Integrated Workplace Management System Market Size (2024 – 2030)

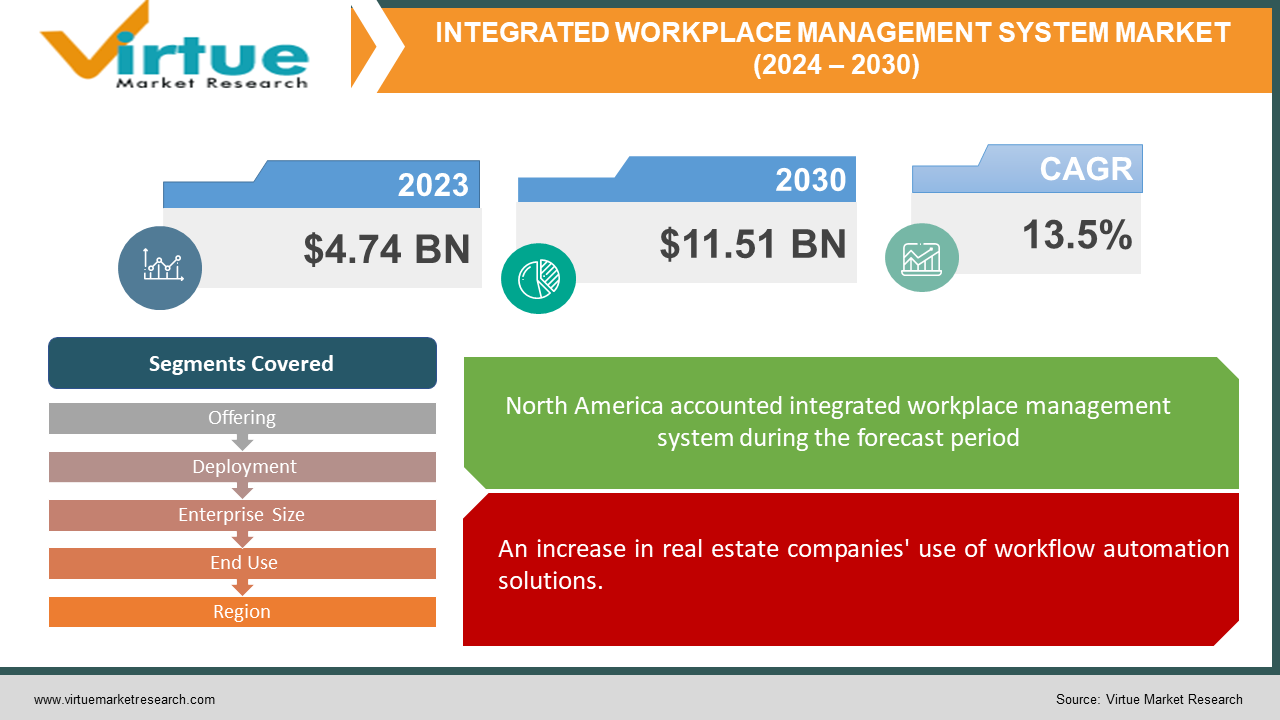

The Global Integrated Workplace Management System Market was valued at USD 4.74 billion and is projected to reach a market size of USD 11.51 billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 13.5% between 2024 and 2030.

The market is anticipated to increase due to the ongoing use of digital workplace solutions and the automation of facility management procedures. For tasks like lease management, facilities and space management, asset and maintenance management, and project management, organizations are increasingly eschewing traditional methods and turning to digital solutions. The market for integrated workplace management systems (IWMSs) is expected to be driven by the growing need for effective and enhanced operational solutions, which will raise the sophistication of solutions and services. Throughout the forecast period, the market is expected to be driven by these systems' benefits, including integrated workflows, real-time tracking, less energy consumption, disaster recovery, safety and security, and data center consolidation.

