Infant Formula Milk Powder Market Size (2024 – 2030)

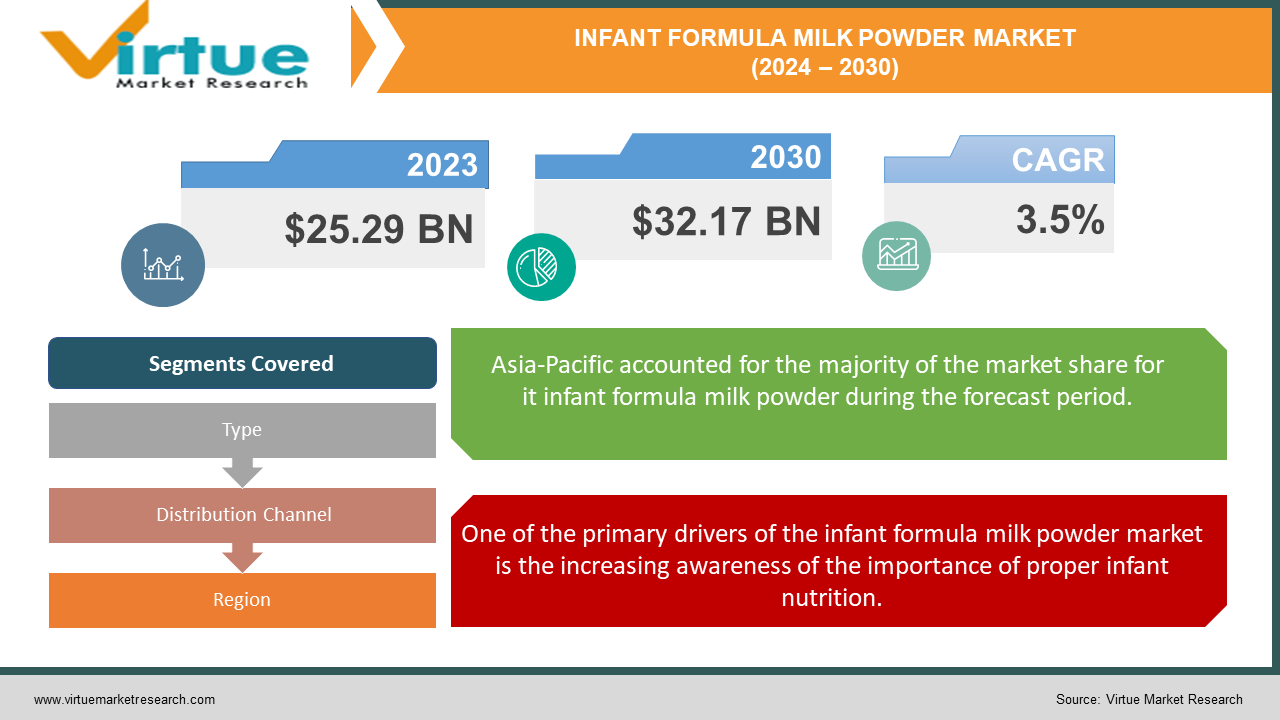

The Global Infant Formula Milk Powder Market was valued at USD 25.29 Billion in 2023 and is projected to reach a market size of USD 32.17 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 3.5%.

The global infant formulation milk powder market is witnessing strong growth pushed by using increasing call for convenient and nutritious feeding alternatives for infants. This marketplace incorporates various sorts of toddler formula powders that cater to the dietary wishes of toddlers who are not breastfed or require supplemental feeding. The expansion of the market is fueled via numerous factors along with rising beginning quotes, increasing attention approximately toddler nutrition and growing disposable earning in emerging economies. It serves alternatively or supplement to breast milk and gives crucial nutrients required for the growth and improvement of toddlers. The market is segmented into differing types based totally on the specific wishes of babies, which includes infant method, follow-on formula and forte formulation for babies with unique nutritional wishes or medical situations.

Key Market Insights:

The demand for organic infant formula is projected to grow at a CAGR exceeding 10% by 2026, driven by increasing parental preference for natural and clean-label ingredients.

Cow's milk-based formula remains the most popular type, but goat milk and soy-based formulas are gaining traction due to perceived health benefits or catering to specific dietary needs.

