Global Industrial Robots Market Size (2024 - 2030)

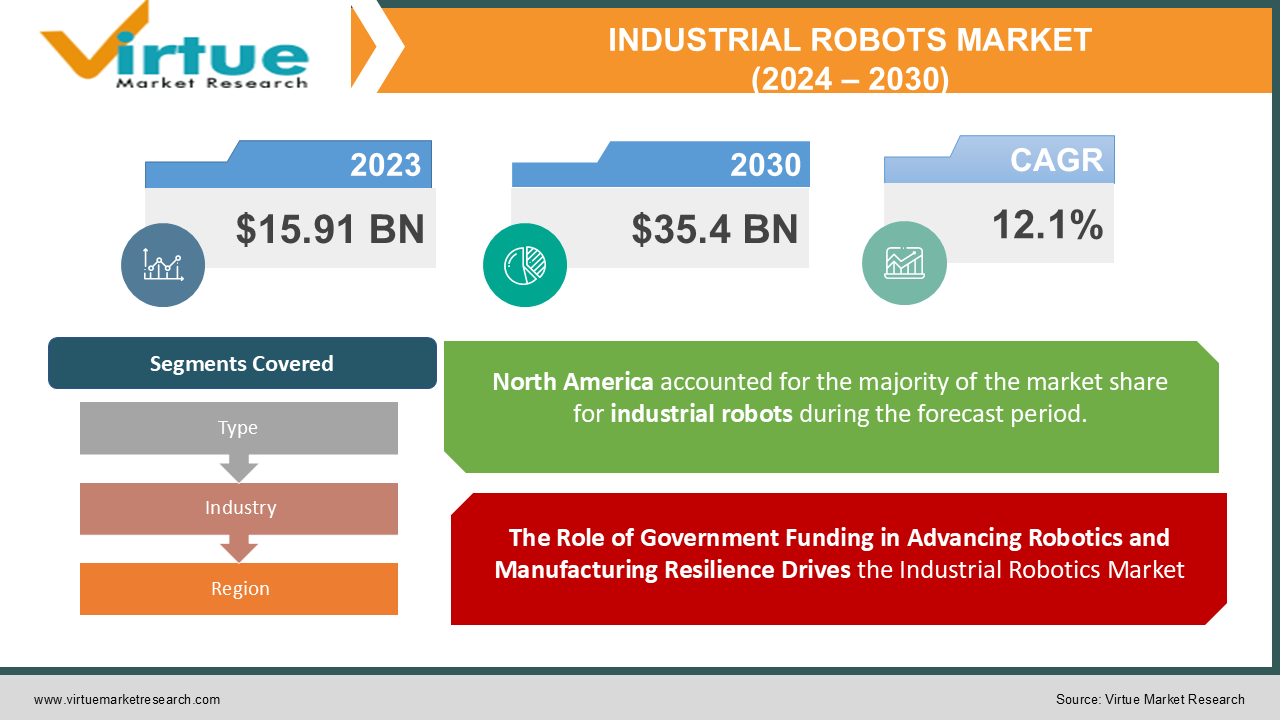

According to our research report, the Global industrial robots market was valued at USD 15.91 billion and is projected to reach a market size of USD 35.4 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 12.1%.

Industry Overview

An industrial robot is a sort of mechanical device that receives input to carry out automatic activities associated with industrial production. According to use and industrial requirements, these robots' programs may be modified as often as necessary. Industrial robots aid in boosting productivity while cutting costs and providing high-quality goods for automation applications. Drive, end-effector, robotic manipulators, sensors, and controls make up the majority of industrial robots. The robotic controller, which aids in providing commands, is the robot's brain. Microphones and cameras are used as robot sensors to keep the machine aware of its surroundings.

The end effectors assist in engaging the robot with the workpieces, whereas the robotic manipulator is typically the robot's arm that aids in movement and placement. Collaborative, cartesian, SCARA, cylindrical, and articulated robots are the five categories of robots most commonly employed in the business. The kind of robot chosen is determined by the level of mobility required, desired size, and payload capacity. Industrial robots aid in enhancing production for a productive and healthy process.

