Infant Formula Ingredients Market Size (2024 – 2030)

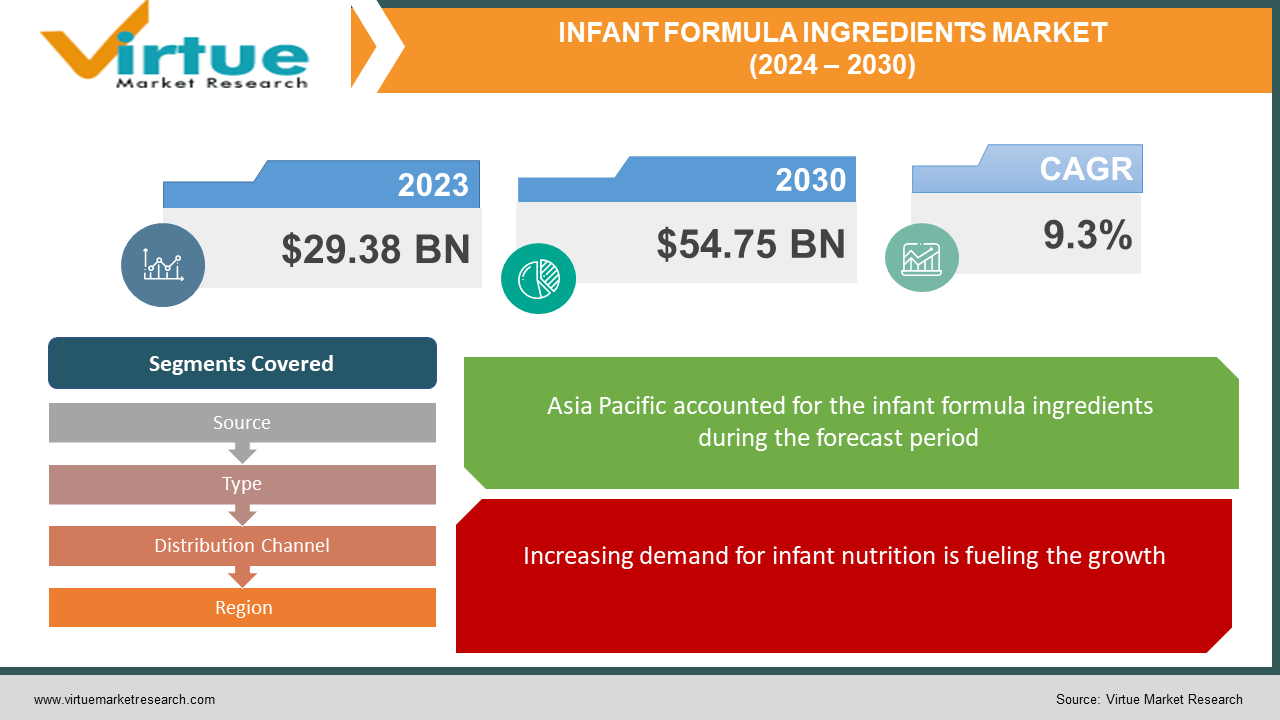

The global infant formula ingredients market was valued at USD 29.38 billion and is projected to reach a market size of USD 54.75 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 9.3%.

Designed to replicate human milk, infant formula is a synthetic diet that is fed to infants up to one year of age. It can take the place of nursing entirely or in part. Authorities such as the Food and Drug Administration (FDA) in the USA, the European Union (EU) in Europe and beyond, and the Codex Alimentarius Commission control the ingredients in baby formula. Cow's milk protein that has been altered to resemble breast milk is used to make infant formula. It has nutrients from the cow's milk as well as lactose, a form of sugar found in milk. The mix also contains additional vitamins and minerals in addition to vegetable oils. Vegetable oils, or a combination of vegetable and animal oils, account for around half of the calories in the formula. This market has had a good presence in the past. However, there were a lot of misassumptions, and it was primarily based on cow milk. Presently, a wide range of formulations are being incorporated owing to demand and need. In the future, with a focus on personalization and organic feed, a notable upsurge is anticipated.

Key Market Insights:

More than 60% of infants under six months are given formula in Africa. 67% of infants in the United States get nutrients from their formula. The dairy-based category had 40% of the market share for components in baby formula in 2022. The most often used ingredients in homemade baby formula recipes are raw goat's milk (23.6%), liver (14.5%), and complete raw cow's milk (24.3%). Raw liver, dried liver, pureed liver, and liver oil are examples of liver-based formulations. About 2–3% of babies are affected by cow's milk protein allergy (CMPA), according to the American Academy of Paediatrics (AAP). To tackle this, hypoallergenic formulations are being used. Additionally, alternatives to cow’s milk are also being researched and experimented with.

