Industrial Mixer Market Size (2023 – 2030)

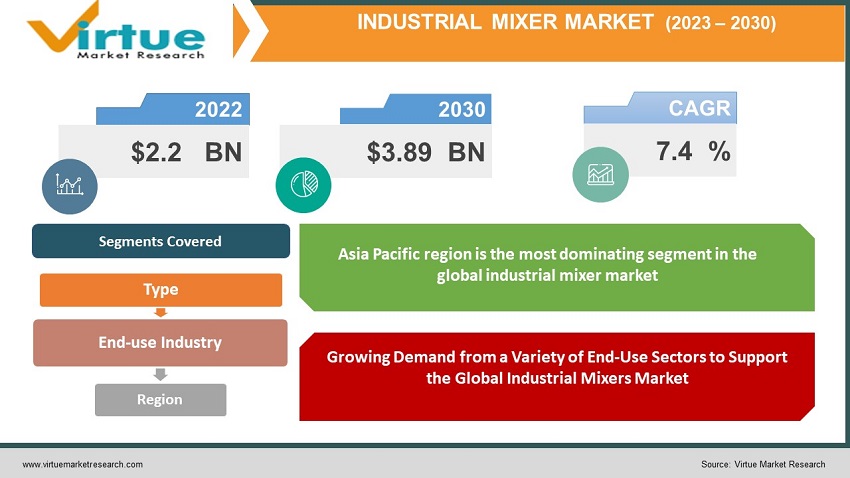

The Global Industrial Mixer Market was evaluated to be worth USD 2.2 Billion in 2022 and is projected to reach a value of USD 3.89 Billion by the end of 2030, growing at a fast CAGR of 7.4% during the outlook period 2023-2030.

Industrial mixers are devices that combine, homogenize, emulsify, and or blend several materials into a single substance. Virtually any solid or liquid that is required to create a final product can be thoroughly combined in a mixer. They are utilized during the manufacturing or processing stages in numerous industries. These devices are widely utilized in a variety of sectors, including adhesive and sealant, automotive, agricultural, food and beverage, pulp and paper, research and lab, cosmetic, pharmaceutical, and chemical industries. Industrial mixers are specialized tools used for a range of tasks in various sectors, including mixing powders, granules, liquids, and other materials. Most industrial mixing procedures are carried out in sealed containers with restricted airflow and set temperatures. Ingredient processed foods, lotions for skin care, and pharmaceuticals are uncommon. The majority of User items are made up of unique mixtures of many materials and chemicals that are not just combined; rather, they are chemically bonded or emulsified to form a unified whole. The most common way to accomplish this particular form of blending is via an industrial mixing device.

Global Industrial Mixer Market Drivers:

Growing Demand from a Variety of End-Use Sectors to Support the Global Industrial Mixers Market:

These industries require mixers to mix, blend, or homogenize materials in large quantities. Due to shifting User preferences, population growth, and the rising incidence of chronic diseases, there is a greater demand for processed and packaged foods, pharmaceuticals, chemicals, and cosmetics. As a result, commerce is looking to enhance its production processes to keep up with the rising demand for goods, which has increased demand for industrial mixers.

Industrial mixer demand will increase as the preference for high-performance and energy-efficient mixers grows:

More sectors are now in need of industrial mixers. By introducing new and sophisticated mixing technologies that have led to mixers that are more effective and efficient, technological breakthroughs have completely transformed the industrial mixer market. With the aid of computational fluid dynamics (CFD), mixer designs have been improved, resulting in less energy being used during mixing. Additionally, more powerful and corrosion-resistant mixers have been produced as a result of the utilization of modern materials like ceramics and composites. The market has also been impacted by automation and control systems because they enable more exact control over the mixing process, which leads to more reliable and high-quality products. Due to these demand for industrial mixers has expanded across a variety of industries as businesses look to enhance their production methods and deliver higher-quality goods.

Global Industrial Mixer Market Challenges:

The expense of maintenance and repair poses an obstacle to the global industrial mixer market:

Industrial mixers need routine maintenance and repairs to keep them operating successfully and efficiently; failing to do so can lead to malfunctions, downtime, and decreased production. Depending on the type of mixer, how often it is used, and the degree of care necessary, the cost of maintenance and repair may change. Companies may deal with these issues by putting preventative maintenance programs in place, purchasing high-quality mixers, and collaborating with suppliers and producers to make sure they have access to replacement components and technical help when they need it.

COVID-19 Impact on Global Industrial Mixer Market:

The global industrial mixer market has been significantly impacted by the COVID-19 pandemic, which has resulted in supply chain interruptions, decreased demand, and changes in User behavior. The demand for industrial mixers used in the food and beverage sector has been reduced as an outcome of the shutting of food service outlets, and production delays and higher prices for manufacturers have been caused by a shortage of raw materials and components. However, as the pandemic recedes and businesses start to reopen, the need for industrial mixers is anticipated to rise as businesses try to streamline their production procedures and satisfy the soaring User demand.

Global Industrial Mixer Market Recent Developments:

- In May 2021: SPX FLOW, a leading manufacturer of industrial mixers announced the launch of a new range of high-performance mixers for the food and beverage industry.

- In October 2021: GEA Group, a German manufacturer of industrial mixers, announced the launch of a new range of mixers for the dairy industry, designed for the production of yogurt and other dairy products.

