IoT Plug-and-Play Solution Market Size (2025-2030)

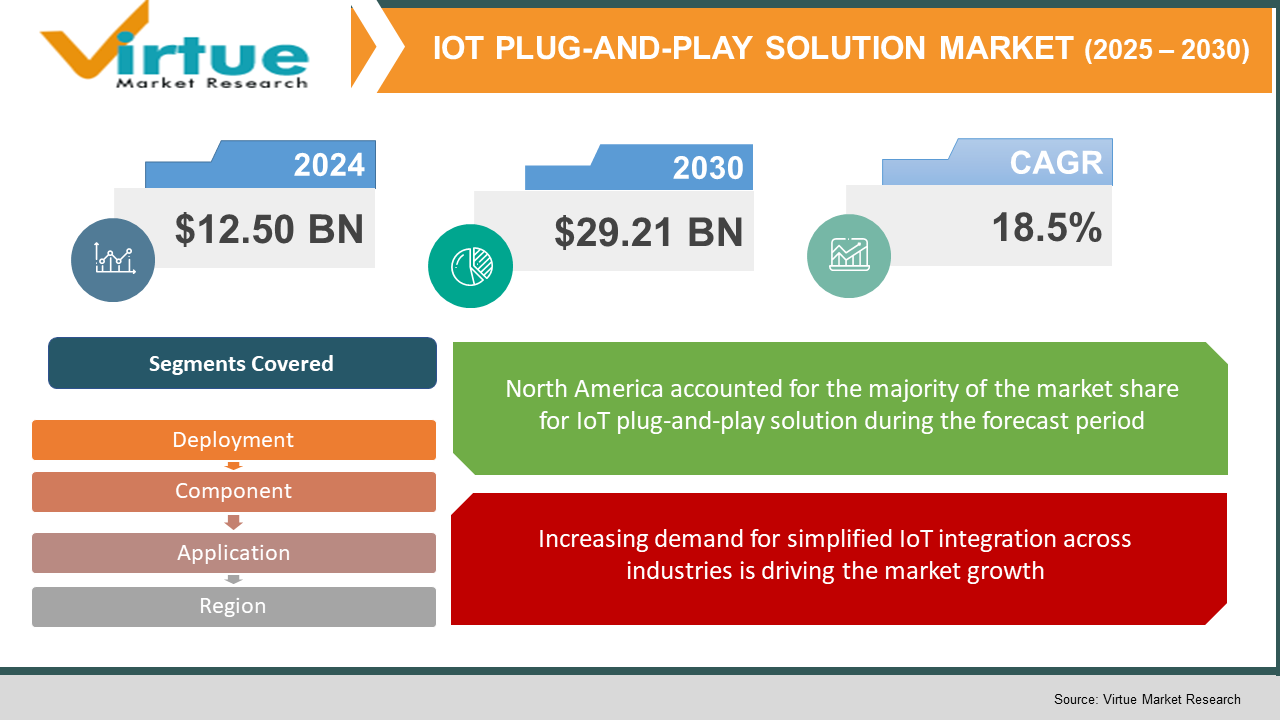

The Global IoT Plug-and-Play Solution Market was valued at USD 12.50 billion in 2024 and is projected to grow at a CAGR of 18.5% from 2025 to 2030, reaching USD 29.21 billion by 2030.

IoT Plug-and-Play solutions refer to systems and devices that can be easily integrated into existing networks without the need for extensive configuration or programming. These solutions are designed to simplify the deployment of IoT devices, enabling seamless connectivity and interoperability across various platforms. The increasing demand for simplified IoT integration, coupled with advancements in wireless communication technologies, is driving the growth of this market. Industries such as smart homes, industrial automation, healthcare, and transportation are increasingly adopting plug-and-play IoT solutions to enhance operational efficiency and user experience. The market's growth is further propelled by the rising adoption of cloud computing, edge computing, and AI-driven analytics, which facilitate real-time data processing and decision-making.

