Global Integrated Material Handling System Market Size (2024– 2030)

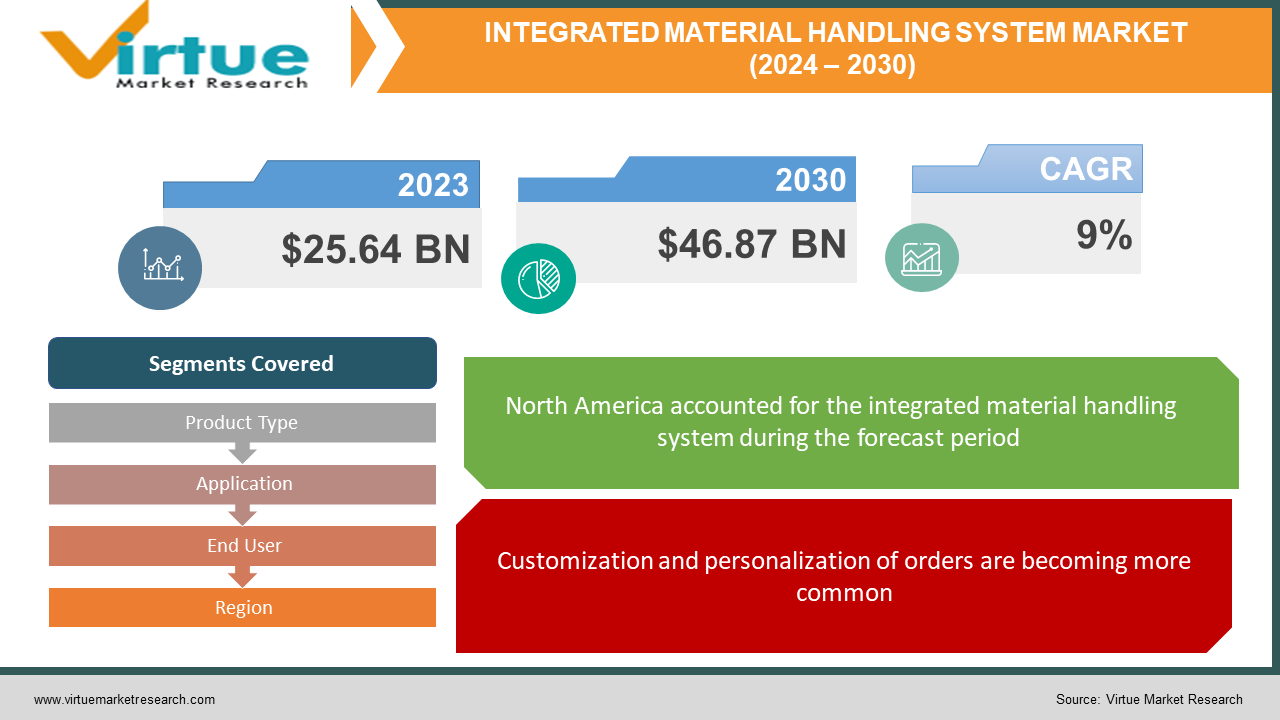

In 2023, The Integrated Material Handling System Market was valued at $ 25.64 Billion, and is projected to reach a market size of $ 46.87 Billion by 2030. Over the forecast period of 2024-2030, market is projected to grow at a CAGR of 9%.

Industry Overview

Consultants and system integrators provide technical services to design and execute a comprehensive handling process to guarantee that all material handling equipment in a facility—whether manual, semi-automated, or automated—works together as a cohesive, integrated material handling system. A system project might comprise paperwork, equipment purchasing (including hardware and software), installation, testing, commissioning, and support, in addition to engineering. A well-built system may help a firm enhance customer service, reduce inventory, shorten delivery times, and minimize total handling costs in production, distribution, and transportation by integrating all the technologies.

The process of programming and configuring industrial robots to conduct automated manufacturing activities is known as integration. Robot integrators are organizations that study your robotic system requirements, develop an automation strategy, and put the strategy into action. The manufacturing cost of the product is covered in the Material Handling Robotics System Integration market report, which is very important for the manufacturer and competitors, as well as raw material prices, manufacturing process costs, labor costs, and energy costs. All of these costs will affect the market trend, so it's important to understand the manufacturing cost better.

Impact of Covid-19 on the Industry

Due to the COVID-19 pandemic and a stop in the functioning of several companies, market growth slowed in 2020. Industry operations, on the other hand, are rising as a result of mass vaccination in numerous nations. In 2022, the market is likely to pick up steam as global conditions improve and the demand for industrial products rises. The emergence and spread of COVID-19 had caught industries and businesses off guard, leaving them with little time to prepare or defend themselves against losses. As a result of the pandemic affecting different sectors throughout the world, the automated material handling equipment market is expected to decline in 2020 compared to the previous year. In most industrial units across the world, it resulted in the closure of manufacturing facilities or the suspension of production activity. Many businesses, including healthcare, e-commerce, and food and beverage, have adjusted their operations as a result of the new normal. Global demand for industrial and consumer goods has risen as well. In comparison to 2020 and 2021, the market is expected to expand in 2022.

