Industrial autonomous-ready applications Market Size (2024 – 2030)

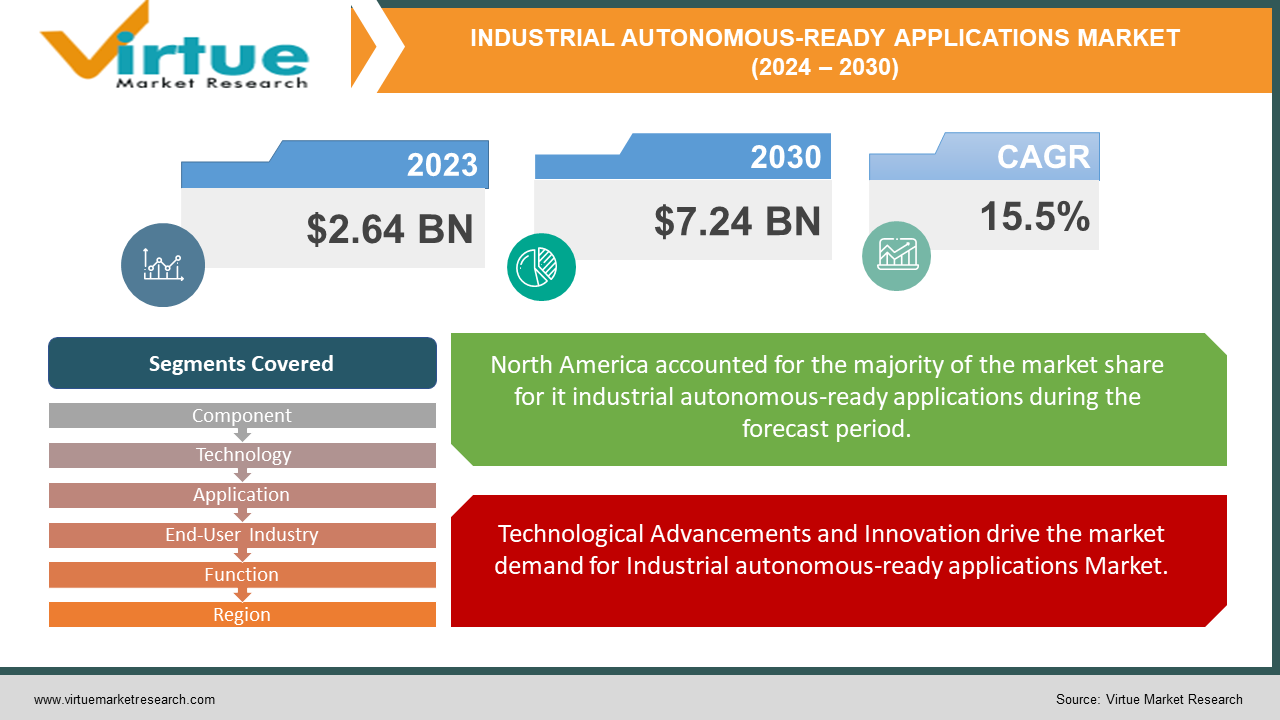

The Global Industrial autonomous-ready applications Market is valued at USD 2.64 Billion and is projected to reach a market size of USD 7.24 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 15.5%.

In recent years, the market for industrial autonomous-ready applications has grown rapidly. These are systems and machines that can perform tasks on their own, without needing human help. They use technologies like artificial intelligence (AI) and machine learning (ML) to make decisions. One big thing driving this market in the long term is the push for higher efficiency. Factories and other industrial places want to make more products faster and cheaper. They also want to use fewer resources and create less waste. This drive for efficiency is making companies invest in autonomous systems that can work better and smarter than humans. One big opportunity in this market is in the area of data analytics. Autonomous systems collect a lot of data while they work. This data can be used to make the systems even better. For example, if a machine sees that it always has a problem at a certain point, it can tell its human operators.

A trend that has been observed in the industry is the growing use of collaborative robots or cobots. These are robots designed to work alongside humans. Unlike traditional robots that stay in one place and do one job, cobots can move around and help humans with different tasks.

