Industrial Networking Solutions Market Size (2024 – 2030)

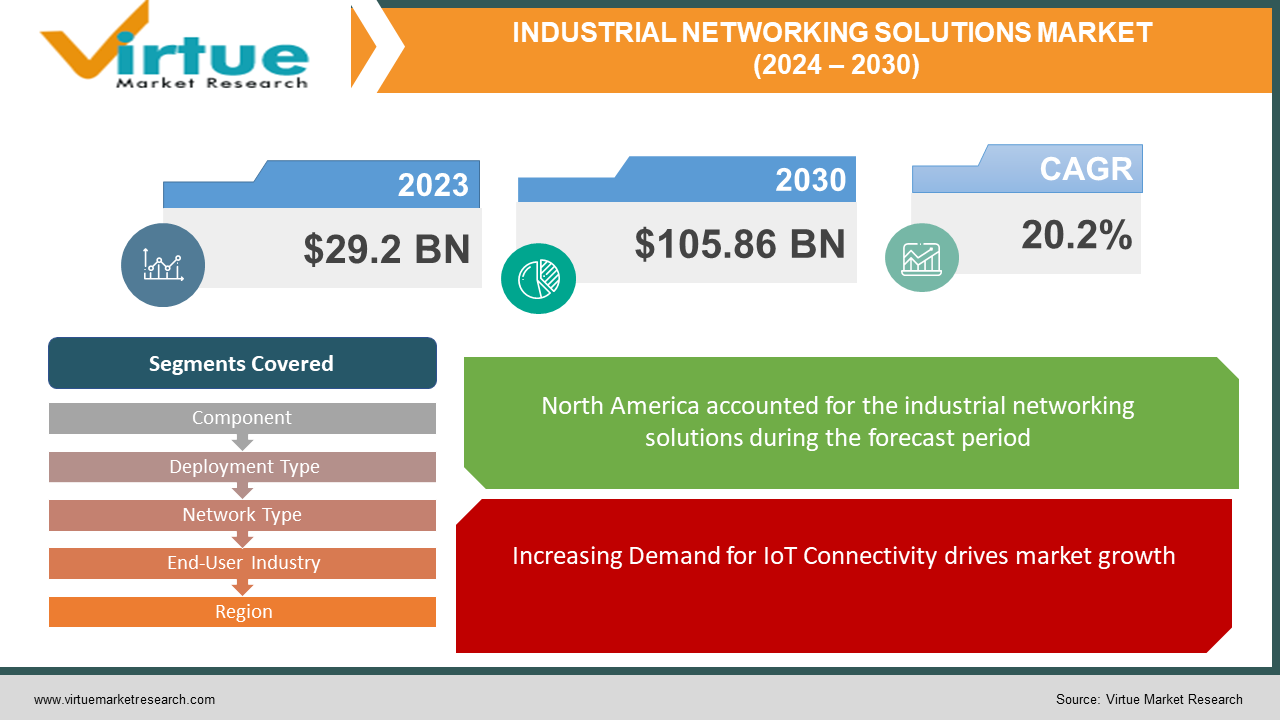

The Industrial Networking Solutions Market was valued at USD 29.2 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 105.86 billion by 2030, growing at a CAGR of 20.2%.

Industrial networking solutions encompass a range of offerings, including products, technologies, and services tailored to facilitate the establishment and administration of resilient, secure, and effective communication infrastructures within industrial settings. These environments span diverse sectors such as manufacturing, energy, utilities, transportation, healthcare, and beyond. The fundamental objective of industrial networking solutions is to facilitate uninterrupted data interchange, control, and surveillance among machinery, devices, sensors, and control systems operating within industrial premises.

Key Market Insights:

A robust industrial network solution serves as the cornerstone of any automation system design, offering robust capabilities for data exchange and control, as well as the flexibility to interconnect diverse devices. Data communication refers to the transfer of information or data, mostly in digital format, from a transmitter to a receiver through a link connecting these two. Traditional communication networks facilitate data transmission among computers and other devices. These networks play a crucial role in product distribution, technical support, and the provision of IT services, utilizing both wired and wireless networking systems.