Key Market Insights:

Global adoption of technologies like mobility, software as a service (SaaS), advanced analytics, and sophisticated sensors is increasing, which is fueling the need for corporate integration. Consequently, there is a rise in the implementation of IWMS throughout various establishments. Globally, businesses want greater openness, understanding, and data about their facilities, corporate procedures, and associated activities. Through the creation of a standardized and structured data repository for all organizational processes, the implementation of an IWMS provides enterprises with transparency in all pertinent areas. Throughout the forecast period, it is expected that demand for IWMS will continue to grow as more enterprises become aware of its many advantages. Businesses must act quickly and wisely to remain competitive in several industries where there is fierce competition. Businesses are under pressure from acquisitions and mergers, financial limitations, reorganizations, and other economic reasons. As a result, there is a greater need for trustworthy, comprehensive management information to aid in decision-making. An IWMS enables firms to produce certain analyses or outputs based on past trends and future projections, and it helps strategic, tactical, and operational decision-making via analysis, reports, and dashboards.

Integrated Workplace Management System Market Drivers:

An increase in real estate companies' use of workflow automation solutions.

Real estate companies are dynamic, requiring management of a wide range of procedures. These procedures involve, among many other things, overseeing several projects, keeping track of numerous sites, keeping current inventory, selling real estate, finding renters, and recruiting investors for new initiatives. Workflow automation makes it possible to track resources, suppliers, products, and transactions inside the commercial operation in real-time. Organizations can focus on their main objectives thanks to this. Real estate firms are driving the market, particularly with their adoption of integrated workflow management systems. In this industry, automation facilitates better communication and lessens the administrative strain on real estate companies. Workflow automation is handled by real estate services through an integrated web interface. Tracking the progress of ongoing projects, contract extensions, building projects, property specifics, correspondence, documentation, and all other associated activities are combined. Moreover, integrated software can collect licenses, sale deeds, subcontractor agreements, and other documentation linked to loans. Because there is an increasing need for trustworthy analytics for capital and real estate planning, the market share of integrated workplace management systems is growing.

Governments are placing more emphasis on energy management.

Due to an increase in energy, waste management, and carbon footprint regulations, organizations must now design and maintain their business practices to restrict and regulate the creation of harmful gasses. For instance, the US federal government passed the Energy Policy Act of 1992, which emphasizes energy reduction and provides guidelines for implementing conservation methods. Currently, the United States has 22 states with a mandatory (non-binding) Energy Efficiency Resource Standard (NERS) and four states with a voluntary one. EERS is a mechanism to encourage more efficient use of natural gas and, in some cases, electricity generation, transmission, and consumption. In addition, the Indian government created the Energy Conservation Building Code (ECBC) on May 27, 2007, for newly constructed commercial buildings. ECBC sets minimum energy requirements for newly constructed commercial buildings with a connected load of 100kW or a contract demand of 120 KVA and above. Because IWMS offers the potential to manage both energy and sustainability, such national government programs for energy management are contributing to the market's expansion. Governments also utilize regulations to force businesses to reduce their carbon emissions. The integrated workplace management system helps determine the emissions that businesses emit and develops a strategy to improve the long-term sustainability of businesses and the environment.

Global Integrated Workplace Management System Market Restraints and Challenges:

Although there is a growing need for integrated workplace management systems, the market's expansion is being impeded by a shortage of competent labor. Furthermore, IWMS is experiencing a scarcity of skilled personnel due to inadequate understanding of cutting-edge technologies. Large IWMS projects have multiple locations dispersed over multiple countries, which makes implementation challenging for inexperienced parties. IWMS initiatives are responsible for monitoring and addressing issues caused by different languages, cultures, local regulations, and business customs. It has proven to be challenging for businesses to determine how corporate goals and regulatory objectives coincide due to a lack of experience at the management and senior levels. Additionally, this keeps businesses from realizing how important it is to have competent property managers.

Global Integrated Workplace Management System Market Opportunities:

Modern technologies like IoT, mobility, SaaS, advanced analytics, and cutting-edge new sensors are enabling an increasing demand for organizational integration. This is affecting how IWMS is being adopted by enterprises. The IWMS platform's social media connections have an impact on project collaboration and space utilization. IWMS enables operations, decision-making, and facility automation by supporting sensor, meter, and smartphone data from machines and devices. Unlike traditional analytic tools, IWMS is pre-configured for business use and is connected to the real estate financial modeling (REFM) business process. Predictive, real-time, and more recent presence and cognitive analytics are all possible with this system. IoT and other developing technologies are among the most promising fields. Adoption of IoT would greatly simplify operations since sensors can automatically gather data, which can then be analyzed for optimally efficient maintenance operations. IoT can also help achieve correct outcomes in the shortest amount of time and lessen the strain on workplace management tools like computerized maintenance management systems (CMMS). Although IoT is still in its infancy, it has enormous development potential. Therefore, the demand for IWMS solutions will change as the IoT market grows.

