IoT in the Building and Automation Market Size (2023 – 2030)

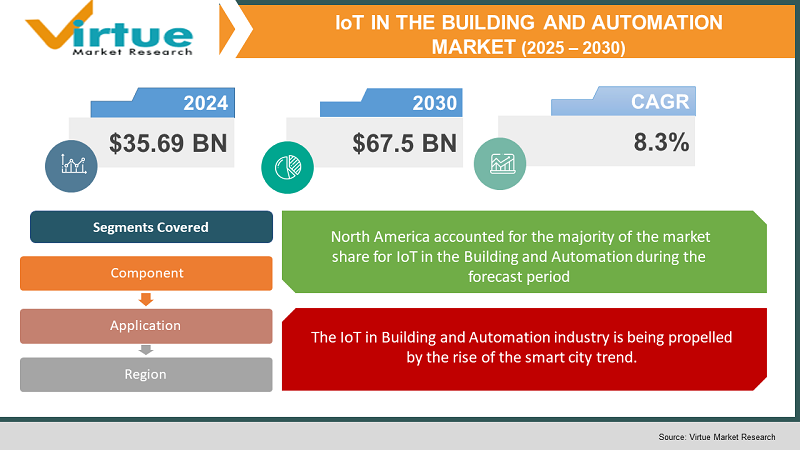

In 2022, the value of IoT in the building and automation market was estimated to be USD $35.69 billion. During the forecast period, from 2023 - 2030, the global market is estimated to grow at an annual rate of 8.3%. By 2030, the worldwide commercial building automation market is projected to reach a value of USD$ 67.5 billion. The market's growth would be aided by the growing use of IoT in building automation systems.

Market Overview

IoT in buildings automates infrastructure, lighting, security systems, heating, ventilation, and air conditioning systems, among other things. A smart building employs technology to make it more efficient, sustainable, safe, and cost-effective. The IoT and connected sensor ecosystem is expanding, and smart building solutions are a part of it.

Water management, video and entertainment, HVAC and energy management, audio, elevator management, lighting and window control, access control and security, and fire safety are among the most sought-after automation services. The global commercial building automation market is estimated to be driven by the expansion of the building and construction sector, rising urbanization in emerging nations, and technological developments. Government regulations aimed at reducing carbon emissions in developing economies are estimated to spur market growth. Smart and networked commercial buildings, with automated controls for HVAC (heating, ventilation, and air conditioning), among other things, are projected to create significant growth opportunities for market participants.

The market is estimated to rise steadily due to rising demand from developing countries and an increase in commercial development and construction projects around the world. During the forecast period, the worldwide commercial building automation market is estimated to gain from an increase in demand for energy-efficient and environmentally friendly buildings.

Covid-19 Impact on IoT in the building and automation market

The reopening of business facilities for in-office work following the pandemic is projected to increase demand for IoT in the building and automation market that ensuring a safe workplace. Following a lockdown, commercial building facilities managers and corporate tenants must provide a safe working environment. As a result, smart technologies are projected to be used to manage regular cleaning and sanitization, proper workplace ventilation, smart entrance control, temperature measurement devices, and space optimization for physical separation. The need for IoT in building solutions is projected to increase as a result of this factor.

Furthermore, this technology may be useful in the future for tracking staff movement and reducing virus spread. Intelligent technology can provide real-time data as it interacts with systems and people. The pandemic has sparked a boom in intelligent building solutions potential to aid in the containment of the disease. In the long run, demand for modern infrastructure is predicted to expand exponentially following the epidemic.

MARKET DRIVERS

The market for IoT in Building and Automation is growing due to an increase in the usage of IoT-enabled BMS.