Key market insights:

Smart home applications accounted for over 30% of the market share in 2024, driven by the increasing adoption of smart appliances and home automation systems.

The industrial automation segment is expected to witness the highest growth rate, with a CAGR of 20.2% during the forecast period, owing to the need for efficient and scalable IoT solutions in manufacturing processes.

Cloud deployment models dominated the market in 2024, contributing to over 60% of the revenue share, due to their scalability and cost-effectiveness.

North America held the largest market share in 2024, accounting for approximately 35% of the global revenue, attributed to the presence of major technology companies and early adoption of IoT technologies.

Asia-Pacific is anticipated to be the fastest-growing region, with a CAGR of 21.3% from 2025 to 2030, driven by rapid industrialization and smart city initiatives in countries like China and India.

Global IoT Plug-and-Play Solution Market Drivers

Increasing demand for simplified IoT integration across industries is driving the market growth

The complexity associated with traditional IoT deployments, which often require extensive programming and configuration, has been a significant barrier to adoption for many organizations. IoT Plug-and-Play solutions address this challenge by offering devices and systems that can be easily integrated into existing networks with minimal setup. This ease of deployment is particularly beneficial for industries lacking extensive IT infrastructure or technical expertise. For instance, in the smart home sector, consumers can effortlessly connect devices like smart thermostats, lighting systems, and security cameras, enhancing user experience and driving market growth. Similarly, in industrial settings, plug-and-play solutions enable rapid deployment of sensors and actuators, facilitating real-time monitoring and control of manufacturing processes. The growing need for operational efficiency, cost reduction, and scalability across various sectors is propelling the demand for simplified IoT integration, thereby driving the growth of the IoT Plug-and-Play Solution Market.

Advancements in wireless communication technologies is driving the market growth

The evolution of wireless communication technologies such as 5G, Wi-Fi 6, and Low Power Wide Area Networks (LPWAN) has significantly enhanced the capabilities of IoT devices. These advancements enable faster data transmission, lower latency, and improved connectivity, which are crucial for the seamless operation of plug-and-play IoT solutions. For example, the deployment of 5G networks facilitates real-time data exchange between devices, supporting applications that require high-speed communication, such as autonomous vehicles and remote healthcare monitoring. Additionally, LPWAN technologies like NB-IoT and LoRaWAN offer extended coverage and low power consumption, making them ideal for connecting a vast number of devices in smart cities and industrial environments. The continuous development and adoption of these wireless technologies are expanding the potential applications of IoT plug-and-play solutions, thereby driving market growth.

Growing adoption of cloud computing and edge computing is driving the market growth

The integration of cloud computing and edge computing with IoT plug-and-play solutions is transforming the way data is processed and analyzed. Cloud computing provides scalable storage and computing resources, allowing organizations to manage large volumes of data generated by IoT devices efficiently. This scalability is particularly beneficial for applications that require centralized data analysis and long-term storage, such as predictive maintenance in industrial settings. On the other hand, edge computing enables data processing closer to the source, reducing latency and bandwidth usage. This is essential for time-sensitive applications like autonomous vehicles and real-time health monitoring. The combination of cloud and edge computing enhances the performance, reliability, and scalability of IoT plug-and-play solutions, making them more attractive to a wide range of industries and driving market expansion.

Global IoT Plug-and-Play Solution Market Challenges and Restraints

Security and privacy concerns is restricting the market growth

As IoT plug-and-play solutions become more prevalent, security and privacy issues have emerged as significant challenges. The ease of device integration, while beneficial for deployment, can also lead to vulnerabilities if proper security measures are not implemented. Unauthorized access, data breaches, and cyberattacks can compromise sensitive information and disrupt operations. For instance, in smart homes, unsecured devices can be exploited to gain access to personal data or control home systems maliciously. In industrial settings, security breaches can lead to operational downtime and financial losses. Additionally, the lack of standardized security protocols across different devices and platforms exacerbates these concerns. Addressing these challenges requires the development and enforcement of robust security standards, regular software updates, and user education on best practices for securing IoT devices.