Industrial Networking Solutions Market Drivers:

Increasing Demand for IoT Connectivity drives market growth.

Numerous industries are actively pursuing enhancements in operational efficiency within their assets and production systems through the convergence and digitization facilitated by emerging solutions in the Industrial Internet of Things (IIoT) and Industry 4.0. However, these endeavors necessitate the secure integration of production environments with conventional networking technologies to enable industries and their key stakeholders to access a wealth of new data, real-time insights, and remote connectivity to operational systems and assets. Presently, Industry 4.0 represents an opportune moment as many industrial applications and digitization initiatives can immediately leverage LTE/4G technology. Moreover, it serves as a crucial step towards fostering the adoption of cellular technology across industrial sectors and establishing a framework for future advancements in networking applications.

The increasing demand for Automation and Connectivity in Industrial Processes is fueling market growth in unprecedented ways.

Industrial automation involves the utilization of control systems to oversee and regulate industrial processes, thereby enhancing efficiency, productivity, and safety. Conversely, industrial connectivity refers to the capability of linking industrial devices and systems with each other and with the internet, thereby enhancing visibility, collaboration, and decision-making capabilities.

Industrial Networking Solutions Market Restraints and Challenges:

High costs hinder market growth.

A significant portion of the total costs in industrial investments is allocated to software, encompassing robust equipment suitable for harsh industrial environments and advanced software for security and communication purposes. Integrating legacy systems with contemporary networking solutions necessitates additional investments in equipment and personnel training. Additionally, the ongoing tasks of updating firmware and implementing cybersecurity measures contribute further to the financial burden. The uncertainty surrounding the return on investment may instill hesitation in adopting these technologies.

Industrial Networking Solutions Market Opportunities:

Increasing Adoption of Industry 4.0 and other Smart Manufacturing Initiatives creates opportunities in the market.

Industry 4.0 represents the fourth industrial revolution, distinguished by the integration of cutting-edge technologies like artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT) to automate and enhance industrial operations. Smart manufacturing, a component of Industry 4.0, specifically emphasizes the application of these technologies to elevate the efficiency, productivity, and adaptability of manufacturing procedures.

Use in a Wide range of applications creates opportunities.

A diverse array of applications benefit from industrial networking solutions, spanning predictive maintenance, remote tracking, and incident management. Furthermore, the solutions offered by prominent players in the industrial networking market cater to various industries, including but not limited to food and beverage, chemicals, machinery manufacturing, medical devices, as well as logistics and transportation.

INDUSTRIAL NETWORKING SOLUTIONS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

20.2% |

|

Segments Covered |

By Component, Deployment Type, Network Type, End-User Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Huawei Technologies Co. Ltd. (China)., Dell Inc. (U.S.), Eaton (U.S.), LP (U.S.), Rockwell Automation Inc. (U.S.), Hewlett Packard Enterprise Development (U.S.), Juniper Networks Inc. (U.S.), Sierra Wireless (Canada), Belden Inc. (U.S.), Veryx Technologies. (U.S.) |

Industrial Networking Solutions Market Segmentation - By Component

-

Software

-

Hardware

-

Services

The services segment holds the largest share of the industrial networking solutions market. The services provided by industrial networking solutions span a spectrum of activities, including network orchestration, testing, auditing, provisioning, consulting, as well as training and education. Moreover, offerings such as network planning, optimization, support, and maintenance are also included in this category. These services are instrumental in meeting clients' diverse needs, thereby contributing to the growth of this sector.

Industrial Networking Solutions Market Segmentation - By Deployment Type

-

On-premises

-

Cloud

The cloud segment commands a dominant position in the market. The escalating adoption of wireless technologies across diverse industry sectors is expected to drive the demand for both cloud-based and on-premises deployment models of industrial networking solutions.