There is a lack of workers as a result of the UK's annual increase in labor costs of more than 12%. Market participants are investing in industrial robots to address these issues. For instance, Rishi Sunak, the chancellor of the Exchequer, invested in robots in January 2022 to assist the UK people and economy in addressing the challenge of inflation brought on by a labor shortage. Additionally, it is predicted that labor costs in the US would rise by more than 20%. As a result, businesses take more steps to employ robots to make up for labor costs and shortages, which propels the industrial robotics market. Additionally, according to information from North American factories and sectors, over 25,000 robots were ordered by manufacturers and other industrial users in 2021 compared to 2019. The microelectronics sector, which utilizes small robots to pick and put small components, is responsible for the high importation of robots. The worldwide microelectronic industry has expanded by more than 10% since 2010 according to trends. Therefore, it is anticipated that the industrial robot market would be driven by the expansion of the microelectronic sector, which requires more robots.

Impact of Covid-19 on the Industry

The COVID-19 pandemic, a fatal respiratory illness that began in China, has now spread around the world. The COVID-19 epidemic negatively impacted the industrial robotics business in 2019 as well because China has been the largest market for industrial robots (40–50 percent share) for at least the last five years. The leading companies in the industrial robots sector, with headquarters in Japan, had a significant drop in revenue in 2019. For instance, FANUC (Japan) reported in March 2020 that its ROBOT division's revenue fell 6.9 percent in 2019 compared to 2018. Industrial robots were slowly installed in several important industries, including automotive, electrical and electronics, metals, and metallurgy, as a result of the COVID-19 epidemic.

Market Drivers

The Role of Government Funding in Advancing Robotics and Manufacturing Resilience Drives the Industrial Robotics Market

Through partnerships and the creation of cutting-edge robotics solutions, the Advanced Robotics for Manufacturing (ARM) Institute aims to increase the competitiveness of US firms. The US Department of Defense provides funding for it. To enable the swift reaction necessary for the COVID-19 pandemic, the institution has appealed for quick and high-impact robotics projects. The Coronavirus Aid, Relief, and Economic Security (CARES) Act would provide funding for the approved ideas. Such enticing incentives motivate businesses to create novel solutions. The production-linked incentive (PLI) plan has been expanded by the Indian government to eleven industrial sectors, with a primary focus on the automotive and automotive component industries. This incentive package is worth Rs. 1.45 trillion. As part of its China Exit Policy, the Japanese government is providing Japanese businesses with USD 221 million in subsidies so they may move their headquarters to India and other countries. The French government has provided financial assistance through its State Guarantee program by guaranteeing the repayment of some qualified loans up to a total of USD 358 billion, helping businesses overcome their liquidity problems. To combat the COVID-19 pandemic's effects, Indonesia launched two stimulus packages. The first package, worth US$725 million, was released in February 2020, while the second, worth US$8 billion, was released in March 2020. To safeguard the economy and small- and medium-sized firms (SMEs), notably in the manufacturing sector, the second stimulus package was introduced.

Increasing automation in the electronics industry Fueling the Growth of Industrial Robotics Market

Electronics businesses will be able to develop more because of the rise in automation since it will be easier and less expensive for them to create prototypes. Throughout the whole manufacturing cycle, robots may be utilized for tasks including assembling, dispensing, milling, inspecting, packing, and palletizing. The demand for robotics is also being aided by improvements in end effectors and vision systems. Robots may pick up unsorted components from bins and mount them in the appropriate orientation, for instance, using random bin picking. Currently, repetitive and redundant jobs like hand assembly and tooling comprise the majority of what manufacturing workers in the electronics sector do. Robotics investments will alter the expectations imposed on people, allowing them to concentrate on high-importance jobs like final inspection and quality control.

