Industrial Hemp Market Size (2024 – 2030)

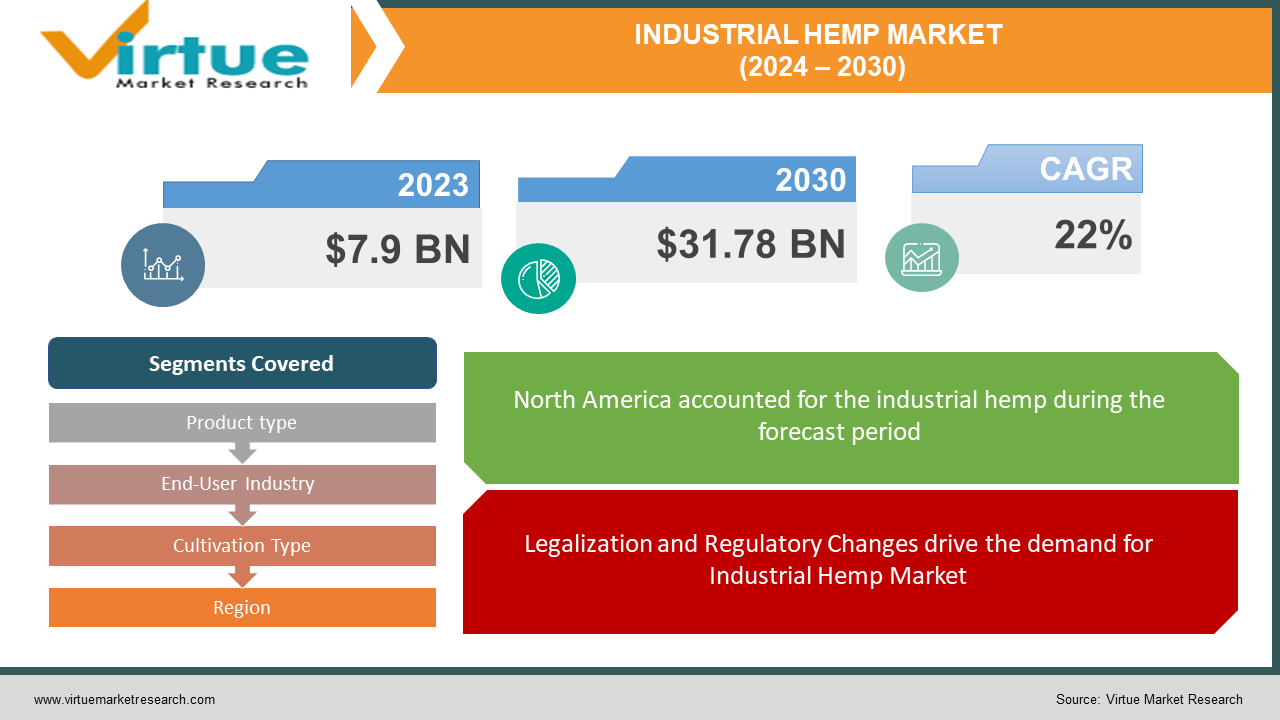

The Global Industrial Hemp Market was valued at USD 7.9 billion in 2023 and is projected to reach a market size of USD 31.78 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 22%.

Industrial hemp, scientifically known as Cannabis sativa, is a variety of the Cannabis plant species that contains low levels of THC (tetrahydrocannabinol), the psychoactive compound found in marijuana. Industrial hemp can be used to produce textiles, biodegradable plastics, construction materials, biofuels, paper, food products (such as hemp seeds, oil, and protein powder), CBD products, and more. The Industrial Hemp Market is expected to grow significantly in the coming years due to the legalization of hemp cultivation in many countries, increasing awareness about the benefits of hemp-derived products, and the expansion of applications beyond traditional uses like textiles and construction materials into areas such as food, beverages, pharmaceuticals, and cosmetics. The major well-established key players in the Industrial Hemp Market are Manitoba Harvest, Hemp, Inc., Canopy Growth Corporation, Charlotte's Web Holdings, Inc., and CV Sciences, Inc.

