Injection Molding Materials Market Size (2024 –2030)

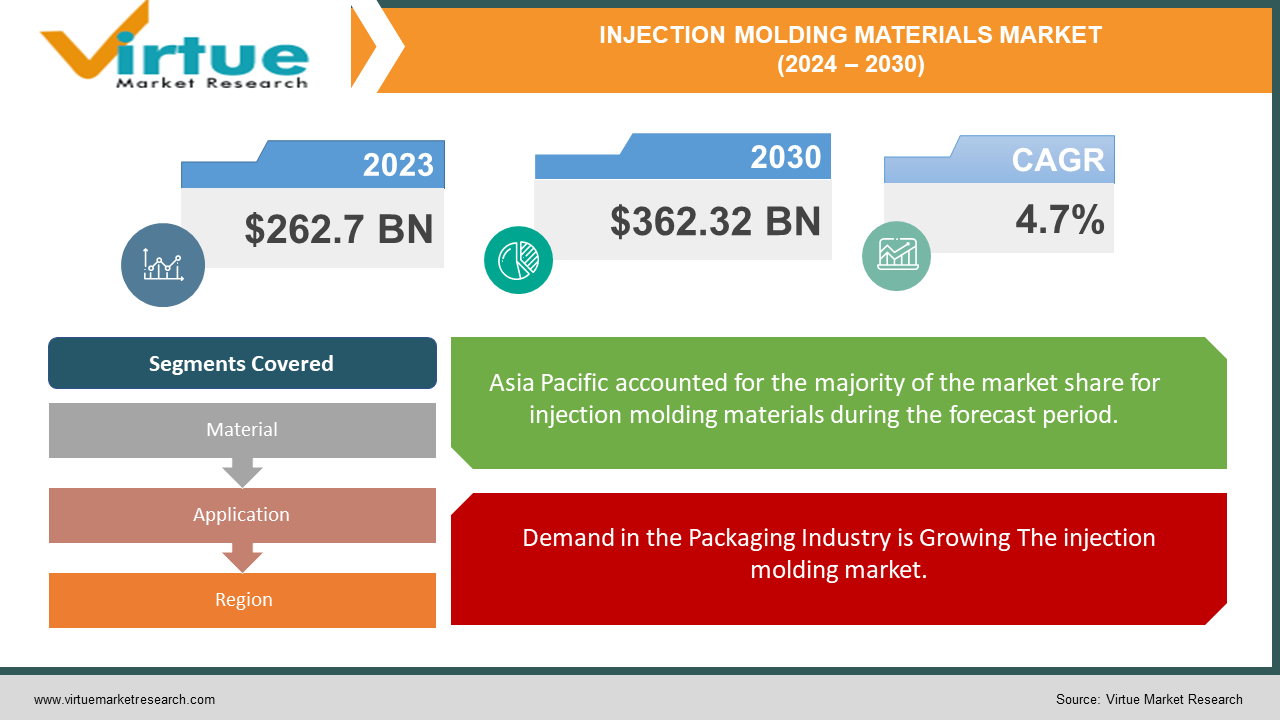

The Global Injection Molding Materials Market was estimated to be worth USD 262.7 billion in 2022 and is projected to reach a value of USD 362.32 billion by 2030, growing at a CAGR of 4.7% during the forecast period 2023-2030.

Injection molding is a process that involves pouring materials into a mold to form objects. Materials of all kinds, including rubber, plastic, glass, and metal, can be used. This is how many commonplace things like bottle caps, containers, and auto parts are made. The main advantages of injection molding are its low energy consumption, low cost of machine maintenance, and high accuracy of manufacture. The market for injection molding materials is expanding as a result of these benefits.

Key Market Insights:

Engineering plastics account for over 35% of the total injection molding materials market, driven by their superior mechanical and thermal properties.The automotive industry consumes approximately 25% of the total injection molding materials, with a high demand for lightweight and durable materials.Asia-Pacific region holds a market share of around 40% in the global injection molding materials market, fueled by the region's manufacturing prowess.Bioplastics and recycled plastics segments are expected to grow at a rate of over 8% annually, driven by sustainability concerns and regulatory initiatives.

Global Injection Molding Materials Market Drivers:

Demand in the Packaging Industry is Growing The injection molding market.

