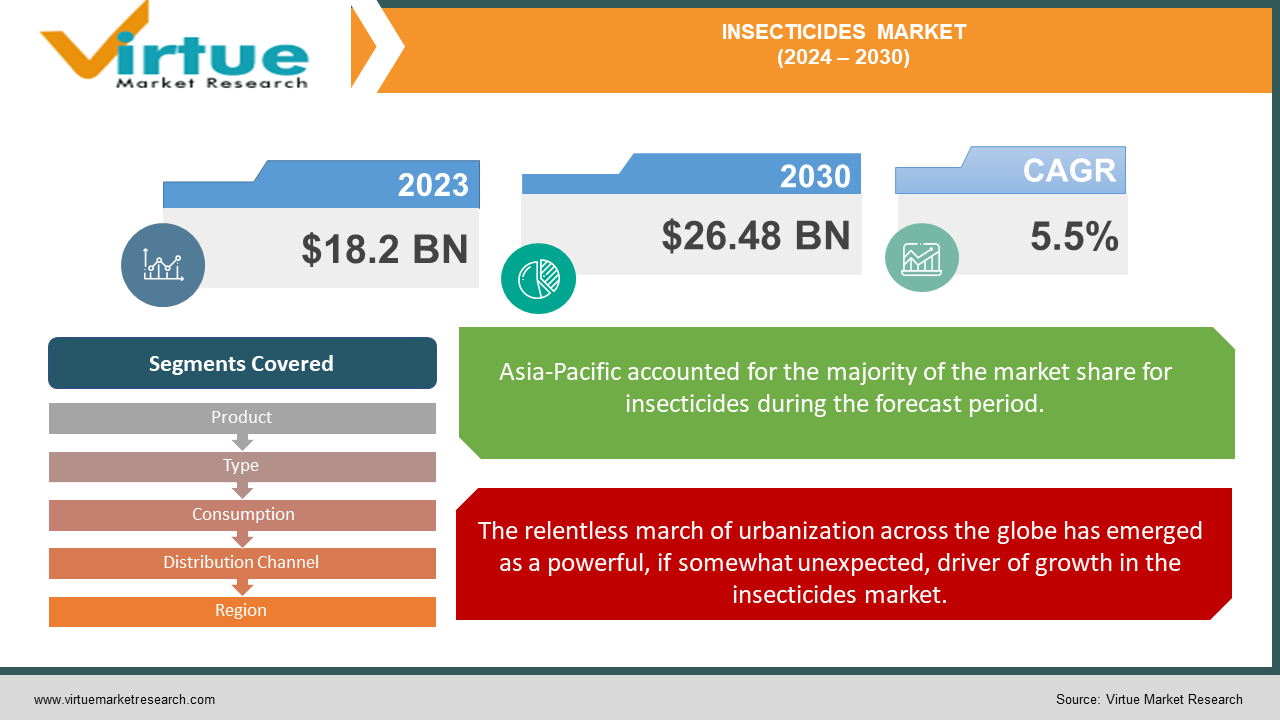

Insecticides Market Size (2024 – 2030)

The Global Insecticides Market was valued at USD 18.2 Billion in 2023 and is projected to reach a market size of USD 26.48 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.5%.

The worldwide market for insecticides is an essential component of the agriculture and pest management industries, serving as a pillar to protect living areas, public health, and crops from the ongoing danger of insect infestations. This dynamic sector is situated at the nexus of changing farming techniques, environmental consciousness, and state-of-the-art chemical innovation. The landscape of pesticides has changed significantly in recent years due to a complex interaction of variables. On the one hand, the pressure on agricultural systems to optimize yields and reduce losses has increased due to the world's ever-increasing population and its insatiable hunger. This has fueled the creation of ever-more complex pesticide formulations intended to counter both enduring pest enemies and new dangers. The possible ecological effects of conventional chemical pesticides have come under scrutiny at the same time that a wave of environmental consciousness has grown. This has sparked a wave of innovation toward more focused, environmentally friendly solutions that try to achieve a precarious balance between sustainability and efficacy. In this context, biopesticides—which are made of natural materials—have become a potential new frontier since they provide a more humane method of controlling pests.

Key Market Insights:

Non-agricultural sectors, such as public health and residential applications, utilize approximately 15% of insecticides.