Owing to increased building efficiency, improved tenant connections, and new revenue generation options, the Internet of Things (IoT) has had a huge impact on the Commercial Real Estate (CRE) market. Installed and utilized to improve building performance efficiency and use sensor-generated data to improve building user experience, an IoT-enabled BMS is installed and used. It can also run all building management solutions with little to no manual intervention utilizing a single infrastructure. IoT-enabled building management systems can be used for a variety of objectives, including lowering energy consumption, repairing and maintaining building systems, and lowering building administration costs. At the building level, property owners use data received from various sensors, such as interior air quality and space use, to govern the building. The Internet of Things allows building owners to have direct dialogues and interactions with building users and renters. Sensors in retail malls can enable owners to contact directly with different customers and give their services, resulting in stronger tenant involvement and customer relationships. As a result, IoT-enabled building management systems are projected to drive the smart buildings industry forward. According to G6 World, by 2030, IoT will save around 1.8 PW of electricity and an additional 3.5 PW of hydrocarbon use, totaling 5.3 PW of energy savings. Implementing the Internet of Things will save 230 billion m3 of water and avert 1 Gt of CO2 emissions.

The IoT in Building and Automation industry is being propelled by the rise of the smart city trend.

Smart buildings play a significant part in smart cities, although the growth of smart buildings and smart cities are not mutually exclusive. Structures with sensor networks can track sustainability performance, monitor power and water usage in real-time, and connect with other smart city components. Governments all around the world are pouring money into smart city projects, which is boosting smart building adoption in different parts of the world. As a result, the expansion of the smart buildings market is projected to be aided by an increase in smart city efforts by various governments. During the COVID-19 conference in November 2020, Transport for Greater Manchester (TfGM) and Vivacity Labs announced the rollout of AI-controlled smart traffic junctions in the city to improve safety and reduce congestion.

MARKET RESTRAINTS

Lack of cooperation among standard-setting bodies is a source of restraint for the IoT in Building and Automation.

For IoT and existing smart building technologies to operate together, there needs to be a lot of collaboration between standard organizations, enterprises, city governments, and other stakeholders. This cooperation in the development of smart cities is critical to understanding the full potential of these technologies. Property and tenant management, as well as facility management, each has its own set of needs and operating systems. Because these systems are not often built to integrate with other systems, obtaining information from building systems can be problematic.

As a result of IoT-enabled devices, there has been an increase in privacy and security concerns which is restraining the market growth

Smart technology is currently being integrated into the designs and operations of many buildings. Tenants and landlords benefit greatly from the deployment of technology such as IoT and sensors. However, building security is jeopardized by the introduction of these technologies. Most IoT devices and sensors have insecure security, use non-standard communication protocols, and run on old, unpatched software, exposing smart buildings to a variety of security flaws. Hackers always look for technological flaws to access a network and steal important data or take control of a facility. Cybercriminals, for example, hack into Business Activity Statement to disable passenger elevators, obtain access to security feeds from closed-circuit televisions (CCTVs), and cause power outages. Any smart building could be vulnerable to a well-planned cyber-attack involving widely available IoT devices and sensors, which could expose critical data storage, servers, and employee and customer information, all of which could be exploited for evil reasons. As a result, the growing privacy and security issues associated with the deployment of IoT-enabled devices are limiting the growth of the IoT in Building and Automation market.

IoT IN THE BUILDING AND AUTOMATION MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

8.3% |

|

Segments Covered |

By Component, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Cisco, IBM, Honeywell, Siemens, Johnson Controls, Huawei, Intel, PTC, ABB, Hitachi, Schneider Electric, Telit, Legrand, Bosch, KMC Controls, Verdigris Technologies, 75F, BuildingIQ, ENTOUCH, Gaia |

This research report based on IoT in the building and automation market is segmented and sub-segmented by Component, Application, and region

IoT in the Building and Automation Market- By Component

- Solution

- Safety and security management

- Access control system

- Video surveillance system

- Fire and life safety system

- Safety and security management

-

- Energy management

- HVAC control system

- Lighting management system

- Energy management

-

- Building infrastructure management

- Parking management system

- Smart water management system

- Elevator and escalator management system

- Building infrastructure management

-

- Network management

- Wired technology

- Wireless technology

- Network management

-

- IWMS

- Operations and services management

- Real estate management

- Environment and energy management

- Facility management

- Capital project management

- IWMS

- Services

- Consulting

- Implementation

- Support and maintenance

Based on the component market is divided into solutions and services.

