Infrastructure as Code Market Size (2024-2030)

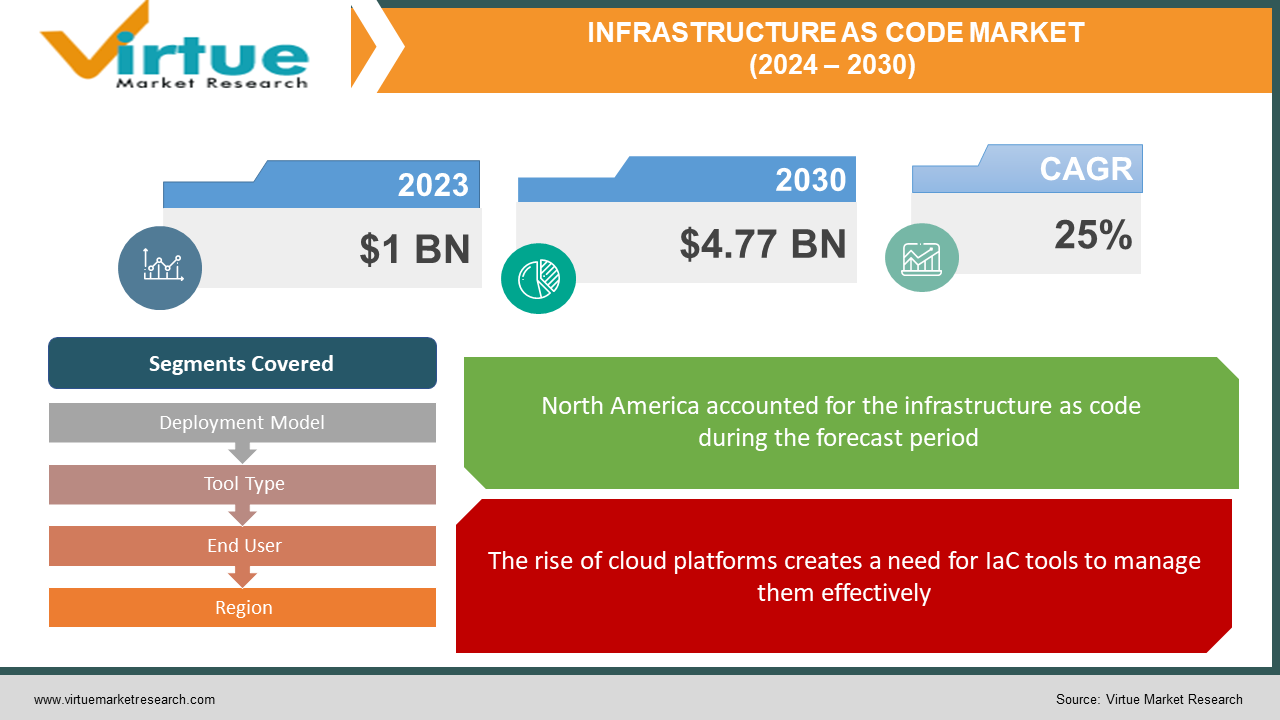

The Infrastructure as Code Market was valued at USD 1billion in 2023 and is projected to reach a market size of USD 4.77 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 25%.

Fueled by the rise of cloud computing and the need for automation, the Infrastructure as Code (IaC) market is booming. IaC empowers businesses to define and provision infrastructure through code, enabling faster, more consistent, and repeatable deployments. This translates to several key benefits: streamlined infrastructure management saving time and resources, consistent configurations minimizing errors, and faster deployment of new infrastructure for a competitive edge. As IT environments become more complex, IaC plays a vital role, and with the emergence of innovative tools and services, the IaC market is poised for continued growth as businesses increasingly leverage automation and cloud technologies.

Key Market Insights:

The Infrastructure as Code (IaC) market is experiencing a boom, driven by the rise of cloud computing and the ever-present need for automation. This translates to significant benefits for businesses. IaC allows them to define and provision infrastructure through code, enabling faster, more consistent, and repeatable deployments. This not only streamlines the process but also minimizes errors by ensuring consistent configurations across deployments. Additionally, IaC automates many infrastructure management tasks, freeing up valuable IT resources for more strategic work.

IaC offers a clear advantage in agility as well. Businesses can deploy new infrastructure quickly and easily with IaC, allowing them to respond faster to changing market demands and stay ahead of the competition. As the IaC market matures, we see a constant stream of innovative tools and services emerge, providing businesses with a wider range of options to meet their specific needs. This continuous innovation ensures IaC remains a relevant and powerful solution for managing infrastructure in today's dynamic IT landscape.