INTEGRATED WORKPLACE MANAGEMENT SYSTEM MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

13.5% |

|

Segments Covered |

By Offering, Deployment, Enterprise Size, End Use, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

IBM, Oracle,Trimble, Accruent, Archibus FM: Systems, iOFFICE, Planon, SAP Causeway, FSI, Spacewell, MRI Software Facilio, Nuvolo |

Global Integrated Workplace Management System Market Segmentation: By Offering

Solution

-

Real Estate & Lease Management

-

Facilities & Space Management

-

Asset & Maintenance Management

-

Project Management

-

Environment Management

Service

-

Professional Services

-

Managed Services

The Global Integrated Workplace Management System Market is Segmented by Offering, Solution held the largest market share last year and is poised to maintain its dominance throughout the forecast period. The facilities and space management sub-segment dominated the market, while the solution segment held the most revenue share. This is explained by the rising need for maintenance and improvements of current systems, which boosts the effectiveness of decision-making procedures. Additionally, facilities and space management solutions enable firms to achieve their main goals by correctly aligning administrative and infrastructure support tasks. The market is divided into segments based on the solution: facilities and space management, asset and maintenance management, project management, environment management, and real estate and lease management. Throughout the forecast period, the service segment is anticipated to increase rapidly, with the professional services segment likely to grow at the quickest rate. With a market share of nearly 67.1%, the professional services segment dominated the market. This is explained by the growing complexity of corporate processes as well as the growing use of IWMS systems. IWMS providers provide professional services targeted at the sector, such as training, software implementations, and consultancy. Additionally, vendors provide client workers with training programs designed to improve productivity and efficacy when managing IWMS solutions. For instance, Accruent, a provider of intelligent and cloud-based solutions, enables clients to increase the performance of their staff by providing thorough training programs through its professional services. Furthermore, the professional services sector is expected to grow even faster due to the increasing need for third-party support and maintenance services, which is being driven by cost-effectiveness and the availability of skilled and knowledgeable specialists.

Global Integrated Workplace Management System Market Segmentation: By Deployment

-

On-Premises

-

Cloud

The Global Integrated Workplace Management System Market is Segmented by Deployment, On-premises held the largest market share last year and is poised to maintain its dominance throughout the forecast period. Last year, the on-premises category brought in the highest revenue share of 51.2%. Due to its secure deployment methodology, on-premises is becoming increasingly popular in the industry. Additionally, the majority of large businesses that use on-premises IWMS solutions have physical servers that are already established, adequate funding, and skilled technicians. Additionally, client companies can scale functionality and manage and upgrade the systems with ease when using on-premises implementation. Organizations in a variety of end-use sectors, including healthcare and BFSI, also favor the on-premises implementation of IWMS systems since security is a top priority. Throughout the forecast period, the cloud segment is predicted to grow at the fastest rate—13.8%. Because of the advantages of cloud-based IWMS solutions, including their low Total Cost of Ownership (TCO), scalability, and flexibility, demand for them has grown.

Global Integrated Workplace Management System Market Segmentation: By Enterprise Size

-

Large Enterprises

-

Small & Medium Enterprises

The Global Integrated Workplace Management System Market is Segmented by Enterprise, Large Enterprises held the largest market share last year and is poised to maintain its dominance throughout the forecast period. Last year, the segment with the biggest revenue share—61.2%—was large enterprises. IWMS solutions are used by large businesses to streamline their intricate work environments. These kinds of businesses require strong monitoring systems and the ability to automate processes related to allocating resources and making strategic decisions. Over the projection period, the segment is anticipated to increase. When offices reopened following the COVID-19 epidemic, companies used transitional measures including workplace segregation to prevent the virus from spreading. This raised demand for IWMS software to effectively manage floorspace and employee health. For example, International Business Machines Corporation unveiled Watson Works, a workplace management solution that uses Watson AI models, in June last year. Watson Works provides a range of applications, such as facilities management, space allocation, employee health prioritization, contact tracing & care management, and workplace re-entry, to address the possible workplace requirements during the pandemic. Throughout the projected period, the small and medium-sized business segment is predicted to grow at the fastest rate, 14.0%. Innovations in technology, such as cloud computing and the Internet of Things (IoT), have reduced the cost and increased accessibility of IWMS systems for small and medium-sized businesses. Because they don't require large upfront investments in hardware and infrastructure, cloud-based IWMS solutions are scalable and affordable for small and medium-sized businesses with tight budgets.