Interoperability issues among diverse devices and platforms is restricting the market growth

The IoT ecosystem comprises a wide array of devices from different manufacturers, each with its own communication protocols and standards. This diversity can lead to interoperability issues, where devices are unable to communicate effectively with each other or with central management systems. Such challenges hinder the seamless integration and scalability of IoT plug-and-play solutions. For example, in a smart city infrastructure, the inability of traffic sensors, surveillance cameras, and public transportation systems to share data can limit the effectiveness of urban management initiatives. To overcome these issues, there is a need for the development of universal standards and protocols that ensure compatibility and interoperability among various IoT devices and platforms. Industry collaborations and regulatory frameworks can play a pivotal role in establishing these standards and facilitating a more cohesive IoT environment.

Market Opportunities

The IoT Plug-and-Play Solution Market presents numerous opportunities across various sectors. In the healthcare industry, the adoption of plug-and-play medical devices can enhance patient monitoring and telemedicine services, especially in remote areas. These solutions enable healthcare providers to collect real-time data on patient vitals, facilitating timely interventions and improving patient outcomes. In agriculture, plug-and-play IoT devices can be used for precision farming, allowing farmers to monitor soil conditions, weather patterns, and crop health, thereby optimizing resource usage and increasing yields. The transportation sector can benefit from plug-and-play solutions through improved fleet management, real-time tracking, and predictive maintenance of vehicles. Additionally, the growing trend of smart cities offers opportunities for the deployment of plug-and-play IoT devices in areas such as energy management, waste management, and public safety. The continuous innovation in sensor technologies, data analytics, and wireless communication further expands the potential applications of IoT plug-and-play solutions, creating new avenues for market growth.

IOT PLUG-AND-PLAY SOLUTION MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

18.5% |

|

Segments Covered |

By deployment, component, application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Microsoft, Cisco, AWS, IBM, Google, Siemens, Huawei, PTC, Bosch.IO, and Advantech |

IoT Plug-and-Play Solution Market segmentation

IoT Plug-and-Play Solution Market By Component

• Hardware

• Software

• Services

The hardware segment dominated the IoT Plug-and-Play Solution Market in 2024, accounting for over 50% of the revenue share. This dominance is attributed to the increasing demand for IoT devices such as sensors, actuators, and gateways that facilitate seamless connectivity and data collection. The proliferation of smart devices in homes, industries, and healthcare settings has significantly contributed to the growth of the hardware segment. Additionally, advancements in miniaturization and energy efficiency of hardware components have made them more accessible and cost-effective, further driving their adoption.

IoT Plug-and-Play Solution Market By Deployment

• Cloud

• On-premises

Cloud deployment models held the largest market share in 2024, contributing to over 60% of the revenue. The scalability, flexibility, and cost-effectiveness of cloud solutions make them an attractive option for organizations seeking to manage and analyze vast amounts of data generated by IoT devices. Cloud platforms enable remote access, real-time data processing, and integration with advanced analytics tools, enhancing the overall efficiency of IoT plug-and-play solutions. The increasing adoption of Software-as-a-Service (SaaS) models and the growing reliance on cloud infrastructure across various industries are expected to sustain the dominance of the cloud segment.

IoT Plug-and-Play Solution Market By Application

• Smart Homes

• Industrial Automation

• Healthcare

• Transportation

• Others

Smart home applications led the market in 2024, accounting for over 30% of the revenue share. The growing consumer interest in home automation, energy efficiency, and security has fueled the adoption of plug-and-play IoT devices such as smart thermostats, lighting systems, and security cameras. The ease of installation and user-friendly interfaces of these devices have made them popular among homeowners. Additionally, the integration of voice assistants and mobile applications has enhanced the functionality and appeal of smart home solutions. The trend towards connected living and the increasing availability of affordable smart devices are expected to drive the continued growth of this segment.

