Industrial Water Purification System Market Size (2024 – 2030)

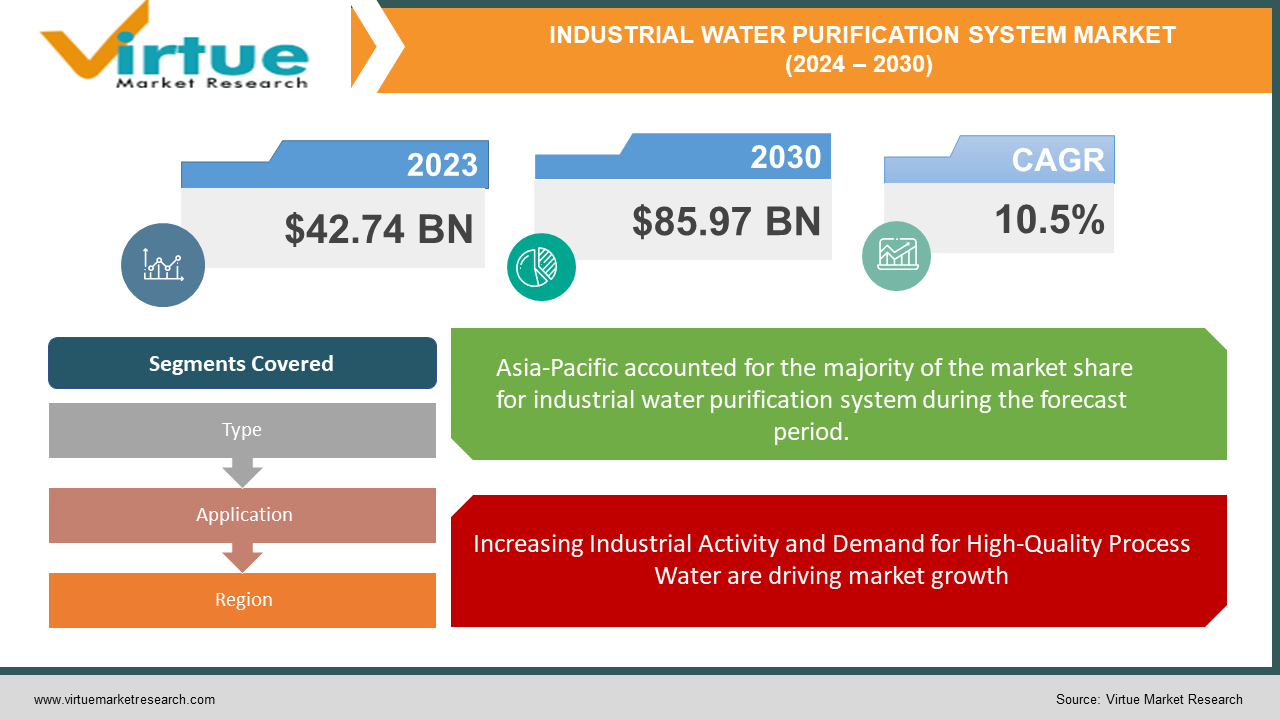

The Global Industrial Water Purification System Market was valued at USD 42.74 billion in 2023 and will grow at a CAGR of 10.5% from 2024 to 2030. The market is expected to reach USD 85.97 billion by 2030.

The industrial water purification system market caters to various industries by providing filtration systems that remove impurities from raw water. These systems are essential for different water qualities needed in processes like power generation, food & beverage production, and pharmaceuticals. The market is expected to grow due to stricter regulations, increasing demand for clean water, and advancements in membrane-based purification technologies.

Key Market Insights:

Increased industrial output across sectors like manufacturing and power generation necessitates high-quality process water. Environmental regulations mandating cleaner water discharge are propelling demand for purification systems. Industries recognize the importance of purified water for efficient operations and product quality.

RO systems hold the dominant market share due to their high efficacy in removing dissolved solids and impurities.