Key Market Insights:

Hemp cultivation is promoted for its environmental sustainability. Hemp plants absorb CO2, require minimal water compared to other crops, and can be grown without the need for synthetic pesticides or fertilizers. Hemp fibers are biodegradable, contributing to reducing waste and pollution. Legalization, consumer demand, technological advancements, regulatory support, and expanding applications are propelling the Industrial Hemp Market. The restraints to the Industrial Hemp Market include regulatory uncertainty, lack of infrastructure for processing and distribution, limited access to banking and financial services due to the stigma associated with cannabis, and competition from other crops. North America occupies the highest share of the Industrial Hemp Market. Asia-Pacific is the fastest-growing segment during the forecast period.

Industrial Hemp Market Drivers:

Legalization and Regulatory Changes drive the demand for Industrial Hemp Market

More countries and regions have legalized hemp cultivation and eased restrictions on its production and sale. It opens up new opportunities for farmers, businesses, and investors. Historically, hemp faced legal restrictions due to its association with marijuana. However, as governments recognize the distinction between hemp and marijuana, they are enacting laws to legalize hemp cultivation. Legalization enables farmers to grow hemp without fear of legal repercussions. This leads to increased production. This expands the availability of hemp-derived products in the market, meeting growing consumer demand. Legalization provides a more secure regulatory environment. This boosts investor confidence in the industry. This, in turn, leads to increased investments in hemp cultivation, processing facilities, research and development, and marketing efforts.

Consumer Demand is propelling the Industrial Hemp Market

Increasing awareness of the various applications and potential health benefits of hemp-derived products fuels consumer demand. Consumer interest in natural and holistic health solutions has surged. Hemp-derived products, particularly CBD, are perceived as natural remedies for various health issues such as pain, anxiety, insomnia, and inflammation. Consumers are seeking alternatives to conventional pharmaceuticals. Thus the demand for hemp-based wellness products grows. Companies are innovating their product offerings to cater to evolving consumer preferences. This includes CBD-infused products such as oils, tinctures, capsules, edibles, skincare products, and beverages. Hemp is increasingly being used in textiles, sustainable fashion, and eco-friendly construction materials. This further expands its market appeal.

Industrial Hemp Market Restraints and Challenges

The major challenge faced by the Industrial Hemp Market is the lack of adequate infrastructure for processing and distribution. Limited processing facilities, transportation networks, and storage capacities can constrain the scalability of hemp cultivation. Another challenge is the uncertainty about future regulations or changes in existing laws. This deters investment and hinders market growth. The other restraints to the Industrial Hemp Market include banking limitations, competition from other crops, and stigma associated with cannabis

Industrial Hemp Market Opportunities:

The Industrial Hemp Market has various opportunities in the market. The industrial hemp market presents a significant opportunity through the expansion of the CBD market. This is driven by increasing consumer interest in natural health and wellness solutions. Opportunities lies in the development of sustainable products, with hemp being a versatile resource for eco-friendly alternatives in textiles, plastics, construction materials, and more. Other Opportunities in the Industrial Hemp Market include global market growth, technological advancements, and increased research and innovation. Technological advancements in cultivation, processing, and product development offer opportunities with increased efficiency, higher yields, and the creation of new and improved hemp-derived goods.

INDUSTRIAL HEMP MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

22% |

|

Segments Covered |

By Product type, End-User Industry, Cultivation Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Manitoba Harvest, Hemp, Inc., Canopy Growth Corporation, Charlotte's Web Holdings, Inc., CV Sciences, Inc., Hempco Food and Fiber Inc., MedMen Enterprises Inc., Tilray, Inc., Ecofibre Limited, Aurora Cannabis Inc. |

Industrial Hemp Market Segmentation: By Product Type

-

-

Hemp Fiber

-

Hemp Seed

-

Hemp Seed Oil

-

CBD Oil

-

Hemp Protein

-

Others (such as hemp hurd, biomass)

-

In 2023, based on market segmentation by Product Type, CBD oil occupies the highest share of the Industrial Hemp Market. This is mainly due to its widespread use in wellness and therapeutic products, experiencing substantial market demand.

