Ionizing Breast Imaging Technology Market Size (2023-2030)

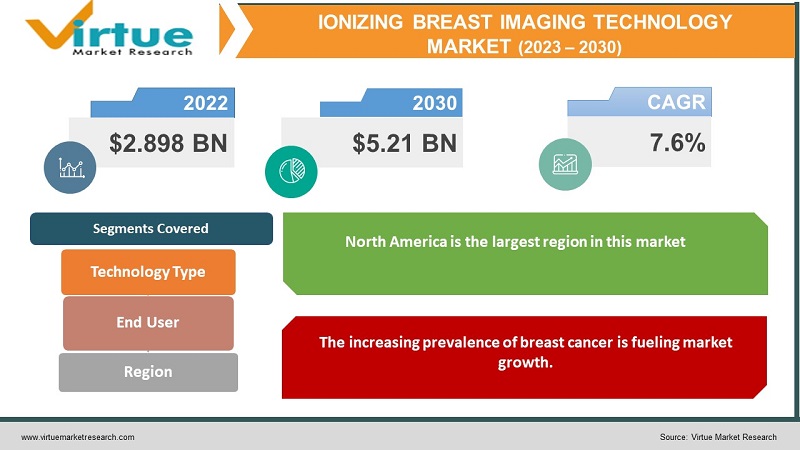

The global ionizing breast imaging technology market was valued at USD 2.898 billion and is projected to reach a market size of USD 5.21 billion by the end of 2030. Over the outlook period of 2023–2030, the market is anticipated to grow at a CAGR of 7.6%.

In the past, mammograms were a popular ionizing breast image technology used for breast cancer detection. When used for breast cancer screening, mammograms can detect the disease early, before any symptoms or indications appear. Mammograms, sometimes called mammography exams, employ X-ray beams, a kind of ionizing radiation, to create images of the inside of the breast. Currently, there have been many technological advancements in mammography techniques. Digital imaging like 3D, computed tomography (CT), and molecular breast imaging are a few. In the future, with reduced radiation, AI and ML integration, and other advanced imaging techniques, this market will witness a tremendous growth rate.

Key Market Insights:

India's breast imaging market was valued at around 110 million US dollars in 2019. In comparison, the value of the market was predicted to nearly double by 2026.

2019 saw 1.3 billion US dollars invested in North America on ionizing breast imaging technology research and analysis, with 845 million US dollars going to Europe. Globally, the value of R&A ionizing breast imaging technologies is expected to rise; by 2026, it should have reached over two billion dollars in North America.

With an R&A value of almost 1.1 billion US dollars in 2020, analog mammography—an ionizing breast imaging technology—had the highest R&A value globally. On the other hand, 691 million US dollars were invested in 3D breast prosthesis research.

With an R&A value of 522 million USD in 2020, analog mammography—an ionizing breast imaging technology—had the highest R&A value in North America. However, research and development costs for CB-CT and 3D breast tomosynthesis were 252 and 344 million dollars, respectively.

In general, almost 1 in 8 cases of breast cancer are missed by screening mammography. False-negative outcomes are more common in women with thick breasts. In addition to mammography, women with thick breasts may benefit from other screening techniques, such as breast ultrasound, breast MRI, and molecular breast imaging (MBI).

Ionizing Breast Imaging Technology Market Drivers:

The increasing prevalence of breast cancer is fueling market growth.

Over the years, there have been many lifestyle changes. There has been a significant rise in the consumption of tobacco and alcohol. Excessive junk food consumption has led to obesity. Apart from this, harmful radiation from electronic equipment has seen an upsurge. Besides, pregnancy after the age of 30 can pose a risk. Moreover, breast cancer risk is elevated in women who use hormone treatment drugs that mix progesterone and estrogen to treat menopausal symptoms. Furthermore, genetic makeup and family history raise the threat. In the United States, breast cancer is the most frequent disease among women; 287,850 new cases are anticipated for 2022. It is extremely necessary to detect this disease at its early stages. This has led to an enlarged awareness amongst women and girls of all age groups. Females are encouraged to regularly check for lumps through a self-breast examination.

Technological advancements are helping the market expand.

Digital breast tomosynthesis (DBT), a multi-image platform, replaced single-emulsion film as the primary method of mammography imaging. Over this history, radiologists have been able to spot tumors with greater ease, and picture quality has improved. Since DBT (Digital Breast Tomosynthesis) was implemented in 2011, there has been a drop in call-back rates and an increase in the number of tumors that are discovered. The fields of artificial intelligence (AI) and machine learning (ML) have emerged recently, and they have the potential to significantly improve reading times as well as the accuracy of mammography screening processes. In this crucial and developing subject, applications in AI-driven breast ultrasonography (US), detection algorithms, and computer-aided diagnosis (CAD) are anticipated to hold immense potential.

Ionizing Breast Imaging Technology Market Restraints and Challenges:

Excessive exposure to radiation, costs, breast density solutions, and limited awareness are the main issues that the market is experiencing.