Global Industrial Water Purification System Market Drivers:

Increasing Industrial Activity and Demand for High-Quality Process Water are driving market growth:

The thriving landscape of manufacturing across chemicals, pharmaceuticals, and food & beverage is placing unprecedented demands on industrial water purification systems. These sectors rely heavily on water for various functions – cooling machinery to prevent overheating, cleaning equipment to maintain hygiene standards, and even as an ingredient in final products. As industrial output surges globally, the need for high-quality process water rises in tandem. Without proper purification, impurities like minerals, salts, and even microorganisms can wreak havoc, leading to inefficiencies like equipment corrosion and production stoppages. In the worst-case scenario, contaminated water can even compromise the quality and safety of final products. This surging demand for consistent, high-grade process water is a key driver propelling the growth of the industrial water purification system market. By ensuring a reliable supply of purified water, these systems empower manufacturers to operate efficiently, maintain high product quality, and navigate the increasingly stringent regulations on environmental impact.

Stringent Environmental Regulations and Focus on Cleaner Water Discharge are driving market growth:

A tightening regulatory noose is another force driving the industrial water purification system market. Governments around the world are enacting stricter environmental laws that limit the amount of pollutants industries can release in their wastewater. These pollutants can range from heavy metals and chemicals to organic matter and harmful bacteria. Previously untreated wastewater could wreak havoc on local ecosystems, disrupt natural water cycles, and pose a significant health risk. To comply with these stricter regulations and avoid hefty fines or even shutdowns, industries are turning to industrial water purification systems as a crucial solution. These systems act as the environmental guardians of industrial processes, effectively filtering out contaminants before they reach waterways. By removing pollutants, industrial water purification safeguards our environment and paves the way for sustainable industrial practices. This ensures a healthier planet for all while allowing industries to operate within the boundaries set by environmental regulations.

Heightened Awareness Regarding Water Quality and its Impact are driving market growth:

The tide is turning in the industrial sector, with a growing awareness of the critical role water quality plays in both operational efficiency and product integrity. Impurities lurking in untreated water can wreak havoc on industrial processes. Mineral buildup can lead to scaling and corrosion in pipes and equipment, causing costly downtime for repairs and replacements. These inefficiencies can significantly disrupt production schedules and impact a company's bottom line. But the dangers extend beyond equipment damage. Contaminated water can infiltrate products themselves, jeopardizing quality and potentially posing health risks to consumers. For instance, hard water with high mineral content can affect the taste and texture of food and beverages. In the pharmaceutical industry, compromised water quality can disrupt the delicate balance of ingredients in sensitive medications. To combat these threats and ensure consistent, high-quality water throughout their processes, industries are increasingly turning to industrial water purification systems. These systems act as a safeguard, meticulously removing impurities and ensuring a reliable supply of pristine water. By investing in water purification, industries not only protect their equipment and production efficiency but also guarantee the quality and safety of their final products.

Global Industrial Water Purification System Market challenges and restraints:

High Initial Investment Cost is a significant hurdle for Industrial Water Purification System:

A major hurdle for the industrial water purification system market is the hefty initial investment. These systems are not one-size-fits-all solutions. Each application requires careful engineering design to ensure the right technology and capacity for the specific water quality and desired outcome. This translates to significant upfront costs for equipment, from complex filtration membranes to pre-treatment units and control systems. The installation process itself can be intricate, involving plumbing modifications and specialized technicians. These factors combine to create a substantial financial barrier, particularly for smaller companies or those with limited capital. This can lead to a hesitation to adopt these systems, hindering broader market growth. However, there are potential solutions emerging, such as rental or lease models for equipment, and pre-configured systems designed for specific industry needs. These options can make high-quality water purification more accessible for a wider range of companies.

