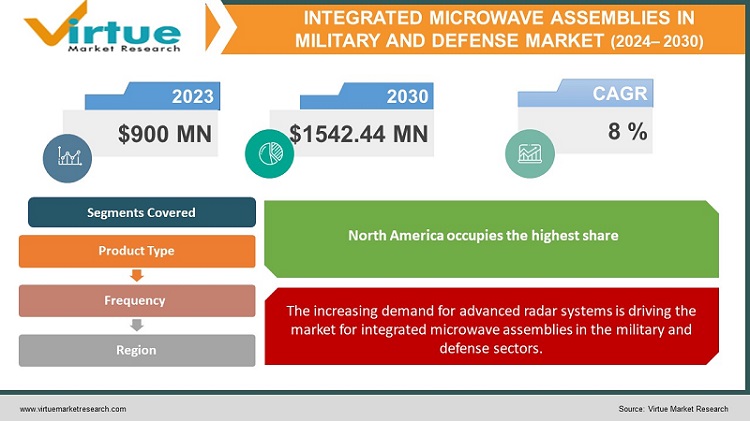

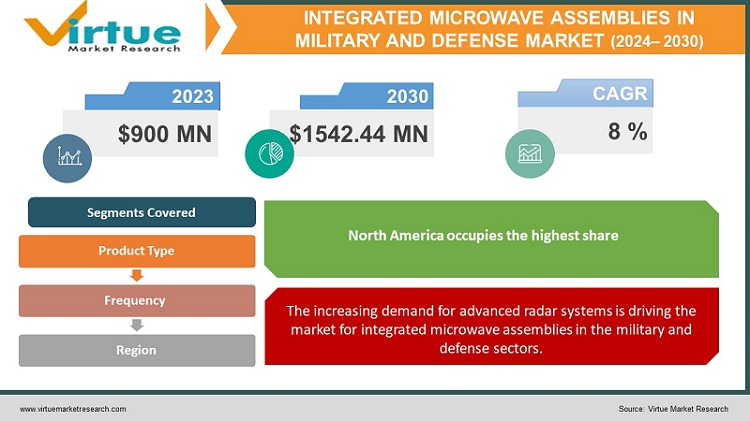

Global Integrated Microwave Assemblies in the Military and Defense Market Size (2024 - 2030)

In 2023, the Global Integrated microwave assemblies in Military and Defense Market was valued at $900 million, and is projected to reach a market size of $1542.44 million by 2030. Over the forecast period of 2024-2030, market is projected to grow at a CAGR of 8%.

Integrated microwave assemblies (IMAs) are crucial parts of a variety of military and defense applications. They are used in electronic defense, satellite communications, radar, and other electronic warfare systems. Performance is boosted, size and weight are reduced, and dependability is raised when microwave parts are assembled into a single unit. The military and defense industry is one of the biggest markets for IMAs, and over the next years, demand is estimated to progressively rise. Among the many military and defense applications where integrated microwave assemblies play an important role are radar systems, electronic countermeasures, and satellite communications. The military and defense market adoption of IMAs is influenced by a number of factors.

Global Integrated microwave assemblies in Military and Defense Market Drivers:

The increasing demand for advanced radar systems is driving the market for integrated microwave assemblies in the military and defense sectors.

The growing need for cutting-edge radar systems is one of the key factors driving the global integrated microwave assemblies (IMAs) market in the military and defense sector. Modern military and defense operations depend heavily on radar systems because they give vital situational awareness and intelligence. Radar system performance is greatly improved by IMAs due to their increased sensitivity, resolution, and range. The need for IMAs is anticipated to rise along with the demand for increasingly sophisticated radar systems. The development of IMAs is also being fuelled by the push toward downsizing and enhanced performance in radar systems. The integration of several microwave components into a single assembly using IMAs results in smaller, lighter, and more effective radar systems.

The growing need for electronic warfare capabilities is fuelling market growth.

