Infusion Therapy Devices Market Size (2025–2030)

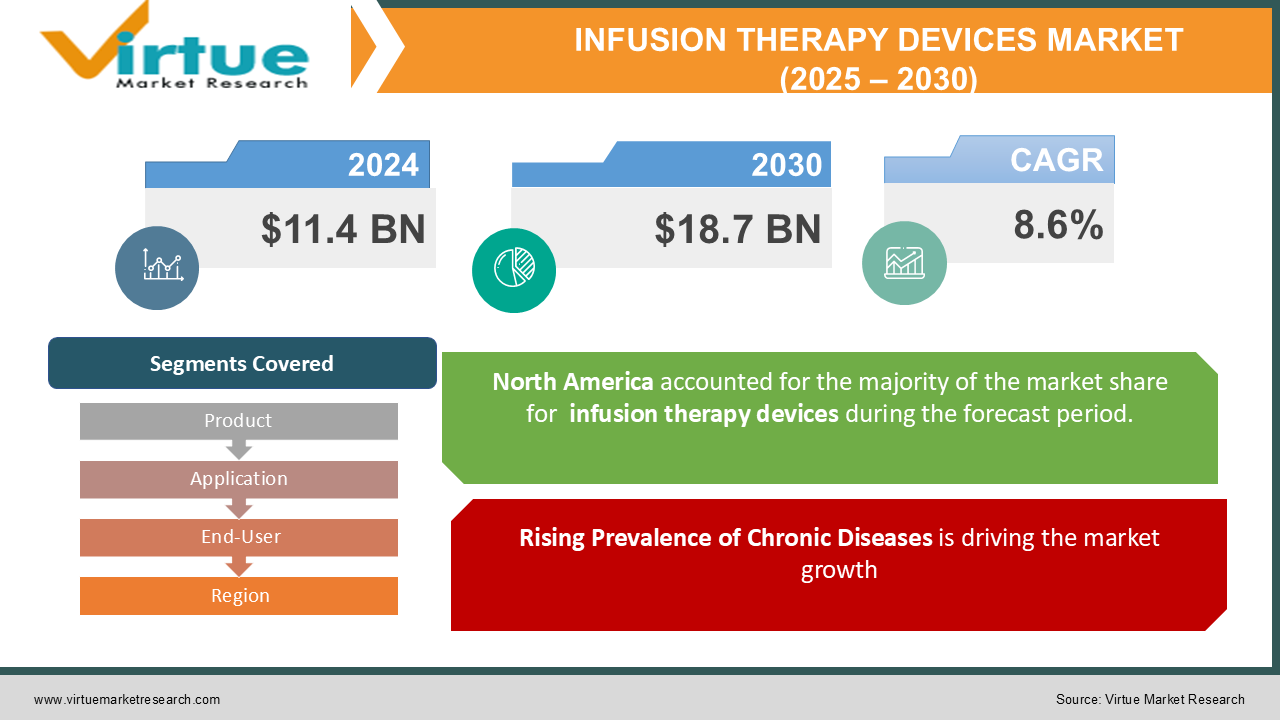

The Global Infusion Therapy Devices Market was valued at USD 11.4 billion in 2024 and is projected to reach USD 18.7 billion by 2030, growing at a CAGR of 8.6% during the forecast period (2025–2030).

Infusion therapy devices are vital medical tools used to deliver fluids, medications, and nutrients directly into a patient’s circulatory system. They are widely used in the treatment of chronic diseases, surgical procedures, and emergency care.

The growth of the market is attributed to the increasing prevalence of chronic diseases like diabetes and cancer, rising demand for ambulatory infusion pumps, and advancements in healthcare infrastructure. Additionally, technological innovations, including smart infusion pumps with advanced safety features, are further propelling market growth.

Key Market Insights

-

Infusion pumps dominate the product segment, accounting for over 45% of the revenue share in 2024 due to their widespread application in chronic disease management.

-

Oncology emerged as the largest application segment, driven by the rising incidence of cancer globally and the increasing use of chemotherapy.