Individuals who undergo the examination are repeatedly exposed to radiation. These radiations can damage our DNA and pose the risk of relapse. As per a research article titled "Radiation-Induced Breast Cancer Incidence and Mortality from Digital Mammography Screening: A Modeling Study” by the National Library of Medicine (NLM), in comparison to the 968 breast cancer deaths prevented by early detection via screening, yearly screening of 100,000 women aged 40 to 74 was expected to cause 125 breast cancers (95% confidence interval [CI]=88-178) and result in 16 fatalities (95% CI=11-23). This paper also published the risk of other specificities. This calls for the necessary steps to be taken to reduce radiation exposure. Secondly, the equipment is very expensive. In addition, maintenance and technological upgrades are important. Ensuring advanced and accessible technologies in all remote areas and cities is a big challenge. Besides, the money required for treatments drains an individual financially. Thirdly, the detection of mammography abnormalities can be difficult to identify in dense breast tissues. Although there are supplementary methods, their usage is limited and impractical. Furthermore, access to education is a barrier in the market. Many women have partial or no understanding of the symptoms. This can lead to late detection, posing a threat to the life of an individual.

Ionizing Breast Imaging Technology Market Opportunities:

Continued investments in research activities have been providing the market with many possibilities. Technological advancements are being worked upon to reduce radiation and to have technologies with more precision and accuracy. Integration with artificial intelligence and machine learning is helping to reduce false positives and negatives. Secondly, personalized medicine is being prioritized. Scientists are working towards developing medicines based on the genetic makeup of an individual. Thirdly, telehealth services and consultation are helping in global operations. Internet connectivity is being facilitated in villages and rural areas. Along with this, educational awareness is being given utmost prominence. Awareness workshops, campaigns, seminars, and other programs are being conducted through corporate, school, and society events.

IONIZING BREAST IMAGING TECHNOLOGY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

7.6% |

|

Segments Covered |

By Technology Type, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Hologic, Inc., Siemens Healthineers, GE Healthcare, Fujifilm Medical Systems, Philips Healthcare, Canon Medical Systems Corporation, Planmed Oy, Delphinus Medical Technologies, Gamma Medica, Aurora Imaging Technology, Inc. |

Ionizing Breast Imaging Technology Market Segmentation:

Ionizing Breast Imaging Technology Market Segmentation: By Technology Type:

- Mammography

- Positron Emission Mammography (PEM)

- Breast Computed Tomography (CT)

- Molecular Breast Imaging (MBI)

- Others

Based on technology type, mammography is considered to be the largest and fastest-growing market. This is because of its history, testing analysis, technological advancements, awareness amongst the public, and accessibility. 2D mammography is an ancient and popular technique used for breast cancer detection due to its high sensitivity and familiarity. Digital Breast Tomosynthesis (3D mammography) is one such technique that is growing at a quick rate owing to its lower recall rates, clear visualization, precision, accuracy, approvals, and patient experience.

Ionizing Breast Imaging Technology Market Segmentation: By End User:

- Hospitals and Clinics

- Diagnostic Imaging Centers

- Breast Care Centers

- Others

Hospitals and clinics are the most dominant end users in the market. This is because of the presence of skilled professionals, infrastructure, top-notch treatments, hygiene, investments, partnerships, and well-equipped machines. It is estimated to hold a total share of around 67%. Diagnostic imaging centers are the fastest-growing owing to rising awareness, effective diagnosis, treatments offered, lesser costs, and expansion in many underdeveloped and developing countries.

Ionizing Breast Imaging Technology Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

Based on region, North America is the largest region in this market. It is estimated to hold a share of around 37%. Countries like the United States and Canada are at the front leading the region. The success of this region is due to technological advancements, accessibility, awareness, investments, the presence of prestigious pharmaceutical companies and hospitals, and an increase in the number of people suffering from cancer. However, Asia-Pacific is predicted to be the fastest-growing region among the others. Countries like Japan, Singapore, Australia, and China were the top leaders. Governmental involvement through initiatives and funds, extensive research activities, accessibility to healthcare and infrastructure, educational programs, collaborations between companies, the rising number of cases, and emerging startups were the main reasons for the flourishment.

COVID-19 Impact Analysis on the Global Ionizing Breast Imaging Technology Market:

The outbreak of the virus hurt the market. To prevent the spread, lockdowns, social isolation, and movement restrictions became the new norm. Hospitals and clinics were filled with individuals affected by the coronavirus. There was a lack of beds, oxygen supplies, and ventilators in many parts of the world. All investments were shifted towards the development of vaccines and healthcare facilities for COVID-19 care. There was fear among the public to step out. Patients were hesitant to seek in-person services to stay healthy. Moreover, there were many layoffs due to uncertainty and losses. This took a financial toll on many houses. The data as per Statista, indicates that the COVID-19 epidemic had a significant impact on Italy's breast cancer screening rate. 2020 saw a 37.6% decline in screenings compared to the prior year. The market is still recovering from the losses. Telehealth services are being looked upon to reduce miscellaneous charges. Furthermore, research is being emphasized to find advanced technologies and vaccines for breast cancer.

