Global Intrusion Detection System Market Size (2024 - 2030)

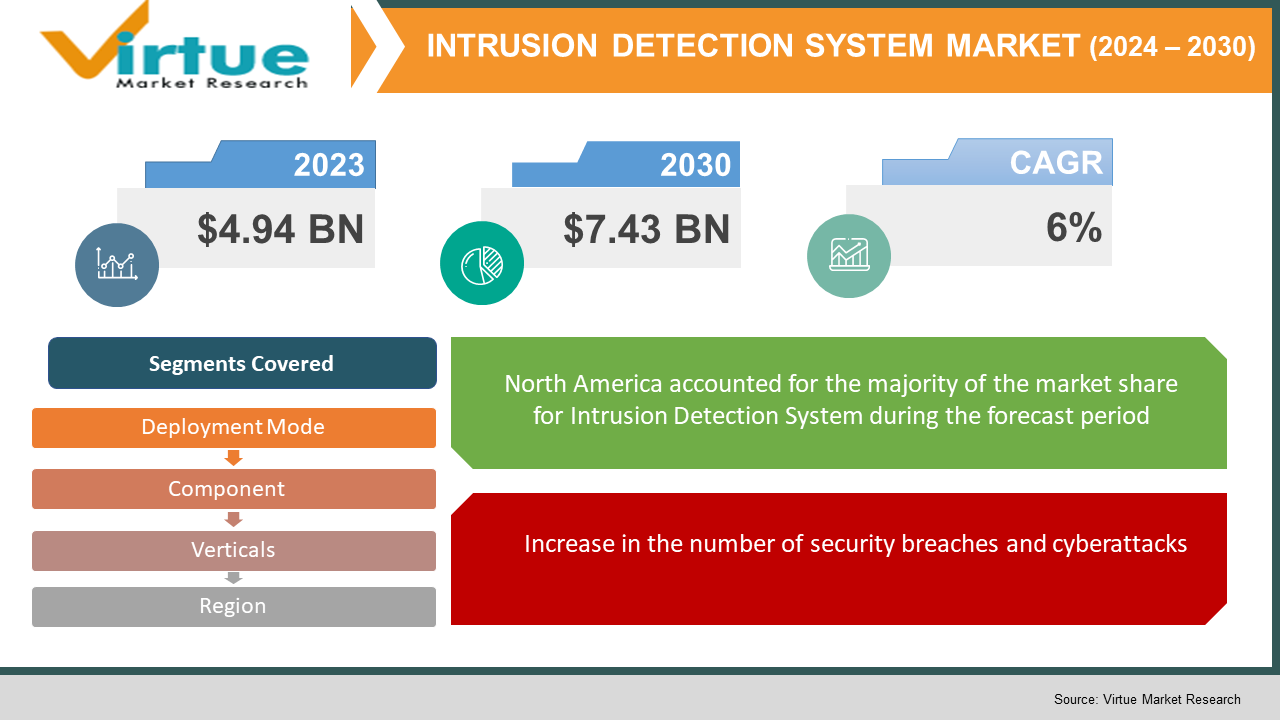

Global Intrusion Detection System Market is valued at USD 4.94 billion in 2023 and is projected to reach USD 7.43 billion by 2030, growing at a CAGR of 6% in the projected period from 2024 to 2030.

Industry Overview

An intrusion detection system (IDS) is a device or set of software applications that detect the presence of an intruder attempting to break into a network or system. The rapid expansion and use of the internet create issues regarding the safe transmission and storage of digital information. Intrusion is a huge issue for business, trade, and governments all around the world. As a result, detection systems that can deliver a quick alarm to an intruder play an increasingly important role. IDS monitors a network or systems for malicious activity or policy breaches and notifies the network administrator or gathers data centralized using a security information and event management (SIEM) system. SIEM integrates outputs from many sources and uses alarm filtering algorithms to discriminate between malicious and false alerts.

IDS comes in various flavors, from antivirus software to hierarchical systems that monitor the traffic of a whole backbone network. The classification strategy is based on the analyzed activity approach or the detection approach. Analyze activity holds network intrusion detection systems (NIDS) and host-based intrusion detection systems (HIDDS) (HIDS). NIDS detects intrusions by evaluating network traffic and monitoring numerous hosts connected to a hub or network switch with port mirroring enabled. HIDS, on the other hand, employs an agent on a host that detects intrusions by examining system calls, application logs, and file-system alterations. The detection strategy, on the other hand, includes signature-based detection, which employs explicitly recognized patterns to detect malicious code, and anomaly detection, which is aimed to detect aberrant activity in the system.

