Insulated Glass Facade Market Size (2024-2030)

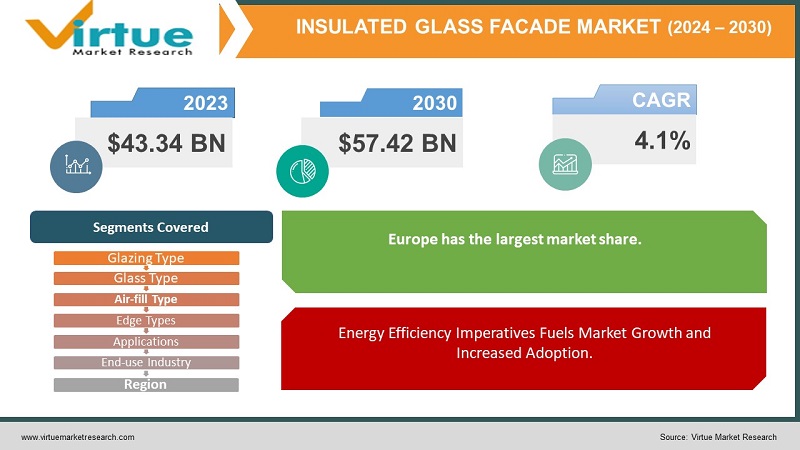

The Insulated Glass Facade Market was valued at USD 43.34 Billion in 2023 and is projected to reach USD 57.42 Billion by 2030, exhibiting a robust CAGR of 4.1% during the forecast period 2024-2030.

Insulated glass facades, often referred to as double or triple-glazed facades, have gained significant traction as innovative architectural solutions that seamlessly combine aesthetics, energy efficiency, and acoustic performance. This market has experienced remarkable expansion owing to the growing demand for environmentally sustainable and visually captivating building designs worldwide. Offering benefits such as thermal insulation, noise mitigation, and enhanced natural light infusion, insulated glass facades have emerged as a preferred option for diverse building types, including commercial, residential, and institutional structures. These facades are widely applied in sectors like corporate offices, hospitality establishments, retail hubs, and healthcare facilities. The escalating focus on environmental awareness and stringent energy efficiency regulations has further hastened the adoption of insulated glass facades, establishing them as a pivotal element in contemporary construction practices.

Global Insulated Glass Facade Market Drivers:

Energy Efficiency Imperatives Fuels Market Growth and Increased Adoption.

The escalating emphasis on energy-efficient buildings has driven the widespread adoption of insulated glass facades. These facades offer a substantial reduction in energy consumption by providing superior thermal insulation, minimizing heat loss during winters and heat gain during summers. As governments and industries strive to achieve sustainability goals and minimize carbon footprint, the demand for buildings with enhanced energy performance has surged, propelling the insulated glass facade market's expansion.

Architectural Elegance and Aesthetic Appeal Contribute to Increased Popularity augmenting the market growth.

Architectural designs have evolved to incorporate sleek and modern aesthetics, focusing on transparency, natural light, and visual appeal. Insulated glass facades cater to this demand by creating seamless and visually striking building exteriors. The ability of these facades to offer panoramic views, dynamic reflections, and striking facades while ensuring occupants' comfort has resulted in their growing popularity across various construction projects.

Stringent Acoustic Regulations Boost Demand Base in Market.

In urban environments, noise pollution has become a significant concern. Insulated glass facades provide excellent sound insulation properties, minimizing noise intrusion from external sources. With strict acoustic regulations governing buildings, the adoption of these facades has surged in commercial spaces, hotels, and healthcare facilities, where noise reduction is of paramount importance for occupant comfort.

Global Insulated Glass Facade Market Challenges:

High Initial Investment Costs Pose Challenges to Potential Adopters Eroding the Demand Base.

While insulated glass facades offer long-term benefits in terms of energy savings and enhanced aesthetics, their initial installation costs can be relatively higher compared to conventional facades. This cost factor can sometimes deter potential adopters, especially in budget-constrained construction projects. Addressing cost concerns while effectively conveying long-term advantages is a challenge that manufacturers and industry stakeholders need to navigate.

The lack of Skilled Professionals Poses Challenges in Designing, Installing, and Maintaining Insulating Glass facades.

The design, installation, and maintenance of insulated glass facades demand specialized technical expertise. Ensuring proper sealing, weatherproofing, and ongoing maintenance to avoid issues like condensation, air leakage, or glass unit failure requires skilled professionals. Meeting these technical demands across diverse construction projects can pose challenges and necessitate continuous training and skill development.

Global Insulated Glass Facade Market Opportunities:

Growing Green Building Certifications Create Opportunities for Market Expansion.