During the projection period, the services category is estimated to increase at a quick pace. This can be attributed to the increasing use of intelligent building technologies. Professional services, like as consultation, system integration, implementation, support, and maintenance, are in high demand. Building infrastructure management, security, and emergency management, and energy management are all part of the solutions category is monopolizing the market,

Energy management is predicted to increase fast as green construction programs and government rules on energy consumption become more stringent. For example, Shanghai's New Development Bank (NDB) used intelligent building technologies to control inside lighting, electric curtains, and windows and saw a 15% reduction in energy consumption. Security systems, surveillance systems, advanced building operation services, and smart workspace solutions are all in high demand in commercial buildings. The security and emergency management solutions segment is likely to be driven by this aspect. It is further divided into three categories: access control, video surveillance, and safety. Because of the increasing hurdles in optimizing commercial building operational expenses, building infrastructure management is likely to develop steadily.

IoT in the Building and Automation Market- By Application

- Residential

- Commercial

- Hotel

- Healthcare

- Retail

- Corporate Offices

- Others

- Industrial

The global market is divided into three categories based on application: residential, commercial, and industrial.

Because stakeholders such as developers and owners of commercial real estate (CRE) are increasingly focusing on intelligent buildings to minimize operational costs, the commercial segment is likely to dominate the segment share. Governments throughout the world are investigating the CRE to invest heavily in and enhance energy-saving construction techniques.

Hotel, healthcare, retail, corporate offices, and others are all included in the commercial section. Because of the growing demand for innovative technologies to manage hospital operations, healthcare is projected to take the lead.

The residential market is estimated to see increasing adoption of intelligent building solutions to manage safety and security, smart maintenance, energy consumption, and other factors. Smart house lighting, HVAC monitoring, smart door, and locking systems, and smart meters are likely to drive up demand for intelligent buildings in residential applications.

IoT in the Building and Automation Market- By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

North America, Europe, Asia Pacific, the Middle East, Africa, and Latin America are the five key regions in which the market is divided.

During the projected period, North America is estimated to dominate the regional revenue share. Important firms across industries in the region are transitioning to intelligent building solutions to optimize workplace operations. Because of increased investments in green building technology, the United States dominated the area in terms of share. For example, after incorporating intelligent building infrastructure, the US-based Duke Energy Centre, a 51-story tower skyscraper, obtained the highest green certificate from LEED Platinum. According to Schneider Electric's Smart Working study, commercial real estate in the United States consumes roughly USD 179 billion in energy each year. This aspect is projected to increase demand in the region for energy-efficient smart infrastructure.

After North America, Europe will have a considerable market share. The European Union's increased focus on deploying effective energy-saving technology in residential and commercial buildings is projected to boost the Internet of Things' market share in the construction industry. By getting the WELL Building Standard accreditation, organizations in Europe are concentrating on employee well-being. As a result, market prospects are projected to grow as the number of smart workplace buildings grows.

During the projection period, Asia Pacific is estimated to grow at a rapid pace. The need for intelligent buildings in the region is poised to rise as smart city projects expand. Furthermore, the technology to control urban space demand is projected to be driven by China and India's expanding populations. Increased government initiatives to construct smart commercial spaces, shopping malls, and communities to cut energy use are also projected to fuel market expansion.

Due to the rising demand for energy-efficient smart building solutions, the Middle East and Africa are experiencing high growth rates. Furthermore, the region is committed to lowering carbon emissions and employs smart technologies to accomplish this goal.

Similarly, Latin America is experiencing steady growth as the government strives to be more efficient and effective. In Brazil, for example, the launch of the Resources Application Plan by the National Energy Conservation Program (PAR PROCELL) is predicted to increase demand for IoT in building technologies.

IoT in the Building and Automation Market by Company

To strengthen their offerings in the IoT in Buildings and automation market, suppliers have used a variety of organic and inorganic growth tactics, such as new product promotions, partnerships and agreements, business expansions, and mergers and acquisitions.

