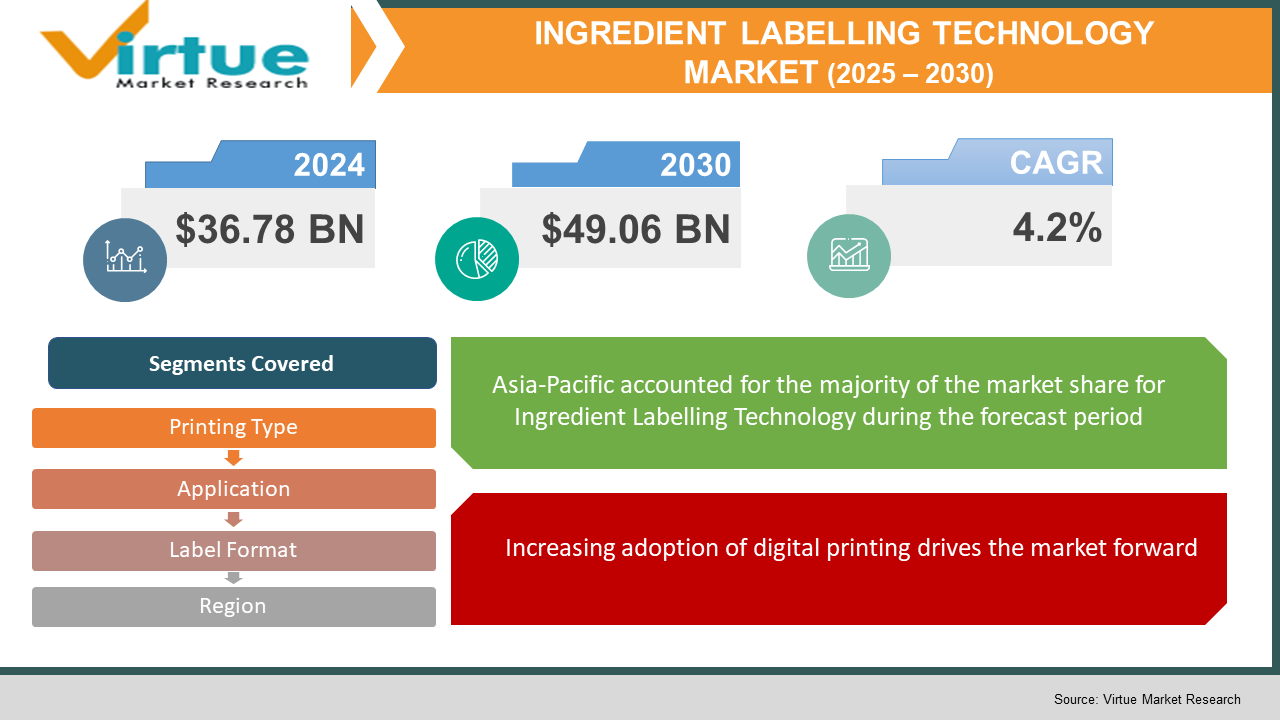

Ingredient Labelling Technology Market Size (2024 – 2030)

The Global Ingredient Labelling Technology Market was valued at USD 36.78 billion in 2023 and is projected to reach a market size of USD 49.06 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.2%.

INDUSTRY OVERVIEW

The term "print label" describes a sheet of material made of metal, fabric, polymer, and paper that is printed and used to display a product's logo, symbols, and published information. It is used to establish brand identification, identify products, and stop counterfeiting to preserve trust. Print labels are directly printed as opposed to woven labels, and they have several advantages including precise printing, high quality, and detailed images. Wet glue, pressure-sensitive, and multi-part tracking labels are only a few of the labelling types for the print labels that are commercially available.