Industrial Networking Solutions Market Segmentation - By Network Type

-

Wired

-

Wireless

The wireless networking segment holds the largest share of the market, primarily attributed to its ability to effortlessly connect numerous devices across various environments without the requirement for expensive cable installations. Radio communication plays a significant role in the design and operation of administrative telecom networks, with the physical layer of the model serving as the primary interface.

Industrial Networking Solutions Market Segmentation - By End-User Industry

-

Automotive

-

Telecommunication

-

Manufacturing

-

chemicals and materials

-

Financial and Banking Industry

-

Logistics

-

Transportation

The chemicals and materials segment is projected to experience the most rapid growth in the industrial networking solutions market. The increasing adoption of advanced networking technologies such as IIoT and WLAN has been instrumental in streamlining manufacturing processes and improving business operations within the manufacturing and construction industries. Through IoT-enabled monitoring solutions and predictive analytics, continuous monitoring of throughput and quality is achievable in the chemical and materials vertical.

Industrial Networking Solutions Market Segmentation- by Region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

North America holds a dominant position in the global industrial networking solutions market, particularly driven by the United States, which has been an early adopter of advanced technologies such as industrial automation, IoT (Internet of Things), and Industry 4.0. This proactive adoption has fueled the demand for industrial networking solutions, facilitating connectivity and data exchange within technologically advanced industries.

On the other hand, Asia-Pacific is poised to witness the swiftest growth in the forecast period, attributed to the rapid development of network infrastructure across the region. Furthermore, various countries in Asia-Pacific have undertaken robust initiatives to bolster industrial networking infrastructure. With substantial government support, China stands out as a significant player in the IIoT landscape. Leveraging its position as one of the world's largest economies, stakeholders including operators and vendors are actively contributing to the delivery of robust and secure industrial networking solutions. Technologies such as Low Power Wide Area networks, including NB-IoT and LTE-M, are facilitating the introduction of innovative services throughout China's industrial landscape.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic compelled numerous manufacturers to increasingly rely on digitalization and automation to mitigate the financial repercussions of the crisis and potential economic uncertainties. While initially perceived as a short-term disruption, the outbreak is anticipated to eventually subside. However, in the long term, the pandemic presents an opportunity for industries to implement essential operational enhancements, with a notable focus on bolstering networking technologies amid the ongoing challenges posed by COVID-19.

latest Trends/ Developments:

-

In July 2023, ABB India’s Electrification business introduced the MegaFlex DPA UPS solution, designed to significantly enhance energy efficiency and reduce the footprint by up to 45 percent, catering specifically to the Indian data center market. This innovative UPS solution not only enriches ABB's product portfolio but also meets the surging demand within the data center industry while contributing to sustainability objectives, solidifying the company's position as a frontrunner in technology advancement. ABB's expansion into the Indian data center market reflects its commitment to providing efficient and sustainable power solutions, aligning with its overarching mission for smart cities.

-

In February 2023, HCL Technologies formed a strategic collaboration with Dell to modernize networks for both telecommunications companies and enterprises, while also introducing pioneering 5G solutions. This partnership aimed to elevate network capabilities and deliver innovative solutions to clients in the telecommunications and business sectors. By joining forces with Dell, HCL Technologies diversified its portfolio of services and solutions, particularly in network modernization and 5G technology. This alliance empowered HCL Technologies to offer enhanced services to clients within the telecom and enterprise sectors, enhancing its competitive stance and potentially bolstering revenue through the provision of groundbreaking networking solutions.

Key Players:

These are the top 10 players in the Industrial Networking Solutions Market: -

-

Huawei Technologies Co. Ltd. (China)

-

Dell Inc. (U.S.)

-

Eaton (U.S.)

-

LP (U.S.)

-

Rockwell Automation Inc. (U.S.)

-

Hewlett Packard Enterprise Development (U.S.)

-

Juniper Networks Inc. (U.S.)

-

Sierra Wireless (Canada)

-

Belden Inc. (U.S.)

