Intralogistics Automation Market Size (2025-2030)

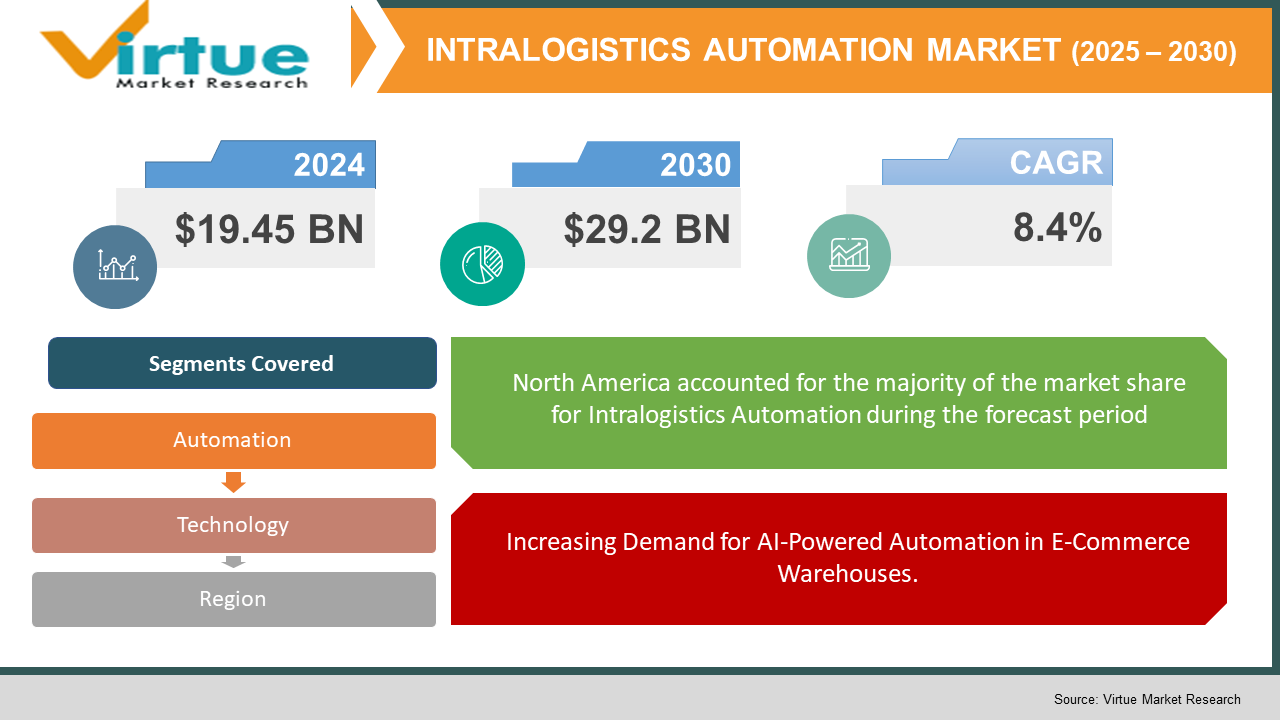

The Intralogistics Automation Market was valued at USD 19.45 billion and is projected to reach a market size of USD 29.2 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 8.4%.

Intralogistics means internal logistics and its primary aim is to focus information in one location and optimize that flow of information and make it flow properly, Intralogistics automation is revolutionizing supply chain operations, enabling real-time material flow, AI-powered inventory management, and robotic warehouse solutions. Businesses are rapidly deploying autonomous mobile robots (AMRs), automated storage & retrieval systems (AS/RS), and AI-driven logistics software to boost warehouse efficiency and reduce labour dependency. The surge in e-commerce last-mile delivery supply chain models is driving demand for automated intralogistics solutions, helping companies enhance order accuracy, speed, and inventory visibility. AI-driven predictive analytics and IoT-enabled tracking are further improving warehouse automation and distribution centre performance.

Key Market Insights:

- A 2023 Gartner report revealed that 70% of warehouses and distribution centres worldwide are expected to fully automate intralogistics operations by 2030, significantly improving supply chain efficiency.

- According to PwC (2023), companies implementing AMRs and AS/RS systems have reported a 40% reduction in warehouse operational costs and a 30% increase in order fulfilment speed, enhancing productivity.

- The rise of e-commerce and rapid order processing is fuelling demand for automated material handling, with Amazon and Walmart increasing intralogistics automation investments by 50% in 2023 to meet growing customer demands.