Market Driver

COVID-19 has caused a surge in demand for automated storage and retrieval solutions in the e-commerce business

The e-commerce business is booming as a result of the exceptional increase in the number of online customers following the COVID-19 epidemic. Consumers have turned to internet purchasing as a result of the implementation of social distancing rules, lockdowns, and other measures in reaction to the COVID-19 epidemic. Business-to-consumer (B2C) and business-to-business (B2B) e-commerce have increased as a result of this. Online sales of medications, home items, and food are all seeing an upsurge in B2C sales. However, such rapid expansion in the e-commerce business has put enormous pressure on companies to acquire and deliver a large number of products in a short period. As a result, e-commerce businesses have used automation in their operations. Mini loads or shuttles, which transport a case or tote to a goods-to-operator (GTO) pickup station, are the most efficient way to handle orders. Most distribution centers work on the operator-to-goods (OTG) approach, which requires the operator to travel to the product. ASRS, which is generally a mini-load or shuttle system, may transport the goods to the operator automatically.

Customization and personalization of orders are becoming more common

As online shoppers' preferences for customized and personalized product orders grow, e-commerce enterprises are finding it increasingly difficult to fulfill complicated requests using manual methods. Customers also want these customized purchases to be delivered at reasonable rates and at the same time as standard orders. Because of the growing popularity of customized orders, manufacturers and warehouse operators have been compelled to improve the efficiency and speed of their picking and sorting operations to achieve economic success. Additionally, because of the extra complexity, manual processing of bespoke orders increases the risk of mistakes. Robotic pickers, ASRS, AGV, automated sorters, and conveyors are examples of AMH systems that may assist handle customized orders more quickly while also lowering mistake rates.

Market Restraints

The high cost of IMHS will act as a market restraint

Small and medium-sized businesses (SMEs) play an important role in a country's economic growth. SMEs assist major businesses with the raw materials and components they require. As a result, material handling activities are critical in these SMEs' supply chains. The large upfront expenses of deploying IMHS technology, on the other hand, prevent SMEs from completely automating their supply chain processes. Because small businesses cannot afford automated solutions, they must rely on traditional/manual material handling methods. Some major businesses reduce their initial expenses by renting industrial vehicles, leasing equipment, or purchasing used equipment. This is anticipated to stymie new equipment purchases.

Unwanted equipment downtime causes the production and financial losses

The failure or breakdown of AMH equipment can have a substantial influence on a company's total profitability. Breakdowns or breakdowns cause the entire production process to be delayed, resulting in output losses and plant performance degradation. Downtimes in capital-intensive industries including automotive, metals and heavy machinery, and food and drinks may cost a corporation an average of USD 22,000 per minute. As a result, such businesses must invest extensively in preventative maintenance of their AMH equipment to avoid downtime and assure proper operation.

GLOBAL INTEGRATED MATERIAL HANDLING SYSTEM MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

9% |

|

Segments Covered |

By Product Type, Application, End User and Geography & Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Daifuku Co. Ltd , Jungheinrich AG, Toyota Industries Corporation, BEUMER Group, Cargotec, Kion Group, Crown Equipment Corporation, SSI Schaefer AG, Hytrol Conveyor Company, Inc |

This research report on the global integrated material handling system market has been segmented and sub-segmented based on, Product Type, Application, End- User and region.

Global Integrated Material Handling System Market – By Product Type

- Hardware

- Software & Services

The market is noticing an increasing demand for software and services segments in the manufacturing and industrial sector. Currently, the software segment is dominating the market based on the product type of integrated material handling systems market. The demand for the hardware segment is also growing due to the growing need for material handling robots and machinery in warehouses and the transport & logistics sector.

Global Integrated Material Handling System Market – By Application

- Assembly

- Distribution

- Transportation

- Packaging

- Others

The market is divided into the assembly, distribution, transportation, packaging, and others in terms of application analysis. Due to the rise of the e-commerce business, the distribution sub-segment has a significant share, since timely distribution and transportation help to meet delivery objectives. This is due to the use of automated material handling equipment such as AGVs and automated storage and retrieval systems, which allow for the efficient and effective transport of materials and goods in a short amount of time. In addition, major online retailers are putting a lot of effort into improving their material handling systems to achieve on-time delivery. Due to rising demand from the food & beverage, pharmaceutical, and e-commerce industries, the packaging sub-segment is predicted to rise gradually throughout the forecast period. Because the items are handled by several persons and are in transit for an extended period, automated packaging is essential. Food is protected from both internal and exterior elements with effective packaging.