Latest Trends/ Developments:

Companies are also spending heavily to improve existing technologies while maintaining competitive pricing. This has resulted in increased market growth. Patient-centric care is an emerging trend. Researchers across the world are focusing on developing surgeries and treatments that cause minimal discomfort, pain, and anxiety in individuals. Governmental organizations and investors are working towards creating more funds to advance human knowledge regarding these technologies.

Key Players:

- Hologic, Inc.

- Siemens Healthineers

- GE Healthcare

- Fujifilm Medical Systems

- Philips Healthcare

- Canon Medical Systems Corporation

- Planmed Oy

- Delphinus Medical Technologies

- Gamma Medica

- Aurora Imaging Technology, Inc.

In September 2023, to better diagnose breast cancer in women, Hologic Inc. and Bayer announced an international partnership to provide contrast-enhanced mammography (CEM) solutions in several European, Canadian, and Asia Pacific nations.

In January 2023, Seno Medical and Genetik Inc. partnered to market, sell, and provide service for Seno Medical's cutting-edge ImagioOpto-Acoustic/Ultrasound (OA/US) Breast Imaging System. Seno's cutting-edge diagnostic breast cancer imaging system uses non-invasive optoacoustic/ultrasound (OA/US) technology to provide information on breast lesions in real-time, allowing providers to characterize masses that may or may not require further invasive diagnostic evaluation. This allows physicians to distinguish between benign and malignant breast lesions.

In November 2022, as a first, Google Health licensed their mammography AI research model to iCAD, a pioneer in medical technology and cancer diagnosis. For the benefit of the more than two million people worldwide who are diagnosed with breast cancer each year, iCAD will work to validate and incorporate Google’s mammography AI technology with its products for use in clinical settings. This will improve breast cancer detection and the assessment of short-term personal cancer risk.

Chapter 1. GLOBAL IONIZING BREAST IMAGING TECHNOLOGY MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL IONIZING BREAST IMAGING TECHNOLOGY MARKET – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.4. Attractive Investment Propositions

2.5. COVID-19 Impact Analysis

Chapter 3. GLOBAL IONIZING BREAST IMAGING TECHNOLOGY MARKET – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL IONIZING BREAST IMAGING TECHNOLOGY MARKET - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.5. PESTLE Analysis

4.4. Porters Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. GLOBAL IONIZING BREAST IMAGING TECHNOLOGY MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL IONIZING BREAST IMAGING TECHNOLOGY MARKET – By Technology Type

6.1. Introduction/Key Findings

6.2. Mammography

6.3. Positron Emission Mammography (PEM)

6.4. Breast Computed Tomography (CT)

6.5. Molecular Breast Imaging (MBI)

6.6. Others

6.7. Y-O-Y Growth trend Analysis By Technology Type

6.8. Absolute $ Opportunity Analysis By Technology Type , 2023-2030

Chapter 7. GLOBAL IONIZING BREAST IMAGING TECHNOLOGY MARKET – By End User

7.1. Introduction/Key Findings

7.2. Hospitals and Clinics

7.3. Diagnostic Imaging Centers

7.4. Breast Care Centers

7.5. Others

7.6. Y-O-Y Growth trend Analysis By End User

7.7 . Absolute $ Opportunity Analysis By End User , 2023-2030

Chapter 8. GLOBAL IONIZING BREAST IMAGING TECHNOLOGY MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By End User

8.1.3. By Technology Type

8.1.5. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By End User

8.2.3. By Technology Type

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By End User

8.3.3. By Technology Type

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By End User

8.4.3. By Technology Type

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By End User

8.5.3. By Technology Type

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. GLOBAL IONIZING BREAST IMAGING TECHNOLOGY MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Hologic, Inc.

9.2. Siemens Healthineers

9.3. GE Healthcare

9.4. Fujifilm Medical Systems

9.5. Philips Healthcare

9.6. Canon Medical Systems Corporation

9.7. Planmed Oy

9.8. Delphinus Medical Technologies

9.9. Gamma Medica

9.10. Aurora Imaging Technology, Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global ionizing breast imaging technology market was valued at USD 2.898 billion and is projected to reach a market size of USD 5.21 billion by the end of 2030. Over the outlook period of 2023–2030, the market is anticipated to grow at a CAGR of 7.6%.

The increasing prevalence of breast cancer and technological advancements are the main drivers propelling the Global Ionizing Breast Imaging Technology Market

Based on Technology Type, the Global Ionizing Breast Imaging Technology Market is segmented into Mammography, Positron Emission Mammography (PEM), Breast Computed Tomography (CT), Molecular Breast Imaging (MBI), and Others

North America is the most dominant region for the Global Ionizing Breast Imaging Technology Market.

. Hologic, Inc., Siemens Healthineers, and GE Healthcare are the key players operating in the Global Ionizing Breast Imaging Technology Market