IoT in network service Market size (2024 – 2030)

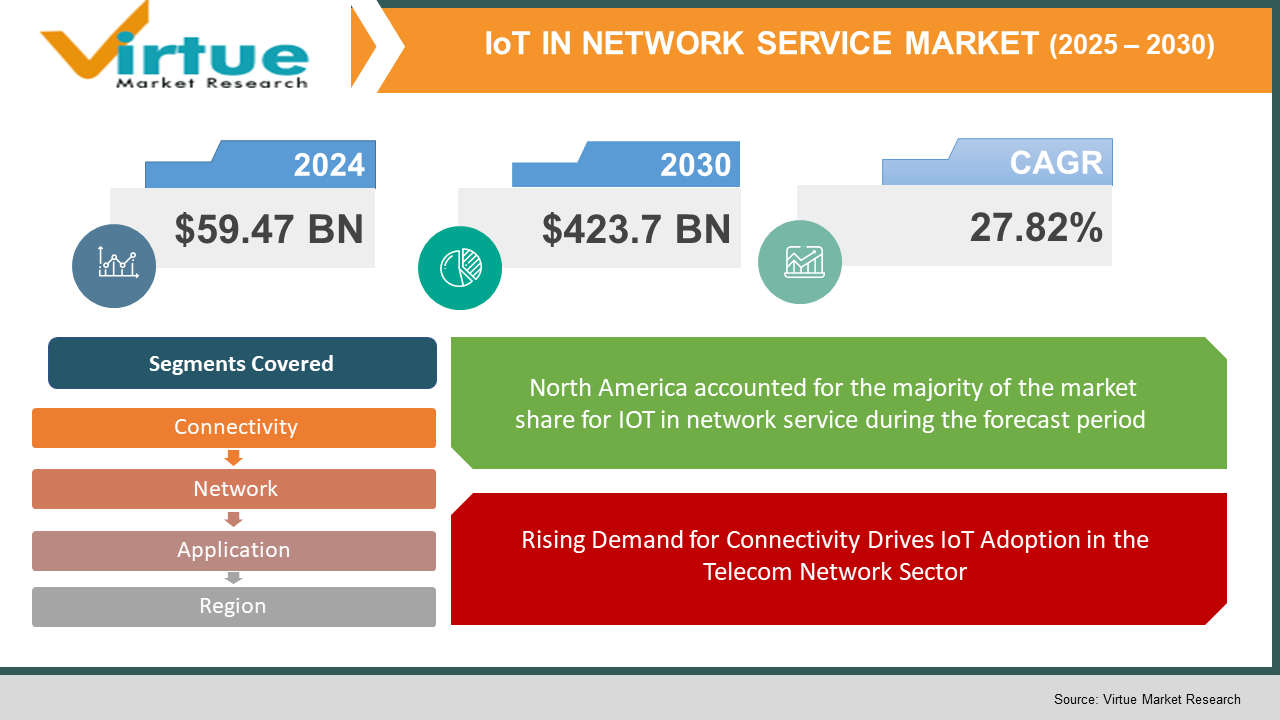

During the projection period, the internet of things (IoT) in the network services market was valued at USD 59.47 billion in 2021, and it is predicted to grow at a CAGR of 27.82 % to USD 423.7 billion by 2030. (2023 - 2030). Multi-cloud adoption, automation, and rising demand for IoT in the industrial area are all driving up demand for IoT managed services around the world.

Market overview

The internet of things (IoT) services industry includes sales of IoT as a service and related devices. End-user firms benefit from business entities that provide professional and managed services such as network management, data management platforms, infrastructure, and IoT technology implementation to make them more automated and intelligent. Internet of things (IoT) services are provided by IoT service providers, who offer consultancy, security, and analytics services according to the business's needs.