Insecticide sales for residential pest control applications account for nearly $1.2 billion annually. The insecticides market saw an increase of 7% in sales volume from 2022 to 2023.

Pyrethroids constitute around 30% of the market share in the insecticides category. Organophosphates make up about 20% of the insecticide market. Neonicotinoids hold roughly 15% of the market share within the insecticides segment.

In 2023, the global market for bioinsecticides was valued at approximately $3.5 billion.

Insecticide resistance is reported in over 500 species of insects worldwide.

Rice and cotton crops are responsible for nearly 40% of the insecticide consumption globally. Approximately 50% of global insecticide usage is focused on cereal crops. The insecticide market for fruit and vegetable crops is valued at about $2.8 billion.

Annual spending on insecticides by the public health sector is around $1.5 billion.

Integrated pest management (IPM) techniques are implemented in about 30% of global agricultural practices.

Insecticides Market Drivers:

The relentless growth of the global population, projected to reach nearly 10 billion by 2050, has catapulted food security to the forefront of international concerns.

The magnitude of the challenge is staggering. The Food and Agriculture Organization (FAO) estimates that insects and other pests are responsible for destroying up to 40% of global crop production annually. This translates to billions of dollars in economic losses and, more critically, represents a substantial threat to food availability in many regions. The specter of climate change further compounds this issue, as altered weather patterns and shifting ecological balances create more favorable conditions for pest proliferation and the emergence of new insect threats. In response to these mounting pressures, there has been a notable intensification of agricultural practices across the globe. Farmers, particularly in developing nations where food insecurity looms large, are increasingly turning to insecticides as a means of safeguarding their harvests. This trend is not merely about boosting yields; it's about ensuring the reliability and consistency of food production in the face of unpredictable pest outbreaks.

The relentless march of urbanization across the globe has emerged as a powerful, if somewhat unexpected, driver of growth in the insecticides market.

The urbanization-driven insecticide market is not limited to outdoor applications. The dense living conditions in many urban areas have led to a surge in indoor pest problems, particularly in multi-unit housing complexes. Bed bugs, once nearly eradicated in many developed nations, have made a dramatic comeback, fueling demand for specialized insecticide formulations designed for indoor use. This trend has spurred innovation in the development of products that balance efficacy with safety concerns unique to indoor environments. The intersection of urbanization and insecticide use has also given rise to novel application methods and technologies. Urban pest control often requires more precise, less obtrusive approaches compared to agricultural settings. This has driven the development of micro-encapsulated insecticides, baits, and other formulations that can be discreetly applied in sensitive urban environments. Additionally, the integration of smart technologies in urban pest management, such as IoT-enabled traps and AI-driven application systems, is opening new avenues for growth in the insecticide market.

Insecticides Market Restraints and Challenges:

At the forefront of these challenges lies the growing public awareness and concern regarding the environmental impact of chemical insecticides. Decades of intensive pesticide use have left an indelible mark on ecosystems worldwide, with consequences that extend far beyond target pest populations. The decline of beneficial insect species, particularly pollinators like bees, has become a rallying cry for environmental activists and a source of genuine concern for agricultural stakeholders. This shift in public sentiment has translated into consumer preferences for "organic" and "chemical-free" products, potentially shrinking the market for traditional synthetic insecticides. The specter of pest resistance looms large as a persistent challenge for the insecticides industry. The evolutionary arms race between insects and the chemicals designed to control them has led to the emergence of resistant populations, rendering once-effective products obsolete. This phenomenon not only undermines the efficacy of existing insecticides but also places immense pressure on research and development efforts to stay ahead of the adaptation curve. The cost of developing novel modes of action is substantial, and the timeline from discovery to market can span decades, creating a bottleneck in the industry's ability to respond to emerging resistance threats.

Insecticides Market Opportunities:

One of the most promising opportunities lies in the realm of biopesticides and other biological control agents. As environmental concerns mount and regulations tighten around synthetic chemicals, the market for naturally derived insecticides is experiencing explosive growth. These products, which include microbial pesticides, plant-incorporated protectants, and biochemical pesticides, offer a more environmentally friendly approach to pest management. The opportunity here extends beyond simply replacing chemical insecticides; it involves developing integrated solutions that leverage the synergies between biological and conventional controls. Companies that can successfully navigate the regulatory pathways for biopesticides and demonstrate their efficacy in real-world conditions stand to capture a significant share of this burgeoning market segment. Nanotechnology presents another frontier of opportunity for the insecticide industry. The application of nanoparticles and nanoformulations in pest control offers the potential for enhanced efficacy, reduced environmental impact, and more precise targeting of pest species. Nanoencapsulation techniques, for instance, can improve the stability and controlled release of active ingredients, potentially reducing the frequency of applications and minimizing off-target effects. Moreover, the unique properties of nanomaterials open up possibilities for entirely new modes of action against insect pests. While regulatory hurdles and safety concerns around nanotechnology persist, early movers in this space could position themselves at the forefront of a revolutionary shift in insecticide design and delivery.

