Inkjet Inks Market Size (2025 – 2030)

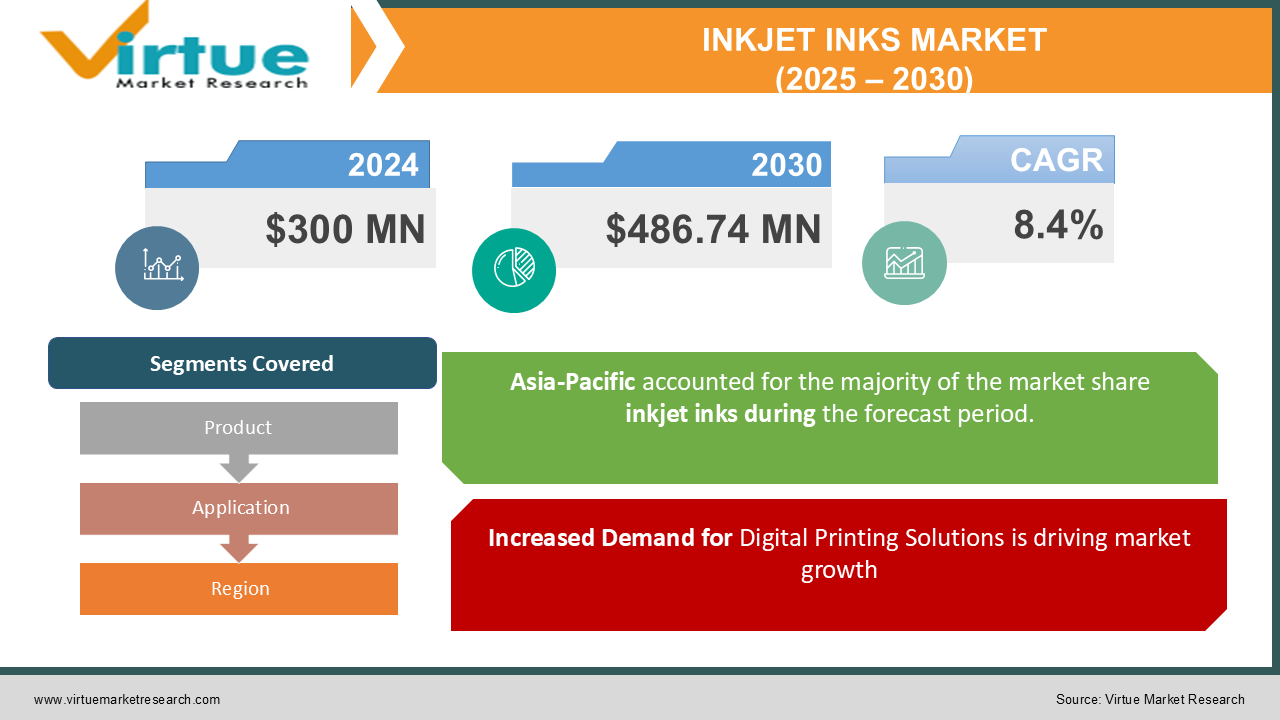

The Global Inkjet Inks Market was valued at USD 300 million in 2024 and is projected to grow at a CAGR of 8.4% from 2025 to 2030. By 2030, the market is expected to reach USD 486.74 million.

The Inkjet Inks Market centers on liquid-based inks used in inkjet printing technologies across industries, including commercial, packaging, and textile printing. The growth of this market is driven by increasing demand for high-quality printing, advancements in digital printing technologies, and rising adoption of inkjet printers in both industrial and home-use settings. The need for vibrant, durable, and application-specific inks is expected to foster further innovation in this domain.

Key Market Insights:

-

The global inkjet printing sector's rapid adoption in industries like textiles, packaging, and graphic arts is driving demand for high-performance inkjet inks.

-

Water-based inks account for a significant share of the market due to their eco-friendly nature, making them the preferred choice across regions with stringent environmental regulations.

-

Solvent-based inks continue to see strong demand in applications requiring water-resistance and durability, particularly in outdoor signage and industrial uses.

-

UV-curable inks are gaining traction in packaging and label printing due to their high adherence, fast curing, and versatility on non-porous substrates.

-

The Asia-Pacific region holds the largest share of the market, driven by increased industrial activities and the booming e-commerce sector requiring enhanced packaging printing.

-

Key technological advancements, such as AI integration in ink formulations and innovations in printhead technology, are reshaping the market landscape. The expansion of on-demand printing services and customization trends in various sectors, including textiles and marketing, significantly contribute to market growth.

Global Inkjet Inks Market Drivers:

Increased Demand for Digital Printing Solutions is driving market growth:

The growing trend of digitization in printing industries worldwide has revolutionized traditional printing processes. Inkjet printing provides high-quality, customizable, and cost-effective solutions, making it a preferred choice for industrial and commercial applications. Additionally, the shift from analog to digital printing in packaging and publishing is accelerating the adoption of inkjet inks. Industries such as textile printing benefit significantly from inkjet technology, which allows for precision and vibrancy while reducing material wastage. Moreover, its compatibility with a variety of substrates—including paper, plastics, and textiles—offers unmatched versatility, further bolstering market demand.