The escalating focus on sustainable construction and green building certifications, such as LEED (Leadership in Energy and Environmental Design) and BREEAM (Building Research Establishment Environmental Assessment Method), presents substantial growth opportunities for the insulated glass facade market. These certifications prioritize energy efficiency, environmental impact, and occupant well-being, aligning perfectly with the benefits offered by insulated glass facades.

Renovation and Retrofit Projects Drive Market Demand Base.

The renovation and retrofit market offers significant avenues for the insulated glass facade industry. Many existing buildings seek to enhance energy efficiency, aesthetics, and overall building performance. Insulated glass facades provide an effective solution for modernizing older structures while incorporating energy-saving features and improved aesthetics, driving demand for these applications.

Technological Advancements in Glass Coatings and Performance Opening New Areas for Sustained Growth.

Ongoing research and development efforts in glass coatings and materials are expected to yield innovations that enhance the performance of insulated glass facades. Smart glass technologies, self-cleaning coatings, and advanced glazing materials can further elevate the value proposition of insulated glass facades. These innovations can open up new application areas and position the market for sustained growth.

INSULATED GLASS FACADE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.1% |

|

Segments Covered |

By Glazing Type, Glass Type, Air-fill Type, Edge Types, Applications, End-use Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Saint-Gobain S.A., Nippon Sheet Glass Co., Ltd., Guardian Industries, Sisecam Group, AGC Inc. |

Insulated Glass Facade Market Segmentation – By Glazing Type

-

Double Glazing

-

Triple Glazing

Based on segmentation by Glazing type, double glazing typically holds a larger market share as it is a more common and established solution due to its balanced performance between insulation improvement and cost-effectiveness.

However, Triple glazing, while offering better thermal performance than Double Glazing, is less prevalent due to its higher cost and potential complexities in installation.

Insulated Glass Facade Market Segmentation – By Glass Type

-

Transparency

-

Clear

-

Extra Clear

-

Ultra Clear

-

-

Tinted Glass

-

Solar-Control Coated

-

Self-Cleaning Coated

Based on market segmentation by Glass type, Clear Glass has the largest market share among the different types of glass for insulated glass facades as it provides a standard and versatile choice that provides transparency without any specialized coatings or tints. It's widely used in various applications due to its cost-effectiveness and widespread availability.

However, the Solar-Control Coated Glass is the fastest-growing segment. Solar-control coated glass is designed to manage solar heat gain and reduce glare while allowing visible light to pass through. This feature aligns with the increasing emphasis on energy efficiency and sustainable building practices.

Insulated Glass Facade Market Segmentation – By Air-fill Type

-

Argon

-

Xenon

-

Atmospheric Air

-

Others

Based on market segmentation by Air-fill type, Argon has the largest market share. Argon is a widely used and cost-effective insulating gas that helps improve the thermal performance of insulated glass units by reducing heat transfer through the gap between glass panes.

However, Atmospheric Air holds the second-largest market share among the air-fill types segment for insulated glass facades. While noble gases like argon are more commonly used due to their superior insulating properties, atmospheric air is sometimes used as a more cost-effective alternative.

Insulated Glass Facade Market Segmentation – By Edge Types

-

Rough Grind

-

Arrissed

-

Super Polished

Based on market segmentation by Edge types, Arrissed edges have the largest market share among the edge types. Arrissed edges are edges that have been slightly chamfered or smoothed, removing any sharp corners or roughness. This edge type strikes a balance between aesthetics, safety, and cost-effectiveness.

However, Super Polished Edge holds the second-largest market share. Super Polished edges offer the highest level of smoothness and refined appearance, making them a popular choice for high-end and luxury architectural projects.

Insulated Glass Facade Market Segmentation – By Applications

-

Sloped/Overhead Glazing

-

Curtain Walls

-

Storefronts

-

Xtreme

-

Non-vision (Spandrel) Location

-

Fixed/Operable Windows

-

Others

Based on market segmentation by Applications, Curtain Walls has the highest market share. Curtain walls are extensively used in modern architecture for their aesthetic appeal, flexibility in design, and ability to enclose large areas with glass, providing both insulation and visual transparency.

However, Storefronts have the second-largest market share as they play a crucial role in commercial and retail spaces, offering a visually appealing way to showcase products and create an inviting entrance for customers. They serve as a bridge between the interior and exterior, providing a balance between transparency and security.

Insulated Glass Facade Market Segmentation – By End-use Industry

-

Commercial

-

Residential

-

Healthcare

-

Education

-

Hospitality & Leisure

-

Retail

-

Public Spaces & Transport

-

Others

Based on market segmentation by End-use Industry, the Commercial category has the highest market. The commercial sector includes a wide range of buildings such as office complexes, business centers, shopping malls, and institutional buildings. Insulated glass facades are frequently chosen for commercial structures due to their ability to provide energy efficiency, visual appeal, and a modern aesthetic. However, the Residential category has the second-largest market share as they are increasingly being used to enhance natural light penetration, provide thermal insulation, and create a modern architectural appeal. Homeowners and developers are recognizing the benefits of these facades in creating visually striking exteriors while also improving energy performance.

