Inspection & Coating Market Size (2025 – 2030)

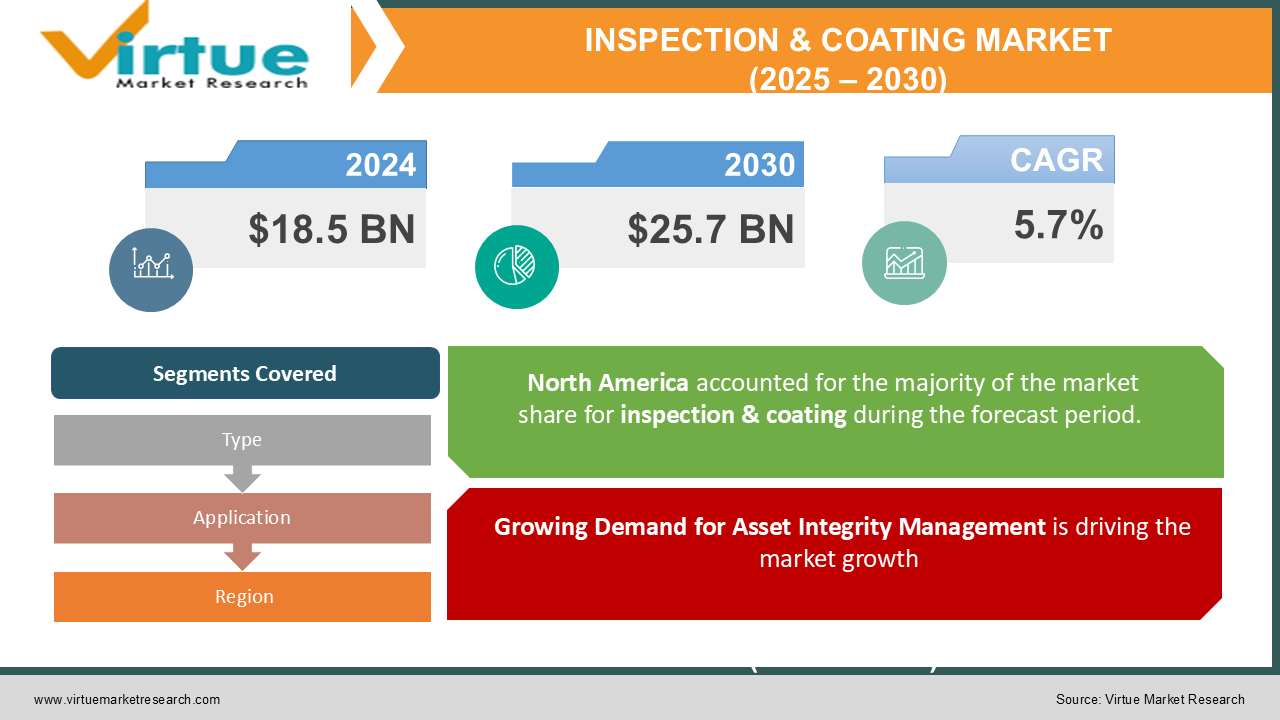

The Global Inspection & Coating Market was valued at USD 18.5 billion in 2024 and is projected to reach USD 25.7 billion by 2030, growing at a CAGR of 5.7% during the forecast period.

This market encompasses services that ensure the structural integrity and surface protection of assets across various industries, including oil & gas, construction, automotive, marine, and power generation.

Inspection and coating services play a crucial role in prolonging the lifespan of industrial equipment, structures, and vehicles while ensuring compliance with safety and environmental standards. The demand for these services is driven by the need for regular maintenance, advancements in coating technologies, and the increasing focus on infrastructure development worldwide.

Key Market Insights

-

Inspection services dominate the market, holding a 60% share in 2024, due to the critical need for ensuring asset integrity and compliance with safety standards.

-

Oil & gas is the largest application segment, accounting for over 35% of market share, driven by the sector's stringent safety and maintenance requirements.

-

The adoption of smart inspection technologies, including drones and IoT-based sensors, is transforming the industry by enhancing efficiency and accuracy.

-

Asia-Pacific is the fastest-growing regional market, with a CAGR of 6.5%, fueled by rapid industrialization and infrastructure projects.

-

Increasing demand for sustainable coatings is propelling the development of eco-friendly and durable coating solutions.

-

Rising investments in renewable energy infrastructure, including wind and solar power plants, are creating new opportunities for inspection and coating services.

-

Stringent regulations regarding worker safety and environmental impact are driving the adoption of advanced inspection and coating techniques globally.

Global Inspection & Coating Market Drivers

1. Growing Demand for Asset Integrity Management is driving the market growth

Industries such as oil & gas, marine, and power generation operate in challenging environments where equipment and structures are exposed to harsh conditions, including corrosion, high pressure, and extreme temperatures. This necessitates regular inspection and coating to ensure asset integrity, minimize downtime, and avoid costly failures.

