IoT Pulse Oximeter Market Size (2023 – 2030)

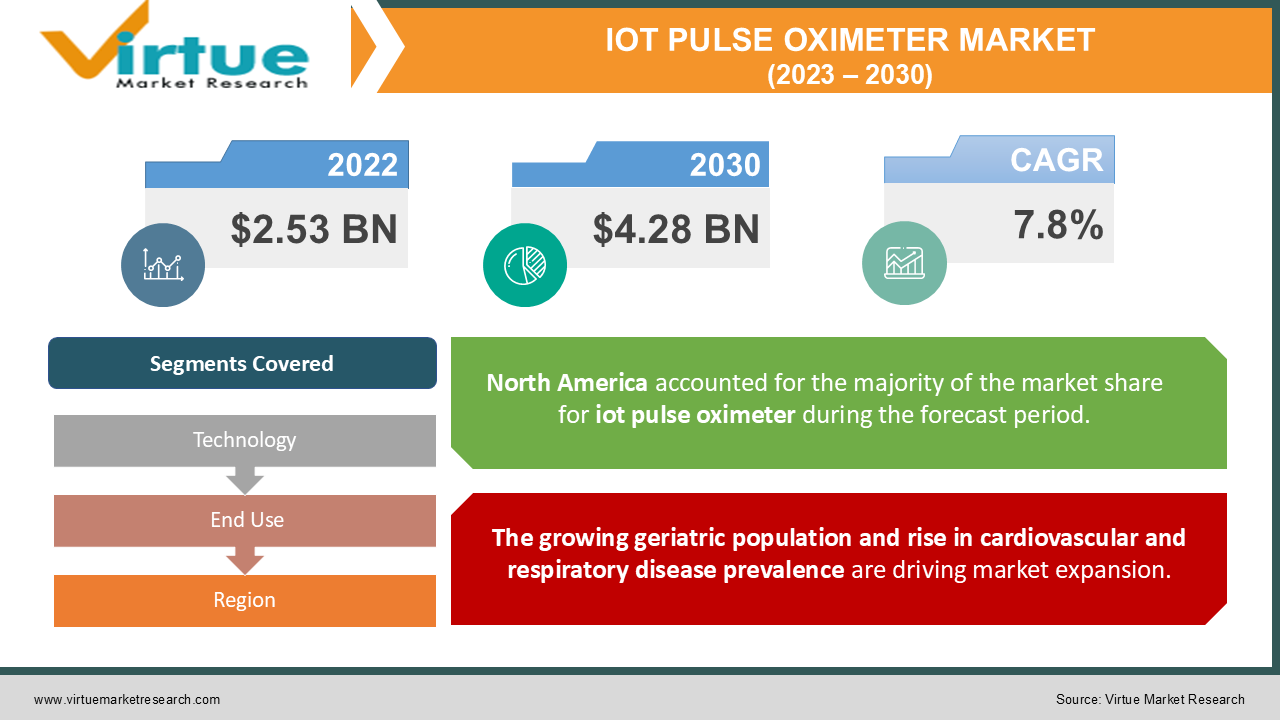

In 2022, the Global IoT Pulse Oximeter Market was valued at USD 2.53 billion and is projected to reach a market size of USD 4.28 billion by 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 7.8%.

Industry Overview:

The oxygen saturation of a person is measured with a pulse oximeter. It is a non-invasive technique that gauges blood oxygen saturation and pulse rate using laser beams. The pulse oximeter may be helpful for those with cardiovascular disorders such as congestive heart failure, high blood pressure, coronary artery disease, and cardiac arrest as well as respiratory conditions such as pneumonia, emphysema, lung cancer, and infections. Additionally, devices are utilized to monitor blood oxygen saturation levels in very young newborns and people with sleep apnea. By using IoT-based Wi-Fi technology, the pulse oximeter device can be utilized to detect the heartbeat and SPO2 of the person. This can help to monitor oxygen saturation levels and also regular check-ups to avoid any critical health situations. A doctor can utilize this tool from anywhere on the hospital grounds to check on a patient's heart rate and oxygen saturation level. Medical information like Sp02, heart rate, and blood pressure is particularly important in determining a person's or a patient's status in a medical setting. They offer incredibly important information about their current physical state, thus using devices to make this process easier offers a lot of advantages. During the current COVID-19 pandemic, demand for smart pulse oximeters increased dramatically to monitor blood oxygen saturation levels. Throughout the projected period, market growth is anticipated to be aided by the availability of new products and significant unmet demands in developing and least-developed economies. In the United States, about 43 states have made it mandatory for newborn screening. A key market driver is anticipated to be the rising incidence of target illnesses such as asthma, hyperlipidemia, diabetes, hypertension, ischemic conditions, cardiac arrhythmia, sleep apnea, and COPD.