Global Integrated Workplace Management System Market Segmentation: By End Use

-

Public Sector

-

IT & Telecom

-

Manufacturing

-

BFSI

-

Real Estate & Construction

-

Retail

-

Healthcare

The Global Integrated Workplace Management System Market is Segmented by End, Manufacturing held the largest market share last year and is poised to maintain its dominance throughout the forecast period. Pneumatic equipment, electronics/semiconductors, feed gas preparation, and other categories are subdivided into the industrial segment. The manufacturing vertical has witnessed a notable surge in competitiveness due to the swift adoption of new technologies. As a result, businesses are eager to implement effective workplace solutions in their production plants. Throughout the projection period, this is expected to fuel demand for IWMS solutions. Due to effective space management, adherence to regulatory compliance, and improvement of operational efficiency and patient experience, among other important factors driving the adoption of IWMS in healthcare organizations, the public sector is predicted to register at the fastest rate during the forecast period. Throughout the projected period, it is expected that the real estate and construction category will increase significantly. The need for IWMS solutions within the real estate and construction market is expected to increase due to the growing need for controlling all significant parts of a real estate project while lowering operating expenses. In addition, vendors in the market are taking advantage of this opening and launching IWMS solutions designed to meet the unique requirements of businesses in the construction and real estate sectors. For example, Trimble Inc. introduced Manhattan ONE, a software suite for centralizing workspace, building, finance leasing, and portfolio information, in May 2020. This software suite allows real-estate data to be monitored and makes evidence-based decision-making easier. The suite also covered the difficulties associated with returning to work after the COVID-19 epidemic.

Global Integrated Workplace Management System Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The Global Integrated Workplace Management System Market is Segmented by End, Manufacturing held the largest market share last year and is poised to maintain its dominance throughout the forecast period. North America's reputation for technology innovation and adoption has long propelled it to the top of the integrated workplace management system (IWMS) revenue contributor market. The United States is unique because of its strong smart building initiatives, which have made the adoption of IWMS systems necessary for effective space, asset, maintenance, and real estate management. The IWMS industry is predicted to continue to be dominated by North America if this trend continues. Due to its early acceptance and large investments in predictive maintenance, especially in sectors like manufacturing and automobiles, Europe trails closely behind and has a prominent presence in the IWMS market. The importance of IWMS solutions in producing useful insights and fostering commercial prospects is becoming more and more apparent to European organizations. In the meantime, the market for IWMS solutions is expanding quickly in Asia-Pacific due to the region's inclusion of significant rising economies and a growing customer base that spans numerous industries. IWMS is being used by both established businesses and start-ups in the region to optimize space and resource use, which is driving additional market expansion. The market's growth is further aided by the outsourcing of IWMS services as a result of a labor shortage in the IT sector, especially in Western and Northern European countries.

COVID-19 Impact Analysis on the Global Integrated Workplace Management System Market:

The market for integrated workplace management systems (IWMS) initially experienced several difficulties, including budget cuts, project delays, and decreased revenue for service providers as a result of lockdowns brought on by pandemics and unpredictability in the economy. But there are now post-pandemic prospects, and the need for sophisticated IWMS features like occupancy tracking and space management is being driven by a greater emphasis on worker safety. Furthermore, the use of cloud-based IWMS solutions—which provide the flexibility and scalability necessary for handling emergencies—has increased in tandem with the shift towards remote work. Despite the setbacks, the pandemic has highlighted how important IWMS is for managing unpredictable work settings, raising hopes for a market recovery as businesses put employee wellbeing first and adjust to the changing hybrid work paradigm.