INSECTICIDES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.5% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Syngenta Group (Switzerland), Bayer CropScience AG (Germany), BASF SE (Germany)Corteva Agriscience (US), FMC Corporation (US), Sumitomo Chemical Co., Ltd. (Japan), Nufarm Ltd (Australia), ADAMA Agricultural Solutions Ltd (Israel), UPL Limited (India), China National Chemical Corporation (China) |

Insecticides Market Segmentation: By Types

-

Synthetic Chemical Insecticides

-

Biopesticides

-

Natural Insecticides

-

Systemic vs. Contact Insecticides

-

Broad-spectrum vs. Selective Insecticides

Synthetic chemical insecticides, particularly pyrethroids and neonicotinoids, remain the most dominant type in terms of market share. These products benefit from a long history of use, proven efficacy across a wide range of pest species, and often lower costs compared to newer alternatives. However, their dominance is gradually eroding due to regulatory pressures and the emergence of resistant pest populations.

Biopesticides represent the fastest-growing segment, driven by increasing environmental concerns, regulatory support, and consumer demand for "greener" pest control options. The compound annual growth rate (CAGR) for biopesticides often outpaces that of synthetic chemicals, sometimes by a factor of two or more. This growth is particularly pronounced in developed markets with stringent regulations on synthetic pesticides but is also gaining traction in emerging economies as awareness of sustainable agriculture practices grows.

Insecticides Market Segmentation: By Distribution Channel

-

Agrochemical Distributors and Retailers

-

Home and Garden Retailers

-

Pest Control Operators (PCOs) and Professional Service Providers

-

Government and Institutional Channels

-

Distributors and Dealers

-

Online Sales

-

Others

The most dominant distribution channel remains traditional agrochemical distributors and retailers, especially for professional and large-scale agricultural use. These established networks benefit from long-standing relationships with farmers, the ability to provide technical support and advice, and often bundled offerings that include other agricultural inputs. In many regions, particularly in developing countries, local agricultural supply stores, and cooperatives play a crucial role in reaching smallholder farmers who may have limited access to digital platforms.

The fastest-growing distribution channel in recent years has been online retail, propelled by the broader e-commerce boom and accelerated by the global pandemic. This channel offers convenience, competitive pricing, and access to a wide range of products, appealing particularly to smaller-scale farmers and home gardeners. The growth of digital agriculture platforms, which often integrate pest management recommendations with product sales, has further boosted this trend.

Insecticides Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

With almost 35% of the global market for insecticides, the Asia-Pacific region is the one with the biggest share. One of the region's main advantages is the diversity of its agriculture. The world's top producers of wheat, rice, and other fruits and vegetables are nations like China and India. Because of this diversity, a broad variety of insecticides that are suited to various crops and pest problems are required. For example, pests like the brown planthopper and rice stem borer pose a danger to rice production in China and India, necessitating the use of efficient pesticide treatments.

With a 15% market share, South America is the area with the quickest rate of growth in the insecticide industry. Due to substantial export activity as well as growing local demand, the region's agriculture industry is one of the main drivers of its rapid expansion. Notable participants in this expansion are Brazil, Argentina, and Chile—Brazil being one of the world's top producers of agricultural products. Large-scale farming operations are a defining feature of South America's agricultural environment, especially in nations like Brazil and Argentina. Large tracts of fertile land in these nations are used to grow a variety of crops, including maize, soybeans, sugarcane, and coffee. Because of the size of these operations, a lot of pesticides are used to protect crops from different kinds of pests.