However, with IaC's growing popularity, security considerations have become paramount. Businesses need to implement robust security measures to protect their IaC pipelines and configurations from vulnerabilities. Additionally, seamless integration with other DevOps tools and platforms is essential for a smooth and efficient workflow. This allows for a holistic approach to infrastructure management, ensuring not only speed and efficiency but also security and reliability.

The Infrastructure as Code Market Drivers:

The rise of cloud platforms creates a need for IaC tools to manage them effectively.

The widespread adoption of cloud platforms like AWS, Azure, and Google Cloud Platform (GCP) has created a surge in demand for IaC tools. IaC seamlessly integrates with these platforms, allowing for automated provisioning and management of cloud infrastructure. This simplifies the process and reduces the risk of errors compared to manual configuration.

IaC automates infrastructure tasks, freeing up IT staff and minimizing misconfigurations.

IT infrastructure is becoming increasingly complex, making manual management time-consuming and prone to errors. IaC automates many infrastructure management tasks, such as provisioning servers, creating networks, and configuring security settings. This frees up IT staff to focus on higher-level tasks and strategic initiatives.

IaC scripts guarantee consistent configurations across deployments, leading to a more predictable IT environment.

IaC scripts define infrastructure as code, ensuring consistent configurations across deployments. This reduces the risk of errors and configuration drift, leading to a more reliable and predictable IT environment. Consistency also simplifies troubleshooting and maintenance tasks.

Businesses can deploy infrastructure faster with IaC, allowing them to respond swiftly to market changes.

With IaC, businesses can deploy new infrastructure quickly and easily. They can define the infrastructure requirements in code and automate the entire deployment process. This agility allows businesses to respond faster to changing market demands and get new products or services to market quicker.

IaC aligns with DevOps practices, facilitating collaboration and streamlining infrastructure management.

DevOps practices emphasize collaboration between development and operations teams. IaC aligns perfectly with DevOps principles by providing a way to automate infrastructure provisioning and configuration. This collaboration and automation lead to faster development cycles and more efficient deployments.

The Infrastructure as Code Market Restraints and Challenges:

Despite its growth, the IaC market faces hurdles that can slow down wider adoption and optimal use. Security is a prime concern. Since IaC defines infrastructure through code, vulnerabilities in the code or configuration can be exploited. Businesses need robust security measures across the entire IaC pipeline.

Another challenge is the skills gap. Widespread IaC adoption demands a workforce comfortable with coding and IaC tools. Businesses may need to invest in training or hire personnel with this expertise. Integrating IaC tools with existing DevOps workflows can also be complex. Ensuring smooth communication and data flow between these systems is crucial for efficient workflows.

Vendor lock-in is another potential pitfall. Some IaC tools are designed for specific cloud platforms, potentially limiting businesses to a single vendor and hindering flexibility. Evaluating vendor-neutral options or IaC tools offering multi-cloud support can help mitigate this risk.

Finally, managing IaC complexity can be an issue as adoption grows. Businesses juggling IaC scripts across various environments need to implement version control, code review practices, and proper documentation for effective IaC governance. Addressing these challenges will ensure IaC reaches its full potential and empowers businesses to manage infrastructure efficiently.

The Infrastructure as Code Market Opportunities:

The IaC market brims with potential for both businesses and technology providers. Security remains a primary concern, opening doors for companies offering robust security solutions specifically designed for IaC pipelines. This includes vulnerability scanning tools, secure code review practices, and integration with security systems. Managing complex IaC environments becomes a challenge as adoption grows. Tools and services that simplify IaC management, like version control automation and configuration drift detection, will be highly sought after. Additionally, solutions that facilitate collaboration and knowledge sharing among IaC teams will be valuable.

The rise of multi-cloud and hybrid cloud environments presents an opportunity for vendors who can provide robust multi-cloud support within their IaC solutions. Integration with emerging technologies like AI and machine learning is another exciting prospect. AI-powered IaC tools can automate tasks like infrastructure configuration optimization and resource provisioning, further enhancing efficiency.

Finally, IaC adoption is expected to grow across various industries. Opportunities exist for developing specialized IaC tools and best practices tailored to the unique needs of specific sectors, such as healthcare or finance. This customization can further drive IaC adoption within these industries, ensuring the IaC market thrives and empowers businesses to manage their infrastructure with greater efficiency, security, and agility.