Key Market Insights:

The Industrial autonomous-ready applications Market is projected to expand at a compound annual growth rate of over 15.5% in the coming seven years, propelled by increasing urbanization and population growth in major cities worldwide.

Siemens AG (Germany), ABB Ltd (Switzerland), and Rockwell Automation, Inc. (United States) are some examples of Industrial autonomous-ready applications Market.

North America & Asia-Pacific accounts for approximately 75-80 % of the Industrial autonomous-ready applications Market, driven by Increasing Emphasis on Efficiency and Productivity, Technological Advancements and Innovation, Shift towards Industry 4.0 and Digital Transformation & Changing Workforce Dynamics and Skills Gap.

Industrial autonomous-ready applications Market Drivers:

Increasing Emphasis on Efficiency and Productivity drives the market demand for Industrial autonomous-ready applications Market.

One of the primary drivers behind the Industrial Autonomous-Ready Applications Market is the growing emphasis on efficiency and productivity in industrial operations. Industries across various sectors are constantly seeking ways to streamline processes, reduce downtime, and optimize resource utilization. Autonomous-ready applications offer a pathway toward achieving these goals by enabling automation and intelligent decision-making. By incorporating autonomous technologies into their operations, industries can enhance efficiency, improve throughput, and ultimately drive higher productivity levels. This driver is fueled by the relentless pursuit of operational excellence and competitive advantage in today's dynamic business landscape.

Technological Advancements and Innovation drive the market demand for Industrial autonomous-ready applications Market.

The rapid pace of technological advancements and innovation is another key driver shaping the Industrial Autonomous-Ready Applications Market. Breakthroughs in areas such as artificial intelligence, machine learning, robotics, and sensor technologies have paved the way for the development of sophisticated autonomous systems. These advancements enable industrial applications to perform complex tasks autonomously, such as predictive maintenance, quality control, and inventory management. Moreover, ongoing research and development efforts continue to push the boundaries of what is possible, driving further innovation in autonomous-ready applications. This driver underscores the pivotal role of technology in driving progress and unlocking new possibilities in industrial automation.

Shift Towards Industry 4.0 and Digital Transformation drives the market demand for Industrial autonomous-ready applications Market.

The shift towards Industry 4.0 and digital transformation initiatives is driving demand for autonomous-ready applications in industrial settings. Industry 4.0, characterized by the integration of digital technologies into manufacturing and production processes, emphasizes the importance of connectivity, automation, and data-driven decision-making. Autonomous-ready applications serve as enablers of Industry 4.0 by providing the foundation for autonomous systems and smart factories. As industries embrace digital transformation to stay competitive and resilient, the adoption of autonomous-ready applications becomes imperative for achieving operational agility and responsiveness to market demands.

Changing Workforce Dynamics and Skills Gap drives the market demand for Industrial autonomous-ready applications Market.

The evolving workforce dynamics and skills gap in industrial sectors are also driving the adoption of autonomous-ready applications. With an aging workforce and a shortage of skilled labor in certain industries, there is a growing need to augment human capabilities with autonomous technologies. Autonomous-ready applications enable industries to automate repetitive tasks, mitigate labor shortages, and empower workers to focus on higher-value activities. Moreover, these applications offer opportunities for up-skilling and reskilling workers to operate and maintain autonomous systems effectively. This driver reflects the ongoing transformation of the industrial workforce and the imperative to embrace automation to address workforce challenges effectively.

Industrial autonomous-ready applications Market Restraints and Challenges:

One of the primary restraints in the market is the high initial cost associated with implementing autonomous-ready systems. Developing and deploying these advanced technologies requires significant investment in hardware, software, and integration processes. Companies must purchase sophisticated robots, sensors, and AI systems, which can be expensive. Additionally, there are costs related to upgrading existing infrastructure to support these new technologies.

For many businesses, especially small and medium-sized enterprises (SMEs), these costs can be prohibitive. They might not have the financial resources to make such a substantial upfront investment, even if the long-term benefits are clear. This financial barrier can slow the adoption rate of autonomous systems in the industrial sector.