Infant Formula Ingredients Market Drivers:

Increasing demand for infant nutrition is fueling the growth.

There has been a lot of awareness among parents about the importance of nutrition during the early stages of infant development. As per the data from UNICEF, undernutrition is a contributing factor in over half of all pediatric fatalities. About 45% of mortality in children under five is attributable to malnutrition, including undernutrition. This statistic has been elevating the demand for healthy nutrition. Six fundamental ingredients make up formulas: protein, fat, carbohydrates, vitamins, minerals, and other nutrients like probiotics and prebiotics. These components aid in introducing healthy bacteria into a newborn's digestive system, which may strengthen immunity. Secondly, they aid in the body's calcium absorption, strong bone development, and rickets prevention. Thirdly, they play a crucial role in the growth and structural integrity of newborns' brain cell membranes and are essential for the proper operation of the nervous system, including memory and motor function. Furthermore, human milk oligosaccharides (HMOs), an innovative component that offers extra health advantages, are introduced in a manner that mimics the makeup of breast milk. They are bioactive components that support the growth of an infant's microbiota and immune system. In response to this need, industry players are spending money on R&D to create and include these ingredients in baby formula products.

Economic development has been facilitating the expansion.

Urbanization has made a lot of progress in developed and developing regions. Because of this, there is a rising middle class with an increasing disposable income, prepared to pay extra for specialized and high-end infant formula products for their kids. Changes in lifestyle and dietary preferences have caused a shift towards these options. People are constantly on the lookout for options that provide extra health advantages, such as probiotics, prebiotics, and organic or natural components. To meet these demands, manufacturers are working on creating high-quality products that have a lot of nutrition and help in the overall development and immunity-building of infants.

Infant Formula Ingredients Market Restraints and Challenges:

Consumer skepticism, associated costs, intense competition, and regulatory requirements are the main issues that the market is currently facing.

For any market to succeed, consumer trust is crucial. There are a lot of people who have prejudices about this product. Misinformation about the contaminants and ingredients is often circulated through group messages. As such, it is vital to spread awareness about the importance and sanctity of this product to create a broader consumer base. Secondly, a lot of infant formulas are subjected to price volatility. This can create disparities for certain sections of society and create hurdles. Thirdly, initiatives to support breastfeeding advocate for nursing as the best feeding option for babies, pointing out several health advantages for both moms and babies. These programs, which are backed by institutions like the United Nations Children's Fund (UNICEF) and the World Health Organization (WHO), seek to raise breastfeeding rates globally and lessen dependency on infant formula. The baby formula sector may face challenges from breastfeeding advocacy activities, as these efforts have the potential to impact consumer views and choices surrounding infant feeding habits. Furthermore, there are a lot of stringent regulations and quality checks that the companies have to adhere to. Manufacturers may find it difficult and time-consuming to comply with these regulations, particularly when adding new substances or changing formulations. Regulation adherence raises the price and complexity of the product creation process, which can create a hindrance for the market.

Infant Formula Ingredients Market Opportunities:

Innovations in functional ingredients provide the market with many possibilities. HMOs and omega-3 fatty acids are abundantly and solely present in breast milk. To replicate breast milk as precisely as possible, prebiotics, probiotics, DHA, and ARA have been included in recent advances to boost the immune system and development of infants. Essential energy comes from carbohydrates, and current trends include a preference for lactose, which mimics the sweetness of breast milk, and the usage of prebiotics to improve gut health. Additionally, certain babies are lactose-intolerant. This means that they are unable to digest dairy products. Consumption of products like cow milk and other related proteins can cause indigestion, bloating, and other health issues. Lactose-free and anti-reflux options are being prioritized as a result. Secondly, personalization of the formula is beneficial. Products are created as per the needs of the baby by analyzing the genetics. Technological advancements in genetic methods and nutrigenomics can help with this step. Thirdly, emerging economies in Asian and African countries provide an ample number of opportunities. By selling and advertising the products in these regions, profits can be increased.