INDUSTRIAL MIXER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

7.4% |

|

Segments Covered |

By Type, End Use Industry , and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

SPX FLOW, GEA Group, Sulzer Ltd., EKATO Group, Philadelphia Mixing Solutions, Charles Ross & Son Company, Bühler AG, Silverson Machines Inc, Alfa Laval AB, Mixer Systems Inc. |

Global Industrial Mixer Market Segmentation

Global Industrial Mixer Market Segmentation: By Type

- Batch mixers

- Continuous mixers

- High-shear mixers

- Low-shear mixers

- Ribbon mixers

- Paddle mixers

- Planetary mixers

- Static mixers

- Dynamic mixers

Batch mixers are the most dominant type of industrial mixers on the market today. They are extensively utilized in many different businesses, including those that produce chemicals, food, and beverages. Because of its adaptability, usability, and capacity to handle a variety of materials, batch mixers are recommended. When compared to other types of mixers, they are also more inexpensive and require rare maintenance. Due to their versatility in handling a variety of materials and their affordability, batch mixer demand is anticipated to increase over time.

High-shear mixers are the industrial mixer market's fastest-growing type. They are employed in processes that demand vigorous mixing and emulsification. In the food and beverage business, high-shear mixers are being utilized more frequently to create items like sauces, dressings, and mayonnaise. They are used in the pharmaceutical sector to make lotions, ointments, and gels. Because of their capacity for handling demanding mixing and emulsification tasks as well as their expanding use in the pharmaceutical and food and beverage sectors, high-shear mixers are on the rise.

Global Industrial Mixer Market Segmentation: By End-use Industry

- Food and Beverage

- Pharmaceuticals

- Chemicals

- Cosmetics

- Others

The food and beverage industry is the most significant segment within the end-use industry segmentation of the global industrial mixer market. The largest user of industrial mixers is the food and beverage sector, where they are employed for a variety of tasks like blending, emulsifying, and mixing. The demand for processed and packaged foods as well as the rising adoption of convenience foods are driving the demand for industrial mixers in the food and beverage sector. Industrial mixers are broadly working in the pharmaceutical and chemical sectors, where they are used to combine and merge ingredients as well as to make tablets, capsules, and other dosage forms.

The industrial mixer market's fastest-growing sector is the cosmetics industry, which is anticipated to expand significantly as a result of the rising demand for personal care goods. Creams, lotions, and other cosmetic items are made in the cosmetics business using industrial mixers. User fondness is changing, and natural and organic goods are becoming more and more popular, which is driving the demand for industrial mixers in the cosmetics business.

Global Industrial Mixer Market Segmentation: By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

The Asia Pacific region is the most dominating segment in the global industrial mixer market as a result of the region's developing manufacturing sector, rising urbanization, and expanding population. The region is also home to several developing countries, which are anticipated to fuel the market for industrial mixers in the coming years. Due to the increasing need for industrial mixers in the oil and gas industry, the Middle East and Africa area is the category with the fastest growth. The oil and gas business uses industrial mixers for a variety of tasks, including blending and mixing drilling fluids, cement slurries, and other substances.

Key Players:

1. SPX FLOW

2. GEA Group

3. Sulzer Ltd.

4. EKATO Group

5. Philadelphia Mixing Solutions

6. Charles Ross & Son Company

7. Bühler AG

8. Silverson Machines Inc.

9. Alfa Laval AB

10. Mixer Systems Inc.

Chapter 1. INDUSTRIAL MIXER MARKET– Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. INDUSTRIAL MIXER MARKET– Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 – 2030

2.3.2. Impact on Supply – Demand

Chapter 3. INDUSTRIAL MIXER MARKET– Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. INDUSTRIAL MIXER MARKET- Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. INDUSTRIAL MIXER MARKET- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. INDUSTRIAL MIXER MARKET– By Type

6.1. Batch mixers

6.2. Continuous mixers

6.3. High-shear mixers

6.4. Low-shear mixers

6.5. Ribbon mixers

6.6. Paddle mixers

6.7. Planetary mixers

6.8. Static mixers

6.9. Dynamic mixers

Chapter 7. INDUSTRIAL MIXER MARKET– By End-User

7.1. Food and Beverage

7.2. Pharmaceuticals

7.3. Chemicals

7.4. Cosmetics

7.5. Others

Chapter 8. INDUSTRIAL MIXER MARKET– By Region

8.1. North America

8.2. Europe

8.3.The Asia Pacific

8.4.Latin America

8.5. Middle-East and Africa

Chapter 9. INDUSTRIAL MIXER MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

9.1. SPX FLOW

9.2. GEA Group

9.3. Sulzer Ltd.

9.4. EKATO Group

9.5. Philadelphia Mixing Solutions

9.6. Charles Ross & Son Company

9.7. Bühler AG

9.8. Silverson Machines Inc

9.9. Alfa Laval AB

9.10. Mixer Systems Inc

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Industrial Mixer Market was evaluated to be worth USD 2.2 Billion in 2022 and is projected to reach a value of USD 3.89 Billion by the end of 2030, growing at a fast CAGR of 7.4% during the outlook period 2023-2030.

Industrial mixers can be classified into several types, batch mixers, Continuous mixers, high-shear mixers, low-shear mixers, ribbon mixers, paddle mixers, static mixers, and dynamic mixers.

Asia Pacific is the largest user of industrial mixers, with China and India being the major contributors to the market growth.

The major end-use industries for industrial mixers include food and beverage, pharmaceutical, chemicals, cosmetics, and others.

The fastest-growing segment in the industrial mixers market is the cosmetic industry, which is likely to grow at a significant rate due to the increasing demand for personal care products.