With the rising awareness of the economic and safety implications of unplanned equipment failures, companies are increasingly investing in preventive maintenance strategies. Inspection services help identify potential issues early, while protective coatings mitigate environmental damage and extend the lifespan of assets.

2. Infrastructure Development and Modernization is driving the market growth

Rapid urbanization and industrialization, particularly in emerging economies, are driving significant investments in infrastructure development. The construction of bridges, highways, pipelines, and industrial plants requires high-quality coatings to protect structures from corrosion and wear.

In developed regions, aging infrastructure is being modernized, creating a steady demand for inspection and coating services. For instance, governments in North America and Europe are allocating substantial budgets for the maintenance and repair of transportation and energy infrastructure, further fueling market growth.

3. Advancements in Coating Technologies is driving the market growth

Technological innovations in coating formulations and application techniques are enhancing the performance and efficiency of coating solutions. The development of high-performance coatings, such as epoxy, polyurethane, and fluoropolymer-based coatings, has significantly improved durability, resistance to corrosion, and environmental compliance.

Additionally, automation and robotics are being integrated into coating processes to improve precision and reduce labor costs. These advancements are encouraging industries to adopt modern coating solutions for better asset protection and reduced maintenance costs.

Global Inspection & Coating Market Challenges and Restraints

1. High Costs of Advanced Inspection and Coating Solutions is restricting the market growth

The implementation of advanced inspection and coating technologies, such as robotic systems, smart sensors, and high-performance coatings, involves significant upfront costs. Small and medium-sized enterprises (SMEs), which often operate under tight budgets, may find it challenging to adopt these solutions.

Additionally, the skilled labor required for operating sophisticated equipment and applying advanced coatings adds to the overall cost, limiting the accessibility of these services in cost-sensitive markets.

2. Stringent Regulatory Compliance is restricting the market growth

The inspection and coating market is highly regulated, with varying safety and environmental standards across regions. Companies must comply with stringent guidelines set by regulatory bodies such as OSHA, EPA, and ISO, which can be complex and resource-intensive.

Non-compliance with these regulations can result in legal penalties, operational disruptions, and reputational damage, making it crucial for market players to invest heavily in compliance monitoring and training. These factors pose challenges, particularly for smaller companies with limited resources.

Market Opportunities

The Global Inspection & Coating Market presents a wealth of growth opportunities. The adoption of smart inspection technologies, such as drones, IoT sensors, and AI-powered analytics, is revolutionizing the industry. These technologies enable real-time data collection, remote monitoring, and predictive maintenance, enhancing efficiency, reducing costs, and improving overall operational performance. The global transition towards renewable energy sources, including wind and solar power, is driving significant demand for inspection and coating services to maintain the integrity of critical infrastructure such as turbines, solar panels, and transmission lines. The rising focus on sustainability is encouraging the development of environmentally friendly coatings, such as low-VOC and bio-based coatings, that minimize environmental impact and comply with stringent regulations. This shift towards eco-friendly solutions is gaining traction as industries strive to reduce their carbon footprint and meet growing consumer demands for sustainable products. The rapid economic growth in emerging economies, particularly in Asia-Pacific, Latin America, and the Middle East & Africa, is fueling significant infrastructure development, creating a growing demand for inspection and coating services to ensure the durability and safety of these assets. Finally, strategic collaborations between service providers, coating manufacturers, and end-user industries are crucial for driving innovation and expanding market reach. These partnerships can result in the development of tailored solutions that address specific industry challenges, enhance operational efficiency, and improve overall asset performance.

INSPECTION & COATING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

5.7% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Akzo Nobel N.V., PPG Industries, Inc., Jotun A/S, The Sherwin-Williams Company, Axalta Coating Systems Ltd., BASF SE, Tnemec Company, Inc., Hempel A/S, Mistras Group, Inc., Aegion Corporation |

Inspection & Coating Market Segmentation - By Type

-

Inspection Services

-

Coating Services

Inspection Services dominate the market, driven by the critical need for periodic assessments of asset integrity and compliance with safety standards.

Inspection & Coating Market Segmentation - By Application

-

Oil & Gas

-

Construction

-

Automotive

-

Marine

-

Power Generation

The Oil & Gas sector dominates the inspection and coating services market, accounting for over 35% of the market share. This dominance is attributed to the industry's unique and demanding requirements. Oil and gas operations involve exposure to harsh environments, including extreme temperatures, corrosive chemicals, and high pressures, necessitating robust and reliable equipment and infrastructure. Stringent safety regulations and the critical nature of oil and gas production further emphasize the need for regular and rigorous inspections and maintenance. Pipelines, refineries, and offshore platforms require meticulous inspection and coating applications to prevent corrosion, leaks, and equipment failures, ensuring safe and uninterrupted operations. The industry's reliance on advanced technologies for exploration and production, coupled with the increasing complexity of operations, necessitates sophisticated inspection and coating solutions to maintain asset integrity and ensure operational efficiency.