Eco-Friendly and Sustainable Printing Inks is driving market growth:

Environmental concerns have led to stricter regulations regarding volatile organic compound (VOC) emissions from printing inks. Water-based and UV-curable inks, known for their lower VOC emissions and minimal environmental impact, have gained widespread acceptance. Consumers' growing preference for sustainable products is also influencing businesses to adopt eco-friendly inks, promoting advancements in bio-based ink formulations. These inks align with the global push for sustainability, making them essential for sectors like packaging, where recyclable and eco-conscious solutions are increasingly mandated.

Customization and Personalization Trends is driving market growth:

The rapid expansion of the e-commerce and retail industries has created demand for customized packaging and personalized marketing materials. Inkjet printing technology facilitates such demands by allowing high-resolution, variable data printing without compromising speed. This adaptability has made inkjet inks indispensable for industries that rely on branding and consumer engagement strategies. Customization trends extend to textiles and home décor as well, where inkjet printing has enabled unique, small-batch productions at competitive costs, driving market growth further.

Global Inkjet Inks Market Challenges and Restraints:

Fluctuations in Raw Material Prices is restricting market growth:

The manufacturing of inkjet inks relies on raw materials such as pigments, dyes, solvents, and resins, which are subject to price volatility due to supply chain disruptions and geopolitical factors. Increases in raw material costs directly impact production costs, making it difficult for manufacturers to maintain competitive pricing. Additionally, supply chain challenges, especially in importing specialty chemicals or pigments, can delay production schedules and strain the operations of small to mid-sized manufacturers. The industry also faces challenges in sourcing sustainable raw materials, which are often costlier and require advanced production technologies.

Technological Complexities and Initial Costs is restricting market growth:

Despite the numerous advantages of inkjet printing, the technology's initial setup costs for industrial-scale operations are significantly high. Investments in advanced inkjet printers, compatible inks, and related machinery can deter smaller businesses from adopting the technology. Furthermore, the formulation of high-quality inks involves sophisticated R&D processes, adding to the complexity and expense. Inkjet inks must also be tailored to specific printing applications, requiring precise performance attributes such as viscosity, surface tension, and drying time. Failure to meet such specifications can lead to printhead damage or suboptimal print quality, creating additional hurdles for manufacturers.

Market Opportunities:

The global inkjet inks market presents vast opportunities as industries increasingly prioritize quality, customization, and sustainability. One major avenue for growth lies in expanding applications in packaging, which has seen an exponential rise due to booming e-commerce activities and evolving consumer preferences. The demand for recyclable, eco-friendly packaging solutions offers lucrative prospects for water-based and UV-curable inks. Moreover, emerging markets in Asia, Africa, and Latin America hold significant potential due to rising disposable incomes, urbanization, and industrial growth. As these regions adopt digital printing technologies, manufacturers have the chance to penetrate untapped markets with innovative, cost-effective ink solutions. Customization trends across fashion, décor, and branding sectors create additional growth avenues, encouraging businesses to invest in advanced inkjet technologies that can deliver bespoke results. Furthermore, collaborations between ink manufacturers and printer developers for integrated solutions can streamline adoption across industries, ensuring sustained market expansion.

INKJET INKS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

8.4% |

|

Segments Covered |

By Product, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

HP Inc., Epson, Canon Inc., DIC Corporation, Sun Chemical Corporation, Flint Group, Fujifilm Holdings Corporation, Sensient Technologies Corporation, Toyo Ink SC Holdings Co., Ltd., Siegwerk Druckfarben AG & Co. KGaA |

Inkjet Inks Market Segmentation: By Product

-

Water-Based Inks

-

Solvent-Based Inks

-

UV-Curable Inks

-

Dye Sublimation Inks

-

Other Specialty Inks

Water-based inks dominate this segment due to their eco-friendly attributes and compliance with stringent regulations. These inks cater to packaging and commercial printing applications, where low-VOC emissions and sustainability are critical factors.

Inkjet Inks Market Segmentation: By Application

-

Packaging

-

Textiles

-

Commercial Printing

-

Industrial Printing

-

Others

Packaging leads the market in application segmentation, fueled by the global rise in e-commerce and the demand for high-quality, visually appealing, and customized packaging solutions.

Inkjet Inks Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific is the dominant region in the global inkjet inks market. The region's industrial expansion, coupled with rapid urbanization and the growth of the e-commerce sector, drives demand for inkjet printing solutions. Countries such as China, India, and Japan are major contributors, leveraging advancements in printing technologies to cater to growing markets like textiles and packaging. The region's competitive manufacturing landscape, availability of cost-effective raw materials, and increasing environmental awareness further bolster its dominance. Moreover, significant investments in digital printing technologies by businesses in Asia-Pacific underscore its leading role in the global inkjet inks market.

