Global Industrial Meat Grinding Equipment Size (2023 - 2030)

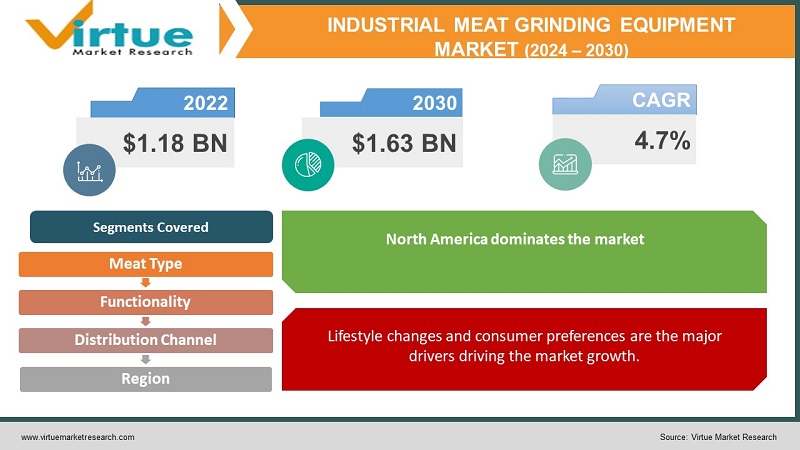

According to the report published by Virtue Market Research in Global Industrial Meat Grinding Equipment Market was valued at USD 1.18 Billion and is projected to reach a market size of USD 1.63 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.7%.

An industrial meat grinder is a machine that uses a feeding worm (auger) under pressure to drive meat or meat trimmings through a horizontally mounted cylinder (barrel). A cutting system consisting of grinder knives revolving with the feeding worm and stationary perforated discs (grinding plates) is located at the barrel's end. Grinding plate holes typically range from 1 to 13mm. The spinning feeding auger compresses the meat, which is then forced through the cutting system and extrudes through the perforations in the grinding plates after being sliced by the revolving grinding blades. A single grinding knife and grinder plate are employed in simple equipment, but in most cases, a succession of plates and rotating knives are utilised. The size of the holes on the last grinding plate determines the degree of mincing. If frozen meat or meat rich in connective tissue is to be chopped into small particles, it should be minced first through a coarse disc and then again to the appropriate size.

Owing to market expansions, advantages, efficiency, emerging food trends, technological advancements, and consumer preference this market has seen rise over the years. During the forecasted period, this market is projected to show notable growth and generate profits.

Global Industrial Meat Grinding Equipment Market Drivers:

Lifestyle changes and consumer preferences are the major drivers driving the market growth.

Packaged and processed ready-to-eat food has played a significant role because of wider option availability, longer shelf life, easy transportation, and relaxation helping to fuel the demand for meat grinding equipment. The capacity of the equipment to adapt to varied meat textures and improve consistencies corresponds with the need for a variety of meat-based items such as sausages, burgers, meatballs, and more. Additionally, customer-specific needs add more weightage. This equipment also helps to remove toxins in the meat. Furthermore, cultural sentiments, taste, and nutritional benefits are associated with meat products aiding the expansion of meat equipment.

The need for increased production efficiency and cost-effectiveness is a major factor in the use of industrial meat grinding equipment.

Manufacturers attempt to optimise their processes to maximise production while minimising labour and operational expenses in an increasingly competitive market scenario. Meat grinding equipment automates the time-consuming procedure of meat preparation, decreasing the need for manual labour and increasing efficiency. This efficiency not only boosts overall profitability for food processing firms but also helps fulfil customer needs for consistent product quality, which is critical in sustaining brand loyalty and market share.

Global Industrial Meat Grinding Equipment Market Challenges:

There has been a rising shift of a vast majority of the population towards the incorporation of vegetarian and vegan-based diets in their lifestyle. This has caused a decline in the number of people who consume meat thereby affecting the meat grinding equipment. Additionally, few of them are following an eggetarian-based diet further causing a hindrance. Secondly, strict adherence to food safety and cleanliness requirements can be neglected becoming a concern. Because meat processing entails the handling of perishable items that are easily contaminated, producers must invest in equipment that is not only efficient but also intended to fulfil stringent cleanliness standards. Balancing technological progress with the requirement of maintaining high food safety standards is a constant problem, necessitating the development of solutions that meet both elements successfully. Furthermore, high initial investments and skilled labour can be a barrier to the industry.