INFANT FORMULA INGREDIENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

9.3% |

|

Segments Covered |

By Source, Type, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Nestlé S.A., Danone S.A., Abbott Laboratories, Reckitt Benckiser Group plc (RB), DSM Nutritional Products AG, Arla Foods Ingredients Group P/S, Kerry Group plc, Fonterra Co-operative Group Limited, Royal FrieslandCampina N.V., Glanbia plc |

Infant Formula Ingredients Market Segmentation: By Source

-

Cow Milk

-

Soy

-

Protein Hydrolysates

-

Others

Cow milk is the largest segment in 2023. In newborn formulae, cow's milk is utilized because it is less expensive, offers the proper ratio of nutrients, and is simpler to digest than other milk varieties. Additionally high in calcium, vitamin D, protein, vitamin B12, riboflavin, phosphorus, and healthy fat are the vitamins and minerals found in cow's milk. The majority of baby formulas are created using protein from cow's milk that has been processed to mimic breast milk. To facilitate digestion and lessen the likelihood of digestive issues like colic and constipation, the milk proteins are partially hydrolyzed. Protein hydrolysates are the fastest-growing segment. In situations where human milk is not accessible, such as for premature babies, protein hydrolysates are utilized in infant formula. They are also used for primary allergy prevention for newborns with cow's milk allergies. Protein hydrolysates are thought to be more well-tolerated and have a lower risk of problems. In place of natural proteins in meals, drinks, and baby foods, protein hydrolysates are employed in infant formula. The complicated structure of milk proteins contains bioactive peptides that are released during hydrolysis.

Infant Formula Ingredients Market Segmentation: By Type

-

Infant Milk Formula

-

Follow-on Milk

-

Others

Infant milk formula holds the largest market segment in 2023. Baby formulas are liquids or powders that have been reconstituted and are given to newborns and early children in place of human milk. For some newborns, they are their sole source of nutrition. Formulated infant milk offers vital elements such as proteins, carbs, lipids, vitamins, and minerals that are critical for a baby's growth and development. It guarantees that babies get enough nourishment, particularly in situations where nursing is not feasible or is not sufficient. Follow-on milk is the fastest-growing category. Toddler milk, often referred to as growing-up milk or follow-up milk, is designed to satisfy the nutritional needs of infants between the ages of six months and three years. Compared to breast milk, it may have more protein, calories, calcium, and other minerals. The fact that follow-on milk has a substantially higher iron content than newborn milk is one of the main nutritional differences between the two.

Infant Formula Ingredients Market Segmentation: By Distribution Channel

-

Supermarkets/Hypermarkets

-

Pharmacy/Medical Stores

-

Specialty Stores

-

Online Retail

-

Others

Supermarkets & hypermarkets are the largest distribution channels. These places have a wide range of baby-formulated food items available, which has increased formula food sales. Besides, people can clear their doubts about the product by asking questions on the spot. Online retail is the fastest-growing segment. This is because of their convenience. People can order the products from the comfort of their homes and have them delivered to their doorstep. Furthermore, many deals and discounts are available, making this an attractive option.

Infant Formula Ingredients Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific has the largest and fastest-growing market. Countries like China, Japan, and India are at the top. This is because of the increasing population. Urbanization has led to a change in the standard of living. People can afford premium products due to this. Research and developmental activities are being given prominence to introduce new formulations to the market. A lot of prominent companies are present in this region that have a global presence. This helps increase the revenue for the market significantly.

COVID-19 Impact Analysis on the Global Infant Formula Ingredients Market:

The market was harmed by the viral epidemic. Lockdowns, movement limitations, and social isolation were among the new standards. Logistics, transportation, and supply chain management were impacted by this. As a result, import-export operations deteriorated. To stop the virus from spreading, all factories and companies had to close. Production and other operations were halted as a result. Because of the erratic nature of the economy, layoffs were common in many areas. Many people experienced job losses. The majority of the funds were allocated to inexpensive utilities and necessities. Funds were set aside for medical supplies such as PPE kits, hospital beds, masks, oxygen tanks, and vaccinations. Launches and partnerships were delayed as a result. As per a report by the Conversation, infant formula shortages left 70% of American shop shelves empty, with 10 states reporting 90% or higher out-of-stock rates. Besides, many people planned not to conceive during this period owing to all the uncertainties. Breast milk was more trusted as there were many cases of adulteration. Post-pandemic, the market has started to get better. Sustainable techniques are now being adopted by the market. Normal operations have resumed following the revisions to the guidelines and the easing of the restrictions. Online retail has increased profitability since it is easier to make purchases there.