-

Veryx Technologies. (U.S.)

Chapter 1. Industrial Networking Solutions Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Industrial Networking Solutions Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Industrial Networking Solutions Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Industrial Networking Solutions Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Industrial Networking Solutions Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Industrial Networking Solutions Market – By Component

6.1 Introduction/Key Findings

6.2 Software

6.3 Hardware

6.4 Services

6.5 Y-O-Y Growth trend Analysis By Component

6.6 Absolute $ Opportunity Analysis By Component, 2024-2030

Chapter 7. Industrial Networking Solutions Market – By Deployment Type

7.1 Introduction/Key Findings

7.2 On-premises

7.3 Cloud

7.4 Y-O-Y Growth trend Analysis By Deployment Type

7.5 Absolute $ Opportunity Analysis By Deployment Type, 2024-2030

Chapter 8. Industrial Networking Solutions Market – By Network Type

8.1 Introduction/Key Findings

8.2 Wired

8.3 Wireless

8.4 Y-O-Y Growth trend Analysis End-Use Industry

8.5 Absolute $ Opportunity Analysis End-Use Industry, 2024-2030

Chapter 9. Industrial Networking Solutions Market – By End-User

9.1 Introduction/Key Findings

9.2 Automotive

9.3 Telecommunication

9.4 Manufacturing

9.5 chemicals and materials

9.6 Financial and Banking Industry

9.7 Logistics

9.8 Transportation

9.9 Y-O-Y Growth trend Analysis End-User

9.10 Absolute $ Opportunity Analysis End-User, 2024-2030

Chapter 10. Industrial Networking Solutions Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Component

10.1.2.1 By Deployment Type

10.1.3 By Network Type

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Component

10.2.3 By Deployment Type

10.2.4 By Network Type

10.2.5 By End-User

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Component

10.3.3 By Deployment Type

10.3.4 By Network Type

10.3.5 By End-User

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Component

10.4.3 By Deployment Type

10.4.4 By Network Type

10.4.5 By End-User

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Component

10.5.3 By Deployment Type

10.5.4 By Network Type

10.5.5 By End-User

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Industrial Networking Solutions Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Huawei Technologies Co. Ltd. (China)

11.2 Dell Inc. (U.S.)

11.3 Eaton (U.S.)

11.4 LP (U.S.)

11.5 Rockwell Automation Inc. (U.S.)

11.6 Hewlett Packard Enterprise Development (U.S.)

11.7 Juniper Networks Inc. (U.S.)

11.8 Sierra Wireless (Canada)

11.9 Belden Inc. (U.S.)

11.10 Veryx Technologies. (U.S.)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

An industrial network solution is the backbone of any automation system architecture as it provides powerful means of data exchange and data controllability and flexibility to connect various devices. Data communication refers to the transfer of information or data, mostly in digital format, from a transmitter to a receiver through a link connecting these two.

The top players operating in the Industrial Networking Solutions Market are - Huawei Technologies Co. Ltd. (China), Dell Inc. (U.S.), Eaton (U.S.), LP (U.S.), Rockwell Automation Inc. (U.S.), Hewlett Packard Enterprise Development (U.S.), Juniper Networks Inc. (U.S.), Sierra Wireless (Canada), Belden Inc. (U.S.), Veryx Technologies. (U.S.).

The COVID-19 pandemic compelled numerous manufacturers to increasingly rely on digitalization and automation to mitigate the financial repercussions of the crisis and potential economic uncertainties.

Industry 4.0 represents the fourth industrial revolution, distinguished by the integration of cutting-edge technologies like artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT) to automate and enhance industrial operations. Smart manufacturing, a component of Industry 4.0, specifically emphasizes the application of these technologies to elevate the efficiency, productivity, and adaptability of manufacturing procedures.

Asia-Pacific is poised to witness the swiftest growth in the forecast period, attributed to the rapid development of network infrastructure across the region. Furthermore, various countries in Asia-Pacific have undertaken robust initiatives to bolster industrial networking infrastructure.