The key drivers propelling the market growth are the brisk growth of the food and beverage (F&B) sector and the rising use of print labels in the food industry. In addition, the widespread use of print labels in a variety of applications, rising consumer health consciousness, rising demand for manufactured goods, and rising disposable incomes all contribute to the market's expansion. The expansion of the market is being favorably impacted by several measures done by the governments of various nations to regulate the insertion of informative labels by the criteria of fast-moving consumer goods (FMCG) for preserving transparency. The market is expanding due to the advent of technologically improved dust control technologies. In addition, substantial financing and expenditures in research and development (R&D) efforts for cutting-edge digital print labels are favorably influencing market expansion. The development of visually appealing print labels, among other things, is fostering a good view of the market globally.

COVD-19 IMPACT ON THE INGREDIENT LABELLING TECHNOLOGY MARKET

No industry has escaped the pandemic wave of effects, which is still spreading around the world. In response to the growing issue, the food and beverage sector is preparing for Coronavirus effects. Due to the widespread epidemic, food and beverage firms have been forced to make difficult choices like temporary cessations to comply with travel restrictions and social segregation conventions, but the effects go well beyond that. However, it was seen that there was a surge in the consumption of food of products during the lockdown as the food and beverages sectors were put into essential commodities. As a result, of this, there was a surge in demand for packaged food which has favorably helped the printing inks market to grow.

MARKET DRIVERS:

Growing shift toward smart packaging is driving the market growth

The development of significant end-use verticals, such as healthcare, cosmetics, food & beverage, and so forth, has led to the ingredient labelling industry emerging as one of the main sectors developing throughout time. To sustain and enhance brand reputation in the markets, this expansion has increased the demand for developing packaging alternatives through the use of smart technologies, such as augmented reality, artificial intelligence, and so forth. Additionally, risks like re-importation, diversion, and counterfeiting have made sophisticated printed packaging necessary to protect businesses' reputations and provide customers, particularly in the medical and food industries, with assurances about the authenticity of their products.

Increasing adoption of digital printing drives the market forward

One of the key aspects fueling the market expansion for ingredient printing is the growing use of digital printing techniques. Digital printing is becoming increasingly popular among package providers as a means of retaining their clientele since it offers benefits including production flexibility, packaging personalization, and quicker printing rates. Digital printing, as opposed to traditional techniques, does not require frequent replacement of the printing plates, enabling shorter turnaround times at lower prices. The need to pack large quantities of goods in short amounts of time while ensuring high-quality prints has also been creating a positive impact on the adoption of digital printing, particularly across retail or e-commerce applications, as a result of increasing market competition and online shopping trends. Furthermore, it's a great option for packaging printing applications since it can print many patterns for series items in offset quality without color restrictions. As part of enhancing its packaging printing services, Fres-co System USA, Inc. announced 2021 the inclusion of digital printing capabilities. This action was intended to give clients in the food, coffee, pet food, and chemical sectors more bespoke printing possibilities for a wide variety of packaging applications.

MARKET RESTRAINTS:

High costs may impede the market growth

High upfront expenses for printed packaging increase the manufacturers' manufacturing costs, which is one of the key factors limiting market development. Given how fiercely competitive the packaging industry is, businesses frequently update or replace their packaging labels, materials, logos, graphics, and other components to maintain their market position and boost brand recognition. The end-users face significant costs as a result of these upgrades or modifications to printed packaging over time, which leads to the need for new labels, seals, inks, and other materials. Additionally, the cost of buying printing or labelling equipment and maintaining it over time forces end users to make significant financial investments, which discourages small and medium-sized firms from adopting the technology. Small startups and organizations typically rely on straightforward and affordable packaging alternatives with little printing to keep manufacturing costs, which hinders the expansion of the industry.

INGREDIENT LABELLING TECHNOLOGY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.2% |

|

Segments Covered |

By PRINTING TYPE, LABEL FORMAT, APPLICATION, and REGION |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

3M Company, Avery Dennison Corporation, Brady Corporation, Cenveo Corporation, Clondalkin Group, Constantia, Fort Dearborn Company, Fuji Seal International Inc, Mondi Group, Multi Packaging Solutions |

This research report on the Ingredient Labelling Technology Market has been segmented and sub-segmented based on Printing type, Label Format, Application and By Region.