COVID-19 pandemic impact on IoT Pulse Oximeter Market

The market for IoT pulse oximeters was hampered in the early stages of the pandemic since the majority of medical device businesses had curtailed or stopped their production and supply activities, which resulted in large losses. A large demand for smart pulse oximeters has arisen, though, as the coronavirus outbreak persisted. To take advantage of the increase in demand, several new businesses have joined the market to close the supply-demand gap and have subsequently gained a large portion of the market. For instance, telehealth business TytoCare, Ltd. (US) introduced its fingertip pulse oximeter (SpO2) in January 2021. The COVID-19 epidemic has considerably raised the need for remote monitoring systems in healthcare facilities like hospitals and nursing homes. For infected and vulnerable individuals, monitoring arterial oxygenation levels was essential to detecting hypoxia during COVID-19. As a result, the demand for pulse oximeters increased due to their increased use of them for patient monitoring, and it is predicted that this need will continue to climb throughout the forecast period.

MARKET DRIVERS:

The growing geriatric population and rise in cardiovascular and respiratory disease prevalence are driving market expansion.

The risk of respiratory and cardiovascular problems rises as people get older. The demand for smart oximeters will eventually rise as the elderly population grows. Additionally, 17.9 million people die from cardiovascular diseases each year, making them the world's biggest cause of mortality. During the forecast period, it is anticipated that these factors would fuel the expansion of the global market for smart oximeters. The need for smart medical devices in the home care scenario is increasing along with public awareness of chronic diseases. This market's expansion is mostly attributable to the demand for healthcare delivery cost minimization, the growing emphasis on active patient involvement & patient-centric care delivery, and the rising number of government programs to promote digital health.

Emerging technological advancements, portability in the devices, and increased product launches are fueling the market growth

The accuracy of the smart pulse oximeter has significantly improved because of developments in sensor technology. Furthermore, these little gadgets are now incredibly intelligent because of tremendous advancements in IoT and AI technologies. The demand for smart medical devices for health and wellness has significantly risen in recent years. Therefore, the portability of the devices and increasing technological advancement offer the IoT pulse oximeter market tremendous growth opportunities. Increasing product launches are anticipated to fuel market expansion throughout the forecast period. Masimo introduced its Dual Set Pulse Oximeter in November 2021. The Eve CCHD Newborn Screening Application was also included to help with the Dual Set Pulse Oximeters' introduction. These enhancements were made specifically to the technology to help with Critical Congenital Heart Disease (CCHD) screening.

MARKET RESTRAINTS:

The possibility of inaccuracy may impede market expansion

Several of the smart pulse oximeters available in the market as over-the-counter (OTC) products that do not go through the FDA review. These oximeters are not meant for medical usage; instead, they are sold directly to consumers as general wellness goods or for use in sports, either in-person or online. These devices frequently lack accuracy, which causes incorrect diagnoses and self-treatment. The market's abundance of fake goods also increases the danger of inaccurate diagnosis. Thus, the risk of inaccuracy restrains the growth of the IoT pulse oximeters market.

Increased pressure on new players as a result of ongoing technological developments by major market competitors

Many well-known companies that sell pulse oximeters are developing fresh developments to set their products apart from those of their rivals. Compared to new players and startups, established players are spending a lot of money on product R&D. As a result, new players are under constant pressure to improve the features and quality of their products. New players frequently use lower pricing tactics, which reduces their profit margins, to get over these obstacles. The availability of technologically improved items increases market rivalry, resulting in costly capital expenditures and raising entry barriers for new businesses.

IOT PULSE OXIMETER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

7.8% |

|

Segments Covered |

By Technology, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Masimo Corporation,GE Healthcare,Koninklijke Philips N.V., Nihon Kohden Corporation, Nonin Medical,Smiths Medical,Mindray Medical International Limited, Contec Medical Systems Co., Ltd., Shenzhen Creative Industry Co., Ltd.,iHealth Labs Inc., Beurer GmbH. |

This research report on the IoT Pulse Oximeter market has been segmented based on Technology, End User, and region.

IoT Pulse Oximeter Market – By Technology

-

Wi-Fi

-

Bluetooth

-

Zigbee

Based on Type, the IoT Pulse Oximeter Market is categorized into Wi-Fi, Bluetooth, and Zigbee. The advantages of Wi-Fi connectivity, such as its long-range (about 120 feet indoors and around 300 feet outside), can be credited for the substantial proportion of this market. During the forecast period, Bluetooth is anticipated to increase at the fastest rate. The effectiveness of products is increased by features like Bluetooth, an alert system, and easy data transfer. Players in the industry launch new items with more features to compete in the market.

IoT Pulse Oximeter Market – By End User

-

Hospitals & Clinics

-

Ambulatory Surgical Centers

-

Home Care Setting

Based on End User, the IoT Pulse Oximeter Market is categorized into Hospitals & Clinics, Ambulatory Surgical Centers, and Home Care Setting. The market was led by the hospitals and clinics segment in 2021, and this trend is anticipated to persist over the forecast period due to an increase in the number of operations and ER visits. In hospitals and clinics, many people are monitored for chronic conditions. Patients typically prefer to be treated at hospitals and clinics because there are modern and comprehensive therapies available there.