Ready-to-feed formula accounts for roughly 40% of the market share, with parents appreciating its convenience and ease of use. However, powder formula is still preferred in some regions due to its longer shelf life and lower cost.

E-commerce platforms are capturing a growing share of infant formula sales, offering convenience and wider product selection for parents. Online sales are expected to reach nearly 20% of the global market by 2025.

The average annual expenditure on infant formula per child can range from USD 100 to USD 1, 000 or more, depending on the formula type, brand, and geographical location.

Nearly 50% of all infant formula sold globally caters to babies aged 0-6 months, highlighting the crucial role formula plays in the early stages of infant development.

Stringent regulations by organizations such as WHO are in place to ensure the safety and quality of infant formula. These regulations cover aspects such as ingredients, manufacturing practices, and labeling.

Around 10% of the global infant formula market is comprised of specialized formulas for babies with allergies, intolerances, or specific health conditions.

The rise of working mothers globally is a significant driver of the infant formula market, as formula provides a reliable and convenient feeding option when breastfeeding is not possible.

Infant Formula Milk Powder Market Drivers:

One of the primary drivers of the infant formula milk powder market is the increasing awareness of the importance of proper infant nutrition.

The first six months of an little one's lifestyles are vital for his or her standard fitness and development. Right nutrition for the duration of this period could have long-term consequences on a baby's bodily and cognitive growth. Formula milk powder affords an opportunity for mothers who are not able to breastfeed or need to supplement their breast milk. With improvements in studies and technology, producers at the moment are able to produce formula that intently mimics the nutritional profile of breast milk, imparting critical nutrients which includes proteins, fat, nutrients, and minerals. The function of paediatricians and healthcare vendors is also good sized in promoting the use of formula milk powder. Healthcare professionals often recommend specific sorts of formula to cope with diverse dietary wishes or scientific conditions in infants, including lactose intolerance, allergic reactions, or prematurity. As a result, mother and father are more likely to consider and use this merchandise, boosting marketplace growth.

The increasing number of working mothers globally is another significant driver of the infant formula milk powder market.

For working mothers who are unable to nurse their children all day, infant formula is an excellent alternative. This will ensure that even when you're not around, your kid gets the nutrition they need. This ease is especially important for working parents in urban areas where life moves swiftly. Furthermore, a growing number of business policies—such as maternity and breastfeeding leave—are available in different nations to benefit moms who work. However, these regulations vary by region, and in some cases, offering a sample might be a more practical approach. Many Working women prefer milk powder since it's convenient to store and carry, which fuels the market's growth.

Infant Formula Milk Powder Market Restraints and Challenges:

The high price of infant formula milk powder is one of the main barriers to the market. Infant formula can be more costly than alternative feeding options, which puts a strain on families—especially those with lower incomes—when compared to other options. The high cost of these products is a result of several factors, including production costs, raw material costs, and strict quality control procedures. A large proportion of the population in many poor nations cannot afford the high price of newborn formula milk powder. Families with little money might find it difficult to pay for the continuous cost of formula, which could result in less-than-ideal eating habits. In certain areas, the lack of government subsidies for infant feeding items or complete health insurance coverage makes this problem worse.

Infant Formula Milk Powder Market Opportunities:

The infant formula milk powder market has significant development potential in emerging regions. These factors lead to an expanding middle class with more disposable income and changing lifestyles, which include a higher rate of female employment engagement. Increased birth rates in emerging countries relative to wealthy ones are another factor driving the need for infant formula products. seize these opportunities by expanding their distribution networks, bringing production in-house, and creating products that are especially designed to meet the nutritional needs and preferences of these customers. Another big opportunity for the infant formula milk powder market is innovation in product development. Thanks to developments in nutritional science and technology, producers are now able to create formulas that closely resemble breast milk while also catering to specific dietary requirements or medical concerns. Probiotics, prebiotics, DHA, ARA, and Other bioactive substances are examples of functional additives that can improve the nutritional profile of baby formula and provide additional health advantages.

