Industrial PC Market Size (2025 – 2030)

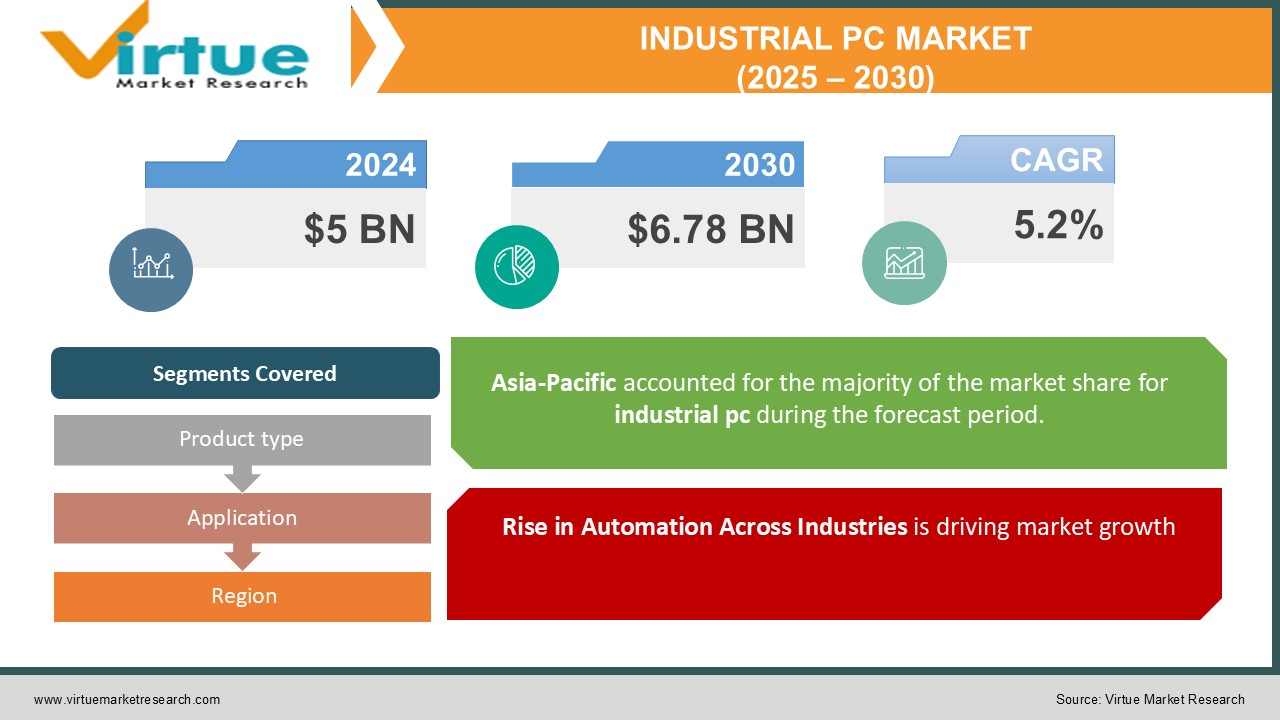

The Global Industrial PC Market was valued at USD 5 billion in 2024 and is projected to grow at a CAGR of 5.2% from 2025 to 2030. The market is expected to reach USD 6.78 billion by 2030.

Industrial PCs are rugged computing devices designed to perform reliably in harsh environments and industrial applications. They are widely used across industries such as manufacturing, healthcare, energy, and transportation for controlling processes, data acquisition, and machine automation. The market growth is driven by the increasing adoption of automation and IoT technologies in industries, requiring robust computing solutions with high reliability and durability.

Key Market Insights

The manufacturing industry holds the largest share in the Industrial PC market due to increased automation adoption and the need for real-time data processing and monitoring. Panel Industrial PCs accounted for the highest revenue share in 2024, driven by their wide adoption in applications requiring touch-based interfaces and compact designs.

The integration of IoT and AI in industrial PCs is a key trend, enabling predictive maintenance and enhanced operational efficiency across industries. Demand for industrial PCs with high processing power and customization options has surged, particularly in energy and utility sectors. Rugged industrial PCs with enhanced thermal management and environmental protection features are gaining significant traction in defense and transportation sectors.

The Asia-Pacific region is the fastest-growing market for industrial PCs, attributed to rapid industrialization in countries like China, India, and South Korea.

Challenges such as high initial costs and compatibility issues with legacy systems continue to hinder widespread adoption in certain industries.

Key players are focusing on expanding product portfolios and offering tailored solutions to meet diverse industry requirements.

Global Industrial PC Market Drivers

Rise in Automation Across Industries is driving market growth:

The increasing adoption of automation technologies across manufacturing, healthcare, and logistics sectors is a major driver of the Industrial PC market. Industries are continuously integrating robotics and automated systems to improve efficiency, reduce labor costs, and maintain product quality. Industrial PCs serve as the backbone for controlling these systems, offering durability and high processing capabilities. The deployment of industrial PCs ensures reliable operation in extreme conditions such as high temperature, dust, and vibrations. As Industry 4.0 continues to shape the manufacturing landscape, the demand for industrial PCs equipped with IoT connectivity and AI-powered analytics is expected to rise significantly, further fueling market growth.

