Intrusion Detection and Prevention Systems Market Size (2024 – 2030)

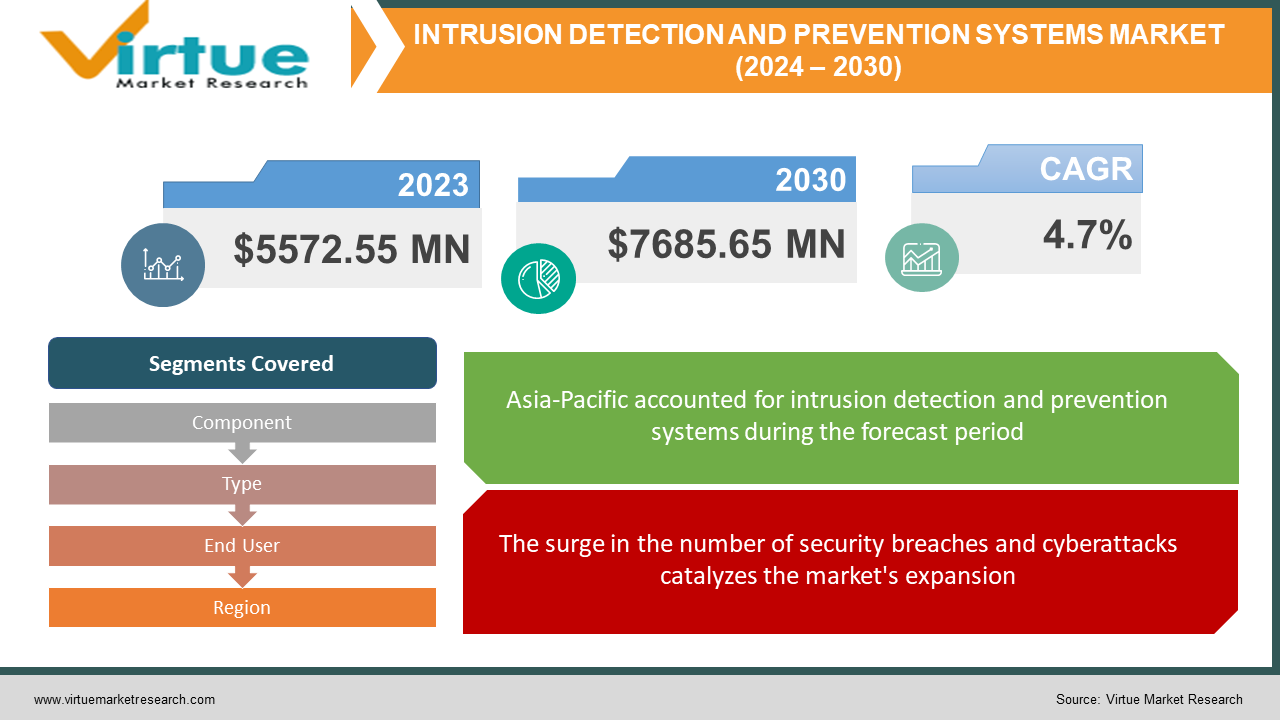

The Global Intrusion Detection and Prevention Systems Market size was exhibited at USD 5572.55 million in 2023 and is projected to hit around USD 7685.65 million by 2030, growing at a CAGR of 4.7% during the forecast period from 2024 to 2030.

The surveillance of network activities to identify possible mishaps, breaches, or imminent cyber threats to an organization's security policy is accomplished through the utilization of intrusion detection and prevention systems. The procedure involves identifying intrusions and subsequently preventing such instances, a process commonly referred to as intrusion prevention. In the realm of computer networks, both intrusion detection systems (IDS) and intrusion prevention systems (IPS) are crafted to identify and halt potential incidents, constituting essential components of security measures.

In certain instances, networks incorporate intrusion detection and prevention systems not only to identify security policy issues but also to prevent users from violating established security policies. The integration of intrusion detection and prevention systems has become a pivotal augmentation to the security frameworks of numerous organizations.