Operational & Maintenance Costs are throwing a curveball at Industrial Water Purification System market:

The allure of industrial water purification systems is undeniable – clean, consistent water for optimal operations. However, the initial investment is just the first hurdle. These systems are not maintenance-free. Running them requires ongoing operational costs that can be a balancing act for companies. Energy consumption is a significant factor, as some purification processes, like Reverse Osmosis, are energy-intensive. Regular replacement of filters and membranes is crucial to maintain efficiency, and these can be expensive depending on the technology and system size. Furthermore, skilled personnel are needed to operate and maintain the systems effectively, adding to the labor costs. Balancing these ongoing expenses with the return on investment (ROI) can be a challenge. Companies need to carefully evaluate the long-term benefits – such as improved product quality, reduced equipment downtime, and potential water reuse – to justify the operational costs. However, advancements in technology are leading to more energy-efficient systems, and some companies offer comprehensive maintenance packages to alleviate the burden on in-house teams. These developments are helping to make the ROI proposition more attractive for a wider range of industries.

Technical Expertise are a growing nightmare for Industrial Water Purification System:

Navigating the complexities of industrial water purification goes beyond just acquiring a system. Choosing the right technology requires expertise. Each industrial application has specific water quality requirements and desired outcomes. Selecting an unsuitable system can lead to inefficiencies or insufficient contaminant removal. For instance, a system designed for removing heavy metals might not be effective against organic matter. Furthermore, even with the right technology, skilled personnel are crucial for operating and maintaining these systems effectively. Improper operation can lead to malfunctions, reduced water quality, and even equipment damage. In conclusion, optimizing industrial water purification necessitates both the right technology and a competent workforce to ensure their optimal performance.

Market Opportunities:

The industrial water purification system market presents a wealth of opportunities driven by converging factors. Firstly, burgeoning industrial activity across sectors like chemicals, pharmaceuticals, and food & beverage is creating a surge in demand for high-quality process water. These industries heavily rely on purified water for functions like cooling, cleaning, and even as an ingredient. Secondly, stricter environmental regulations on industrial wastewater discharge are propelling the adoption of purification systems. By effectively filtering contaminants before they reach waterways, these systems empower industries to comply with regulations and minimize their environmental impact. Thirdly, a growing awareness within industries regarding the critical role of water quality is driving market growth. Impurities in water can lead to inefficiencies like equipment corrosion and production stoppages, while compromising product quality and safety. Industrial water purification safeguards against these threats, ensuring consistent, high-grade water throughout processes. Furthermore, advancements in technology are leading to more efficient and cost-effective purification systems, making them a more viable option for a wider range of companies. The increasing focus on water conservation also presents an opportunity. Purification systems enable water reuse and recycling within industrial processes, promoting sustainable practices. Finally, the growing demand for clean water in regions facing water scarcity is another potential growth driver. By providing access to purified water, these systems can empower industries to operate in water-stressed regions. By addressing these opportunities and overcoming challenges like high initial costs and technical expertise requirements, the industrial water purification system market is poised for significant growth in the coming years.

INDUSTRIAL WATER PURIFICATION SYSTEM MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

10.5% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

A.O. Smith Corporation (Aquasana Inc.), Suez Water Technologies & Solutions (SUEZ), Xylem Inc., Pentair PLC, Veolia Environnement S.A., Dow Inc., DuPont de Nemours, Inc., GE Water & Process Technologies (GEA Group), Toray Industries, Inc., 3M Company |

Industrial Water Purification System Market segmentation - By Type

-

Membrane Filtration

-

Deionization

Within the industrial water purification system market, Membrane Filtration reigns supreme. This dominance stems from its exceptional efficiency in removing a broad spectrum of contaminants, including dissolved solids, impurities, and bacteria. Reverse Osmosis (RO), a type of membrane filtration, is the most widely used technology due to its versatility. Deionization (DI), while crucial for applications requiring ultrapure water like pharmaceuticals, caters to a more specific niche market compared to the broader applicability of membrane filtration across various industries.

Industrial Water Purification System Market segmentation - By Application

-

Power Generation

-

Oil & Gas

Determining the most prominent sector between Power Generation and Oil & Gas in the industrial water purification system market is difficult to pinpoint definitively. it's more accurate to say that both Power Generation and Oil & Gas are prominent sectors for the industrial water purification system market, each with their own unique and significant reasons for utilizing these systems.