Intrusion Prevention Systems (IPS) added the ability to stop attacks in addition to detecting them to IDS solutions. Intrusion detection and prevention systems (IDPS) are primarily concerned with spotting potential occurrences, logging data, attempting to stop them, and reporting to security administrators. The prospect of authorized users abusing their rights and the expansion of diverse computer networks have significant consequences for the intrusion detection problem.

The market is expected to develop due to the increased use of new technologies in both the commercial and industrial sectors. With advancements in semiconductor technology such as LED and photodiode, biometrics technology allows authentication for fingerprints, palm veins, face recognition, iris recognition, DNA, and retina. The integration of a detection system with an authentication system results in the fulfillment of some sectors' high-security demands, which helps to market growth shortly.

Impact of Covid-19 on the Industry

In the middle of the COVID-19 epidemic, numerous governments and regulatory bodies need both public and commercial enterprises to adopt new strategies for working remotely while maintaining social distance. Since then, digital business practices have become the new business continuity plan (BCP) for many firms. With the increased usage of mobile devices and Internet penetration throughout the world, people are increasingly turning to digital solutions like IDPS to defend themselves against cyber-attacks.

Organizations, on the other hand, are using numerous ideas such as bring your device (BYOD) and work from home (WFH) to modernize their work cultures. IDPS solutions help enterprises to maintain business continuity by utilizing IDPS software to protect themselves against cybercrime and harmful threat actors. Many companies are aggressively investing in research and development to create analytics software to track the spread of COVID-19.

Market Drivers

Increase in the number of security breaches and cyberattacks

Massive cyberattacks occur across the world and involve the use of the internet for planned and politically driven assaults on endpoints, networks, data, and other IT infrastructures, resulting in data loss for individuals, businesses, and governments. The frequency of cyber-crime is increasing due to the significant development in digital transactions across sectors. The surge in business data breaches or data leakage is propelling the market for intrusion detection and prevention systems.

Rapid growth in BYOD and CYOD trends

Organizations are deploying their workers as BYOD-related technology improves. Organizations are subscribing to security services to safeguard devices such as smartphones, tablets, desktops, and laptops from cyber dangers as the BYOD model is adopted. With the increased usage of BYOD, businesses must safeguard devices not only inside the workplace but also those with remote access to the corporate network. This aspect has considerably enhanced IDPS solution acceptance, which is projected to fuel the IDPS market's development.

Market Restraints

Small and medium-sized businesses have a limited security budget

Several firms, particularly SMEs, are concerned about cybersecurity spending. Large corporations have adequate finances to establish an effective and efficient information security control environment. It is difficult for SMEs to invest large quantities in cybersecurity since they also invest large sums in other IT infrastructure. The R&D costs necessary to build cutting-edge cybersecurity solutions are considerable, resulting in the exorbitant price of the security solutions. The inability of cybersecurity experts to carry out their IT security activities successfully is still a major worry.

Lack of Expertise in the Industry

The greatest difficulty that enterprises confront today is a lack of cybersecurity expertise. Organizations are unable to satisfy their expanding IT security demands due to a lack of competent security employees. Many firms hire security specialists who do not have the necessary skills to assess and identify sophisticated threats while under assault.

INTRUSION DETECTION SYSTEM MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6% |

|

Segments Covered |

By Components, Deployment Mode, Verticals, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Cisco Systems, Inc., IBM Corporation, McAfee Corp., Trend Micro Inc., Palo Alto Networks, Inc., AT&T, Cybersecurity, Darktrace, FireEye, Alert Logic, Fortinet |

This research report on the global intrusion detection systems market has been segmented and sub-segmented based on, Components, Deployment mode, Vertical, and Geography & region.

Global Intrusion Detection System Market- By Components

- Solutions

- Hardware

- Software

- Services

- Integration

- Support and Maintenance

After-sales services and maintenance are also expected to be important factors in future growth. Artificial intelligence advancements may result in an improved threat monitoring system that provides proactive threat detection, boosting the demand for detection systems. Increased use of intuitive touch-based intrusion detection systems (IDS) and the development of video-based intrusion detection systems (IDS) are also expected to drive industry demand. The growing need in the BFSI industry to secure stored assets such as money, lockers, and gold ornaments opens up new opportunities.

Global Intrusion Detection System Market- By Deployment Mode

- Cloud

- On-premises

Based on deployment, the global intrusion detection system market is segmented into cloud and premises. The on-premises segment is projected to dominate the market in terms of deployment methods.