Due to their ability to collaborate with people, collaborative robots may be included in already-existing manufacturing lines. These robots may be reprogrammed for different tasks once their usage in a particular application is complete since they are simpler to program Since the product cycles for electronics sometimes only last a few months, robots offer flexibility and reusability. Specialized robots have been created by several businesses. As an illustration, the KR 3 AGLIUS from KUKA (Germany) is designed for quick cycle times in tasks like handling displays and circuit boards, handling tiny screws, and polishing smartphone cases.

Market Restraints

High costs of deployment, especially for SMEs

Especially for businesses with no past expertise, a robotic automation project might be difficult. Not only is a significant monetary investment necessary to buy the robot, but it is also necessary for integration, programming, and maintenance. In some circumstances, a bespoke integration could be necessary, which would increase total expenses. It's possible that businesses don't always have the equipment and space needed to deploy robots. Return on investment (ROI) can be difficult for SMEs because they often produce in modest volumes. Companies that use irregular or seasonal production schedules are further examples of the problem. Since items need to be updated yearly on average, rapidly changing consumer preferences will necessitate regular robot retraining. Another issue is over-automation.

For instance, compared to its Japanese competitors, the US car sector originally utilized a higher level of automation. Cost overruns resulted from the fact that many robots were rendered superfluous or outdated as a result of changing product lines and consumer demand over time. An organization's operating expenditures may not always be reduced by replacing human personnel. Between US$3,000 and US$, 100,000 can be spent on a single collaborative robot system. Even more expensive, ranging from USD 15,000 to USD 150,000, is an industrial robotic system. Automation is an expensive investment for SMEs, particularly when they are involved in low-volume manufacturing, due to the cost of industrial robots, integration fees, and peripherals like end effectors and vision systems.

Interoperability and integration issues with industrial robots

Any factory or industrial facility must have interoperability. To link and synchronize disparate automation systems, a modular architecture must be included for both hardware and software. Here, programming, diagnosing, and monitoring software are the main topics. Industries frequently employ robot arms from various manufacturers. Companies could also need to reprogramme robots because of a shift in demand or production or to make room for new components like vision systems and end effectors. The integrator, not the manufacturer or the end-user, is in charge of deciding how to integrate, set up, or program the robot. Due to their particular requirements and staffing shortage, SMEs in particular face significant challenges with interoperability.

ROBOTICS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

12.1% |

|

Segments Covered |

By Type, Industry and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

ABB LTD. (ABB ROBOTICS), DAIHEN CORPORATION, DENSO CORPORATION (DENSO ROBOTICS), FANUC CORPORATION, KAWASAKI HEAVY INDUSTRIES LTD., KUKA ROBOTICS CORPORATION, MITSUBISHI ELECTRIC CORPORATION, NACHI-FUJIKOSHI CORPORATION (NACHI ROBOTIC SYSTEMS, INC.), PANASONIC CORPORATION, SEIKO EPSON CORPORATION, UNIVERSAL ROBOTS A/S, YASKAWA ELECTRIC CORPORATION |

This research report on the global industrial robots market has been segmented and sub-segmented based on, and Geography & region.

Global Industrial Robots Market- By Type

- Traditional Industrial Robots

- Collaborative Robots

The market is divided into Traditional Industrial Robots and Collaborative Robots based on type. Since of its great adaptability in assembly, palletizing, welding, painting, and other processes, the Traditional Industrial Robots sub-segment of Articulated Robots retains a sizable market share. These systems are adaptable because they are not restricted to movement along the corresponding axis.

duties involving other robot systems. To stop or alter human actions to prevent accidents and injuries, players in the industry have linked these systems with sensors and cameras. These systems, which are relatively less expensive than conventional ones, work in conjunction with human workers to cut down on idle time and speed up operations that call for human involvement, helping the industrial robotics industry flourish.

Global Industrial Robots Market- By Industry

- Automotive

- Electrical And Electronics

- Plastics, Rubber, And Chemicals

- Metals And Machinery

- Food And Beverages

- Others

Automotive, Electrical and Electronics, Plastics, Rubber, and Chemicals, Metals and Machinery, Food and Beverages, and Others are the market segments based on industry. Due to evolving developments, such as the creation of electric vehicles and energy-efficient drive systems, which are pushing people to replace their old cars with more contemporary ones, the automotive sector currently accounts for a sizable portion of the market.

