Industrial Lifting Equipment Market Size (2024 – 2030)

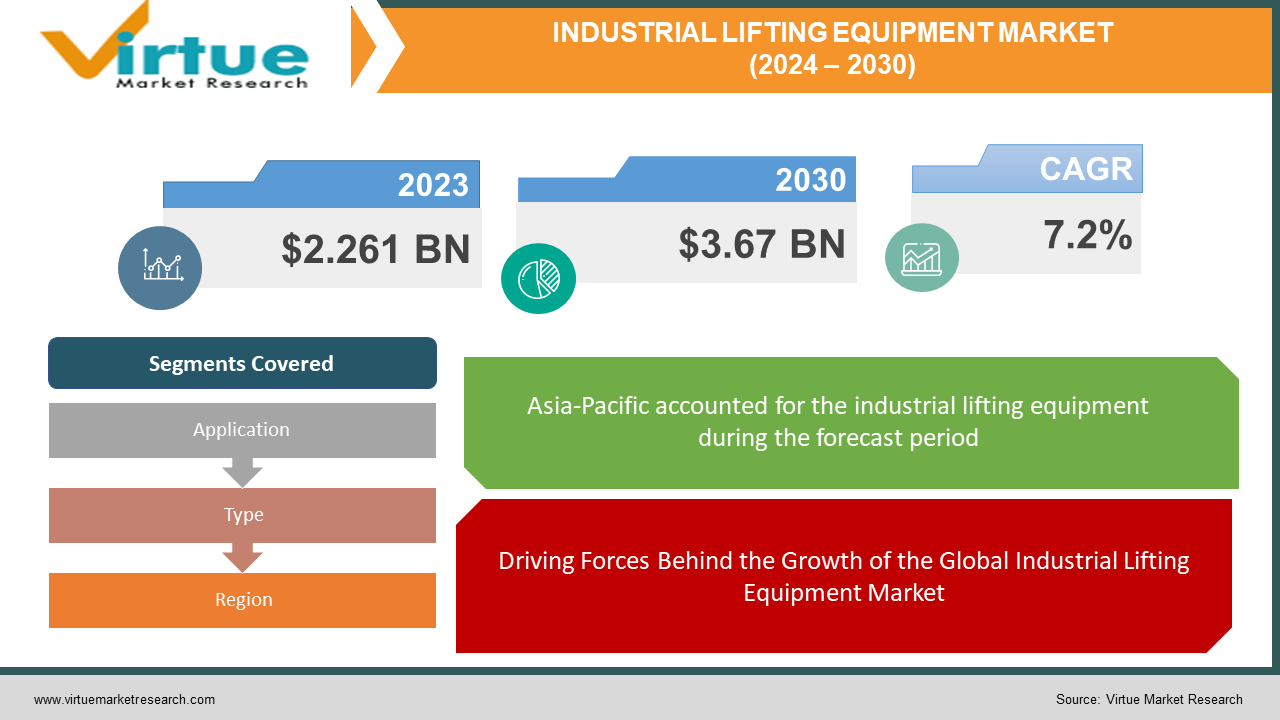

The Global Industrial Lifting Equipment Market was valued at USD 2.261 Billion in 2023 and is projected to reach a market size of USD 3.67 Billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 7.2% between 2024 and 2030.

The manufacturing industries have grown quickly since the Second Industrial Revolution began, especially since the mid-1990s. These sectors constantly strive for higher levels of productivity and follow the "everything under one roof" philosophy. Manufacturers have faced handling difficulties throughout the Industrial Revolution. These difficulties involve moving items from one place to another, which may involve lifting, dragging, or transporting. It can be challenging to lift items, particularly if they are fragile, heated, or very heavy. Because of this, almost every industry depends on lifting equipment to deal with these problems successfully. Specialized machinery or processes intended to lessen human effort in precisely putting and lifting goods are referred to as industrial lifting equipment. This equipment includes a wide variety of items, such as hoists, cranes, lifting platforms, hook sheaves, and automated or manual systems. By using such equipment, industries may reduce the dangers involved in manual lifting jobs, improve efficiency, and simplify processes while guaranteeing worker safety. As a result, industrial lifting equipment is a crucial part of contemporary manufacturing processes, facilitating the efficient flow of materials while maximizing output and safety regulations.