Growing Demand for Data-Driven Operations is driving market growth:

The need for data-driven decision-making in industries has grown with advancements in IoT and cloud computing technologies. Industrial PCs play a critical role in acquiring, processing, and transmitting data from industrial processes, enabling real-time monitoring and predictive maintenance. This capability minimizes downtime and enhances productivity. For example, in the energy sector, industrial PCs are used to monitor grid performance and optimize energy distribution. The increasing importance of big data analytics and smart manufacturing practices is driving the adoption of high-performance industrial PCs across multiple industries.

Expanding Applications in Emerging Economies is driving market growth:

Emerging economies in Asia-Pacific, South America, and Africa are witnessing rapid industrialization, leading to a surge in demand for industrial automation. Governments and private enterprises are investing heavily in infrastructure and smart city projects, which involve the integration of industrial PCs in systems such as intelligent traffic management, automated warehouses, and renewable energy solutions. The growing awareness of operational efficiency and the benefits of automation among SMEs in these regions is expected to further boost the adoption of industrial PCs.

Global Industrial PC Market Challenges and Restraints

High Initial Costs and Maintenance Expenses is restricting market growth: One of the significant barriers to the widespread adoption of industrial PCs is their high upfront cost. Industrial PCs are designed to meet rigorous environmental standards, incorporating advanced materials and components that make them more expensive than consumer-grade PCs. Small and medium-sized enterprises (SMEs) often find it challenging to justify these costs, especially in low-margin industries. Additionally, the maintenance and repair of industrial PCs can be costly due to the specialized expertise required and the unavailability of replacement components. These factors can deter potential buyers, particularly in price-sensitive markets.

Compatibility Issues with Legacy Systems is restricting market growth: Many industries still operate with legacy systems that are not compatible with modern industrial PCs. Integrating new industrial PCs into existing setups often requires extensive modifications, leading to increased costs and delays. This challenge is particularly pronounced in sectors such as oil and gas, where upgrading legacy infrastructure is both complex and expensive. Moreover, the lack of standardized protocols among different manufacturers further complicates integration efforts. Addressing these compatibility issues is crucial for driving the adoption of industrial PCs in traditional industries.

Market Opportunities

The Industrial PC market presents significant opportunities for growth, driven by technological advancements and evolving industrial needs. The increasing adoption of Industry 4.0 practices across various sectors highlights the growing importance of smart manufacturing and data-driven operations. With the proliferation of IoT, industrial PCs are becoming central to enabling connected ecosystems that provide real-time insights and automation. The rising demand for customized industrial PCs tailored to specific applications offers immense potential for manufacturers to expand their product portfolios and cater to niche markets. Furthermore, the focus on sustainability and energy efficiency is driving the development of industrial PCs with low power consumption and high-performance capabilities. Emerging economies represent a lucrative market, with governments and enterprises investing in infrastructure development and industrial automation. By addressing challenges such as cost and compatibility, companies can unlock new avenues for growth and capitalize on the rising demand for reliable, durable, and intelligent computing solutions in industrial environments.

INDUSTRIAL PC MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

5.2% |

|

Segments Covered |

By Product type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Advantech, Siemens, Beckhoff Automation, General Electric, Rockwell Automation, Kontron, Mitsubishi Electric, AAEON Technology, B&R Automation, Panasonic Industrial Devices |

Industrial PC Market Segmentation - By Product Type

-

Panel Industrial PC

-

Rack Mount Industrial PC

-

Box Industrial PC

-

Embedded Industrial PC

-

DIN Rail Industrial PC

-

Thin Client Industrial PC

Panel Industrial PCs lead the market due to their versatility and integration of touch-screen interfaces, widely adopted in manufacturing and healthcare sectors.

Industrial PC Market Segmentation - By Application

-

Manufacturing

-

Automotive

-

Energy & Utilities

-

Healthcare

-

Transportation

-

Others

Manufacturing holds the largest share, driven by the need for automation and real-time process monitoring, significantly contributing to operational efficiency.

Industrial PC Market Segmentation - By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific dominates the Industrial PC market, driven by rapid industrialization, increased adoption of automation, and investments in smart manufacturing technologies. Countries like China and India lead this growth due to robust government initiatives supporting industrial modernization. The region's diverse industries, ranging from automotive to electronics, have embraced industrial PCs to enhance operational efficiency and reduce production costs. Furthermore, the growing presence of global players and regional manufacturing hubs has strengthened the market. Asia-Pacific's role as a major exporter of consumer electronics and industrial goods further underscores its dominance in the Industrial PC market.