INGREDIENT LABELLING TECHNOLOGY MARKET – BY PRINTING TYPE

- Flexographic

- Digital, Gravure

- Lithographic

- Screen

- Others

Based on printing type, the Ingredient Labelling Technology market is segmented into Flexographic, Digital, Gravure, Lithographic and Screen among others. In terms of revenue, the lithographic category had a significant portion of the market in 2021. Due to a combination of excellent prints and effectiveness in large-scale projects, the segment is anticipated to have significant expansion throughout the projection period. Additionally, flat materials including fabric, foil, paper, plastic, and flat cardboard are appropriate for this lithographic method.

Gravure printing is also a major contributor the market growth. Photographs may be printed using gravure printing inks, which can also be used to print on paper cups, thin papers, films, and metal foils. In this procedure, "liquid inks" are used. These printing technologies may be used to produce a wide range of applications for food packaging, tobacco products, and cosmetics on a range of substrates, including cardboard, paper, plastic, foil, and labels.

On a variety of substrates, including paper, laminates, films, foils, and corrugated cardboard, flexographic inks can be used. Due to their affordability and eco-friendliness, these inks are predicted to rise significantly throughout the projected period. Additionally, the requirement for flexographic ink in the United States and other European nations is aided by the rising need for flexible packaging and cardboard printing by logistical volume.

INGREDIENT LABELLING TECHNOLOGY MARKET – BY LABEL FORMAT

- Wet-glue Labels

- Pressure-sensitive Labels

- Linerless Labels

- Multi-part tracking Labels

- Sleeves

- In-mold Labels

Based on label format, the Ingredient Labelling Technology market is segmented into Wet-glue Labels, Pressure-sensitive Label, Linerless Label, Multi-part tracking Labels, In-mold Labels and Sleeves. In-mold labels, which are made from plastic films printed using a variety of printing processes, will be in high demand over the anticipated time. The movie is edited to give the Label's necessary framework. The Label may be found within the mold that is being used to industrialize the container. Because there is no post-Labelling process involved with in-mold labelling, time and effort are saved.

INGREDIENT LABELLING TECHNOLOGY MARKET - BY APPLICATION

- Food

- Beverage

- Healthcare

- Cosmetics

- Household

- Industrial

Based on label format, the Ingredient Labelling Technology market is segmented into Food, Beverage, Healthcare, Cosmetics, Household and Industrial. According to projections, the food business will have the largest market share of any. Modern retail trade venues, including supermarkets and convenience stores, which may contain a broader variety of frozen food goods, are becoming more widely used as the world economies develop. According to the Organization for Economic Co-operation and Development (OECD), sales of frozen and packaged foods have risen in several emerging nations. In 2021, it led the package printing market with a market share of $22,526.62 million. The advancement of packaging styles to support the food industry has been made possible by a variety of variations, including personalized or unique labelling for chocolates or beers, distinctive designs during holiday seasons, graphical designs or pictures, creative labels, and many more. Some of the key package elements printed in glass, cardboard, or plastic that are intended to enhance brand promotion and draw in more customers include the incorporation of holograms, emphasizing product advantages, nutritional charts, environmental effects, and so forth. To provide customers with comprehensive, convenient product information that is simple to study via a smartphone and thus increases customer attention, the development of smart packaging labels, such as scannable QR codes, NFC chips, and others, has emerged as a crucial factor for the food and beverage industry.

A dairy firm in Central America debuted enhanced, high-protein milk in 2020 and ran a marketing utilizing packaging to integrate and inform consumers. These milk sachets have a special DM code on the carton that, when scanned, invites the customer to download an app so they may join a drawing for cash prizes. Additionally, this app aids in promoting the health and welfare of the users by offering recipes, health advice, product advantages, packaging details, and other information. This is thought to enhance the company's long-term sales development before better-printed packaging.