Key Market Insights:

The market for industrial lifting equipment is expanding significantly due to several causes, such as the growing demand in the mining, warehousing, and shipping industries. Because of their legendary adaptability, forklifts rule the industry, especially in sectors like manufacturing and construction where effective material handling is crucial. Particularly in growing nations like as China and India, the fast expansion of manufacturing and construction activity has placed the Asia Pacific area at the forefront of this economic trajectory. Furthermore, as companies place a greater emphasis on environmental responsibility, there has been a discernible movement towards eco-friendly equipment, indicating that sustainability considerations are having an increasing impact on market dynamics. This is in line with more extensive international programs meant to lessen environmental effects and reduce carbon footprint. Additionally, the development of automation and remote-control technology significantly impacts industry trends by increasing operational efficiency. Safety is still the top priority despite these developments, which is why stronger laws and cutting-edge safety measures have been put in place for lifting equipment design and operation. The market for industrial lifting equipment is being driven forward by this convergence of variables, which sets it up for long-term growth and development.

Global Industrial Lifting Equipment Market Drivers:

Driving Forces Behind the Growth of the Global Industrial Lifting Equipment Market

The global industrial lifting equipment market is witnessing remarkable expansion, driven by heightened demand across diverse industries. A significant catalyst for this growth is the burgeoning shipping and logistics sector, propelled by the surge in international trade. With the continuous increase in global commerce, ports, and shipping yards are experiencing a surge in cargo volumes, necessitating robust lifting equipment to handle larger and more complex loads. Cranes, hoists, and specialized lifting solutions are becoming indispensable tools for efficiently and safely moving cargo within these facilities. The demand for innovative lifting solutions is particularly pronounced as logistics operations seek to optimize efficiency and mitigate potential risks associated with handling heavy loads. Consequently, manufacturers of industrial lifting equipment are experiencing a surge in orders as they strive to meet the evolving needs of the shipping and logistics industry. This trend underscores the pivotal role of lifting equipment in facilitating the smooth operation of global supply chains and underscores its significance in supporting the ongoing expansion of international trade.

Construction Industry Boom Fuels Demand for Industrial Lifting Equipment

The surging construction industry stands out as a significant driver for the industrial lifting equipment market, fuelled by an increasing emphasis on large-scale infrastructure projects and towering edifices worldwide. Construction companies, propelled by urbanization and economic development, are in constant need of a diverse array of lifting equipment to facilitate their ambitious endeavors. This demand encompasses a spectrum of machinery, including mobile cranes tailored for maneuvering prefabricated structures, tower cranes indispensable for high-rise construction, and forklifts vital for efficient material handling on construction sites. The construction sector's relentless pursuit of safe and efficient lifting solutions at every stage of project execution underscores the pivotal role played by industrial lifting equipment. As construction projects grow in complexity and scale, the market for lifting equipment experiences a parallel expansion, driven by the imperative to ensure worker safety, optimize operational efficiency, and meet stringent project timelines. Consequently, manufacturers and suppliers of industrial lifting equipment are witnessing a surge in demand as they endeavor to meet the diverse requirements of the booming construction industry, thus cementing their crucial position in supporting the construction sector's continued growth and development.

Global Industrial Lifting Equipment Market Restraints and Challenges:

While the global industrial lifting equipment market boasts a promising future, it contends with notable challenges that hinder its widespread adoption. Foremost among these hurdles is the substantial upfront cost associated with acquiring such machinery. Ranging from intricate cranes to heavy-duty forklifts, the initial investment can pose a significant financial burden, particularly for smaller enterprises with limited capital resources. Moreover, the ongoing maintenance expenses further compound the financial challenges, requiring companies to allocate additional funds for upkeep and repairs. Another pressing issue is the complexity of operating some lifting equipment, which necessitates skilled operators to ensure safe and efficient usage. However, the scarcity of readily available skilled workers presents a formidable barrier, impeding the seamless integration of advanced lifting solutions into various industries. This shortage of qualified personnel not only impedes productivity but also raises safety concerns, potentially jeopardizing both workers' well-being and operational efficiency. As stakeholders navigate these challenges, efforts to address cost barriers, enhance training programs, and streamline maintenance processes will be crucial in fostering the broader adoption of industrial lifting equipment, thereby unlocking its full potential in driving productivity and safety across diverse sectors.