-

Hospitals remain the leading end-user segment, capturing over 55% of the market share, supported by the need for complex and precise medication delivery.

-

North America holds the largest market share, owing to advanced healthcare infrastructure and high adoption rates of innovative technologies.

-

Emerging markets in Asia-Pacific are witnessing robust growth due to rising healthcare spending and increasing awareness of infusion therapy benefits.

-

The shift toward home healthcare is boosting the demand for portable and user-friendly infusion devices, particularly among geriatric populations.

Global Infusion Therapy Devices Market Drivers

1. Rising Prevalence of Chronic Diseases is driving the market growth

The increasing incidence of chronic diseases such as diabetes, cancer, and cardiovascular disorders is a major driver of the infusion therapy devices market. According to the World Health Organization (WHO), non-communicable diseases account for over 70% of global deaths annually, necessitating effective treatment solutions.

Infusion therapy devices play a critical role in managing these conditions by ensuring precise delivery of medications, nutrients, and fluids. As chronic diseases require long-term treatment, the demand for reliable and efficient infusion devices continues to grow.

2. Advancements in Infusion Device Technology is driving the market growth

Technological advancements in infusion devices are significantly driving market growth. Innovations such as smart infusion pumps equipped with drug libraries, dose error reduction systems, and wireless connectivity are enhancing patient safety and treatment efficiency.

Moreover, the development of portable and wearable infusion pumps has revolutionized home healthcare, enabling patients to receive treatment in the comfort of their homes. These advancements are not only improving patient outcomes but also expanding the application scope of infusion therapy devices.

3. Growing Preference for Home Healthcare is is driving the market growth

The shift toward home healthcare is a notable trend fueling the demand for infusion therapy devices. With the rising geriatric population and the need to reduce hospital stays, home-based care is gaining traction globally.

Infusion devices designed for home use, such as portable pumps, are enabling patients to manage chronic conditions more effectively. This trend is particularly significant in developed countries, where healthcare systems are focusing on reducing costs and enhancing patient convenience.

Global Infusion Therapy Devices Market Challenges and Restraints

1. High Costs of Infusion Devices and Treatment is restricting the market growth

The high cost of advanced infusion therapy devices poses a significant barrier to market growth. Smart infusion pumps, which offer enhanced safety and functionality, are often expensive, making them less accessible to low-income populations and smaller healthcare facilities.

Additionally, the cost of maintaining and servicing these devices adds to the financial burden. While the benefits of infusion therapy are well-recognized, cost-related challenges may limit their widespread adoption, particularly in developing regions.

2. Risks Associated with Infusion Therapy is restricting the market growth

Despite their effectiveness, infusion therapy devices are not without risks. Complications such as infections, air embolism, and incorrect dosage delivery can occur, leading to adverse patient outcomes. These risks are often associated with improper device use or lack of training among healthcare professionals.

Manufacturers are addressing these concerns by incorporating advanced safety features into their devices. However, ensuring proper training and adherence to guidelines remains crucial for minimizing risks and enhancing the adoption of infusion therapy devices.

Market Opportunities

The infusion therapy devices market presents significant growth opportunities, particularly in emerging economies where healthcare infrastructure is improving. As governments and private organizations invest in modernizing healthcare systems, the adoption of advanced medical devices, including infusion therapy systems, is expected to rise.

Additionally, the integration of infusion devices with electronic health records (EHR) offers opportunities for seamless data management and improved patient care. This feature is gaining popularity in developed regions, where healthcare providers prioritize interoperability and data-driven decision-making.

Moreover, the growing demand for personalized medicine and precision drug delivery is driving innovation in infusion device design. Manufacturers focusing on developing user-friendly, portable, and intelligent devices are well-positioned to capitalize on the expanding market opportunities.