- A McKinsey study (2023) found that IoT-enabled intralogistics solutions have reduced inventory shrinkage by 25% and optimized warehouse space utilization by 35%, driving higher profitability and operational efficiency.

- According to Deloitte’s 2023 Global Logistics Survey, over 60% of global supply chain leaders stated that investments in AI-powered intralogistics automation are their top priority for achieving faster order fulfilment and operational cost reductions over the next five years.

Intralogistics Automation Market Drivers:

Increasing Demand for AI-Powered Automation in E-Commerce Warehouses.

The increasing demand for AI-powered intralogistics automation is one of the primary factors driving market growth. Companies are deploying machine learning algorithms, real-time data analytics, and robotic automation to optimize warehouse AI-based demand forecasting and predictive maintenance are further improving supply chain agility by preventing disruptions and ensuring seamless operations. workflows and enhance material handling efficiency. AI-powered autonomous mobile robots (AMRs) and AS/RS systems are revolutionizing warehouse storage, retrieval, and order fulfilment by reducing manual labour and increasing throughput. According to Deloitte (2023), businesses that have adopted AI-driven intralogistics automation have achieved a 35% increase in productivity and a 25% reduction in warehouse downtime. AI-based demand forecasting and predictive maintenance are further improving supply chain agility by preventing disruptions and ensuring seamless operations. As companies focus on digital transformation and Industry 4.0 adoption, the demand for smart logistics platforms, cloud-based warehouse control systems, and IoT-integrated automation solutions continues to rise. Businesses investing in AI-powered robotic logistics solutions are gaining a competitive edge, reducing costs, and improving operational efficiency.

E-commerce has become a key component of the demand for intralogistics automation as companies keep cutting down on delivery times and offer a more seamless experience.

The rapid growth of e-commerce and omnichannel fulfilment is driving demand for automated intralogistics solutions to optimize warehouse space utilization, speed up order processing, and enhance last-mile delivery. With global e-commerce sales exceeding USD 6.3 trillion in 2023, companies are automating sorting, packaging, and warehouse distribution using AI-driven robotics and cloud-based logistics platforms. Amazon and Alibaba have increased investments in autonomous intralogistics systems by 50%, ensuring faster order fulfilment. Retailers are deploying automated picking robots, conveyor systems, and AI-powered inventory management to handle high order volumes while reducing errors. The shift toward AI-integrated smart warehouses and IoT-enabled logistics hubs is accelerating warehouse automation adoption, making supply chains more resilient and scalable.

Intralogistics Automation Market Restraints and Challenges:

These automation systems are not cost-effective and can also pose cybersecurity risks. The rise in integration costs can also be off-putting to firms

Despite its growth, the intralogistics automation market faces challenges such as high initial investment costs, integration complexities, and cybersecurity risks. Deploying AI-driven robotic logistics systems requires substantial capital investment, making adoption difficult for small and mid-sized enterprises (SMEs). Another key challenge is system interoperability, as many warehouses still use legacy infrastructure that lacks compatibility with modern IoT-enabled automation platforms. Companies often face delays and increased costs during integration and workforce training. Additionally, cybersecurity risks associated with cloud-based warehouse automation remain a concern. According to IBM (2023), 60% of logistics firms have identified data security and system vulnerabilities as major risks when adopting cloud-based intralogistics solutions. Addressing these challenges requires advanced encryption, robust cybersecurity frameworks, and seamless legacy system integration.

Intralogistics Automation Market Opportunities:

The rising adoption of AI, IoT, and 5G-enabled intralogistics automation presents significant market opportunities. According to Statista (2023), 75% of logistics firms plan to invest in AI-powered warehouse robotics to optimize order fulfilment and material handling. The growing emphasis on sustainable and energy-efficient logistics is driving demand for eco-friendly warehouse automation solutions. Companies investing in AI-driven green logistics have reported a 20% reduction in energy consumption and carbon emissions, making sustainability a key driver for intralogistics automation. Moreover, the demand for cloud-based warehouse management systems (WMS) and automated inventory tracking is increasing, enabling businesses to enhance supply chain visibility and predictive analytics. Businesses offering scalable, AI-driven intralogistics automation solutions tailored for high-speed e-commerce logistics will benefit from rising global demand.