INGREDIENT LABELLING TECHNOLOGY MARKET - BY REGION

- North America

- Europe

- The Asia Pacific

- Latin America

- The Middle East

- Africa

By region, the Ingredient Labelling Technology Market is grouped into North America, Europe, Asia Pacific, Latin America, The Middle East and Africa. The ingredient labelling market was dominated by the Asia Pacific, which in 2021 had the biggest revenue share (35.6%). In 2021, Asia Pacific led the worldwide market, and it is anticipated to continue with this trend throughout the forecast period. The region's market growth has been influenced favorably by rising packaged food consumption as well as the packaging and labelling industry's rapid expansion as a result of the emergence of numerous businesses, including the food & beverage industry, and consumer goods industry, health care sector, and e-commerce.

INGREDIENT LABELLING TECHNOLOGY MARKET - BY COMPANIES

Some of the major players operating in the Ingredient Labelling Technology Market include:

- 3M Company

- Avery Dennison Corporation

- Brady Corporation

- Cenveo Corporation

- Clondalkin Group

- Constantia, Fort Dearborn Company

- Fuji Seal International Inc

- Mondi Group

- Multi Packaging Solutions

NOTABLE HAPPENING IN THE INGREDIENT LABELLING TECHNOLOGY MARKET

APPROVAL- April 2021 marked the achievement by Neenah Inc. of nine validated U.S. Department of Agriculture (USDA) Certified Biobased Products in its array of durable label solutions, demonstrating the company's dedication to sustainability initiatives. Various DISPERSA, ENDURA, and PREVAIL durable label and board products have obtained the right to display a distinctive USDA label indicating their biobased content ranging from 68-99% thanks to this third-party verification.

ACQUISITION- In March 2021, Fort Dearborn bought Hammer Package Corporation. By utilizing Hammer's technology, Fort Dearborn will be able to significantly increase the company's capacity, capabilities, and global reach while strengthening its position in the decorative label and packaging industry.

PRODUCT LAUNCH- EverLiner Labelite and EverLiner M R, two new paper-based sustainable EverLiner products from Mondi Group that are made from recycled and lightweight materials, were introduced in February 2021. They offer more environmentally friendly answers to a variety of problems.

Chapter 1. Ingredient Labelling Technology Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Ingredient Labelling Technology Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2024 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. Ingredient Labelling Technology Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Ingredient Labelling Technology Market Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Ingredient Labelling Technology Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Ingredient Labelling Technology Market – By Printing Type

6.1. Flexographic

6.2. Digital, Gravure

6.3. Lithographic

6.4. Screen

6.5. Others

Chapter 7. Ingredient Labelling Technology Market – By Label Format

7.1. Wet-glue Labels

7.2. Pressure-sensitive Labels

7.3. Linerless Labels

7.4. Multi-part tracking Labels

7.5. Sleeves

7.6. In-mold Labels

Chapter 8. Ingredient Labelling Technology Market – By Application

8.1. Food

8.2. Beverage

8.3. Healthcare

8.4. Cosmetics

8.5. Household

8.6. Industrial

Chapter 9. Ingredient Labelling Technology Market- By Region

9.1. North America

9.2. Europe

9.3. Asia-Pacific

9.4. Latin America

9.5. The Middle East

9.6. Africa

Chapter 10. Ingredient Labelling Technology Market – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

10.1. 3M Company

10.2. Avery Dennison Corporation

10.3. Brady Corporation

10.4. Cenveo Corporation

10.5. Clondalkin Group

10.6. Constantia, Fort Dearborn Company

10.7. Fuji Seal International Inc

10.8. Mondi Group

10.9. Multi Packaging Solutions

Download Sample

Choose License Type

2500

4250

5250

6900