Inspection & Coating Market Segmentation - By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

North America dominates the inspection and coating services market, accounting for over 30% of global revenue in 2024, driven by the presence of well-established industries like oil & gas, construction, and automotive. Europe is a significant market, with growth fueled by the modernization of aging infrastructure and stringent environmental regulations. Countries like Germany, France, and the UK are leading adopters of advanced inspection and coating technologies. The Asia-Pacific region is the fastest-growing market, experiencing a CAGR of 6.5% during the forecast period, driven by rapid industrialization, urbanization, and infrastructure development in countries like China, India, and Japan. Latin America is witnessing steady growth, supported by the expansion of the oil & gas sector and investments in infrastructure development, with Brazil and Mexico being key markets. The Middle East & Africa region offers significant growth potential due to ongoing investments in oil & gas projects, construction activities, and renewable energy infrastructure.

COVID-19 Impact Analysis

The COVID-19 pandemic had a mixed impact on the Global Inspection & Coating Market. While disruptions in supply chains and project delays initially hampered market growth, the demand for maintenance and repair services surged as industries focused on optimizing existing assets. The pandemic also accelerated the adoption of remote inspection technologies, such as drones and IoT sensors, to ensure operational continuity amid movement restrictions. Post-pandemic, the market is expected to recover and grow steadily, driven by increased investments in infrastructure and the adoption of advanced technologies.

Latest Trends/Developments

The industrial coatings market is undergoing a significant transformation, driven by several key trends. The integration of automation in inspection services, through the utilization of robotics, drones, and AI-powered systems, is revolutionizing inspection processes, enhancing efficiency, and significantly reducing human error. This shift towards automation allows for more frequent and thorough inspections, leading to improved quality control and reduced downtime. Concurrently, manufacturers are increasingly focusing on developing sustainable coating solutions, such as low-VOC and bio-based coatings, to address growing environmental concerns and comply with stringent regulatory requirements. The emergence of digital twin technology, which creates virtual replicas of physical assets, is enabling predictive maintenance strategies. By simulating and predicting maintenance needs, businesses can proactively address potential issues before they escalate into costly failures, optimizing equipment uptime and minimizing operational disruptions. Advancements in coating materials, driven by nanotechnology, are leading to the development of coatings with superior durability, corrosion resistance, and thermal performance, enhancing the longevity and performance of coated surfaces across various industries. Finally, the rising adoption of predictive maintenance, facilitated by IoT-based sensors and AI analytics, allows industries to move beyond reactive maintenance strategies towards a more proactive and data-driven approach, optimizing maintenance schedules, minimizing downtime, and maximizing asset utilization. These trends collectively point towards a future where industrial coatings are not only durable and protective but also sustainable, intelligent, and integrated with advanced technologies, enhancing operational efficiency and driving innovation across various industries.

Key Players

-

Akzo Nobel N.V.

-

PPG Industries, Inc.

-

Jotun A/S

-

The Sherwin-Williams Company

-

Axalta Coating Systems Ltd.

-

BASF SE

-

Tnemec Company, Inc.

-

Hempel A/S

-

Mistras Group, Inc.

-

Aegion Corporation

Chapter 1. Inspection & Coating Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Inspection & Coating Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Inspection & Coating Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Inspection & Coating Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Inspection & Coating Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Inspection & Coating Market – By Type

6.1 Introduction/Key Findings

6.2 Inspection Services

6.3 Coating Services

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. Inspection & Coating Market – By Application

7.1 Introduction/Key Findings

7.2 Oil & Gas

7.3 Construction

7.4 Automotive

7.5 Marine

7.6 Power Generation

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Inspection & Coating Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Inspection & Coating Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Akzo Nobel N.V.

9.2 PPG Industries, Inc.

9.3 Jotun A/S

9.4 The Sherwin-Williams Company

9.5 Axalta Coating Systems Ltd.

9.6 BASF SE

9.7 Tnemec Company, Inc.

9.8 Hempel A/S

9.9 Mistras Group, Inc.

9.10 Aegion Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market was valued at USD 18.5 billion in 2024 and is projected to reach USD 25.7 billion by 2030, growing at a CAGR of 5.7%.

Key drivers include the growing demand for asset integrity management, infrastructure development, and advancements in coating technologies.

The market is segmented by Type (Inspection Services, Coating Services) and Application (Oil & Gas, Construction, Automotive, Marine, Power Generation).

North America dominates the market, accounting for over 30% of global revenue in 2024, followed by significant growth in Asia-Pacific.

Major players include Akzo Nobel N.V., PPG Industries, Inc., Jotun A/S, and The Sherwin-Williams Company.