Global Industrial Lifting Equipment Market Opportunities:

The global industrial lifting equipment market presents exciting growth opportunities. The rising focus on sustainability is pushing manufacturers to develop eco-friendly equipment. This includes electric or hybrid-powered alternatives to traditional fuel-powered options, reducing emissions and catering to environmentally conscious businesses. Additionally, the integration of advanced technologies like automation and remote control functionalities creates opportunities for improved efficiency and safety. For instance, automated lifting systems can streamline material handling in warehouses and factories, while remote control allows for safer operation of equipment in hazardous environments. Companies that can innovate and cater to these growing demands for sustainable and technologically advanced lifting equipment are well-positioned to capitalize on the potential of this expanding market.

INDUSTRIAL LIFTING EQUIPMENT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.2% |

|

Segments Covered |

By Application, Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Haulotte Group, Hyster-Yale Materials Handling, Inc., Ingersoll-Rand PLC, Jungheinrich AG, KION Group AG, KITO Corporation, Komatsu Ltd., Konecranes, Liebherr Group, Linamar Corporation, Mammoet, Manitowoc Co., Inc. |

Global Industrial Lifting Equipment Market Segmentation: By Application

-

Manufacturing

-

Wholesale And Retail Distribution

-

Freight And Logistics

-

Construction

The Global Industrial Lifting Equipment Market Segmented by Application, Construction held the largest market share last year and is poised to maintain its dominance throughout the forecast period. The construction industry reigns supreme in the global industrial lifting equipment market, having secured the largest market share and projected to hold onto its lead. This dominance is unsurprising. Large-scale infrastructure projects and towering high-rises require a diverse arsenal of lifting equipment, from mobile cranes maneuvering prefabricated components to tower cranes reaching for the sky during high-rise construction. Forklifts play a crucial role in on-site material handling, ensuring a smooth workflow. The sheer scale and complexity of modern construction projects necessitate robust and reliable lifting equipment, solidifying the construction industry's position as the driving force behind this market segment.

Global Industrial Lifting Equipment Market Segmentation: By Type

-

Boom Lifts

-

Scissor Lifts

-

Vertical Mast Lifts

-

forklift

The Global Industrial Lifting Equipment Market Segmented by Type, forklift held the largest market share last year and is poised to maintain its dominance throughout the forecast period. In the realm of the global industrial lifting equipment market, forklifts have emerged as the dominant force, capturing the largest market share and poised to sustain this position in the foreseeable future. This supremacy is attributed to several factors, foremost among them being the unparalleled versatility and indispensability of forklifts across diverse industries. Forklifts excel in handling a wide array of materials and goods, from palletized loads to bulk commodities, making them an indispensable asset in warehouses, distribution centers, manufacturing facilities, and construction sites worldwide. Moreover, the evolution of forklift technology has further bolstered their appeal, with advancements such as electric-powered models offering enhanced efficiency, reduced emissions, and lower operational costs compared to traditional diesel-powered counterparts. Additionally, the growing emphasis on workplace safety has propelled the adoption of forklifts equipped with advanced safety features and ergonomic design elements, further solidifying their status as the preferred choice for material handling tasks. As industries continue to prioritize efficiency, productivity, and safety in their operations, the demand for forklifts is expected to remain robust, cementing their dominance in the global industrial lifting equipment market landscape for the foreseeable future.

Global Industrial Lifting Equipment Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The Global Industrial Lifting Equipment Market Segmented by Region, Asia-Pacific held the largest market share last year and is poised to maintain its dominance throughout the forecast period. Asia-Pacific stands out as the global leader in the industrial lifting equipment market, holding the largest market share and is expected to stay on top. This dominance stems from the region's booming manufacturing and construction sectors. Rapid industrialization fuels the demand for cranes, hoists, and forklifts to handle heavy machinery and materials. Similarly, large-scale infrastructure projects across Asia-Pacific necessitate a robust lifting equipment ecosystem. While North America and Europe boast established industrial sectors, their growth is projected to be faster than Asia-Pacific. This is due to ongoing modernization efforts and infrastructure upgrades in these regions, creating a need for advanced lifting equipment. As these regions prioritize efficiency and safety, they are likely to invest in automation and other technological advancements, further propelling their market growth.