Insulated Glass Facade Market Segmentation – By Region

-

North America

-

Europe

-

Asia-Pacific

-

Middle East and Africa

-

South America

Based on market segmentation by Regions, Europe has the largest market share. Europe is known for its advanced architectural practices, emphasis on energy efficiency, and a strong focus on sustainable building design. Insulated glass facades are widely adopted in European countries to improve thermal performance, reduce energy consumption, and enhance aesthetic appeal. However, Asia-Pacific is the fastest-growing region as the region has been experiencing rapid urbanization, economic growth, and increasing investments in infrastructure and real estate. As a result, there is a growing demand for modern and energy-efficient building solutions, including insulated glass facades.

Global Insulated Glass Facade Market Key Players:

-

Saint-Gobain S.A.

-

Nippon Sheet Glass Co., Ltd.

-

Guardian Industries

-

Sisecam Group

-

AGC Inc.

Chapter 1. Insulated Glass Facade Market - Scope & Methodology

1.1 Market Segmentation

1.2 Assumptions

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Insulated Glass Facade Market - Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.3 COVID-19 Impact Analysis

2.3.1 Impact during 2024 – 2030

2.3.2 Impact on Supply – Demand

Chapter 3. Insulated Glass Facade Market - Competition Scenario

3.1 Market Share Analysis

3.2 Product Benchmarking

3.3 Competitive Strategy & Development Scenario

3.4 Competitive Pricing Analysis

3.5 Supplier - Distributor Analysis

Chapter 4. Insulated Glass Facade Market - Entry Scenario

4.1 Case Studies – Start-up/Thriving Companies

4.2 Regulatory Scenario - By Region

4.3 Customer Analysis

4.4 Porter's Five Force Model

4.4.1 Bargaining Power of Suppliers

4.4.2 Bargaining Powers of Customers

4.4.3 Threat of New Entrants

4.4.4 .Rivalry among Existing Players

4.4.5 Threat of Substitutes

Chapter 5. Insulated Glass Facade Market - Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Insulated Glass Facade Market - By Glazing Type

6.1 Double Glazing

6.2 Triple Glazing

Chapter 7. Insulated Glass Facade Market - By Glass Type

7.1 Transparency

7.2 Clear

7.3 Extra Clear

7.4 Ultra Clear

7.5 Tinted Glass

7.6 Solar-Control Coated

7.7 Self-Cleaning Coated

Chapter 8. Insulated Glass Facade Market - By Air-fill Type

8.1 Argon

8.2 Xenon

8.3 Atmospheric Air

8.4 Others

Chapter 9. Insulated Glass Facade Market - By Edge Types

9.1 Rough Grind

9.2 Arrissed

9.3 Super Polished

Chapter 10. Insulated Glass Facade Market - By Applications

10.1 Sloped/Overhead Glazing

10.2 Curtain Walls

10.3 Storefronts

10.4 Xtreme

10.5 Non-vision (Spandrel) Location

10.6 Fixed/Operable Windows

10.7 Others

Chapter 11. Insulated Glass Facade Market - By End-use Industry

11.1 Commercial

11.2 Residential

11.3 Healthcare

11.4 Education

11.5 Hospitality & Leisure

11.6 Retail

11.7 Public Spaces & Transport

11.8 Others

Chapter 12. Insulated Glass Facade Market - By Region

12.1 North America

12.2 Europe

12.3 Asia-Pacific

12.4 Latin America

12.5 The Middle East

12.6 Africa

Chapter 13. Insulated Glass Facade Market – Key Players

13.1 Saint-Gobain S.A.

13.2 Nippon Sheet Glass Co., Ltd.

13.3 Guardian Industries

13.4 Sisecam Group

13.5 AGC Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Insulated Glass Facade Market was valued at USD 43.34 Billion in 2023 and is projected to reach USD 57.42 Billion by 2030, exhibiting a robust CAGR of 4.1% during the forecast period 2024-2030.

Energy efficiency imperatives, architectural elegance and aesthetics, and stringent acoustic regulations are the key market drivers for the Global Insulated Glass Facade Market.

Double Glazing and Triple Glazing are the segments under the Global Insulated Glass Facade Market by Glazing Type.

Europe dominates the market in Global Insulated Glass Facade Market due to its advanced architectural practices, emphasis on energy efficiency, and strong focus on sustainable building design.

The Residential sector is the fastest-growing segment due to the rising demand for energy-efficient homes and modern aesthetics.