However, the home care setting segment is anticipated to experience significant growth throughout the forecast period due to the rise in the number of elderly people and the incidence of various chronic respiratory diseases, both of which encourage the use of oxygen level monitoring devices during the diagnostic and therapeutic phases. The prevalence of chronic pulmonary and cardiac problems is anticipated to increase as the population ages. This is estimated to increase the demand for monitoring tools, including pulse oximeters, in residential settings. The deployment of IoT-enabled medical devices for patient monitoring has also been fueled by the rising trend toward self-health management.

Modern healthcare facilities called ambulatory surgery centers offer same-day surgical care, including diagnostic and preventative procedures, and surgeries that don't require a hospital stay. The number of patients utilizing the emergency medical services offered by ambulatory surgery centers for cardiovascular and respiratory disorders is predicted to rise during the forecast period.

IoT Pulse Oximeter Market - By Region:

-

North America

-

Europe

-

Asia-Pacific

-

Rest of the World

In 2021, the North American IoT Pulse Oximeter market held the highest share due to the region's developed healthcare system, high adoption of smart medical devices, and the presence of several medical device manufacturers. Additionally, the market is being driven by the growing prevalence of cardiovascular and respiratory conditions as well as patients being more aware of smart pulse oximeters. The leading market players in this area and their contribution through the introduction of cutting-edge products are also promoting the market growth.

Medical device firms' expanding R&D spending and rising investment in the R&D industry are the main drivers of the European IoT Pulse Oximeter market. The existence of major market participants also significantly contributes to market expansion. Additionally, the market for smart pulse oximeters is expanding due to the growing geriatric population and the incidence of cardiovascular and respiratory disorders in the region.

The Asia-Pacific IoT Pulse Oximeter market is anticipated to grow at the quickest rate due to the region's quickly expanding and improving healthcare infrastructure, rising demand for smart medical devices, and rising awareness of oximeters. Additionally, the development of the R&D infrastructure and the expanding medical device sector, as well as rising government backing and sizeable investments by key market participants, all contribute to the market's expansion.

Major Key Players in the Market

The major players in the global IoT Pulse Oximeter Market are

-

Masimo Corporation

-

GE Healthcare

-

Koninklijke Philips N.V.

-

Nihon Kohden Corporation

-

Nonin Medical

-

Smiths Medical

-

Mindray Medical International Limited

-

Contec Medical Systems Co., Ltd.

-

Shenzhen Creative Industry Co., Ltd.

-

iHealth Labs Inc.

-

Beurer GmbH.

Notable happenings in the IoT Pulse Oximeter Market in the recent past:

-

Product Launch- In January 2021, Tyto Care introduced a fingertip pulse oximeter that connects to the TytoCare device through a cable to log test results to patients' EHRs, enabling remote clinician monitoring.

-

Product Launch- In March 2021, Nonin Medical released two new disposable products, a single-use wristband and a sensor for the company's WristOx2 3150 wrist-worn pulse oximeter (SpO2). These innovative disposables provide quick and affordable ways to lessen the risk of infectious pathogens being exposed to patients and healthcare professionals.

-

Product Launch- In January 2020, Vyaire Medical made their MX40, a reusable telemetry adaptor, commercially accessible in the United States. This product has a SpO2 port that works with both the Masimo LNCS and Philips 9-pin pulse oximeter sensor.

Chapter 1. IoT Pulse Oximeter Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. IoT Pulse Oximeter Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. IoT Pulse Oximeter Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. IoT Pulse Oximeter Market Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. IoT Pulse Oximeter Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. IoT Pulse Oximeter Market – By Technology

6.1. Wi-Fi

6.2. Bluetooth

6.3. Zigbee

Chapter 7. IoT Pulse Oximeter Market – By End User

7.1. Hospitals & Clinics

7.2. Ambulatory Surgical Centers

7.3. Home Care Setting

Chapter 8. IoT Pulse Oximeter Market- By Region

8.1. North America

8.2. Europe

8.3. Asia-Pacific

8.4. Latin America

8.5. The Middle East

8.6. Africa

Chapter 9. IoT Pulse Oximeter Market –key players

9.1 Masimo Corporation

9.2 GE Healthcare

9.3 Koninklijke Philips N.V.

9.4 Nihon Kohden Corporation

9.5 Nonin Medical

9.6 Smiths Medical

9.7 Mindray Medical International Limited

9.8 Contec Medical Systems Co., Ltd.

9.9 Shenzhen Creative Industry Co., Ltd.

9.10 iHealth Labs Inc.

9.11 Beurer GmbH.

Download Sample

Choose License Type

2500

4250

5250

6900