Global Industrial Meat Grinding Equipment Market Opportunities:

Technological advancements, demand for processed meat, and consumer preference are presenting the market with ample opportunities for progress. The rising number of food outlets, restaurants, and hotels has further boosted the growth. Moreover, the popularity of local and international cuisines amongst the public is playing a significant role. Collaborations and partnerships between companies have had a positive impact on the industry.

COVID-19 Impact on the Global Industrial Meat Grinding Equipment Market:

The outbreak of Covid-19 took a toll on the meat and meat equipment industry. People became biased towards the consumption of plant-based foods due to the minimized associated risks. There was a lot of environmental awareness created which caused a decline in meat consumption Lockdowns, social isolation, and movement restrictions were the new norm. This affected the supply chain and the import-export trade causing an economic slowdown. The closure of industries and manufacturing units created a setback. Moreover, travel restrictions were placed due to which the food and beverage industry incurred losses. Furthermore, the lack of labourers caused an obstacle in carrying out various processes. However, post-pandemic, the industry picked up with relaxations of rules, upliftment of lockdowns and digital transformation.

Global Industrial Meat Grinding Equipment Market Recent Developments:

- In April 2023, a new Canadian meat processing hub, the Centre for Meat Innovation and Technology was launched in Ontario to advance and strengthen new technology and employee skills in the segment.

- In March 2023, The U.S. Department of Agriculture (USDA) announced an investment of more than $43 million in meat and poultry processing research, innovation and expansion in support of its ongoing efforts to transform the food system at every stage along the supply chain.

- In November 2021, MEAT! Your Maker, best known for its commercial-grade processing equipment announced the release of .75 HP and 1 HP stainless steel meat grinders as well as a Foot Pedal Switch to fill in gaps in terms of both price point and output capabilities.

- In November 2021, the governments of Canada and Ontario announced an investment of up to $7 million that supported increased meat processing capacity in the province.

INDUSTRIAL MEAT GRINDING EQUIPMENT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.7% |

|

Segments Covered |

By Meat Type, Functionality, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Hobart Corporation, BIRO Manufacturing Company, Marel, Weiler, Risco Group, Butcher Boy Machines International, Meyn Food Processing Technology B.V., Jarvis Products Corporation, Mainca, Grote Company |

Global Industrial Meat Grinding Equipment Market Segmentation: By Meat Type

-

Beef

-

Pork

-

Mutton

-

Others

Pork is the largest growing segment in the industrial meat grinding equipment market. Factors like grinding consistency, cost, adaptability, health and nutritional benefits, taste, and consumer demand help in boosting the market growth. Additionally, the wide options offered by these meat products help in expansion. Beef is the fastest growing showing a significant profit. Consumer demand, bulk production, and processed product availability are the main elements leading to the growth rate. The mutton segment is expected to show steady growth due to consumer trends, protein content, and cultural diversity.

Global Industrial Meat Grinding Equipment Market Segmentation: By Functionality

-

Manual

-

Electric

Electric meat grinding equipment is the largest and fastest-growing segment in this market owing to its combination of efficiency, convenience, and technical innovation. As commercial and industrial demand for processed meat increases, so does the need for simplified manufacturing processes, which pushes the development of electric equipment. Furthermore, continuous improvements in motor power, user-friendly interfaces, and smart features are fuelling the growth of electric meat grinders.

Global Industrial Meat Grinding Equipment Market Segmentation: By Distribution Channel

-

Online Retail

-

Distributors & Wholesalers

Because of their role in simplifying the supply chain and efficiently linking manufacturers with a huge network of retailers and enterprises, distributors and wholesalers are the largest growing distribution channel for industrial meat grinding equipment. Their existing infrastructure, logistical experience, and capacity to effectively distribute products across multiple markets position them as critical partners in meeting the demands of numerous sectors.

Online retail is the fastest-growing distribution channel, owing to changing customer demands for convenience, a wide range of product options, and smooth purchasing experiences. Customers may quickly compare specifications, read reviews, and make educated selections from the comfort of their homes. Additionally, the fast expansion of e-commerce has been fuelled by advances in secure payment gateways and efficient delivery methods.