The rising demand for electronic warfare (EW) capabilities in the military and defense industry is a significant factor propelling the global market for integrated microwave assemblies. Electronic warfare requires identifying, rejecting, or interrupting enemy radar and communications systems. Many electronic warfare systems depend on IMAs because of their capacity to generate, amplify, and filter signals. As more sophisticated EW capabilities become necessary, it is predicted that demand for IMAs will increase. EW expertise is more in demand as sophisticated radar and communication systems are used more frequently. More complex and efficient EW systems might be made possible by merging a number of microwave parts into a single assembly using IMAs.

Global Integrated microwave assemblies in Military and Defense Market Challenges:

Due to their intricate design and integration requirements, integrated microwave assemblies (IMAs) pose a significant challenge to the military and defense industries. The development of IMAs requires expertise in microwave engineering because they integrate several components into a single assembly. Complex engineering and production techniques are needed for this project, which raises costs and extends the development cycle. Manufacturing of IMA is challenging because of these design and integration issues, which are problematic for the military and defense industry.

Global Integrated microwave assemblies in Military and Defense Market Opportunities:

The growth of 5G and wireless communications is one of the key opportunities for the global market for integrated microwave assemblies in the military and defense sectors. Better microwave components are required for both civil and military applications as a result of the increased need for high-speed wireless communications and the introduction of 5G technology. Due to their high-frequency and high-power characteristics, IMAs are essential elements of 5G wireless communication networks. Manufacturers of IMAs in the military and defense industry have a fantastic opportunity to extend their product selection and hit new markets due to the rise in demand for 5G and wireless communications. Additionally, IMAs can enhance trustworthy and efficient communication in 5G wireless communications systems, which can enhance situational awareness.

COVID-19 Impact on Global Integrated microwave assemblies in the Military and Defense Market:

The COVID-19 pandemic has harmed global integrated microwave assemblies in the military and defense sectors. The market has been adversely affected by delays in product deliveries and project deadlines brought on by travel restrictions, the disruption of the global supply chain, and the closure of manufacturing facilities. The COVID-19 outbreak has, however, also created new markets for worldwide integrated microwave assemblies in the defense industry. As demand for unmanned systems, remote sensing, and secure communication systems rises, advanced microwave parts are becoming more and more essential in the military and defense sector. Additionally, the transition to digital and remote operations has allowed IMAs manufacturers to develop more reliable and effective products for the military and defense industry.

Global Integrated microwave assemblies in Military and Defense Market Recent Developments:

In December 2021, for use in electronic warfare systems, CAES unveiled a wideband, high-power RF amplifier based on gallium nitride (GaN). For SWaP-restricted assets, the ruggedized amplifier's best power-to-weight ratio allows deep-reach electronic assault capabilities.

In June 2022, new active electronically scanned array (AESA) radars are currently installed on more than 70 F-16 Fighting Falcons in 12 Air National Guard units. Pilots can now detect, target, identify, and attack a variety of threats with higher accuracy and across larger distances because of this new radar technology.

GLOBAL INTEGRATED MICROWAVE ASSEMBLIES IN THE MILITARY AND DEFENSE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8% |

|

Segments Covered |

By Product Type, Frequency and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Analog Devices(US), Teledyne Technologies(US), MACOM(US), Qorvo(US),CAES(US) CPI International (US), APITech (US),National Instruments (US), Narda-MITEQ (US) |

Global Integrated microwave assemblies in Military and Defense Market Segmentation: By Product Type

-

Amplifiers

-

Frequency Converters

-

Oscillators

-

Frequency Synthesizers

-

Others

The product type category of the global integrated microwave assemblies market in the military and defense industry includes items like amplifiers, frequency converters, oscillators, frequency synthesizers, and other products. Amplifiers are predicted to dominate the market due to their critical role in enhancing the sensitivity and range of radar and communication systems. However, frequency synthesizers are anticipated to grow at the fastest rate due to their growing use in electronic warfare and intelligence, surveillance, and reconnaissance (ISR) applications. The rising need for downsizing and enhanced performance in military and defense systems are driving the adoption of IMAs in frequency converters and oscillators. Filters, switches, and attenuators are among the items in the other product types section that are essential for permitting the fusion of several microwave components into a single assembly. Due to the rising need for specialized and customized IMAs for military and defense applications, this market is predicted to expand steadily.