INFUSION THERAPY DEVICES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

8.6% |

|

Segments Covered |

By Product, Application, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Becton, Dickinson and Company (BD), Baxter International Inc., ICU Medical, Inc., Fresenius Kabi AG, Smiths Medical, Medtronic plc, B. Braun Melsungen AG, Terumo Corporation, Nipro Corporation, Hospira, Inc. |

Infusion Therapy Devices Market Segmentation - By Product

-

Infusion Pumps

-

Intravenous (IV) Sets

-

Cannulas

-

Needleless Connectors

Infusion pumps are the largest segment, owing to their extensive use in chronic disease management and surgical procedures. Their ability to deliver precise and controlled medication doses makes them indispensable in healthcare.

Infusion Therapy Devices Market Segmentation - By Application

-

Oncology

-

Diabetes

-

Pain Management

-

Others

Oncology stands as the dominant application segment within the infusion therapy market, driven by the escalating incidence of cancer worldwide and the increasing reliance on infusion therapy for the delivery of chemotherapy and pain management medications. Chemotherapy, a cornerstone treatment for various cancer types, often requires intravenous administration to ensure precise dosing and optimal therapeutic efficacy. Infusion therapy provides a reliable and controlled method for delivering these potent drugs, minimizing systemic side effects and maximizing their effectiveness. Moreover, the growing complexity of cancer treatments and the emergence of targeted therapies have further solidified the role of infusion therapy in oncology. Many novel cancer drugs, such as monoclonal antibodies and immunotherapy agents, necessitate intravenous administration due to their intricate mechanisms of action and the need for precise dosing. Additionally, infusion therapy plays a crucial role in managing cancer-related pain and other symptoms. Pain medications, such as opioids and non-opioid analgesics, can be administered intravenously to provide rapid relief and improve patient comfort. As the global cancer burden continues to rise, coupled with advancements in cancer research and treatment, the demand for infusion therapy within the oncology setting is projected to remain robust, driving significant growth in the overall infusion therapy market.

Infusion Therapy Devices Market Segmentation - By End-User

-

Hospitals

-

Home Healthcare

-

Ambulatory Surgical Centers

Hospitals continue to dominate the infusion therapy market, driven by the increasing complexity of treatments and the need for specialized care. These institutions possess the infrastructure, expertise, and resources to manage intricate infusion regimens, particularly for critically ill patients requiring intensive care. The availability of highly skilled healthcare professionals, including physicians, nurses, and pharmacists, is a key factor contributing to the dominance of hospitals. These professionals possess the knowledge and experience to administer complex infusions safely and effectively, monitor patient responses, and make necessary adjustments to treatment plans. Additionally, hospitals often have dedicated infusion centers staffed by specialized nurses, ensuring consistent and high-quality care.

Infusion Therapy Devices Market Segmentation - By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

North America dominates the global infusion therapy devices market, holding over 40% of the revenue share in 2024. The region’s leadership is attributed to advanced healthcare infrastructure, high healthcare spending, and the widespread adoption of innovative medical technologies. The United States is the largest market within the region, driven by the increasing prevalence of chronic diseases and a well-established reimbursement framework.

Asia-Pacific is the fastest-growing region, driven by rising healthcare awareness, increasing investments in healthcare infrastructure, and the growing prevalence of chronic diseases. Countries like China and India are witnessing significant market expansion due to their large patient populations and improving access to healthcare services.

COVID-19 Impact Analysis

The COVID-19 pandemic had a profound impact on the global infusion therapy devices market. During the initial phase, the demand for infusion pumps surged as hospitals struggled to manage critically ill patients requiring continuous medication delivery. Infusion devices played a vital role in administering fluids, drugs, and nutritional support to COVID-19 patients. However, the pandemic also disrupted supply chains and manufacturing activities, leading to temporary shortages of medical devices. Despite these challenges, the long-term impact of COVID-19 on the infusion therapy devices market has been largely positive. The pandemic highlighted the importance of robust healthcare infrastructure and the need for advanced medical devices, driving investment and innovation in the sector.