IoT Plug-and-Play Solution Market Regional segmentation

• North America

• Europe

• Asia-Pacific

• South America

• Middle East and Africa

North America held the largest market share in 2024, accounting for approximately 35% of the global revenue. The region's dominance is attributed to the presence of major technology companies, early adoption of IoT technologies, and significant investments in research and development. The United States, in particular, has been at the forefront of implementing IoT solutions across various sectors, including smart homes, healthcare, and industrial automation. The robust IT infrastructure, favorable regulatory environment, and high consumer awareness have also contributed to the widespread adoption of plug-and-play IoT solutions in the region. Additionally, initiatives such as smart city projects, digital transformation in enterprises, and the growing use of cloud platforms have further fueled market growth. Canada is also witnessing increased adoption, particularly in the industrial and healthcare sectors. The region benefits from a mature technology ecosystem and a strong emphasis on cybersecurity, which supports the deployment of secure and scalable plug-and-play IoT systems. The combination of technological advancement, supportive infrastructure, and increasing demand across sectors ensures that North America remains the dominant force in the global IoT plug-and-play solution market.

COVID-19 Impact Analysis on IoT plug-and-play solution Market

The COVID-19 pandemic had a profound impact on the global IoT Plug-and-Play Solution Market. In the initial phases of the pandemic, supply chain disruptions, labor shortages, and reduced capital expenditure led to delays in IoT project deployments across several industries. Many organizations postponed their digital transformation plans, which temporarily slowed down the adoption of plug-and-play IoT solutions. However, as the pandemic progressed, the demand for remote monitoring, automation, and contactless technologies surged, creating new opportunities for IoT solution providers. Sectors such as healthcare, logistics, and smart homes experienced accelerated adoption of plug-and-play devices. In healthcare, the need for remote patient monitoring and real-time data tracking became critical, leading to increased deployment of wearable IoT devices and connected health systems. Similarly, the rise in e-commerce and logistics during lockdowns drove the demand for real-time fleet and inventory management using plug-and-play IoT devices. The smart home segment also saw growth, as people spent more time indoors and sought to enhance convenience and safety through home automation. Moreover, the shift toward remote working increased the need for smart and secure connectivity solutions. Post-pandemic, the market is expected to witness sustained growth due to the realization among businesses of the value of automation and remote capabilities. The pandemic acted as a catalyst, accelerating digital transformation and highlighting the importance of scalable and easy-to-deploy IoT solutions. As industries prioritize resilience and flexibility, the demand for plug-and-play IoT systems is likely to grow significantly, making them an integral part of future technology strategies across sectors.

Latest Trends/Developments

One of the most significant trends in the IoT Plug-and-Play Solution Market is the growing integration of artificial intelligence (AI) and machine learning (ML) to enhance automation and analytics capabilities. AI-powered plug-and-play devices are capable of learning user behavior, predicting maintenance needs, and optimizing resource consumption in real-time, thereby increasing their value across applications. Another key development is the expansion of edge computing, which allows for faster data processing at the device level, reducing latency and enabling real-time decision-making. This is particularly useful in industrial automation and healthcare, where timing and responsiveness are critical. Additionally, there is a growing focus on interoperability standards to overcome integration challenges between devices from different manufacturers. Industry alliances and consortiums are working towards creating open frameworks and standardized communication protocols to support plug-and-play functionality across diverse ecosystems. The emergence of 5G connectivity is also transforming the market by enabling high-speed, low-latency connections, which are essential for real-time applications such as autonomous vehicles and smart manufacturing. Furthermore, the market is seeing an increase in SaaS-based IoT platforms that provide user-friendly dashboards and analytics tools, simplifying the management of connected devices. Companies are also emphasizing cybersecurity, with developments in secure booting, encrypted communication, and device authentication to ensure the integrity and privacy of IoT networks. On the consumer front, voice assistants and smart home hubs are becoming more advanced, facilitating seamless integration of multiple smart devices with minimal user intervention. In the business domain, digital twin technology is gaining traction, allowing organizations to create virtual replicas of physical systems to simulate and optimize performance. These innovations reflect a broader trend toward creating intelligent, secure, and interoperable plug-and-play IoT environments that cater to the evolving needs of both consumers and enterprises.