Professional and managed services are the two most common types of internet of things (IoT) services. A professional service is an intangible product sold by a contractor or product vendor to assist a customer in managing a particular aspect of their business. Manufacturing, retail, IT & telecom, transportation & logistics, utilities, healthcare, energy, and others are examples of verticals. Smart buildings, smart manufacturing, smart transportation and logistics, smart healthcare, smart retail, and smart energy are some of the uses of internet of things services.

Companies are resuming operations and adapting to the new normal as they recover from the COVID-19 impact, which had previously resulted in restrictive containment measures such as social distancing, remote working, and the closure of commercial activities, all of which created operational challenges.

The IoT service industry is predicted to be driven by a growth in the internet of things application cases. The areas where IoT can be utilized to automate processes and increase efficiency are known as IoT use cases. IoT has found applications in a variety of domains throughout time, including manufacturing, farming, smartwatches, smart cities, transportation, and other fields, which has raised the demand for IoT services such as consultancy, data management, network management, and security services, and others. Telit, a leading IoT enabler, for example, offers an IoT security system that allows customers to control and monitor surveillance while also collecting and analyzing data to improve building security and turn them into smart buildings. The IoT use cases are predicted to fuel market expansion by increasing demand for IoT services.

COVID-19 Impact on IOT in network service Market

During the pandemic, IoT device usage has risen in a variety of industries, including healthcare, utilities, manufacturing, and transportation and logistics. As a result, there is a growing demand for IoT professional services across several sector verticals. In healthcare, for example, IoT professional services are increasingly used in telemedicine solutions such as remote patient monitoring and remote diagnostics, as well as linked ambulance and connected workforce solutions. As a result, as the number of instances of COVID-19 rises, so does the demand for IoT-based solutions to enhance the conditions of patients and healthcare workers. Furthermore, the COVID-19 outbreak has had a significant impact on the energy industry, allowing business leaders to consider IoT professional services as a replacement for manual infrastructure intervention by field personnel. To address potential failures, organizations have begun to consider intelligent asset management systems for remote monitoring, alerts and notifications, remote services and control, predictive analytics, and preventive maintenance using historical and real-time data analysis.

MARKET DRIVERS

Market growth will be boosted by the use of IoT-powered smart cameras for security:

Security can be a serious worry in remote regions where pricey equipment is put. Other resources are also employed to power the equipment in remote areas, such as batteries and fuel. For telecom organizations, theft of equipment and consumable resources can be costly. As a result, telecom businesses must assure the implementation of robust security protocols. At their remote locations, telecom companies can deploy IoT-powered smart cameras. Smart cameras can identify tampering on-site and immediately notify the necessary authorities. Telecom businesses can also utilize beacons and RFID badges to secure the perimeter and prevent unwanted entry. This method can also be used by telecom companies to construct a geofence for their IoT devices.

Rising Demand for Connectivity Drives IoT Adoption in the Telecom Network Sector

The demand for greater connectivity has grown dramatically over the years as a result of technical improvement and growing inventiveness. This is likely to boost IoT adoption in the telecom industry, resulting in market expansion. Furthermore, as the volume of data related to telecommunications increases, so will the requirement for data management technologies. The risk connected with data privacy, on the other hand, is one of the major worries that could have a negative influence on market growth throughout the projection period. Manufacturers might also underline the importance of wireless connectivity and the Internet of Things. An increase in telco adoption, penetration of smart connected devices, and demand for network bandwidth control and automation in communication operations are expected to boost the IoT network services market. Additionally, the developing next-generation wireless networks, as well as the utilization of smart technologies and distributed applications, are expected to present considerable potential opportunities for the telecom IoT market throughout the forecast period. Vodafone Idea (Vi) launched an integrated IoT solution in April 2021 to take advantage of the Digital India and Smart Cities missions' prospects.

MARKET RESTRAINTS

The lack of spectrum allocation regulations is a major hurdle to market expansion

The lack of spectrum allocation regulations is a major impediment to market expansion. Relationships with network service providers and IoT platform suppliers change regionally, affecting relationships between IoT platform providers and Network-as-a-Service providers significantly. Additionally, telecom service providers are struggling to keep up with customer demand for bandwidth-intensive applications and high-quality network experiences. The inability to build a healthy partnership between IoT platform suppliers and Network-as-a-Service providers, as well as IoT platform vendors changing regionally, is projected to stymie the IoT network Service Market's growth.