Latest Trends/Developments

The adoption of smart infusion pumps with advanced safety features, such as drug libraries and dose error reduction systems, is on the rise. These technologies are enhancing patient safety and treatment efficiency by automating tasks, reducing the risk of medication errors, and providing real-time monitoring of infusion parameters. This integration allows for precise drug delivery, minimizes waste, and optimizes treatment outcomes. Portable and wearable infusion devices are gaining popularity, particularly in home healthcare settings. These devices offer convenience and flexibility, allowing patients to maintain their daily routines while receiving treatment. By eliminating the need for frequent hospital visits, these devices improve patient quality of life and reduce healthcare costs. Additionally, portable infusion pumps are equipped with advanced features such as wireless connectivity, remote monitoring, and automated alerts, ensuring patient safety and adherence to treatment plans. The integration of infusion therapy devices with telehealth platforms is emerging as a key trend, enabling remote monitoring and improved patient management. By connecting patients with healthcare providers through virtual consultations, telehealth solutions facilitate timely intervention, reduce hospitalizations, and enhance patient satisfaction. These solutions often incorporate remote monitoring capabilities, allowing healthcare professionals to track infusion parameters, identify potential issues, and provide timely adjustments to treatment plans. Manufacturers are focusing on developing eco-friendly infusion devices to reduce medical waste and support environmental sustainability. By incorporating recyclable materials, energy-efficient components, and minimizing packaging, these devices contribute to a more sustainable healthcare industry. Additionally, some manufacturers are developing devices with extended battery life, reducing the need for frequent battery replacements and minimizing electronic waste.

Key Players

-

Becton, Dickinson and Company (BD)

-

Baxter International Inc.

-

ICU Medical, Inc.

-

Fresenius Kabi AG

-

Smiths Medical

-

Medtronic plc

-

B. Braun Melsungen AG

-

Terumo Corporation

-

Nipro Corporation

-

Hospira, Inc.

Chapter 1. Infusion Therapy Devices Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Infusion Therapy Devices Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Infusion Therapy Devices Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Infusion Therapy Devices Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Infusion Therapy Devices Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Infusion Therapy Devices Market – By Product

6.1 Introduction/Key Findings

6.2 Infusion Pumps

6.3 Intravenous (IV) Sets

6.4 Cannulas

6.5 Needleless Connectors

6.6 Y-O-Y Growth trend Analysis By Product

6.7 Absolute $ Opportunity Analysis By Product, 2025-2030

Chapter 7. Infusion Therapy Devices Market – By Application

7.1 Introduction/Key Findings

7.2 Oncology

7.3 Diabetes

7.4 Pain Management

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Infusion Therapy Devices Market – By End-User

8.1 Introduction/Key Findings

8.2 Hospitals

8.3 Home Healthcare

8.4 Ambulatory Surgical Centers

8.5 Y-O-Y Growth trend Analysis By End-User

8.6 Absolute $ Opportunity Analysis By End-User, 2025-2030

Chapter 9. Infusion Therapy Devices Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product

9.1.3 By Application

9.1.4 By End-User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product

9.2.3 By Application

9.2.4 By End-User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product

9.3.3 By Application

9.3.4 By End-User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product

9.4.3 By Application

9.4.4 By End-User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product

9.5.3 By Application

9.5.4 By End-User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Infusion Therapy Devices Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Becton, Dickinson and Company (BD)

10.2 Baxter International Inc.

10.3 ICU Medical, Inc.

10.4 Fresenius Kabi AG

10.5 Smiths Medical

10.6 Medtronic plc

10.7 B. Braun Melsungen AG

10.8 Terumo Corporation

10.9 Nipro Corporation

10.10 Hospira, Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market was valued at USD 11.4 billion in 2024 and is projected to reach USD 18.7 billion by 2030, with a CAGR of 8.6%.

Key drivers include the rising prevalence of chronic diseases, technological advancements, and the growing preference for home healthcare.

Segments include Product (Infusion Pumps, IV Sets, Cannulas, Needleless Connectors), Application (Oncology, Diabetes, Pain Management), and End-User (Hospitals, Home Healthcare, Ambulatory Surgical Centers).

North America dominates, accounting for over 40% of the market share, driven by advanced healthcare infrastructure and high adoption of innovative technologies.

Leading players include Becton, Dickinson and Company, Baxter International Inc., ICU Medical, Inc., and others.