Key Players

- Microsoft

- Cisco Systems

- Amazon Web Services

- IBM Corporation

- Google LLC

- Siemens AG

- Huawei Technologies Co. Ltd.

- PTC Inc.

- Bosch.IO

- Advantech Co. Ltd.

Chapter 1. IoT plug-and-play solution Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Source

1.5. Secondary Source

Chapter 2. IoT plug-and-play solution Market – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. IoT plug-and-play solution Market – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Packaging COMPONENT Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. IoT plug-and-play solution Market - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. IoT plug-and-play solution Market - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. IoT plug-and-play solution Market – By COMPONENT

6.1 Introduction/Key Findings

6.2 Hardware

6.3 Software

6.4 Services

6.5 Y-O-Y Growth trend Analysis By COMPONENT

6.6 Absolute $ Opportunity Analysis By COMPONENT , 2025-2030

Chapter 7. IoT plug-and-play solution Market – By Application

7.1 Introduction/Key Findings

7.2 Smart Homes

7.3 Industrial Automation

7.4 Healthcare

7.5 Transportation

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. IoT plug-and-play solution Market – By Deployment

8.1 Introduction/Key Findings

8.2 Cloud

8.3 On-premises

8.4 Y-O-Y Growth trend Analysis Deployment

8.5 Absolute $ Opportunity Analysis Deployment , 2025-2030

Chapter 9. IoT plug-and-play solution Market , BY GEOGRAPHY – MARKET SIZE, FORECAST, TRENDS & INSIGHTS

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By Application

9.1.3. By Deployment

9.1.4. By COMPONENT

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By Application

9.2.3. By Deployment

9.2.4. By COMPONENT

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.1. By Country

9.3.1.1. China

9.3.1.2. Japan

9.3.1.3. South Korea

9.3.1.4. India

9.3.1.5. Australia & New Zealand

9.3.1.6. Rest of Asia-Pacific

9.3.2. By Application

9.3.3. By Deployment

9.3.4. By COMPONENT

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.1. By Country

9.4.1.1. Brazil

9.4.1.2. Argentina

9.4.1.3. Colombia

9.4.1.4. Chile

9.4.1.5. Rest of South America

9.4.2. By Deployment

9.4.3. By Application

9.4.4. By COMPONENT

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.1. By Country

9.5.1.1. United Arab Emirates (UAE)

9.5.1.2. Saudi Arabia

9.5.1.3. Qatar

9.5.1.4. Israel

9.5.1.5. South Africa

9.5.1.6. Nigeria

9.5.1.7. Kenya

9.5.1.8. Egypt

9.5.1.9. Rest of MEA

9.5.2. By Deployment

9.5.3. By Application

9.5.4. By COMPONENT

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. IoT plug-and-play solution Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Microsoft

10.2 Cisco Systems

10.3 Amazon Web Services

10.4 IBM Corporation

10.5 Google LLC

10.6 Siemens AG

10.7 Huawei Technologies Co. Ltd.

10.8 PTC Inc.

10.9 Bosch.IO

10.10 Advantech Co. Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global IoT Plug-and-Play Solution Market was valued at USD 12.50 billion in 2024 and is projected to grow at a CAGR of 18.5% from 2025 to 2030, reaching USD 29.21 billion by 2030.

Key drivers include simplified integration, advances in wireless technologies, and growing adoption of cloud and edge computing

component: hardware, software, services; by deployment: cloud, on-premises; by application: smart homes, industrial automation, healthcare, transportation, others

North America leads the market with a 35% share in 2024, driven by early IoT adoption and strong technological infrastructure

Major players include Microsoft, Cisco, AWS, IBM, Google, Siemens, Huawei, PTC, Bosch.IO, and Advantech