Data security and privacy concerns are acting as a roadblock to industry expansion.

The Internet of Things (IoT) is vulnerable to threats that could result in significant financial and data losses. More than 70% of IoT devices include major security flaws. The IoT professional services market offers considerable growth potential for businesses of all sizes and industries; yet, preserving data security and privacy is a major problem for market participants. The installed smart devices and sensors continuously generate a large amount of data, which is projected to aid data-handling firms in gaining insights into their competitors' market positions. Enterprises are demanding improved security and privacy protections as the popularity of IoT professional services grows. As the number of IoT devices grows, a slew of security and privacy vulnerabilities will emerge, making every endpoint, gateway, sensor, and smartphone a possible hacking target. As a result, there is a critical demand for enterprise IoT security and privacy protection.

This research report is based on IOT in network service Market segmented and sub-segmented by Connectivity, network, application, and region.

IOT in network service Market by connectivity

- Cellular Technologies

- LPWAN

- NB-IoT

- Radio Frequency-Based

Cellular Technologies, LPWAN, NB-IoT, and Radio Frequency-Based are the many types of connectivity in the IoT Telecom Services Market. The NB-IoT is predicted to grow at the fastest rate during the forecast period. By 2030, it is expected to grow at a 26.4 percent CAGR, reaching $15.2 billion. NB-IoT (Narrowband-IoT) is a narrowband radio technology for M2M and Internet of Things (IoT) devices and applications that demand low-cost, low-power wireless transmission across a longer range for long battery life. The NB-IoT connectivity technology component of the market is estimated to develop at the quickest rate during the forecast period due to the emergence of low-power high-range wireless connectivity technologies. The market for transportation, logistics tracking, and traffic management applications is predicted to increase at a similar rate. In December 2020, BSNL, in conjunction with Skylotech India, announced a breakthrough in satellite-based NB-IoT, in support of Prime Minister Shri Narendra Modi's goal of a wholly digital India (Narrow Band-Internet of Things). Because of this solution, India now has access to a widespread network of connectivity for millions of previously disconnected equipment, sensors, and industrial IoT devices.

IOT in network service Market by network management solution

- Network Performance Monitoring and Optimization

- Network Traffic Management

- Network Security Management

- Others

IoT Telecom Services Market has been divided into Network Management solutions into Network Performance Monitoring and Optimization, Network Traffic Management, Network Security Management, and Others. Because they secure data and resources in a network by leveraging firewalls and other IoT-enabled security solutions for effective network management, network security management solutions are predicted to grow at a CAGR of 18% over the forecast period. An administrator can administer a network that comprises both physical and virtual firewalls from a single location using network security management. To obtain visibility into network behavior, automate device configuration, enforce global policies, view firewall traffic, produce reports, and provide a uniform management interface for physical and virtual systems, administrators need network security management solutions.

IOT in network service Market by application

- Smart Buildings

- Smart Transport and Logistics

- Smart manufacturing

During the projected period, smart transportation and logistics will lead the market by application segment. The integration of sophisticated technology with current transportation and logistics infrastructure to deliver real-time online information about traffic flow, asset tracking, and passengers/commuters is known as smart transport and logistics. Traffic management, supply chain and logistics management, inventory management, passenger information system management, fleet management, freight management, cargo and container tracking, ticketing management, and parking management are just a few of the applications. Professional IoT services assist firms in the transportation and logistics industries in achieving automation via the use of IoT technical solutions.