INFANT FORMULA MILK POWDER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3.5% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Nestlé S.A. (Switzerland), Danone S.A. (France), Abbott Laboratories (USA), Mead Johnson Nutrition Company (US), Friesland Campina (Netherlands), Meiji Holdings Co., Ltd. (Japan), Yili Group (China), Inner Mongolia Yili Industrial Group Co., Ltd. (China), Fonterra Co-operative Group Limited (New Zealand), Being mate Group (China), Bellamy’s Organic (Australia), Champion Laboratories |

Infant Formula Milk Powder Market Segmentation: By Type

-

Starting Formula (Stage 1)

-

Follow-on Formula (Stage 2)

-

Growing-up Formula (Stage 3)

-

Specialty Formula

About 45% of the infant formula milk powder industry is accounted for by starting formula, commonly referred to as Stage 1 formula. This dominance is explained by its vital role in giving babies and infants up to six months of age the nutrients they need. Starting formula offers a balanced combination of proteins, lipids, carbs, vitamins, and minerals that are essential for a baby's healthy growth and development. It is made to resemble the nutritional profile of breast milk. The constant birth rate in different areas guarantees a constant need for beginning formula. Since newborns need to be fed right away and in sufficient quantities, commencing formula is a necessary item for many parents.

Within the infant formula milk powder industry, specialty formula is increasing at the fastest rate, although currently having a lesser market share of about 10%. Because certain health Concerns are becoming more common in newborns and parents and healthcare professionals are becoming more aware of these problems, there is a rapidly developing need for specialist formula. Infants are increasingly being diagnosed with gastrointestinal problems, cow's milk protein allergy, and lactose intolerance. For families impacted by this condition, specialty formulas are a vital option because they are made especially to meet certain health needs.

Infant Formula Milk Powder Market Segmentation: By Distribution Channel

-

Supermarkets/Hypermarkets

-

Convenience Stores

-

Pharmacies/Drugstore

-

Online Retail

-

Others

The infant formula milk powder industry is dominated by supermarkets and hypermarkets, with a market share of more than 35%. Supermarkets and hypermarkets offer a single shopping experience and are often located well to accommodate a large number of customers. In supermarkets and supermarkets, there are a wide variety of newborn formula milk powders to suit different demands and tastes. Through these, customers can choose from a variety of brands, varieties (such as initial formulas, follow-up formulas and specialty formulas), and pricing ranges.

Online retail, although currently occupying a smaller market share of about 15 per cent, is the fastest growing distribution channel in the infant formula milk powder market. The increase in e-commerce has changed the way consumers buy, offering unprecedented convenience and accessibility. The online retail segment is growing rapidly due to technological advances, changes in consumer behaviour and the global shift towards digital retail. Online retail offers unparalleled convenience and allows consumers to shop from the comfort of their homes at any time. This is particularly beneficial for parents with young children, who may find it difficult to visit stores. E-commerce platforms generally offer a wide range of products compared to physical stores. Consumers can access various brands, types and formulations of milk powder for infant formulas, including niche and specialized products that may not be available locally.

Infant Formula Milk Powder Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

The Middle East & Africa

Asia-Pacific holds approximately 35% of the market share for infant milk powder. The region's dominance can be attributed to its significant population, growing urbanization, rising disposable incomes, and evolving dietary trends. Countries like China, India, Japan, and South Korea have played a significant role in driving the market's expansion in Asia-Pacific. With more than half of the global population residing in Asia-Pacific, along with a considerable number of infants and young children, there is a substantial demand for powdered infant milk in the region.

North America holds a substantial portion of the global infant formula milk powder market, approximately 30%. Even though the market in North America is well-established, it is currently undergoing significant growth due to advancements in product formulation, rising health consciousness, and the strong presence of major brands. Continuous innovations in infant formula are a key feature of the North American market, with a focus on organic, non-GMO, and specialty formulas catering to specific dietary needs like lactose intolerance and allergies. In North America, there is a growing trend among parents towards seeking health and wellness, leading to a higher demand for high-quality and nutritionally dense infant formulas.

COVID-19 Impact Analysis on the Infant Formula Milk Powder Market:

Strict lockdown measures and travel restrictions worldwide hampered the movement of raw materials, packaging materials, and finished infant formula products. This caused delays in production and transportation, leading to shortages in certain regions. Lockdowns and social distancing measures also disrupted labour availability in manufacturing plants and logistics companies. This resulted in production slowdowns and potential quality control issues due to reduced manpower. The pandemic also affected the sourcing of key ingredients like milk powder, vitamins, and minerals. Border closures and export restrictions in some countries posed challenges for manufacturers in obtaining essential components.