Global Intrusion Detection System Market- By Verticals

- Banking, Financial Services, and Insurance (BFSI)

- Government and Defense

- Healthcare

- Information Technology (IT) and Telecom

- Retail and eCommerce

- Manufacturing

- Others (EDUCATION, Media and Entertainment, and Transportation and Logistics)

In terms of use, BFSI applications regulate, among other things, aviation, security, transportation, and medical services. An intrusion detection system (IDS) is effectively used as the ideal option for safeguarding online financial systems against intrusions and assaults, which is supporting the intrusion detection system market share internationally.

Global Intrusion Detection System Market- By Geography & Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

North America's economy is arrestable and well-established, allowing the area to engage heavily in R&D operations, consequently contributing to the development of new technology in IDIDPsThe presence of the majority of significant competitors is projected to be a major factor driving the growth of the North American IDPS market. Customers' needs are met by key companies like as Cisco Systems (US), IBM (US), McAfee (US), Palo Alto Networks (US), FireEye (US), and Fortinet (US), as well as various start-ups in the region, who provide better IDPS solutions and services.

Global Intrusion Detection System Market- By Companies

- Cisco Systems, Inc.

- IBM Corporation

- McAfee Corp.

- Trend Micro Inc.

- Palo Alto Networks, Inc.

- AT&T Cybersecurity

- Darktrace

- FireEye

- Alert Logic

- Fortinet

NOTABLE HAPPENINGS IN THE GLOBAL INTRUSION DETECTION MARKET IN THE RECENT PAST:

- Merger & Acquisition: - In 2022, Cisco Acquired Opsani. Opsani, situated in Redwood City, California, is a privately held enterprise software firm. The acquisition will allow Cisco AppDynamics to expand its product and engineering teams, expand our platform's capabilities to better observe enterprise-scale, cloud-native environments, and accelerate our path to availability and the delivery of the performance and optimization that our customers require. The acquisition of Opsani follows the previous acquisitions of Epsagon and reflex and demonstrates Cisco's commitment to its Full-Stack Observability strategy.

- Merger & Acquisition: - In 2022, McAfee Corp. (NASDAQ: MCFE, "McAfee"), a global leader in online security, has completed its acquisition by an investor group led by Advent International Corporation ("Advent") and funds advised by Permira, Crosspoint Capital Partners L.P. ("Crosspoint"), Canada Pension Plan Investment Board ("CPP Investments"), GIC Private Limited ("GIC"), and an Abu Dhabi Investment Authority ("ADIA") (collectively, "the Investor Group").

- Merger & Acquisition: - In 2021, Cisco acquired Replex. Replex is a privately held German corporate software firm. The purchase of Replex will assist AppDynamics in extending its product and technical personnel to accelerate and enhance product features that observe enterprise-scale, cloud-native settings. Replex's extensive experience in Kubernetes, real-time data extraction, and analytics will boost AppDynamics' world-class product and engineering team, allowing us to expedite the delivery of Cisco's Full-Stack Observability goal.

Chapter 1. GLOBAL INTRUSION DETECTION SYSTEM MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL INTRUSION DETECTION SYSTEM MARKET – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2024 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. GLOBAL INTRUSION DETECTION SYSTEM MARKET – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. GLOBAL INTRUSION DETECTION SYSTEM MARKET - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. GLOBAL INTRUSION DETECTION SYSTEM MARKET Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL INTRUSION DETECTION SYSTEM MARKET – By Components

6.1. Solutions

6.1.1. Hardware

6.1.2. Software

6.2. Services

6.2.1. Integration

6.2.2. Support and Maintenance

Chapter 7. GLOBAL INTRUSION DETECTION SYSTEM MARKET – By Deployment Mode

7.1. Cloud

7.2. On-premises

Chapter 8. GLOBAL INTRUSION DETECTION SYSTEM MARKET – By Verticals

8.1. Banking, Financial Services, and Insurance (BFSI)

8.2. Government and Defense

8.3. Healthcare

8.4. Information Technology (IT) and Telecom

8.5. Retail and eCommerce

8.6. Manufacturing

8.7. Others (EDUCATION, Media and Entertainment, and Transportation and Logistics)

Chapter 9. GLOBAL INTRUSION DETECTION SYSTEM MARKET – By Region

9.1. North America

9.2. Europe

9.3. The Asia Pacific

9.4. Latin America

9.5. The Middle East and Africa

Chapter 10. GLOBAL INTRUSION DETECTION SYSTEM MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

10.1. Cisco Systems, Inc.

10.2. IBM Corporation

10.3. McAfee Corp.

10.4. Trend Micro Inc.

10.5. Palo Alto Networks, Inc.

10.6. AT&T Cybersecurity

10.7. Darktrace

10.8. FireEye

10.9. Alert Logic

10.10. Fortinet

Download Sample

Choose License Type

2500

4250

5250

6900