However, Hemp fiber is the fastest-growing segment during the forecast period and is projected to grow at a CAGR of 11%. This is due to the increasing demand for sustainable and eco-friendly materials. The trend towards environmental consciousness and regulations promoting sustainability is also accelerating the growth of the hemp fiber market.

Industrial Hemp Market Segmentation: By End-User Industry

-

-

Agriculture

-

Textile Industry

-

Food and Beverage Industry

-

Pharmaceutical Industry

-

Personal Care and Cosmetics Industry

-

Construction Industry

-

Automotive Industry

-

Others (such as paper industry, biofuel industry)

-

In 2023, based on market segmentation by the End-User Industry, the textile industry segment occupies the highest share of the Industrial Hemp Market. Hemp fibers are popular for their durability, breathability, and sustainability. This makes them popular for textiles, apparel, and home furnishing applications.

However, the food and beverage industry is the fastest-growing segment during the forecast period. This is mainly due to the increasing demand for plant-based and functional foods. Hemp seeds, oil, and protein are gaining popularity as nutritious ingredients in a variety of food and beverage products. This is due to their high protein content, essential fatty acids, and other health benefits.

Industrial Hemp Market Segmentation: By Cultivation Type

-

Organic Hemp

-

Conventional Hemp

In 2023, based on market segmentation by Cultivation Type, the Conventional hemp cultivation segment occupies the highest share of the Industrial Hemp Market. This is mainly due to traditional farming practices, wider accessibility to conventional agricultural inputs, and established cultivation methods.

However, Organic hemp cultivation is the fastest-growing segment during the forecast period. This growth is driven by increasing consumer preferences for organic products, environmental sustainability concerns, and a growing market for organic foods and products

Industrial Hemp Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In 2023, based on market segmentation by region, North America occupies the highest share of the Industrial Hemp Market. This growth is due to favorable regulatory changes, increasing consumer demand for hemp-derived products, and a robust hemp industry infrastructure. North America is a technologically advanced region with a well-established hemp industry infrastructure. The United States has seen significant growth in hemp cultivation, following the passage of the 2018 Farm Bill, which legalized the commercial production of hemp. Canada has also been a key player in the industrial hemp market. Canada has a long history of hemp cultivation and a diverse range of hemp-derived products.

However, Asia-Pacific is the fastest-growing segment during the forecast period. This is mainly due to the expanding legalization, rising awareness of hemp's benefits, and a growing market for hemp-based products. Countries like China, India, Japan, and Australia, have significant market shares due to increasing hemp cultivation and exploring diverse applications. The Asia-Pacific region has a large population base with changing consumer preferences. This creates significant opportunities for hemp-based products in various industries such as textiles, food and beverage, and personal care.

COVID-19 Impact Analysis on the Global Industrial Hemp Market:

The COVID-19 pandemic had a significant impact on the Industrial Hemp Market. There were lockdowns, restrictions on movement, safety measures, and border closures. The pandemic disrupted global supply chains. This affected the availability of raw materials and finished hemp products. This led to delays in production, transportation, and distribution, impacting the entire hemp supply chain. Changes in consumer behavior influenced the demand for hemp-derived products. There was a surge in demand for health and wellness products, including CBD. The closure of retail outlets and reduced consumer spending in some sectors dampened overall demand. Companies explored new product formulations, packaging solutions, and distribution channels to adapt to changing market consumer preferences. Thus, the pandemic accelerated certain trends in the Industrial Hemp Market.

Latest Trends/ Developments:

One of the developments, in the Industrial Hemp Market is the ongoing research into the potential health benefits of hemp and CBD. This brings innovation in product development and formulation. There is a growing number of consumers incorporating CBD into their wellness routines. This trend leads to increased demand for hemp-derived CBD oils, tinctures, edibles, and topicals. There is a growing emphasis on sustainability within the hemp industry. Companies are prioritizing environmentally friendly cultivation practices and eco-friendly packaging solutions. Technology is playing an important role in the hemp industry, from precision agriculture techniques to advanced extraction methods. Automation, data analytics, and blockchain technology are utilized to improve efficiency, quality control, and traceability throughout the supply chain.