Global Integrated microwave assemblies in Military and Defense Market Segmentation: By Frequency

-

KU-Band

-

C-Band

-

KA-Band

-

L-Band

-

S-Band

-

Others

In the military and defense industry, integrated microwave assemblies are sold in KU-band, C-band, KA-band, L-band, and S-band categories based on frequency. C-Band is anticipated to hold the biggest market share because of its numerous uses in military and defense systems, including radar, communication, and electronic warfare. The KA-Band section is estimated to expand at the quickest rate due to its expanding use in satellite communication and surveillance systems. The L-band and S-band are also predicted to experience steady growth because they are utilized in telemetry, remote sensing, and other applications. The other frequency segment includes devices that operate at frequencies other than the ones in the aforementioned bands, such as X-Band and VHF/UHF. This market is anticipated to grow at a moderate rate as a result of the growing demand for specialized and customized IMAs for military and defense applications.

Global Integrated microwave assemblies in Military and Defense Market Segmentation: By Region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

The following geographical divisions may also be used to categorize the global market for integrated microwave assemblies in the defense and military sectors: North America, Europe, Asia Pacific, South America, and Middle East & Africa. Due to the region's presence of important defense contractors, cutting-edge research and development facilities, and high levels of defense spending, North America is anticipated to have the biggest market share. Due to rising investments in defense modernization and the creation of cutting-edge military technologies, Europe is anticipated to experience significant growth. Due to rising military spending and expanded use of cutting-edge defense technologies in nations like China and India, the Asia Pacific region is estimated to develop at the fastest rate.

Global Integrated microwave assemblies in Military and Defense Market Key Players:

-

Analog Devices(US)

-

Teledyne Technologies(US)

-

MACOM(US)

-

Qorvo(US)

-

CAES(US)

-

CPI International (US)

-

APITech (US)

-

National Instruments (US)

-

Narda-MITEQ (US)

Chapter 1. Integrated microwave assemblies in Military and Defense Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Integrated microwave assemblies in Military and Defense Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2024 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. Integrated microwave assemblies in Military and Defense Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Integrated microwave assemblies in Military and Defense Market - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Integrated microwave assemblies in Military and Defense Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Integrated microwave assemblies in Military and Defense Market - By Product Type

6.1 Amplifiers

6.2 Frequency Converters

6.3 Oscillators

6.4 Frequency Synthesizers

6.5 Others

Chapter 7. Integrated microwave assemblies in Military and Defense Market - By Frequency

7.1 KU-Band

7.2 C-Band

7.3 KA-Band

7.4 L-Band

7.5 S-Band

7.6 Others

Chapter 8. Integrated microwave assemblies in Military and Defense Market - By Region

8.1 North America

8.2 Europe

8.3 Asia-Pacific

8.4 Rest of the World

Chapter 9. Integrated microwave assemblies in Military and Defense Market - Key Players

9.1 Analog Devices(US)

9.2 Teledyne Technologies(US)

9.3 MACOM(US)

9.4 Qorvo(US)

9.5 CAES(US)

9.6 CPI International (US)

9.7 APITech (US)

9.8 National Instruments (US)

9.9 Narda-MITEQ (US)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

In 2023, the Global Integrated microwave assemblies in Military and Defense Market was valued at $900 million, and is projected to reach a market size of $1542.44 million by 2030. Over the forecast period of 2024-2030, market is projected to grow at a CAGR of 8%.

The Global Integrated microwave assemblies in the Military and Defense Market are driven by the Growing need for electronic warfare capabilities.

The Segments under the Global Integrated microwave assemblies in the Military and Defense Market by Frequency are KU-Band, C-Band, and KA-Band.

China, Japan, South Korea, Singapore, and India are the most dominating countries in the Asia Pacific region for the Global Integrated microwave assemblies in the Military and Defense Market.

Analog Devices (US), Teledyne Technologies (US), and MACOM (US) are the three major leading players in the Global Integrated microwave assemblies in the Military and Defense Market.