Industrial Water Purification System Market segmentation - Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

With rapid industrialization, growing environmental regulations, and a strong push for water conservation, Asia Pacific is currently the most dominant region in the Industrial Water Purification System Market. This region is expected to maintain its lead position due to government initiatives and the sheer scale of industrial activity.

COVID-19 Impact Analysis on the Global Industrial Water Purification System Market

The COVID-19 pandemic caused a ripple effect on the industrial water purification system market. Initial lockdowns and supply chain disruptions led to temporary production slowdowns and project delays. However, the impact wasn't uniform. A heightened focus on hygiene in various industries, particularly food & beverage and pharmaceuticals, increased demand for high-quality water for cleaning and production processes. Additionally, stricter regulations on hygiene and sanitation in response to the pandemic might have spurred long-term adoption of purification systems. On the other hand, some sectors like power generation might have experienced decreased demand due to temporary shutdowns or reduced industrial activity. Overall, the long-term impact of COVID-19 on the market remains to be seen. While initial disruptions were present, the pandemic's emphasis on hygiene and potential for increased regulations could pave the way for future growth in the industrial water purification system market.

Latest trends/Developments

The industrial water purification system market is witnessing a wave of innovation and adaptation. Firstly, advancements in membrane filtration technology are leading to the development of more efficient and cost-effective membranes. This allows for a wider range of industries to consider the benefits of purification. Secondly, there's a growing focus on sustainability. Manufacturers are developing systems that optimize water reuse and minimize waste generation during the purification process. This aligns perfectly with the increasing focus on water conservation efforts globally. Thirdly, the concept of "smart" purification systems is gaining traction. These integrate sensors and automation to monitor water quality, optimize performance, and predict maintenance needs. This not only improves efficiency but also allows for remote monitoring and control. Finally, there's a trend towards pre-configured and modular systems. These offer faster deployment times and cater to specific industry needs, making purification more accessible for smaller companies. By embracing these trends, the industrial water purification system market is well-positioned to address the evolving needs of various industries while promoting sustainable water management practices.

Key Players:

-

A.O. Smith Corporation (Aquasana Inc.)

-

Suez Water Technologies & Solutions (SUEZ)

-

Xylem Inc.

-

Pentair PLC

-

Veolia Environnement S.A.

-

Dow Inc.

-

DuPont de Nemours, Inc.

-

GE Water & Process Technologies (GEA Group)

-

Toray Industries, Inc.

-

3M Company

Chapter 1. Industrial Water Purification System Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Industrial Water Purification System Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Industrial Water Purification System Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Industrial Water Purification System Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Industrial Water Purification System Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Industrial Water Purification System Market – By Type

6.1 Introduction/Key Findings

6.2 Membrane Filtration

6.3 Deionization

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Industrial Water Purification System Market – By Application

7.1 Introduction/Key Findings

7.2 Power Generation

7.3 Oil & Gas

7.4 Y-O-Y Growth trend Analysis By Application

7.5 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Industrial Water Purification System Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Industrial Water Purification System Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 A.O. Smith Corporation (Aquasana Inc.)

9.2 Suez Water Technologies & Solutions (SUEZ)

9.3 Xylem Inc.

9.4 Pentair PLC

9.5 Veolia Environnement S.A.

9.6 Dow Inc.

9.7 DuPont de Nemours, Inc.

9.8 GE Water & Process Technologies (GEA Group)

9.9 Toray Industries, Inc.

9.10 3M Company

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Industrial Water Purification System Market was valued at USD 42.74 billion in 2023 and will grow at a CAGR of 10.5% from 2024 to 2030. The market is expected to reach USD 85.97 billion by 2030.

Increasing Industrial Activity and Demand for High-Quality Process Water, Stringent Environmental Regulations and Focus on Cleaner Water Discharge, Heightened Awareness Regarding Water Quality and its Impact these are the reasons which is driving the market.

Based on Application it is divided into two segments – Power Generation, Oil & Gas.

Asia is the most dominant region for the luxury vehicle Market.

O. Smith Corporation (Aquasana Inc.), Suez Water Technologies & Solutions (SUEZ), Xylem Inc., Pentair PLC.