COVID-19 Impact Analysis on the Inkjet Inks Market:

The COVID-19 pandemic had a complex and mixed impact on the inkjet inks market. In the early stages, the market faced significant setbacks due to global lockdowns, widespread supply chain disruptions, and reduced demand for commercial printing. With businesses halting operations or shifting to remote work, industries heavily reliant on inkjet printing—such as advertising, events, and publishing—suffered sharp declines. These sectors experienced substantial reductions in print volumes as public gatherings and marketing campaigns were either postponed or canceled. However, not all sectors within the inkjet ink market were negatively affected. The packaging and e-commerce industries saw a notable surge in demand for inkjet inks, as online shopping soared during the pandemic. This increase in online purchases led to greater demand for customized and innovative packaging solutions, which often rely on high-quality inkjet printing. Furthermore, the pandemic accelerated digital transformation, prompting many businesses to enhance their online presence through digital marketing strategies and customized printed materials. This shift towards personalized branding materials further bolstered the inkjet inks market. Sustainability also became a key driver during the pandemic. As environmental concerns grew, many companies began prioritizing eco-friendly practices, including the use of sustainable inks. This trend prompted manufacturers to invest in developing and producing more environmentally friendly inkjet inks, aligning with broader global sustainability goals. Looking ahead, the inkjet inks market is expected to recover strongly post-pandemic. As industries adjust to the "new normal," the demand for versatile, application-specific inkjet inks is set to rise. The acceleration of e-commerce, digital marketing, and sustainability trends are likely to continue shaping the future of the market, ensuring robust growth in the coming years.

Latest Trends/Developments:

Several key trends are shaping the inkjet inks market, with sustainability and innovation leading the way. One of the most notable trends is the rise of water-based and UV-curable inks, which reflect growing environmental awareness. These inks are more eco-friendly and align with global sustainability goals, driving their adoption in industries looking to reduce their environmental footprint. Another trend gaining traction is the use of dye-sublimation inks in textile and apparel printing. These inks are particularly popular due to their ability to produce vibrant, long-lasting prints on synthetic fabrics, making them ideal for the fashion and sportswear industries. The shift toward these inks is accelerating as demand for customized and high-quality textile products rises. Advancements in nanotechnology are also revolutionizing the inkjet ink industry. Nanotech-enhanced inks offer superior color vibrancy, faster drying times, and improved adhesion properties. These innovations are enabling more precise and efficient printing, enhancing the quality of printed materials across a wide range of applications. Smart packaging is another area where inkjet printing is making significant inroads. The growing demand for interactive and personalized packaging is driving the use of inkjet inks to print QR codes, barcodes, and other interactive features on packaging. This trend is particularly evident in the food and beverage industry, where consumer engagement and brand interaction are key. Finally, the integration of Artificial Intelligence (AI) and the Internet of Things (IoT) into inkjet printing processes is enhancing both precision and efficiency. By enabling tailored ink formulations and improving the accuracy of print applications, these technologies are setting new standards in industrial printing. These trends are expected to further propel the growth of the inkjet inks market, ensuring the technology’s continued relevance and importance across various industries.

Key Players:

-

HP Inc.

-

Epson

-

Canon Inc.

-

DIC Corporation

-

Sun Chemical Corporation

-

Flint Group

-

Fujifilm Holdings Corporation

-

Sensient Technologies Corporation

-

Toyo Ink SC Holdings Co., Ltd.

-

Siegwerk Druckfarben AG & Co. KGaA

Chapter 1. Inkjet Inks Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Inkjet Inks Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Inkjet Inks Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Inkjet Inks Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Inkjet Inks Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Inkjet Inks Market – By Product Type

6.1 Introduction/Key Findings

6.2 Water-Based Inks

6.3 Solvent-Based Inks

6.4 UV-Curable Inks

6.5 Dye Sublimation Inks

6.6 Other Specialty Inks

6.7 Y-O-Y Growth trend Analysis By Product Type

6.8 Absolute $ Opportunity Analysis By Product Type, 2025-2030

Chapter 7. Inkjet Inks Market – By Application

7.1 Introduction/Key Findings

7.2 Packaging

7.3 Textiles

7.4 Commercial Printing

7.5 Industrial Printing

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Inkjet Inks Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Inkjet Inks Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 HP Inc.

9.2 Epson

9.3 Canon Inc.

9.4 DIC Corporation

9.5 Sun Chemical Corporation

9.6 Flint Group

9.7 Fujifilm Holdings Corporation

9.8 Sensient Technologies Corporation

9.9 Toyo Ink SC Holdings Co., Ltd.

9.10 Siegwerk Druckfarben AG & Co. KGaA

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Global Inkjet Inks Market was valued at USD 300 million in 2024 and is projected to grow at a CAGR of 8.4% from 2025 to 2030. By 2030, the market is expected to reach USD 486.74 million.

Key drivers include increasing demand for digital printing solutions, eco-friendly and sustainable ink formulations, and rising trends in customization and personalization across industries.

The market is segmented by product (water-based inks, solvent-based inks, UV-curable inks, etc.) and application (packaging, textiles, commercial printing, etc.).

Asia-Pacific is the dominant region, driven by industrial growth, e-commerce expansion, and advancements in printing technologies.

Key players include HP Inc., Epson, Canon Inc., DIC Corporation, and Sun Chemical Corporation.