Latest Trends/ Developments:

Baby formula products with clean labels, that is, those devoid of harmful additives, preservatives, and synthetic ingredients, are becoming more popular among consumers. Formulas with identifiable, natural ingredients like plant-based oils, organic dairy proteins, and natural sweeteners are being emphasized. In response to this trend, producers are reformulating their goods and utilizing clear labeling to inform customers of the provenance and caliber of components.

Key Players:

-

Nestlé S.A.

-

Danone S.A.

-

Abbott Laboratories

-

Reckitt Benckiser Group plc (RB)

-

DSM Nutritional Products AG

-

Arla Foods Ingredients Group P/S

-

Kerry Group plc

-

Fonterra Co-operative Group Limited

-

Royal FrieslandCampina N.V.

-

Glanbia plc

-

In January 2024, the Thai government approved the use of Aequival, a 2'-Fucosyllactose (2'-FL) component from FrieslandCampina Ingredients, in newborn milk formulas and follow-up formulations. For kids three years old and up, flavored milk drinks were the first to be authorized. The most prevalent human milk oligosaccharide (HMO) in human milk is 2'-FL. Research demonstrates that 2'-FL, in part because of its bifidogenic properties, can be extremely beneficial for promoting health during infancy and youth.

-

In September 2023, in China, Danone announced its plans to introduce a novel baby formula that has milk droplets that resemble breast milk's composition. Inspired by human milk, the formula called Nuturis comprises lipid droplets covered with milk phospholipids. Among the many health advantages of human milk are better growth, development of the eyes and brain, decreased risk of allergies, and a decreased frequency of infections and diseases. Danone's newborn formula, Aptamil, includes Human-Residential Bifidobacteria (HRB) breve M-16V, the first strain of HRB authorized for use in baby food in China.

-

In May 2023, Alpha-lactalbumin, an EAA-rich component for baby formula, was introduced, by Arla Foods Ingredients. This formula is high in vital amino acids and offers a balanced intake of protein. The most prevalent protein in human milk is alpha-lactalbumin, which is also naturally present in cow's milk. It's a crucial component of low-protein baby formulas that helps producers make goods that mimic breast milk more precisely.

Chapter 1. Infant Formula Ingredients Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Infant Formula Ingredients Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Infant Formula Ingredients Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Infant Formula Ingredients Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Infant Formula Ingredients Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Infant Formula Ingredients Market – By Source

6.1 Introduction/Key Findings

6.2 Cow Milk

6.3 Soy

6.4 Protein Hydrolysates

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Source

6.7 Absolute $ Opportunity Analysis By Source, 2024-2030

Chapter 7. Infant Formula Ingredients Market – By Type

7.1 Introduction/Key Findings

7.2 Infant Milk Formula

7.3 Follow-on Milk

7.4 Others

7.5 Y-O-Y Growth trend Analysis By Type

7.6 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 8. Infant Formula Ingredients Market – By Distribution Channels

8.1 Introduction/Key Findings

8.2 Supermarkets/Hypermarkets

8.3 Pharmacy/Medical Stores

8.4 Specialty Stores

8.5 Online Retail

8.6 Others

8.7 Y-O-Y Growth trend Analysis By Distribution Channels

8.8 Absolute $ Opportunity Analysis By Distribution Channels, 2024-2030

Chapter 9. Infant Formula Ingredients Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Source

9.1.3 By Type

9.1.4 By Distribution Channels

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Source

9.2.3 By Type

9.2.4 By Distribution Channels

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Source

9.3.3 By Type

9.3.4 By Distribution Channels

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Source

9.4.3 By Type

9.4.4 By Distribution Channels

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Source

9.5.3 By Type

9.5.4 By Distribution Channels

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Infant Formula Ingredients Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Nestlé S.A.

10.2 Danone S.A.

10.3 Abbott Laboratories

10.4 Reckitt Benckiser Group plc (RB)

10.5 DSM Nutritional Products AG

10.6 Arla Foods Ingredients Group P/S

10.7 Kerry Group plc

10.8 Fonterra Co-operative Group Limited

10.9 Royal FrieslandCampina N.V.

10.10 Glanbia plc

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global infant formula ingredient market was valued at USD 29.38 billion and is projected to reach a market size of USD 54.75 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 9.3%.

The increasing demand for infant nutrition and economic development are the main factors propelling the global infant formula ingredient market.

Based on type, the global infant formula ingredient market is segmented into infant milk formula, follow-on milk, and others.

Asia-Pacific is the most dominant region for the global infant formula ingredient market.

Nestlé S.A., Danone S.A., and Abbott Laboratories are the key players operating in the global infant formula ingredient market.