Because they are lightweight and pliable, plastics are frequently used in packaging. They are frequently used in place of glass in the packaging of prepared foods, veggies, baked goods, and frozen foods. The packaging industry encountered difficulties during the COVID-19 pandemic, including labor and material shortages, which slowed down operations. However, the industry is predicted to recover as consumer tastes shift and more packaged foods and beverages are purchased. PET and HDPE plastic bottles are still in demand, but different kinds of plastic are also required for different packaging requirements throughout the pandemic.

The demand for electronics and consumer goods is rising, which is driving the global injection molding market.

Because plastic is so easy to shape and design, it's a great material to use for electronic devices. Even pieces can be assembled without the need for additional screws or clips. The ability to produce extremely small parts with high precision through a process known as micro injection molding is crucial as electronic components get smaller. Due to its efficiency and ability to produce high-quality products, injection molding is used in the production of many electronic items, including computer parts, earphones, plugs, and cell phone covers.

Injection Molding Materials Market Challenges and Restraints:

The fact that injection-molded plastics are harmful to the environment is one of their main issues. They are typically made of oil, which emits pollutants both during production and burning. China and other industrialized nations produce large amounts of carbon dioxide, contributing to global warming. This occurs as a result of the large-scale CO2 emissions from the chemical, transportation, and construction industries. Thus, the more plastics we produce, the more environmental damage we cause.

Injection Molding Materials Market Opportunities:

High-performance materials like thermoplastic elastomers, which combine the properties of plastic and rubber while being lighter than steel and other plastics, are becoming more and more popular due to the quick advances in automotive technology. Because vehicle components are being produced using technical polymers and injection-molded thermoplastic elastomers, this shift is contributing to a roughly 40% decrease in the total number of automobiles on the road. The fact that these materials now satisfy the same requirements as traditional rubber components emphasizes how crucial plastics are for reducing weight. This pattern fits in with the larger opportunities observed in the market for injection molding materials, where a rise in the demand for eco-friendly materials, such as bioplastics, presents an opportunity for companies to create sustainable substitutes. While investing in specialized metal materials to meet the growing demand for metal injection molding, manufacturers can also customize materials to meet specific industry needs in the electronics, aerospace, automotive, and healthcare sectors. Furthermore, the utilization of rapid prototyping technologies such as 3D printing opens doors for material suppliers to provide appropriate materials for additive manufacturing. Furthermore, new development opportunities in a variety of industries are presented by the growing interest in smart materials with distinctive properties. Lastly, businesses can improve customer satisfaction and stand out from the competition by providing personalized solutions and value-added services. All things considered, the market for injection molding materials offers a wealth of chances for product expansion, innovation, and adjustment to changing industry needs.

INJECTION MOLDING MATERIALS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.7% |

|

Segments Covered |

By Material, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BASF, ExxonMobil, LyondellBasell, Eastman Chemical Company, Huntsman Corporation, Dow Chemicals, DuPont, SABIC, Ineos Group, Magna International Inc |

Global Injection Molding Materials Market Segmentation: By Material

-

Plastics

-

Metals

With 98.3% of sales, injection molding is the most common manufacturing method in the plastics industry. It's widely used because it's inexpensive, quick, and reliable at producing large quantities of goods. This is particularly useful for manufacturing consumer goods, building parts, and packaging. The industry grows because injection molding uses special plastics that are strong, heat-resistant, and produce less waste. Metal materials are predicted to increase by 7.3% in the future. Because metal can be formed into intricate shapes and doesn't rust, it's a popular material for parts. Because less invasive surgeries are performed, there is also a growing market for metal parts in medicine. Businesses are beginning to use bioplastics, which are regular plastics but better for the environment, as recycling plastics gets more expensive. Additionally, the industry will expand due to the increased demand for rubber and ceramic parts in automobiles, electronics, and medicine.

Global Injection Molding Materials Market Segmentation: By Application

-

Packaging

-

Medical

With 32.4% of sales going to the packaging sector, injection-molded plastics are most commonly used in this industry. A focus on sustainability, shifts in consumer preferences, and the rise of internet shopping are the main drivers of this demand. Additionally, sectors like food processing, personal care, and pharmaceuticals require more packaging. New technologies that require injection-molded electronic components, such as smartphones and artificial intelligence, have an impact on the injection molding market. Due to the increased demand for medical equipment following COVID-19, the medical industry is predicted to grow at a rate of 5.7%. This growth is also being driven by advancements in surgical techniques. The growing popularity of electric vehicles in the automotive sector presents opportunities for injection molding businesses. Injection-molded plastic is gradually taking the place of metal in automobile components, particularly in areas like the brakes, gearboxes, and seals. It is anticipated that this trend will persist in the future.