IOT in network service Market by region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

The IoT Telecom Services Market has been divided into five regions: North America, Europe, Asia Pacific, South America, and the Rest of the World. The IoT Telecom Services Market is expected to be dominated by North America in 2021. The growth of IoT telecom services in this region is being driven by the increasing adoption of smart connected devices and technologies, as well as telcos promoting OTT applications. Because of the increasing usage of cloud-based technologies in the region, North America is likely to lead the market over the forecast period. Furthermore, one of the important factors projected to fuel the market growth during the forecast period is increased investment by telecom service providers in IoT adoption in this area. Manx Telecom, a mobile network operator (MNO), rebranded its Worldwide Solutions subsidiary as OV in May 2021 to serve the increasing global IoT industry with its existing global mobile virtual network enabler (MVNE) and trip SIM businesses.

After the United States, Europe is likely to be the second-largest market for IoT in-network services. In this field, there are increased research and development expenditures as well as advancements in Internet of Things (IoT) managed services and applications. Furthermore, the region's quick expansion is fuelled by tremendous breakthroughs in the automotive industry and technological advancements, as well as an increase in IoT managed services applications that demand companies' digitization. In the regional industry, the United Kingdom and Germany are the two major revenue producers, and they have emerged as the most enticing market location for market participants.

The APAC region is undergoing tremendous technical advancements, as well as increased industrialization and foreign investment in growing economies like India and China.

IOT in network service Market by company

Players in the IoT Telecom Services market use a variety of methods, including technology launches, acquisitions, partnerships, and R&D. Several businesses have fragmented the market for IoT Telecom Services industry outlook in 2021. Ericsson, Vodafone, Telstra, Sierra Wireless, Pure Software, Sequans Communications, Orange, T-Mobile, Telus, and MediaTek are among the top ten IoT in-network Services firms.

NOTABLE HAPPENINGS IN IOT in network service Market IN THE RECENT PAST:

PRODUCT INTEGRATION

- In September 2021, Telstra built innovation centers in India to solve AI and IoT problems.

PRODUCT LAUNCH

- In May 2021, Manx Telecom, a mobile network operator (MNO), rebranded its Worldwide Solutions subsidiary as OV to serve the increasing global IoT industry with its existing global mobile virtual network enabler (MVNE) and trip SIM businesses.

- In April 2021, Bharti Airtel Ltd unveiled its internet of things (IoT) platform, allowing businesses to connect and manage billions of devices and apps.

COLLABORATIONS

- In January 2021, Atos and IBM partnered to assist businesses to speed their digital transformation and improve business operations. Clients may expect to have access to automation solutions that use AI and hybrid cloud technologies to enable digital acceleration, boost productivity, and lower costs as a result of the cooperation. Manufacturing, energy and utilities, oil and gas, retail, and transportation will benefit from Atos and IBM's collaboration to address business difficulties.

Chapter 1.IOT in network service Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2.IOT in network service Market – Executive Summary

2.1. Market Size & Forecast – (2022 – 2026) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-16 Impact Analysis

2.3.1. Impact during 2022 - 2026

2.3.2. Impact on Supply – Demand

Chapter 3.IOT in network service Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4.IOT in network service Market - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. IOT in network service Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6.IOT in network service Market – By Connectivity

6.1. Cellular Technologies

6.2. LPWAN

6.3. NB-IoT

6.4. Radio Frequency-Based

Chapter 7.IOT in network service Market – By Network Management Solution

7.1. Network Performance Monitoring and Optimization

7.2. Network Traffic Management

7.3. Network Security Management

7.4. Others

Chapter 8.IOT in network service Market – By Application

8.1. Smart Buildings

8.2. Smart Transport and Logistics

8.3. Smart manufacturing

Chapter 9.IOT in network service Market – By Region

9.1. North America

9.2. Europe

9.3. The Asia Pacific

9.4. Latin America

9.5. The Middle East

9.6. Africa

Chapter 10.IOT in network service Market – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

10.1. Ericsson

10.2. Vodafone

10.3. Telstra

10.4. Sierra Wireless

10.5. Pure Software

10.6. Sequans Communications

10.7. Orange

10.8. T-Mobile

10.9. Telus

10.10. MediaTek

Download Sample

Choose License Type

2500

4250

5250

6900