Key Players:

-

Manitoba Harvest

-

Hemp, Inc.

-

Canopy Growth Corporation

-

Charlotte's Web Holdings, Inc.

-

CV Sciences, Inc.

-

Hempco Food and Fiber Inc.

-

MedMen Enterprises Inc.

-

Tilray, Inc.

-

Ecofibre Limited

-

Aurora Cannabis Inc.

Market News:

-

In January 2024, the FDA-Center for Veterinary Medicine, in collaboration with AAFCO, tentatively approves hemp seed meal for hens at egg farms. Hemp Feed Coalition hails it as a "landmark achievement," anticipating benefits for healthy hens and eggs. The FDA-CVM's rigorous evaluation confirms the safety and viability of Hemp Seed Meal, marking a historic milestone after over three years of effort. The recommendation opens opportunities for agricultural advancement and sustainable farming practices.

-

In January 2023, HempMeds Brasil introduced two innovative full-spectrum products tailored to meet the evolving needs of Brazilian physicians seeking options to recommend to their patients.

Chapter 1. Industrial Hemp Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Industrial Hemp Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Industrial Hemp Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Industrial Hemp Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Industrial Hemp Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Industrial Hemp Market – Product Type

6.1 Introduction/Key Findings

6.2 Hemp Fiber

6.3 Hemp Seed

6.4 Hemp Seed Oil

6.5 CBD Oil

6.6 Hemp Protein

6.7 Others (such as hemp hurd, biomass)

6.8 Y-O-Y Growth trend Analysis Product Type

6.9 Absolute $ Opportunity Analysis Product Type, 2024-2030

Chapter 7. Industrial Hemp Market – By Cultivation Type

7.1 Introduction/Key Findings

7.2 Organic Hemp

7.3 Conventional Hemp

7.4 Y-O-Y Growth trend Analysis By Cultivation Type

7.5 Absolute $ Opportunity Analysis By Cultivation Type, 2024-2030

Chapter 8. Industrial Hemp Market – By End-User

8.1 Introduction/Key Findings

8.2 Agriculture

8.3 Textile Industry

8.4 Food and Beverage Industry

8.5 Pharmaceutical Industry

8.6 Personal Care and Cosmetics Industry

8.7 Construction Industry

8.8 Automotive Industry

8.9 Others (such as paper industry, biofuel industry)

8.10 Y-O-Y Growth trend Analysis By End-User

8.11 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 9. Industrial Hemp Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 Product Type

9.1.3 By Cultivation Type

9.1.4 By End-User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 Product Type

9.2.3 By Cultivation Type

9.2.4 By End-User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 Product Type

9.3.3 By Cultivation Type

9.3.4 By End-User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 Product Type

9.4.3 By Cultivation Type

9.4.4 By End-User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 Product Type

9.5.3 By Cultivation Type

9.5.4 By End-User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Industrial Hemp Market – Company Profiles – (Overview, Product Type Portfolio, Financials, Strategies & Developments)

10.1 Manitoba Harvest

10.2 Hemp, Inc.

10.3 Canopy Growth Corporation

10.4 Charlotte's Web Holdings, Inc.

10.5 CV Sciences, Inc.

10.6 Hempco Food and Fiber Inc.

10.7 MedMen Enterprises Inc.

10.8 Tilray, Inc.

10.9 Ecofibre Limited

10.10 Aurora Cannabis Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Industrial Hemp Market was valued at USD 7.9 billion and is projected to reach a market size of USD 31.78 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 22%.

Legalization, consumer demand, technological advancements, and regulatory support are the market drivers of the Global Industrial Hemp Market.

Organic Hemp and conventional Hemp are the segments under the Global Industrial Hemp Market by Cultivation Type.

North America is the most dominant region for the Global Industrial Hemp Market.

Manitoba Harvest, Hemp, Inc., Canopy Growth Corporation, Charlotte's Web Holdings, Inc., and CV Sciences, Inc. are the key players in the Global Industrial Hemp Market.