INTRALOGISTICS AUTOMATION MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

8.4% |

|

Segments Covered |

By automation, technology, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Honeywell Intelligrated , Siemens Logistics , Dematic (KION Group) , Daifuku Co., Ltd. , Murata Machinery, Ltd. , Swisslog Holding AG (KUKA Group) , SSI Schaefer Group , Geek+ , Fetch Robotics (Zebra Technologies) , AutoStore |

Intralogistics Automation Market Segmentation:

Intralogistics Automation Market Segmentation: By Automation:

- In-Built Machinery

- Remote Operated

In-built machinery automation refers to fixed, integrated automation systems within warehouses and distribution centres, including automated storage & retrieval systems (AS/RS), conveyor belts, robotic picking systems, and AI-driven material handling solutions. These solutions are ideal for high-volume warehouses that require continuous, large-scale operations with minimal human intervention.

Remote-operated automation includes cloud-based warehouse management systems (WMS), AI-powered robotic process automation (RPA), and IoT-enabled fleet tracking. These systems allow warehouse managers to monitor and control warehouse operations from remote locations, improving flexibility and operational efficiency. A 2023 Statista report revealed that over 70% of logistics firms are investing in remote-operated automation solutions, particularly autonomous mobile robots (AMRs) and drone-based inventory monitoring

Intralogistics Automation Market Segmentation: By Technology:

- Automated Storage and Retrieval Systems (AS/RS)

- Automated Guided Vehicles (AGVs)

- Autonomous Mobile Robots (AMRs)

- Warehouse Management Systems (WMS)

Automated Storage and Retrieval Systems (AS/RS) are widely used in high-density warehouses and distribution centres to optimize space utilization, improve picking accuracy, and reduce manual handling errors. These systems include shuttles, vertical lift modules (VLMs), and robotic cranes, enabling seamless material movement and storage. Similarly, Automated Guided Vehicles (AGVs), including forklifts, tow tractors, and pallet movers, are becoming essential for streamlining warehouse transportation, reducing human dependency, and minimizing errors in material movement.

Autonomous Mobile Robots (AMRs) are gaining significant traction due to their flexibility, real-time navigation capabilities, and AI-driven decision-making. Unlike AGVs, AMRs operate without fixed paths, dynamically adjusting to warehouse traffic and optimizing picking routes. On the software side, Warehouse Management Systems (WMS) are becoming the backbone of intralogistics automation, providing real-time inventory visibility, AI-powered demand forecasting, and cloud-based warehouse analytics.

Intralogistics Automation Market Segmentation: By Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East and Africa

North America leads the intralogistics automation market, driven by advanced supply chain infrastructure, high e-commerce penetration, and strong investments in AI-driven warehouse automation. According to a 2023 Gartner report, over 80% of warehouses in the U.S. and Canada are expected to implement automated material handling systems and AI-powered robotics by 2026. Companies like Amazon, Walmart, and FedEx are heavily investing in AS/RS, autonomous mobile robots (AMRs), and AI-integrated WMS to enhance operational efficiency. Europe is also a key market, with Germany, France, and the UK leading in robotic warehouse automation, sustainability-focused logistics, and government-backed smart manufacturing initiatives.

Asia-Pacific is the fastest-growing region, with China, India, and Japan investing in warehouse robotics, AI-driven supply chain solutions, and cloud-based WMS to support booming e-commerce logistics. Statista (2023) reports that 70% of Asian logistics firms plan to integrate AI-powered intralogistics systems by 2027 to keep pace with rising consumer demand. South America and the Middle East & Africa are witnessing steady growth, particularly in Brazil, Mexico, the UAE, and Saudi Arabia, where businesses are modernizing ports, distribution centres, and warehouse automation infrastructure.

COVID-19 Impact Analysis on the Intralogistics Automation Market:

The COVID-19 pandemic accelerated demand for warehouse automation, as businesses faced labour shortages, supply chain disruptions, and increased e-commerce demand. Companies invested in AI-driven robotics, automated storage, and real-time inventory tracking to meet the surge in online orders. Businesses adopting autonomous intralogistics solutions reported a 40% increase in warehouse productivity, with cloud-based logistics systems playing a crucial role in optimizing operations. Post-pandemic, the demand for contactless, AI-powered warehouse automation continues to rise, ensuring long-term market growth. The shift toward contactless logistics and remote warehouse management further drove the adoption of cloud-based WMS and IoT-enabled tracking solutions. The momentum for smart logistics and AI-driven warehouse automation continues, ensuring long-term growth and resilience in the supply chain sector.