Latest Trends/ Developments:

The integrated workplace management system (IWMS) industry has undergone several strategic changes, with several significant partnerships and acquisitions changing the field. In May 2023, Tango and Crestron Electronics expanded their partnership with the release of Desk Touch, a hardware desk scheduling solution. This integration offers extensive insights and improves office use and collaboration with Tango's desk booking technology. Comparably, enhanced building operations management is made possible by Petra’s April 2023 improvements to Archi bus IWMS, which increase occupancy transparency and analysis possibilities. By combining Condeco and Office + Spacey in October 2022, Thomas Bravo will become a leading player in the global workplace IT solutions market, improving its offers in asset management and workplace experiences. In the meantime, The Building People's acquisition of Infonaut in January 2022 fits in with their plan to use cutting-edge technology to enhance worker productivity. In the meantime, The Building People's acquisition of Infonaut in January 2022 fits in with their plan to maximize workplace productivity through the integration of innovative technologies. To meet the demands of hybrid work and broaden its clientele globally, Tango strengthened its position in real estate and facilities management when it acquired Agilest Corporation in the same month. These acquisitions and strategic alliances show the industry's dedication to change and meeting changing workplace demands.

Key players:

-

IBM

-

Oracle

-

Trimble

-

Accruent

-

Archibus

-

FM: Systems

-

iOFFICE

-

Planon

-

SAP

-

Causeway

-

FSI

-

Spacewell

-

MRI Software

-

Facilio

-

Nuvolo

Chapter 1. Integrated Workplace Management System Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Integrated Workplace Management System Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Integrated Workplace Management System Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Integrated Workplace Management System Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Integrated Workplace Management System Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Integrated Workplace Management System Market – By Offering

6.1 Introduction/Key Findings

6.2 Solution

6.3 Real Estate & Lease Management

6.4 Facilities & Space Management

6.5 Asset & Maintenance Management

6.6 Project Management

6.7 Environment Management

6.8 Service

6.9 Professional Services

6.10 Managed Services

6.11 Y-O-Y Growth trend Analysis By Offering

6.12 Absolute $ Opportunity Analysis By Offering, 2024-2030

Chapter 7. Integrated Workplace Management System Market – By Deployment

7.1 Introduction/Key Findings

7.2 On-Premises

7.3 Cloud

7.4 Y-O-Y Growth trend Analysis By Deployment

7.5 Absolute $ Opportunity Analysis By Deployment, 2024-2030

Chapter 8. Integrated Workplace Management System Market – By Enterprise Size

8.1 Introduction/Key Findings

8.2 Large Enterprises

8.3 Small & Medium Enterprises

8.4 Y-O-Y Growth trend Analysis By Enterprise Size

8.5 Absolute $ Opportunity Analysis By Enterprise Size, 2024-2030

Chapter 9. Integrated Workplace Management System Market – By End User

9.1 Introduction/Key Findings

9.2 Public Sector

9.3 IT & Telecom

9.4 Manufacturing

9.5 BFSI

9.6 Real Estate & Construction

9.7 Retail

9.8 Healthcare

9.9 Y-O-Y Growth trend Analysis By End User

9.10 Absolute $ Opportunity Analysis By End User, 2024-2030

Chapter 10. Machine Learning Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Offering

10.1.3 By End User

10.1.4 By Enterprise Size

10.1.5 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Offering

10.2.3 By Deployment

10.2.4 By Enterprise Size

10.2.5 By End User

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Offering

10.3.3 By Deployment

10.3.4 By Enterprise Size

10.3.5 By End User

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Offering

10.4.3 By Deployment

10.4.4 By Enterprise Size

10.4.5 By End User

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Offering

10.5.3 By Deployment

10.5.4 By Enterprise Size

10.5.5 By End User

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Integrated Workplace Management System Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 IBM

11.2 Oracle

11.3 Trimble

11.4 Accruent

11.5 Archibus

11.6 FM: Systems

11.7 iOFFICE

11.8 Planon

11.9 SAP

11.10 Causeway

11.11 FSI

11.12 Spacewell

11.13 MRI Software

11.14 Facilio

11.15 Nuvolo

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

By 2023, the global Integrated Workplace Management System market is expected to be valued at US$ 4.74 billion.

Through 2030, the global Integrated Workplace Management System market is expected to grow at a CAGR of 13.5%.

By 2030, the global Integrated Workplace Management System market is expected to grow to a value of US$ 11.51 billion.

North America is predicted to lead the market for global Integrated Workplace Management Systems.

The global Integrated Workplace Management System market has segments of, Offering (Solution, Service), Deployment, Enterprise Size, End Use, And Region.