Key Market Insights:

The heightened threat of intrusions targeting enterprise networks has spurred a swift uptake of intrusion detection and prevention systems (IDPS). The ongoing digitization across diverse industry sectors is reshaping the operational landscape and customer service approaches of businesses. Enterprises are expanding their influence, enhancing productivity, and broadening their customer base through constantly connected digital solutions. Maintaining robust network security is paramount to ensuring the effective functionality of these tools. The escalating incidents of cybersecurity breaches across various sectors have generated a significant demand for a spectrum of security tools capable of real-time detection and prevention of network attacks. These dynamics are anticipated to drive market growth throughout the evaluation period.

Global Intrusion Detection and Prevention Systems Market Drivers:

The surge in the number of security breaches and cyberattacks catalyzes the market's expansion.

Globally, significant instances of cyberattacks involve the deliberate and politically motivated use of the internet to target endpoints, networks, data, and other IT infrastructures, resulting in data loss for individuals, enterprises, and governments. The escalating prevalence of digital transactions across various sectors worldwide has led to a rise in cybercrimes. The surge in enterprise data breaches and data leakage is driving the growth of the intrusion detection and prevention systems market.

Advancement of BYOD to Support Market Growth

Furthermore, with the evolution of technology related to "bring your own device" (BYOD), businesses are empowering their workforce. The BYOD model's popularity has prompted businesses to enlist security services to safeguard electronic devices such as smartphones, desktop computers, tablets, and laptops from cyberattacks. The increased adoption of BYOD necessitates industries to secure devices with remote access to the company's network, including confidential ones. This aspect is anticipated to significantly boost the adoption of detection solutions, leading to an increased market penetration.

Global Intrusion Detection and Prevention Systems Market Restraints and Challenges:

The market encounters impediments and challenges stemming from the constrained security budgets prevalent among small and medium-sized enterprises.

The allocation of funds for cybersecurity poses a significant concern for various organizations, especially SMEs. While large enterprises boast adequate budgets to establish a robust information security control environment, SMEs find it challenging to allocate substantial capital to cybersecurity, considering their substantial investments in other facets of IT infrastructure. The development of cutting-edge cybersecurity solutions incurs high Research and Development (R&D) expenses, contributing to the elevated pricing of security solutions. This limitation in budget remains a significant hurdle for cybersecurity professionals striving to execute their IT security operations effectively.

The shortage of skilled security professionals poses a challenge to market growth.

Presently, organizations grapple with a prominent challenge – the scarcity of cybersecurity expertise. The deficiency in skilled security professionals hampers organizations' ability to meet their evolving IT security requirements. Many organizations engage security professionals who lack the necessary skills to analyze and identify advanced threats during cyberattacks.

Global Intrusion Detection and Prevention Systems Market Opportunities:

The market is presented with significant opportunities driven by the swift expansion of BYOD and CYOD trends.

As technology advances in the BYOD domain, organizations are leveraging this progress to mobilize their workforce. Embracing the BYOD model, enterprises are enlisting security services to safeguard a spectrum of devices, including smartphones, tablets, desktops, and laptops, from potential cyber threats. The escalating prevalence of BYOD necessitates enterprises to secure not only devices within office premises but also those with remote access to the corporate network. This development has substantially heightened the adoption of Intrusion Detection and Prevention Systems (IDPS) solutions, contributing to the anticipated growth of the IDPS market.

INTRUSION DETECTION AND PREVENTION SYSTEMS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.7% |

|

Segments Covered |

By Component, Type, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Allegion plc, ASSA ABLOY, Bosch Sicherheitssysteme GmbH, Broadcom, Carrier Fire & Security EMEA BV, Check Point Software Technologies Ltd., Cisco Systems, Inc. , Control4 Corporation, Detection.com, Godrej.com |

Global Intrusion Detection and Prevention Systems Market: By Component

-

Solutions

-

Hardware

-

Software

-

Services

-

Integration

-

Support & Maintenance

The intrusion detection and prevention systems market is categorized by component, with solutions and services being the main divisions. The solutions segment further includes hardware and software, while the services segment comprises integration and support & maintenance.

The solutions segment is anticipated to witness significant growth during the projection period, driven by the increasing adoption of IDPS software and hardware tools by global enterprises. The surge in digitization has heightened internet-based commercial activities, necessitating robust network protection systems. IDPS software and hardware are designed for seamless integration with existing security infrastructure, facilitating quick adoption and efficient detection and prevention of suspicious activities on private networks.