Latest Trends/ Developments:

Parents are increasingly seeking infant formulas with clean labels, prioritizing natural ingredients and minimal processing. This translates to a demand for formulas with organic or non-GMO (genetically modified organism) ingredients. Consumers are demanding greater transparency from formula manufacturers. This includes information about the origin of ingredients, manufacturing processes, and quality control measures. The presence of artificial sweeteners, flavors, or thickeners in infant formula is raising concerns among some parents. Manufacturers are responding by developing formulas free from these additives. Infant formula manufacturers are constantly monitoring the latest scientific research on infant nutrition. This knowledge informs the development of formulas with optimized nutrient profiles specifically designed to support different stages of development. Certain formulas are fortified with additional nutrients like prebiotics, probiotics, or DHA (docosahexaenoic acid), an omega-3 fatty acid essential for brain development. These additions aim to mimic the benefits of breast milk. Busy parents appreciate the convenience of ready-to-feed formulas that require no preparation. These formulas are pre-mixed and sterilized, minimizing the risk of contamination during preparation.

Key Players:

-

Nestlé S.A. (Switzerland)

-

Danone S.A. (France)

-

Abbott Laboratories (USA)

-

Mead Johnson Nutrition Company (US)

-

Friesland Campina (Netherlands)

-

Meiji Holdings Co., Ltd. (Japan)

-

Yili Group (China)

-

Inner Mongolia Yili Industrial Group Co., Ltd. (China)

-

Fonterra Co-operative Group Limited (New Zealand)

-

Being mate Group (China)

-

Bellamy’s Organic (Australia)

-

Champion Laboratories

Chapter 1. Infant Formula Milk Powder Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Infant Formula Milk Powder Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Infant Formula Milk Powder Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Infant Formula Milk Powder Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Infant Formula Milk Powder Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Infant Formula Milk Powder Market – By Type

6.1 Introduction/Key Findings

6.2 Starting Formula (Stage 1)

6.3 Follow-on Formula (Stage 2)

6.4 Growing-up Formula (Stage 3)

6.5 Specialty Formula

6.6 Y-O-Y Growth trend Analysis By Type

6.7 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Infant Formula Milk Powder Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Supermarkets/Hypermarkets

7.3 Convenience Stores

7.4 Pharmacies/Drugstore

7.5 Online Retail

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Distribution Channel

7.8 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Infant Formula Milk Powder Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Infant Formula Milk Powder Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Nestlé S.A. (Switzerland)

9.2 Danone S.A. (France)

9.3 Abbott Laboratories (USA)

9.4 Mead Johnson Nutrition Company (US)

9.5 Friesland Campina (Netherlands)

9.6 Meiji Holdings Co., Ltd. (Japan)

9.7 Yili Group (China)

9.8 Inner Mongolia Yili Industrial Group Co., Ltd. (China)

9.9 Fonterra Co-operative Group Limited (New Zealand)

9.10 Being mate Group (China)

9.11 Bellamy’s Organic (Australia)

9.12 Champion Laboratories

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

In developing economies, growing disposable incomes and urbanization are leading to a demand for convenient and premium infant formula options.

Concerns about the safety of formula due to past incidents of contamination or misleading marketing practices can create hesitancy among parents. Additionally, the spread of misinformation online regarding formula versus breastfeeding can create confusion.

Nestlé S.A. (Switzerland), Danone S.A. (France), Abbott Laboratories (USA), Mead Johnson Nutrition Company (US), Friesland Campina (Netherlands), Meiji Holdings Co., Ltd. (Japan), Yili Group (China), Inner Mongolia Yili Industrial Group Co., Ltd. (China), Fonterra Co-operative Group Limited (New Zealand), Being mate Group (China), Bellamy’s Organic (Australia).

Asia-Pacific holds approximately 35% of the market share for infant milk powder. The region's dominance can be attributed to its significant population, growing urbanization, rising disposable incomes, and evolving dietary trends.

North America holds a substantial portion of the global infant formula milk powder market, approximately 30%.