COVID-19 Impact Analysis on the Global Industrial Lifting Equipment Market:

The global industrial lifting equipment market faced significant challenges amidst supply chain disruptions caused by lockdowns and travel restrictions during the COVID-19 pandemic. Movement restrictions impeded the transportation of both raw materials and finished equipment, resulting in shortages and delays in production. Furthermore, the pandemic-induced economic slowdown, particularly in sectors like construction and manufacturing, led to reduced demand for lifting equipment as projects faced delays and budget constraints. Moreover, the heightened focus on essential medical equipment and supplies during the peak of the pandemic diverted resources away from industrial lifting equipment production, further exacerbating the market's challenges. These combined factors created a turbulent environment for the industrial lifting equipment sector, highlighting the vulnerabilities of supply chains and the necessity for resilience and adaptability in navigating unforeseen disruptions. As industries gradually recover and adapt to the post-pandemic landscape, efforts to strengthen supply chains, diversify production capabilities, and address evolving market demands will be crucial for revitalizing the industrial lifting equipment market.

Latest Trends/ Developments:

Lifting equipment is becoming more and more important as the shipping, warehouse, and dockyard industries grow due to the increase in e-commerce activities. Simultaneously, there is a strong focus on improving worker safety, which encourages the adoption of equipment that reduces injuries. In addition, a noteworthy development in lifting equipment technology is the incorporation of electric and smart solutions, which are becoming more popular because of their higher efficiency and data-driven capabilities. There is a noticeable increase in demand for affordable internal combustion engine (IC) powered lifters in growing economies like China and India, where manufacturing and infrastructure are key areas. This need is propelling market expansion and innovation.

Key Players:

-

Haulotte Group

-

Hyster-Yale Materials Handling, Inc.

-

Ingersoll-Rand PLC

-

Jungheinrich AG

-

KION Group AG

-

KITO Corporation

-

Komatsu Ltd.

-

Konecranes

-

Liebherr Group

-

Linamar Corporation

-

Mammoet

-

Manitowoc Co., Inc.

Chapter 1. INDUSTRIAL LIFTING EQUIPMENT MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. INDUSTRIAL LIFTING EQUIPMENT MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. INDUSTRIAL LIFTING EQUIPMENT MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. INDUSTRIAL LIFTING EQUIPMENT MARKET - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. INDUSTRIAL LIFTING EQUIPMENT MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. INDUSTRIAL LIFTING EQUIPMENT MARKET – By Type

6.1 Introduction/Key Findings

6.2 Boom Lifts

6.3 Scissor Lifts

6.4 Vertical Mast Lifts

6.5 forklift

6.6 Y-O-Y Growth trend Analysis By Type

6.7 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. INDUSTRIAL LIFTING EQUIPMENT MARKET – By Application

7.1 Introduction/Key Findings

7.2 Manufacturing

7.3 Wholesale And Retail Distribution

7.4 Freight And Logistics

7.5 Construction

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. INDUSTRIAL LIFTING EQUIPMENT MARKET , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. INDUSTRIAL LIFTING EQUIPMENT MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Haulotte Group

9.2 Hyster-Yale Materials Handling, Inc.

9.3 Ingersoll-Rand PLC

9.4 Jungheinrich AG

9.5 KION Group AG

9.6 KITO Corporation

9.7 Komatsu Ltd.

9.8 Konecranes

9.9 Liebherr Group

9.10 Linamar Corporation

9.11 Mammoet

9.12 Manitowoc Co., Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

By 2023, the Global Industrial Lifting Equipment market is expected to be valued at USD 2.261 Billion.

Through 2030, the Global Industrial Lifting Equipment market is expected to grow at a CAGR of 7.2%.

By 2030, the Global Industrial Lifting Equipment market is expected to grow to a value of USD 3.67 billion.

Asia-Pacific is predicted to lead the Global Industrial Lifting Equipment market.

The Global Industrial Lifting Equipment market has segments Type, application, and Regions.