The services segment is expected to experience rapid growth due to the growing preference for high-quality IDPS solution integration and maintenance. Often provided by developers alongside the IDPS, these services enable organizations to swiftly implement and maintain their network security infrastructure. Network safety retailers' services assist companies in making informed investments in network security and cyber risk management, facilitating timely upgrades based on evolving cybersecurity needs.

Global Intrusion Detection and Prevention Systems Market: By Type

-

Network-Based

-

Wireless-Based

-

Host-Based

-

Network Behavior Analysis

The global market is segmented by type into wireless-based, network-based, host-based, and network behavior analysis. The network-based segment is projected to grow significantly in the coming years due to its real-time tracking of live traffic and quick issue flagging. NIDS response times surpass those of host-based IDPS, and these systems are easy to install on enterprise networks.

The host-based segment is expected to register a considerable CAGR during the forecast period, owing to its capability to detect network attacks that may elude network-based systems. These systems operate effectively in encrypted network traffic environments and monitor both computers and endpoints.

Global Intrusion Detection and Prevention Systems Market: By End User

-

Banking, Financial Services, and Insurance (BFSI)

-

Information Technology & Telecom

-

Retail and E-commerce

-

Government & Defense

-

Manufacturing

-

Media & Entertainment

-

Others

The global market is divided into BFSI, manufacturing, government & defence, information technology & telecom, retail and e-commerce, media & entertainment, and others based on vertical categories. Because cyber-crimes are becoming a bigger danger to financial institutions, the Banking, Financial Services, and Insurance (BFSI) category is expected to grow at a significant compound annual growth rate (CAGR) throughout the course of the projection period. The use of IDPS in this industry has been driven by the growth of digital transactions and the requirement to protect sensitive consumer data. The increasing prevalence of digital banking and mobile wallets has increased the demand for network security, which in turn has created opportunities for market participants.

Due to the increase in geopolitical conflicts and threats emanating from external sources to government online platforms, the demand for IDPS is anticipated to expand rapidly in the government and defense sectors. With the use of websites and mobile applications, governments all over the world are expanding and simplifying governance. Government agencies are concentrating on implementing multilayered network security in addition to developing incredibly effective websites to instantly identify and stop attempts at data breaches.

Global Intrusion Detection and Prevention Systems Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The markets for intrusion detection and prevention systems worldwide are divided into five regions: Europe, Asia Pacific, North America, Latin America, and the Middle East and Africa. Due to rising business expenditure on bolstering cybersecurity, North America is anticipated to lead the market throughout the forecast period. Governments and the commercial sector in this region are very concerned about cybercrimes. It is anticipated that growing government measures to support digital ecosystems and create effective cybersecurity solutions would increase market prospects in the region. The market in this area is anticipated to grow as a result of the widespread use of digital technologies across sectors and the significant presence of major companies in the US and Canada.

COVID-19 Impact on the Global Intrusion Detection and Prevention Systems Market:

Governments and regulatory bodies around the world are forcing public and commercial organizations to adopt new policies on remote work and social distancing amid the COVID-19 pandemic catastrophe. Since then, numerous organizations have adopted digital methods of conducting business as their new business continuity plan (BCP). People are becoming more and more motivated to utilize digital technologies like IDPS to defend against cyberattacks as a result of the pervasive use of mobile devices and the global Internet.

However, to modernize their work cultures, organizations are also implementing new ideas like work-from-home (WFH) and bring-your-own devices (BYOD). With the use of IDPS software, IDPS solutions enable organizations to maintain business continuity while protecting themselves against malevolent threat actors and cybercrimes. Numerous sectors are making significant R&D investments to create analytics software for tracking the COVID-19 outbreak.

Recent Trends and Developments in the Global Intrusion Detection and Prevention Systems Market:

In September 2023, McAfee, LLC, a prominent provider of online protection solutions, introduced McAfee Scam Protection, an AI-driven tool aimed at proactively identifying and blocking phishing scams. This innovative tool notifies users of potential scams and prevents websites from loading, even if a user unintentionally clicks on the associated links.