INFRASTRUCTURE AS CODE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

25% |

|

Segments Covered |

By Deployment Model, Tool Type, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform (GCP), HashiCorp (Terraform), Red Hat (Ansible), IBM, Oracle, Puppet, Chef, ServiceNow, Broadcom |

Infrastructure as Code Market Segmentation: By Deployment Model

-

On-Premises

-

Cloud-Based

-

Hybrid

The dominant segment in the IaC deployment model is Cloud-Based. Its scalability and elimination of on-premises infrastructure management overhead make it popular. However, the fastest-growing segment is also Cloud-Based. This is driven by the increasing adoption of cloud computing and the need for businesses to automate and manage their cloud infrastructure effectively.

Infrastructure as Code Market Segmentation: By Tool Type

-

Configuration Management Tools

-

Configuration Orchestration Tools

Within the IaC tool type sector, Configuration Management tools like Ansible and Chef hold the dominant market share, catering to individual server and network device configuration. However, Configuration Orchestration tools like Terraform and AWS CloudFormation are experiencing the fastest growth. This surge is driven by their ability to manage the entire infrastructure provisioning and configuration workflow, streamlining complex deployments and integrating seamlessly with cloud platforms.

Infrastructure as Code Market Segmentation: By End User

-

Information Technology (IT)

-

DevOps Teams

-

Line of Business (LOB)

The dominant segment in the IaC market by End User is Information Technology (IT) departments, who leverage IaC for automating and managing infrastructure. However, the Line of Business (LOB) segment is experiencing the fastest growth. As businesses strive for agility, LOBs are increasingly adopting user-friendly IaC tools to manage their own infrastructure needs, reducing reliance on IT teams.

Infrastructure as Code Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America: North America currently reigns supreme in the IaC market, boasting the largest market share. This dominance can be attributed to two key factors. Firstly, several major IaC tool providers like HashiCorp and Red Hat have their roots in North America, fostering a strong ecosystem and early adoption of IaC solutions. Secondly, North American businesses have a high concentration of advanced cloud adoption, creating a fertile ground for IaC implementation to manage this complex infrastructure.

Europe: The European IaC market demonstrates consistent growth, fueled by a rise in IT spending focused on infrastructure automation. As businesses across Europe navigate digital transformation initiatives, the efficiency and consistency offered by IaC solutions become increasingly attractive. This trend, coupled with government support for digitalization efforts, is paving the way for a stable and growing IaC market in the region.

Asia-Pacific: The Asia-Pacific region boasts the fastest growth rate in the IaC market. This rapid expansion is driven by several factors. The rapid proliferation of cloud services across the region creates a strong foundation for IaC adoption. Additionally, increasing internet connectivity and a burgeoning IT talent pool, particularly in countries like China and India, contribute to the swift embrace of IaC technologies. As businesses in Asia-Pacific strive for agility and efficiency, IaC is poised to become a critical tool for managing their expanding infrastructure needs.

South America: The South American IaC market, although smaller compared to other regions, holds promising growth potential. Growing awareness of the benefits associated with IaC, such as automation and faster deployments, is fueling interest in this technology. Furthermore, increased investments in cloud technologies across South American businesses are creating a favorable environment for IaC adoption. With these trends in motion, the IaC market in South America is expected to witness significant growth in the coming years.

Middle East and Africa: The Middle East and Africa represent the nascent stages of IaC adoption. However, there are positive signs for future growth. Governments across the region are actively promoting digitalization efforts and investing in infrastructure development. This increased focus on technology, coupled with growing awareness of IaC benefits, is expected to accelerate IaC adoption in this region. As the Middle East and Africa embrace cloud technologies and automation becomes a priority, the IaC market is poised for significant expansion in the years to come.

COVID-19 Impact Analysis on the Infrastructure as Code Market:

The COVID-19 pandemic, while disruptive to many sectors, surprisingly had a positive impact on the IaC market. Lockdowns and remote work demands forced businesses to migrate workloads to the cloud for employee access. IaC played a starring role by automating and streamlining cloud infrastructure provisioning, enabling a smooth transition to remote work.

Furthermore, the pandemic exposed vulnerabilities in businesses lacking digital resilience. IaC's ability to automate infrastructure management and expedite deployments became even more valuable. Businesses utilized IaC to adapt to rapidly changing market demands and maintain operational continuity. Additionally, the pandemic accelerated cloud adoption as companies sought scalability and remote access to resources. IaC's seamless integration with cloud platforms further fueled its adoption alongside the cloud migration trend.