Global Industrial Meat Grinding Equipment Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

North America dominates the market due to a developed economy, consumer demand, established industries, and technological advancements. The USA and Canada stand at the forefront. Asia Pacific is the fastest-growing region due to Government initiatives, funds, demand, changing lifestyles, and preferences, a growing economy, and emerging industries. China, Japan, and South Korea are the leading regions due to their vast population and growing demand. Europe is amongst the leading regions owing to diverse tastes and preferences.

Global Industrial Meat Grinding Equipment Market Key Players:

-

Hobart Corporation

-

BIRO Manufacturing Company

-

Marel

-

Weiler

-

Risco Group

-

Butcher Boy Machines International

-

Meyn Food Processing Technology B.V.

-

Jarvis Products Corporation

-

Mainca

-

Grote Company

Chapter 1. Industrial Meat Grinding Equipment Market – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Industrial Meat Grinding Equipment Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.4. Attractive Investment Propositions

2.5. COVID-19 Impact Analysis

Chapter 3. Industrial Meat Grinding Equipment Market – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Industrial Meat Grinding Equipment Market Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.5. PESTLE Analysis

4.4. Porters Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Industrial Meat Grinding Equipment Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Industrial Meat Grinding Equipment Market – By Meat Type

6.1. Introduction/Key Findings

6.2 Beef

6.3 Pork

6.4 Mutton

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Meat Type

6.7 Absolute $ Opportunity Analysis By Meat Type, 2024-2030

Chapter 7. Industrial Meat Grinding Equipment Market – By Functionality

7.1. Introduction/Key Findings

7.2 Manual

7.3 Electric

7.4 Y-O-Y Growth trend Analysis By Functionality

7.5 Absolute $ Opportunity Analysis By Functionality, 2023-2030

Chapter 8. Industrial Meat Grinding Equipment Market – By Distribution Channel

8.1. Introduction/Key Findings

8.2 Online Retail

8.3 Distributors & Wholesalers

8.4 Y-O-Y Growth trend Analysis By Distribution Channel

8.5 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. Industrial Meat Grinding Equipment Market , By Geography – Market Size, Forecast, Trends & Insights

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2 By Meat Type

9.1.3. By Functionality

9.1.4. By Distribution Channel

9.1.6. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1. U.K.

9.2.2. Germany

9.2.3. France

9.2.4. Italy

9.2.5. Spain

9.2.6. Rest of Europe

9.2.2. By Meat Type

9.2.3. By Functionality

9.2.4 . By Distribution Channel

9.2.6. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.1. By Country

9.3.1. China

9.3.2. Japan

9.3.3. South Korea

9.3.4. India

9.3.5. Australia & New Zealand

9.3.6. Rest of Asia-Pacific

9.3.2 By Meat Type

9.3.3. By Functionality

9.3.4 By Distribution Channel

9.3.6. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.1. By Country

9.4.1. Brazil

9.4.2. Argentina

9.4.3. Colombia

9.4.4. Chile

9.4.5. Rest of South America

9.4.2. By Meat Type

9.4.3. By Functionality

9.4.4. By Distribution Channel

9.4.6. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.1. By Country

9.5.1. United Arab Emirates (UAE)

9.5.2. Saudi Arabia

9.5.3. Qatar

9.5.4. Israel

9.5.5. South Africa

9.5.6. Nigeria

9.5.7. Kenya

9.5.8. Egypt

9.5.9. Rest of MEA

9.5.2. By Meat Type

9.5.3. By Functionality

9.5.4 By Distribution Channel

9.5.7. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Industrial Meat Grinding Equipment Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Hobart Corporation

10.2 BIRO Manufacturing Company

10.3 Marel

10.4 Weiler

10.5 Risco Group

10.6 Butcher Boy Machines International

10.7 Meyn Food Processing Technology B.V.

10.8 Jarvis Products Corporation

10.9 Mainca

10.10 Grote Company

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

According to the report published by Virtue Market Research in Global Industrial Meat Grinding Equipment Market was valued at USD 1.18 Billion and is projected to reach a market size of USD 1.63 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.7%.

The Global Industrial Meat Grinding Equipment Market Drivers are Lifestyle changes as well as consumer preferences and the need for increased production efficiency & and cost-effectiveness.

The USA is the most dominating country in the region of North America for the Global Industrial Meat Grinding Equipment Market.

Hobart Corporation, BIRO Manufacturing Company, and Marel are the leading players in the Global Industrial Meat Grinding Equipment Market.