In October 2023, Juniper Networks, a provider of secure AI-driven network solutions, disclosed the expansion of its Connected Security portfolio through the introduction of new products and capabilities. These tools empower enterprises to seamlessly extend security services and implement zero-trust policies across distributed data center environments.

In October 2022, Moxa Inc., a major networking solution provider based in Taiwan, rolled out industrial IDS/IPS on its EDR-G9010 series secure routers, along with the MXsecurity industrial security management software.

Key Players:

-

Allegion plc

-

ASSA ABLOY

-

Bosch Sicherheitssysteme GmbH

-

Broadcom

-

Carrier Fire & Security EMEA BV

-

Check Point Software Technologies Ltd.

-

Cisco Systems, Inc.

-

Control4 Corporation

-

Detection.com

-

Godrej.com

Chapter 1. Intrusion Detection and Prevention Systems Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Intrusion Detection and Prevention Systems Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Intrusion Detection and Prevention Systems Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Intrusion Detection and Prevention Systems Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Intrusion Detection and Prevention Systems Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Intrusion Detection and Prevention Systems Market – By Component

6.1 Introduction/Key Findings

6.2 Solutions

6.3 Hardware

6.4 Software

6.5 Services

6.6 Integration

6.7 Support & Maintenance

6.8 Y-O-Y Growth trend Analysis By Component

6.9 Absolute $ Opportunity Analysis By Component, 2024-2030

Chapter 7. Intrusion Detection and Prevention Systems Market – By Type

7.1 Introduction/Key Findings

7.2 Network-Based

7.3 Wireless-Based

7.4 Host-Based

7.5 Network Behavior Analysis

7.6 Y-O-Y Growth trend Analysis By Type

7.7 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 8. Intrusion Detection and Prevention Systems Market – By End User

8.1 Introduction/Key Findings

8.2 Banking, Financial Services, and Insurance (BFSI)

8.3 Information Technology & Telecom

8.4 Retail and E-commerce

8.5 Government & Defense

8.6 Manufacturing

8.7 Media & Entertainment

8.8 Others

8.9 Y-O-Y Growth trend Analysis By End User

8.10 Absolute $ Opportunity Analysis By End User, 2024-2030

Chapter 9. Intrusion Detection and Prevention Systems Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Component

9.1.3 By Type

9.1.4 By By End User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Component

9.2.3 By Type

9.2.4 By End User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Component

9.3.3 By Type

9.3.4 By End User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Component

9.4.3 By Type

9.4.4 By End User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Component

9.5.3 By Type

9.5.4 By End User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Intrusion Detection and Prevention Systems Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Allegion plc

10.2 ASSA ABLOY

10.3 Bosch Sicherheitssysteme GmbH

10.4 Broadcom

10.5 Carrier Fire & Security EMEA BV

10.6 Check Point Software Technologies Ltd.

10.7 Cisco Systems, Inc.

10.8 Control4 Corporation

10.9 Detection.com

10.10 Godrej.com

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Intrusion Detection and Prevention Systems Market size is valued at USD 5572.55 million in 2023.

The worldwide Global Intrusion Detection and Prevention Systems Market growth is estimated to be 4.7% from 2024 to 2030.

The Global Intrusion Detection and Prevention Systems Market is segmented By Component (Solutions, Services), By Type (Network-Based, Wireless-Based, Host-Based, Network Behavior Analysis), By End User (Banking, Financial Services, and Insurance (BFSI), Information Technology & Telecom, Retail and E-commerce, Government & Defense, Manufacturing, Media & Entertainment, Others).

The Global Intrusion Detection and Prevention Systems Market is poised for growth, driven by increasing cyber threats. Emerging trends include AI-powered threat detection, cloud-based solutions, and integration with IoT security. Opportunities lie in advanced analytics, threat intelligence, and collaboration to counter evolving cyber threats effectively, ensuring robust cybersecurity infrastructure worldwide.

The COVID-19 pandemic has accelerated the adoption of remote work, amplifying cyber threats. This heightened vulnerability has spurred a surge in demand for Intrusion Detection and Prevention Systems, driving market growth as organizations prioritize cybersecurity to safeguard their dispersed digital environments from evolving threats.