COVID-19 Impact Analysis on the Industrial PC Market

The COVID-19 pandemic had a profound impact on the Industrial PC market, both presenting challenges and driving growth in unexpected ways. At the onset of the pandemic, widespread manufacturing shutdowns and global supply chain disruptions severely hindered production timelines and delayed projects. Many industries faced setbacks as they struggled to maintain regular operations amid these challenges. However, the crisis also accelerated the adoption of automation, remote monitoring, and digital technologies as businesses scrambled to ensure continuity. Industrial PCs became crucial in this shift, playing a key role in facilitating digital transformation efforts across various sectors. These systems enabled remote access to critical infrastructure and allowed for continuous monitoring and control of operations, even from a distance. With the need for business continuity and remote operations greater than ever, industries increasingly turned to industrial PCs to support their operations. As the pandemic gradually receded, the demand for advanced industrial PCs soared, driven by a renewed focus on resilience, automation, and operational efficiency. This trend was particularly evident in the healthcare sector, where automation technologies, powered by industrial PCs, were rapidly adopted for diagnostics, patient treatment, and overall healthcare management. The increased reliance on automation and digital systems during the pandemic highlighted the importance of robust digital infrastructure in maintaining business operations. Ultimately, the COVID-19 pandemic served as a catalyst for accelerating digital transformation, cementing the role of industrial PCs as essential components of modern industrial operations. As industries focus on building more resilient, automated, and efficient systems, the demand for industrial PCs is expected to continue growing in the years ahead.

Latest Trends/Developments

The Industrial PC market is undergoing a significant transformation, driven by several key trends that are reshaping the industry. The integration of IoT and AI technologies has significantly enhanced the capabilities of industrial PCs, enabling real-time analytics, predictive maintenance, and overall improvements in operational efficiency. These innovations allow industries to gather valuable data and make more informed decisions, optimizing processes across various sectors. In response to the demands of harsh industrial environments, ruggedized designs with advanced thermal management and durability features have become the norm for industrial PCs. These features ensure reliable performance even in challenging conditions, such as extreme temperatures, vibrations, and dust. The rise of edge computing has further expanded the potential of industrial PCs by enabling localized data processing, which reduces latency and improves the speed and accuracy of decision-making. Energy efficiency is another key focus, with manufacturers increasingly prioritizing the development of models that align with global sustainability goals. This includes designing industrial PCs that consume less power while maintaining high performance, contributing to greener industrial operations. The growth of collaborative robotics (cobots) has also contributed to the increased demand for industrial PCs, as these systems are often used to control and manage robotic operations on factory floors. Finally, with the increasing prevalence of cyber threats targeting industrial systems, cybersecurity has become a crucial consideration in product development. Industrial PCs are now being designed with advanced security features to protect against potential vulnerabilities and ensure the integrity of sensitive data. As industries continue to innovate and evolve, industrial PCs remain at the forefront of digital transformation, playing a pivotal role in enhancing efficiency, connectivity, and security across various sectors.

Key Players

-

Advantech

-

Siemens

-

Beckhoff Automation

-

General Electric

-

Rockwell Automation

-

Kontron

-

Mitsubishi Electric

-

AAEON Technology

-

B&R Automation

-

Panasonic Industrial Devices

Chapter 1. Industrial PC Market– Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Industrial PC Market– Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Industrial PC Market– Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Industrial PC Market- Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Industrial PC Market– Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Industrial PC Market– By Product Type

6.1 Introduction/Key Findings

6.2 Panel Industrial PC

6.3 Rack Mount Industrial PC

6.4 Box Industrial PC

6.5 Embedded Industrial PC

6.6 DIN Rail Industrial PC

6.7 Thin Client Industrial PC

6.8 Y-O-Y Growth trend Analysis By Product Type

6.9 Absolute $ Opportunity Analysis By Product Type, 2025-2030

Chapter 7. Industrial PC Market– By Application

7.1 Introduction/Key Findings

7.2 Manufacturing

7.3 Automotive

7.4 Energy & Utilities

7.5 Healthcare

7.6 Transportation

7.7 Others

7.8 Y-O-Y Growth trend Analysis By Application

7.9 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Industrial PC Market, By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Industrial PC Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Advantech

9.2 Siemens

9.3 Beckhoff Automation

9.4 General Electric

9.5 Rockwell Automation

9.6 Kontron

9.7 Mitsubishi Electric

9.8 AAEON Technology

9.9 B&R Automation

9.10 Panasonic Industrial Devices

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Industrial PC Market was valued at USD 5 billion in 2024 and is projected to grow at a CAGR of 5.2% from 2025 to 2030. The market is expected to reach USD 6.78 billion by 2030.

Key drivers include the rise in automation across industries, growing demand for data-driven operations, and expanding applications in emerging economies.

The market is segmented by product type (e.g., Panel PCs, Box PCs) and by application (e.g., manufacturing, automotive).

Asia-Pacific is the dominant region, driven by rapid industrialization and the adoption of automation technologies.

Leading players include Advantech, Siemens, Beckhoff Automation, General Electric, and Rockwell Automation.