COVID-19 Impact Analysis on the Insecticides Market:

The initial lockdowns and border restrictions severely disrupted the global supply chain for insecticides. The movement of raw materials and finished products became sluggish, creating shortages and delays. Imagine factories in China, a major producer of insecticide ingredients, facing production slowdowns due to lockdowns, leaving manufacturers worldwide scrambling for alternatives. As concerns about food security mounted during the pandemic, the focus shifted towards protecting staple crops like rice, wheat, and corn. Farmers prioritized insecticides crucial for these crops, potentially leading to a decline in demand for insecticides used on other agricultural products. Imagine a scenario where farmers opt for broad-spectrum insecticides to ensure the yield of essential food crops, even if it means sacrificing the use of more targeted insecticides for specialty crops. Concerns about the environmental impact of chemical pesticides may have gained traction during the pandemic. This could lead to a growing interest in biopesticides, which are derived from natural sources and often perceived as a more sustainable alternative. Lockdowns and movement restrictions fueled the growth of e-commerce platforms for agricultural supplies, including insecticides. This could provide farmers with greater access to a wider range of products and potentially streamline the purchasing process.

Latest Trends/ Developments:

RNA Interference (RNAi) Technology is a cutting-edge technology that disrupts the genetic makeup of specific insects, hindering their growth and reproduction. Imagine a future where RNAi-based insecticides can target specific pest genes, effectively controlling their populations without harming other organisms. New formulations are being developed that break down quickly in the environment, minimizing the risk of soil and water contamination. Imagine insecticides that target pests effectively but degrade rapidly, leaving minimal environmental residue. Extracts from neem oil, pyrethrum, and other botanical sources are being incorporated into insecticides. These offer a safer alternative to synthetic chemicals and often have faster degradation rates in the environment. Drones are revolutionizing agricultural practices. Imagine using drones equipped with sophisticated spraying systems to deliver precise amounts of insecticide directly to affected areas of a field, minimizing waste and environmental impact.

Key Players:

-

Syngenta Group (Switzerland)

-

Bayer CropScience AG (Germany)

-

BASF SE (Germany)

-

Corteva Agriscience (US)

-

FMC Corporation (US)

-

Sumitomo Chemical Co., Ltd. (Japan)

-

Nufarm Ltd (Australia)

-

ADAMA Agricultural Solutions Ltd (Israel)

-

UPL Limited (India)

-

China National Chemical Corporation (China)

Chapter 1. Insecticides Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Insecticides Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Insecticides Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Insecticides Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Insecticides Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Insecticides Market – By Type

6.1 Introduction/Key Findings

6.2 Synthetic Chemical Insecticides

6.3 Biopesticides

6.4 Natural Insecticides

6.5 Systemic vs. Contact Insecticides

6.6 Broad-spectrum vs. Selective Insecticides

6.7 Y-O-Y Growth trend Analysis By Type

6.8 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Insecticides Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Agrochemical Distributors and Retailers

7.3 Home and Garden Retailers

7.4 Pest Control Operators (PCOs) and Professional Service Providers

7.5 Government and Institutional Channels

7.6 Distributors and Dealers

7.7 Online Sales

7.8 Others

7.9 Y-O-Y Growth trend Analysis By Distribution Channel

7.10 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Insecticides Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Insecticides Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Syngenta Group (Switzerland)

9.2 Bayer CropScience AG (Germany)

9.3 BASF SE (Germany)

9.4 Corteva Agriscience (US)

9.5 FMC Corporation (US)

9.6 Sumitomo Chemical Co., Ltd. (Japan)

9.7 Nufarm Ltd (Australia)

9.8 ADAMA Agricultural Solutions Ltd (Israel)

9.9 UPL Limited (India)

9.10 China National Chemical Corporation (China)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global population is steadily increasing, putting pressure on food production systems. Crop losses due to insects are a significant threat to food security. This necessitates effective insect control measures, driving the demand for insecticides.

Exposure to certain insecticides, even at low levels, can pose health risks to farmers, applicators, and consumers. This raises concerns about the long-term health effects of these chemicals.

Syngenta Group (Switzerland), Bayer CropScience AG (Germany), BASF SE (Germany), Corteva Agriscience (US), FMC Corporation (US), Sumitomo Chemical Co., Ltd. (Japan), Nufarm Ltd (Australia), ADAMA Agricultural Solutions Ltd (Israel), UPL Limited (India), China National Chemical Corporation (China).

The market is dominated by Asia Pacific, which commands a market share of around 35%.

With a market share of about 15%, South America is expanding the quickest.