Trends/Developments:

Companies like Siemens and Honeywell are deploying digital twin technology for real-time warehouse simulation and optimization. SAP, Oracle, and Manhattan Associates are enhancing cloud-based WMS platforms, integrating 5G connectivity and AI-powered automation.

Cloud-based intralogistics solutions are becoming the industry standard, offering real-time inventory tracking, remote warehouse management, and seamless AI integration. 75% of new WMS deployments are cloud-native, enabling scalable, flexible, and data-driven warehouse operations. IoT sensors, RFID tracking, and 5G-enabled connectivity are further enhancing warehouse visibility and supply chain resilience.

The adoption of autonomous mobile robots (AMRs), robotic picking systems, and AI-driven conveyor technologies is accelerating. Amazon and DHL increased investments in warehouse robotics by 50% in 2023, significantly improving order accuracy and operational efficiency. Automated storage and retrieval systems (AS/RS) and robotic forklifts are further enhancing warehouse throughput and minimizing labour dependency.

Key Players:

- Honeywell Intelligrated

- Siemens Logistics

- Dematic (KION Group)

- Daifuku Co., Ltd.

- Murata Machinery, Ltd.

- Swisslog Holding AG (KUKA Group)

- SSI Schaefer Group

- Geek+

- Fetch Robotics (Zebra Technologies)

- AutoStore

Chapter 1. INTRALOGISTICS AUTOMATION MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. INTRALOGISTICS AUTOMATION MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. INTRALOGISTICS AUTOMATION MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. INTRALOGISTICS AUTOMATION MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. INTRALOGISTICS AUTOMATION MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. INTRALOGISTICS AUTOMATION MARKET – By Automation

6.1 Introduction/Key Findings

6.2 In-Built Machinery

6.3 Remote Operated

6.4 Y-O-Y Growth trend Analysis By Automation

6.5 Absolute $ Opportunity Analysis By Automation , 2025-2030

Chapter 7. INTRALOGISTICS AUTOMATION MARKET – By Technology

7.1 Introduction/Key Findings

7.2 Automated Storage and Retrieval Systems (AS/RS)

7.3 Automated Guided Vehicles (AGVs)

7.4 Autonomous Mobile Robots (AMRs)

7.5 Warehouse Management Systems (WMS)

7.6 Y-O-Y Growth trend Analysis By Technology

7.7 Absolute $ Opportunity Analysis By Technology , 2025-2030

Chapter 8. INTRALOGISTICS AUTOMATION MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Technology

8.1.3. By Automation

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Automation

8.2.3. By Technology

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Automation

8.3.3. By Technology

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Automation

8.4.3. By Technology

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Automation

8.5.3. By Technology

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. INTRALOGISTICS AUTOMATION MARKET – Company Profiles – (Overview, Packaging Automation Portfolio, Financials, Strategies & Developments)

9.1 Honeywell Intelligrated

9.2 Siemens Logistics

9.3 Dematic (KION Group)

9.4 Daifuku Co., Ltd.

9.5 Murata Machinery, Ltd.

9.6 Swisslog Holding AG (KUKA Group)

9.7 SSI Schaefer Group

9.8 Geek+

9.9 Fetch Robotics (Zebra Technologies)

9.10 AutoStore

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The market is expanding due to rising e-commerce demand, labour shortages, and the adoption of AI-driven warehouse automation. Businesses are investing in autonomous mobile robots (AMRs), automated storage & retrieval systems (AS/RS), and AI-powered WMS to optimize warehouse efficiency.

Major industries include e-commerce, retail, manufacturing, food & beverage, and pharmaceuticals. These sectors rely on robotic automation, real-time inventory tracking, and AI-driven warehouse management to enhance supply chain operations.

AI enhances predictive demand forecasting, autonomous material handling, and real-time warehouse monitoring. According to McKinsey (2023), AI-driven intralogistics automation has increased warehouse productivity by 35%, reducing manual errors and operational delays.

A Cloud-based WMS enables real-time data access, remote warehouse management, and IoT-enabled predictive analytics. Statista (2023) reports that 75% of logistics firms are shifting to cloud-native intralogistics platforms for scalability and flexibility.

North America and Europe dominate due to advanced supply chain infrastructure and high AI adoption rates. Asia-Pacific is the fastest-growing region, with China, India, and Japan investing in smart warehouses, AI-driven logistics, and automated fulfillment centres