Global Injection Molding Materials Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

The injection-molded plastics market is one of the largest in Asia Pacific, accounting for 40.4% of total sales. It is anticipated that this market will continue to expand due to the abundance of factories, low labor costs, and increased investments in electronics, medical, and packaging. The medical sector is expanding in North America as a result of rising healthcare costs and an increase in the number of elderly patients. The demand for injection-molded plastic medical services has increased due to the COVID-19 pandemic. Additionally, due to innovation, the packaging and automotive industries are expanding quickly. The injection-molded plastics market is expanding quickly in Europe as well. This is a result of the increased need for food and drink packaging that is efficient. Businesses such as Berry Global and Mondi Group are investing heavily in the development of innovative packaging products, such as robust containers and specialized shaped bottles. Germany holds the largest market share in the injection molded plastics industry, which is expanding at the fastest rate in the UK.

COVID-19 Impact on the Global Injection Molding Materials Market:

Injection-molded plastic gloves, masks, and packaging materials were in high demand during the COVID-19 pandemic. The United States saw a 0.9% increase in plastic material production despite the closure of numerous businesses. Due to transportation limitations and social distancing regulations, more people were shopping online, which increased the demand for packing boxes and containers. Over the next ten years, it is anticipated that these trends will persist, spurring further expansion in the injection molded plastics sector.

Latest Trend/Development:

Car manufacturers must figure out how to use less fuel in light of recent changes to fuel economy regulations. Making cars lighter is one method; lighter cars require less fuel. A car with 10% less weight can reduce gas costs by 5% to 7%. In addition to producing less CO2, lighter cars are better for the environment. Additionally, lighter cars handle and accelerate more smoothly. By lessening noise and vibrations, they also provide a more comfortable ride, particularly on bumpy roads. Automakers are concentrating on employing unique materials to create automotive components, such as various types of thermoplastic elastomers. This material contributes to the current trend of lighter cars. Larger batteries in electric cars are one example of a technology that lighter cars can support. However, the COVID-19 pandemic caused a decline in car sales in the first half of 2020.

Key Players:

-

BASF

-

ExxonMobil

-

LyondellBasell

-

Eastman Chemical Company

-

Huntsman Corporation

-

Dow Chemicals

-

DuPont

-

SABIC

-

Ineos Group

-

Magna International Inc

Market News:

-

The large oil and gas corporation ExxonMobil inaugurated a new recycling facility in Texas, USA, in December 2022. With the help of advanced technology, this plant can break down difficult-to-recycle plastics and convert them into materials for new products.

-

SABIC, a chemical company, will participate in Plastindia 2023, a sizable exhibition, in January 2023. The rubber and plastic industries will benefit greatly from this show, and SABIC will be heavily represented there.

Chapter 1. Injection Molding Materials Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Injection Molding Materials Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Injection Molding Materials Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Injection Molding Materials Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Injection Molding Materials Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Injection Molding Materials Market – By Material

6.1 Introduction/Key Findings

6.2 Plastics

6.3 Metals

6.4 Y-O-Y Growth trend Analysis By Material

6.5 Absolute $ Opportunity Analysis By Material, 2024-2030

Chapter 7. Injection Molding Materials Market – By Application

7.1 Introduction/Key Findings

7.2 Packaging

7.3 Medical

7.4 Y-O-Y Growth trend Analysis By Application

7.5 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Injection Molding Materials Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Material

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Material

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Material

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Material

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Material

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Injection Molding Materials Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 BASF

9.2 ExxonMobil

9.3 LyondellBasell

9.4 Eastman Chemical Company

9.5 Huntsman Corporation

9.6 Dow Chemicals

9.7 DuPont

9.8 SABIC

9.9 Ineos Group

9.10 Magna International Inc

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Injection Molding Materials Market was estimated to be worth USD 262.7 billion in 2022 and is projected to reach a value of USD 362.32 billion by 2030, growing at a CAGR of 4.7% during the forecast period 2023-2030.

Increasing Packaging Industry Demand is Boosting The market for injection molding and increased demand for consumer goods and electronics is boosting the global injection molding market are the factors driving the Global Injection Molding Materials Market.

Growing Environmental Issues Are Blocking the Market Market expansion for injection molding.

Metal material is the fastest growing in the Global Injection Molding Materials Market.

Europe region is the fastest growing in the Global Injection Molding Materials Market.