Additionally, there is intense competition among market participants that are attempting to automate to satisfy customer demand. Companies in the industrial robot market are concentrating on other industries, such as pharmaceuticals, food, and beverages, where the quality and accuracy of raw materials/products play a crucial role in market growth.

Global Industrial Robots Market- By Geography & Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

The Industrial Robotics Market is divided into four regions based on geography: North America, Europe, Asia Pacific, and the Rest of the World. Due to growing labor costs in APAC, which force enterprises to automate their production processes to maintain a cost advantage, the Asia-Pacific region occupies a sizable portion of the market. Due to cheap production costs, easy access to economic labor, mild emissions, safety regulations, and government incentives for foreign direct investment (FDI), automation in APAC nations will soon increase, which will accelerate the global expansion of the industrial robotics industry.

Global Industrial Robots Market- By Companies

- ABB LTD. (ABB ROBOTICS)

- DAIHEN CORPORATION

- DENSO CORPORATION (DENSO ROBOTICS)

- FANUC CORPORATION

- KAWASAKI HEAVY INDUSTRIES LTD.

- KUKA ROBOTICS CORPORATION

- MITSUBISHI ELECTRIC CORPORATION

- NACHI-FUJIKOSHI CORPORATION (NACHI ROBOTIC SYSTEMS, INC.)

- PANASONIC CORPORATION

- SEIKO EPSON CORPORATION

- UNIVERSAL ROBOTS A/S

- YASKAWA ELECTRIC CORPORATION

NOTABLE HAPPENINGS IN THE GLOBAL INDUSTRIAL ROBOTS MARKET IN THE RECENT PAST:

- Product Launch: - In 2021, The i4 series SCARA robot, a new industrial robot from OMRON Corporation, was introduced. The robot has an easy-to-install and transports high-speed automated high-precision assembly. These robots from the i4 series are designed to be small and lightweight.

- Research & Development: - In 2021, the company Kawasaki Heavy Industries A domestic automated polymerase chain reaction (PCR) test system that runs Kawasaki robots at Fujita Medical University in Aichi Prefecture has been installed, according to the business.

- Product Launch: - In 2021, The new operating system iiQKA.OS, which vastly eases the usage of robots, made its debut according to Kuka AG. The new operating system serves as the backbone of the ecosystem as a whole and provides a robust range of applications, components, devices, and services.

Chapter 1. Industrial Robots Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Industrial Robots Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.4. Impact during 2024 - 2030

2.5. Impact on Supply – Demand

Chapter 3. Industrial Robots Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Industrial Robots Market Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Industrial Robots Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Industrial Robots Market – By Type

6.1. Traditional Industrial Robots

6.2. Collaborative Robots

Chapter 7. Industrial Robots Market – By Industry

7.1. Automotive

7.2. Electrical And Electronics

7.3. Plastics, Rubber, And Chemicals

7.4. Metals And Machinery

7.5. Food And Beverages

7.6. Others

Chapter 8. Industrial Robots Market - By Region

8.1. North America

8.2. Europe

8.3. Asia-Pacific

8.4. Latin America

8.5. The Middle East

8.6. Africa

Chapter 9. Industrial Robots Market – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

9.1. ABB LTD. (ABB ROBOTICS)

9.2. DAIHEN CORPORATION

9.3. DENSO CORPORATION (DENSO ROBOTICS)

9.4. FANUC CORPORATION

9.5. KAWASAKI HEAVY INDUSTRIES LTD.

9.6. KUKA ROBOTICS CORPORATION

9.7. MITSUBISHI ELECTRIC CORPORATION

9.8. NACHI-FUJIKOSHI CORPORATION (NACHI ROBOTIC SYSTEMS, INC.)

9.9. PANASONIC CORPORATION

9.10. SEIKO EPSON CORPORATION

9.11. UNIVERSAL ROBOTS A/S

9.12.YASKAWA ELECTRIC CORPORATION

Download Sample

Choose License Type

2500

4250

5250

6900