While there were challenges like potential delays due to supply chain disruptions for hardware and software, the overall impact of COVID-19 on the IaC market was positive. The pandemic underscored the importance of automation, agility, and cloud adoption – areas where IaC shines. This resulted in a significant acceleration of IaC adoption across industries, solidifying its position as a critical tool for modern infrastructure management.

Latest Trends/ Developments:

The IaC market is abuzz with exciting developments. Security remains a prime focus, with new tools emerging for vulnerability scanning, secure code review, and SIEM integration within IaC pipelines. Immutable infrastructure, where deployments are treated as unchangeable versions, is gaining traction due to its security benefits and ease of IaC management. Additionally, IaC tools are increasingly integrating with GitOps workflows, providing a familiar and collaborative environment for developers and operations teams.

Furthermore, low-code/no-code IaC solutions are on the rise, empowering users with less coding experience through drag-and-drop interfaces and pre-built templates. This trend allows businesses to democratize IaC and involve non-technical users in infrastructure management. IaC's applications are expanding beyond just provisioning servers and networks, now encompassing security configurations, application deployment, and even edge computing environments.

The growing adoption of multi-cloud and hybrid cloud environments necessitates IaC tools that offer seamless integration and management across various platforms. Finally, AI and machine learning are poised to revolutionize IaC. AI-powered tools can automate tasks like infrastructure configuration optimization, resource provisioning, and anomaly detection, leading to greater efficiency and security. These trends signify the continuous evolution of the IaC market, paving the way for a future of simpler, more secure, and agile infrastructure management.

Key Players:

-

Amazon Web Services (AWS)

-

Microsoft Azure

-

Google Cloud Platform (GCP)

-

HashiCorp (Terraform)

-

Red Hat (Ansible)

-

IBM

-

Oracle

-

Puppet

-

Chef

-

ServiceNow

-

Broadcom

Chapter 1. Infrastructure as Code Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Infrastructure as Code Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Infrastructure as Code Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Infrastructure as Code Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Infrastructure as Code Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Infrastructure as Code Market – By Deployment Model

6.1 Introduction/Key Findings

6.2 On-Premises

6.3 Cloud-Based

6.4 Hybrid

6.5 Y-O-Y Growth trend Analysis By Deployment Model

6.6 Absolute $ Opportunity Analysis By Deployment Model, 2024-2030

Chapter 7. Infrastructure as Code Market – By Tool Type

7.1 Introduction/Key Findings

7.2 Configuration Management Tools

7.3 Configuration Orchestration Tools

7.4 Y-O-Y Growth trend Analysis By Tool Type

7.5 Absolute $ Opportunity Analysis By Tool Type, 2024-2030

Chapter 8. Infrastructure as Code Market – By End-Use Industry

8.1 Introduction/Key Findings

8.2 Information Technology (IT)

8.3 DevOps Teams

8.4 Line of Business (LOB)

8.5 Y-O-Y Growth trend Analysis By End-Use Industry

8.6 Absolute $ Opportunity Analysis By End-Use Industry, 2024-2030

Chapter 9. Infrastructure as Code Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Deployment Model

9.1.3 By Tool Type

9.1.4 By End-Use Industry

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Deployment Model

9.2.3 By Tool Type

9.2.4 By End-Use Industry

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Deployment Model

9.3.3 By Tool Type

9.3.4 By End-Use Industry

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Deployment Model

9.4.3 By Tool Type

9.4.4 By End-Use Industry

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Deployment Model

9.5.3 By Tool Type

9.5.4 By End-Use Industry

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Infrastructure as Code Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Amazon Web Services (AWS)

10.2 Microsoft Azure

10.3 Google Cloud Platform (GCP)

10.4 HashiCorp (Terraform)

10.5 Red Hat (Ansible)

10.6 IBM

10.7 Oracle

10.8 Puppet

10.9 Chef

10.10 ServiceNow

10.11 Broadcom

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Infrastructure as Code Market was valued at USD 1 billion in 2023 and is projected to reach a market size of USD 4.77 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 25%.

Rise of Cloud Computing, Need for Automation, Improved Consistency and Repeatability, Increased Agility and Time to Market, Growing Adoption of DevOps.

Configuration Management Tools, Configuration Orchestration Tools.

North America holds the dominant position in the Infrastructure as Code market due to a high concentration of major IaC tool providers and advanced cloud adoption.

Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform (GCP), HashiCorp (Terraform), Red Hat (Ansible), IBM, Oracle, Puppet, Chef, ServiceNow, Broadcom.