing faith in new IoT startups and making investments and helping them make inroads into the markets. Big players are focusing on product launches, acquisitions, and R&D activities to capture the market space.

NOTABLE HAPPENING IN IoT IN SMART UTILITY AND ENERGY MARKET

- ACQUISITION – In March 2020, Emerson Electric Co. announced the complete acquisition of Verdant, a leading provider of energy management solutions for the hospitality industry. Emerson's energy management and optimization capabilities for commercial and residential applications are projected to grow as a result of this purchase.

- PRODUCT LAUNCH - In 2020, Honeywell International Inc. launched a set of integrated solutions to assist property owners in enhancing the well-being of their building environments and operating more cleanly and safely.

- PRODUCT LAUNCH - In December 2020, ZF launched telematics-based fleet management solutions for Light Commercial Vehicle. The TX-FLEX driver app offers improved operational performance, safety, and customer service levels, and also, enables operators or owners to manage all their commercial vehicles and drivers from this designed platform.

- COLLABORATION - In 2019, Accenture teamed up with Snam, one of the world's largest energy infrastructure businesses, to investigate Internet of Things (IoT)-based solutions for boosting energy network innovation and sustainability.

- COLLABORATION – In December 2019, Itron has signed a deal with a Brazilian utility firm to upgrade the Consolidated Utility District's water distribution infrastructure (CUDRC). The company will deploy Itron Smart Water Communication Modules throughout its 1,400 kilometers of water pipes, as per the deal. CUDRC will use Itron's network to boost operating efficiency, track water leaks, and simplify meter reading.

Chapter 1. IoT in Smart Utility and Energy Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. IoT in Smart Utility and Energy Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. IoT in Smart Utility and Energy Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. IoT in Smart Utility and Energy Market Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. IoT in Smart Utility and Energy Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. IoT in Smart Utility and Energy Market – By Components

6.1. Platform

6.2. Solutions

6.3. Services

Chapter 7. IoT in Smart Utility and Energy Market – By Solution

7.1. Asset Monitoring Management

7.2. Safety & Security

7.3. Supervisory Control and Data Acquisition (SCADA)

7.4. Connected Logistics

7.5. Energy Management

7.6. Mobile Workforce Management

7.7. Others

Chapter 8. IoT in Smart Utility and Energy Market – By Application

8.1. Water and Wastewater Management

8.2. Oil & Gas Management

8.3. Electricity Grid Management

8.4. Coal Mining

8.5. Others

Chapter 9. IoT in Smart Utility and Energy Market – By Services

9.1. Consulting

9.2. Integration and Deployment

9.3. Support and Maintenance

Chapter10. IoT in Smart Utility and Energy Market- By Region

10.1. North America

10.2. Europe

10.3. Asia-Pacific

10.4. Latin America

10.5. The Middle East

10.6. Africa

Chapter 11. IoT in Smart Utility and Energy Market – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

11.1 General Electric Digital (U.S.)

11.2 ABB Ltd. (Switzerland)

11.3 Siemens AG (Germany)

11.4 IBM Corporation (U.S.)

11.5 Huawei Technologies Co. Ltd (China)

11.6 Cisco Systems, Inc. (U.S.)

11.7 HCL Technologies (India)

11.8 Intel Corporation (U.S.)

11.9 Dassault Systemes (France)

11.10 Robert Bosch GmbH (Germany)

11.11 Schneider Electric SE Vodafone (UK)

11.12 Telit (UK)

11.13 Landis Gyr (Switzerland)

Download Sample

Choose License Type

2500

4250

5250

6900