Global Integrated Material Handling System Market – By End User

- Aerospace

- Automotive

- Chemicals

- Construction

- Consumer goods

- E-Commerce

- Government

- Healthcare

E-commerce, automotive, food & drinks, pharmaceuticals, aviation, semiconductors & electronics, and others are all included in the research. Due to increased penetration of online shopping trends, the existence of large online suppliers, developing logistics infrastructure, and other factors, the e-commerce sub-segment is predicted to grow considerably throughout the projection period. This trend is driving warehouse operators to add automation technology into their warehouses to manage the supply chain ecosystem more efficiently. Food and beverage, aviation, semiconductors, and automotive sub-segments are predicted to increase gradually due to rising demand for durable and non-durable items, emerging trends in precise packaging, transportation of semiconductors and their components, and other factors.

Global Integrated Material Handling System Market – By Geography & Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

North America, Europe, Asia Pacific, the Middle East, Africa, and Latin America are the five key areas in which the market is divided. They're broken down even further into countries. Rising awareness of warehouse automation, increased emphasis on robots and automation by major nations like China and Japan, and the rising e-commerce industry are some of the key causes driving Asia Pacific's increased market share. The automated material handling equipment market in the Asia Pacific has grown due to the rapid expansion of the automotive, e-commerce, food & beverage, and healthcare industries in growing markets like China and Japan. Furthermore, governments in Asia Pacific countries are placing a greater emphasis on workplace safety and security, which may be best achieved by implementing automated material handling equipment.

North America and Europe are expected to rise significantly during the projection period, owing to an increase in e-commerce sales, as well as an increase in demand for durable and non-durable items, which would force manufacturers to invest in large assembly lines and material handling equipment.

The Middle East and Africa, as well as Latin America, are likely to develop at a steady pace, thanks to rising e-commerce and retail penetration, as well as a strong inflow of foreign direct investments from online retailers looking to establish up warehousing facilities to serve to the untapped market.

Global Integrated Material Handling System Market – By Companies

- Daifuku Co. Ltd

- Jungheinrich AG

- Toyota Industries Corporation

- BEUMER Group

- Cargotec

- Kion Group

- Crown Equipment Corporation

- SSI Schaefer AG

- Hytrol Conveyor Company, Inc

NOTABLE HAPPENINGS IN THE GLOBAL INTEGRATED MATERIAL HANDLING SYSTEM MARKET IN THE RECENT PAST:

- Business Expansion: - In December 2021, to provide supply chain solutions, the KION Group constructed a new forklift truck facility in China. For future manufacture of industrial vehicles and supply chain solutions in Jinan, the factory has a total volume of roughly 140 million.

- Product Launch: - In August 2021, Toyota Material Handling Japan has introduced the SenS+ operation assist system, which detects and identifies persons and objects behind the forklift and regulates and stops the truck's rearward motion.

- Business Partnership: - In February 2021, daifuku and AFT industries teamed together to make use of both firms' material handling experience in the automobile sector. Daifuku and AFT will benefit from each other as a strategy to expand global markets and ensure increased demand and investments in material handling systems from car manufacturers.

Chapter 1. Global Integrated Material Handling System Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Global Integrated Material Handling System Market – Executive Summary

2.1. Market Size & Forecast – (2022 – 2027) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2022 - 2027

2.3.2. Impact on Supply – Demand

Chapter 3. Global Integrated Material Handling System Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Global Integrated Material Handling System Market Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Global Integrated Material Handling System Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global Integrated Material Handling System Market – By Product Type

6.1. Hardware

6.2. Software & Services

Chapter 7. Global Integrated Material Handling System Market – By End User

7.1. Aerospace

7.2. Automotive

7.3. Chemicals

7.4. Construction

7.5. Consumer goods

7.6. E-Commerce

7.7. Government

7.8. Healthcare

Chapter 8. Global Integrated Material Handling System Market – By Application

8.1. Assembly

8.2. Distribution

8.3. Transportation

8.4. Packaging

8.5. Others

Chapter 9. Global Integrated Material Handling System Market- By Region

9.1. North America

9.2. Europe

9.3. Asia-Pacific

9.4. Latin America

9.5. The Middle East

9.6. Africa

Chapter 10. Global Integrated Material Handling System Market – Key Companies

10.1 Daifuku Co. Ltd

10.2 Jungheinrich AG

10.3 Toyota Industries Corporation

10.4 BEUMER Group

10.5 Cargotec

10.6 Kion Group

10.7 Crown Equipment Corporation

10.8 SSI Schaefer AG

10.9 Hytrol Conveyor Company, Inc

Download Sample

Choose License Type

2500

4250

5250

6900