- Cisco

- IBM

- Honeywell

- Siemens

- Johnson Controls

- Huawei

- Intel

- PTC

- ABB

- Hitachi

- Schneider Electric

- Telit

- Legrand

- Bosch

- KMC Controls

- Verdigris Technologies

- 75F

- BuildingIQ

- ENTOUCH

- Gaia.

NOTABLE HAPPENINGS IN THE IOT IN BUILDING AND AUTOMATION MARKET IN THE RECENT PAST:

- PRODUCT LAUNCH

In September 2021, Legrand launched the Living Now design which is characterized by the high purity of form and precision of geometry to fit all houses. It can be installed to demonstrate its revolutionary possibilities when used in conjunction with connected smart systems.

- MERGERS AND ACQUISITIONS

In January 2022, Johnson Controls acquired FogHorn, a prominent developer of Edge AI software for industrial and commercial Internet of Things (IoT) applications johnson Controls expedited its vision of smart, autonomous buildings that continuously learn, adapt, and respond to the requirements of the environment and people by integrating Foghorn's world-class Edge AI throughout its OpenBlue product range.

- PARTNERSHIP

Honeywell and Nexii Building Solutions Inc. announced a strategic agreement in July 2021 to help speed the development of low-impact buildings. Under the terms of this agreement, Honeywell will be the sole provider of building technology for Nexii's new buildings, with solutions that conserve energy and increase operational efficiency.

Chapter 1.IoT in the Building and AutomationMarket – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2.IoT in the Building and AutomationMarket – Executive Summary

2.1. Market Size & Forecast – (2022 – 2026) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-16 Impact Analysis

2.3.1. Impact during 2022 - 2026

2.3.2. Impact on Supply – Demand

Chapter 3.IoT in the Building and AutomationMarket – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4.IoT in the Building and AutomationMarket - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. IoT in the Building and AutomationMarket - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6.IoT in the Building and AutomationMarket – By Component

6.1. Solution

6.1.1. Safety and security management

6.1.1.1. Access control system

6.1.1.2. Video surveillance system

6.1.1.3. Fire and life safety system

6.1.2. Energy management

6.1.2.1. HVAC control system

6.1.2.2. Lighting management system

6.1.3. Building infrastructure management

6.1.3.1. Parking management system

6.1.3.2. Smart water management system

6.1.3.3. Elevator and escalator management system

6.1.4. Network management

6.1.4.1. Wired technology

6.1.4.2. Wireless technology

6.1.5. IWMS

6.1.5.1. Operations and services management

6.1.5.2. Real estate management

6.1.5.3. Environment and energy management

6.1.5.4. Facility management

6.1.5.5. Capital project management

6.2. Services

6.2.1. Consulting

6.2.2. Implementation

6.2.3. Support and maintenance

Chapter 7.IoT in the Building and AutomationMarket – By Application

7.1. Residential

7.2. Commercial

7.2.1. Hotel

7.2.2. Healthcare

7.2.3. Retail

7.2.4. Corporate Offices

7.2.5. Others

7.3. Industrial

Chapter 8.IoT in the Building and AutomationMarket – By Region

8.1. North America

8.2. Europe

8.3. The Asia Pacific

8.4. Latin America

8.5. The Middle East

8.6. Africa

Chapter 9.IoT in the Building and AutomationMarket – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

9.1. Cisco

9.2. IBM

9.3. Honeywell

9.4. Siemens

9.5. Johnson Controls

9.6. Huawei

9.7. Intel

9.8. PTC

9.9. ABB

9.11. Hitachi

9.12. Schneider

9.13. Electric

9.14. Telit

9.15. Legrand

9.16. Bosch

9.17. KMC Controls

9.18. Verdigris Technologies

9.19. 75F

9.20. BuildingIQ

9.21. ENTOUCH

9.22. Gaia

Download Sample

Choose License Type

2500

4250

5250

6900