Industrial autonomous-ready applications Market Opportunities:

One significant opportunity lies in the realm of predictive maintenance. Autonomous systems equipped with advanced sensors and AI capabilities can continuously monitor the condition of industrial equipment. They collect and analyze data in real-time, identifying patterns and anomalies that might indicate potential failures before they occur. Predictive maintenance offers numerous benefits, such as reducing downtime, extending the lifespan of machinery, and lowering maintenance costs. By predicting when a machine is likely to fail, companies can schedule maintenance activities proactively, avoiding unexpected breakdowns that can halt production. This approach not only saves money but also enhances operational efficiency.

Moreover, the data collected by these autonomous systems can be used to improve the design and manufacturing of future equipment, leading to more reliable and durable machinery. Companies that can leverage predictive maintenance effectively will gain a competitive edge, as they can operate more smoothly and with fewer interruptions.

INDUSTRIAL AUTONOMOUS-READY APPLICATIONS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

15.5% |

|

Segments Covered |

By Component, Technology, Application, End-User Industry, Function and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Siemens AG (Germany), ABB Ltd (Switzerland), Rockwell Automation, Inc. (United States), Honeywell International Inc. (United States), Fanuc Corporation (Japan), Yaskawa Electric Corporation (Japan), KUKA AG (Germany), Schneider Electric SE (France), General Electric Company (United States), Omron Corporation (Japan), Mitsubishi Electric Corporation (Japan), Bosch Rexroth AG (Germany), NVIDIA Corporation (United States), Intel Corporation (United States), Microsoft Corporation (United States), Alphabet Inc. (Google) (United States), IBM Corporation (United States), Amazon.com, Inc. (United States), Cognex Corporation (United States), DJI (China) |

Industrial autonomous-ready applications Market Segmentation: By Component

-

Hardware

-

Software

-

Services

The hardware segment represents the largest component of the industrial autonomous-ready applications market. This includes critical physical elements such as sensors, actuators, controllers, processors, and cameras. Sensors play a vital role by collecting data from the environment, which is essential for the operation of autonomous systems. They provide the necessary inputs for decision-making processes, ensuring accuracy and efficiency. Actuators and controllers then translate these decisions into actions, allowing machines to interact with their surroundings. The growing demand for robust and reliable hardware is driven by the need for precise and consistent performance in various industrial applications, from manufacturing to logistics. High-quality hardware ensures that autonomous systems can operate seamlessly and safely, thus justifying its position as the largest segment in the market.

The software segment is the fastest-growing component in the industrial autonomous-ready applications market. This rapid growth is fueled by advancements in artificial intelligence (AI), machine learning (ML), data analytics, and robotics software. Software enables the intelligence and adaptability of autonomous systems, allowing them to learn from data, make informed decisions, and optimize operations over time. With industries increasingly adopting digital transformation strategies, the demand for sophisticated software solutions that can integrate with existing systems and improve operational efficiency is surging. Moreover, cloud-based solutions and edge computing are further enhancing the capabilities of autonomous applications, making them more accessible and scalable. The continuous evolution of AI and ML technologies promises even greater advancements in the future, cementing software's role as the fastest-growing segment in this market.

Industrial autonomous-ready applications Market Segmentation: By Technology

-

Machine Vision

-

Natural Language Processing (NLP)

-

Machine Learning

-

Edge Computing

-

Cloud Computing

-

IoT (Internet of Things)

Machine vision stands as the largest technology segment in the industrial autonomous-ready applications market. This technology involves the use of cameras and image processing algorithms to enable machines to "see" and interpret their surroundings. In industrial settings, machine vision is critical for tasks such as quality control, inspection, and guidance of autonomous systems. Its ability to detect defects, measure components, and ensure precision in manufacturing processes makes it indispensable. The extensive application of machine vision across various industries, from automotive and electronics to pharmaceuticals and food & beverage, drives its dominance in the market. The technology's maturity, reliability, and proven benefits in enhancing productivity and product quality contribute to its leading position.

Artificial Intelligence (AI) is the fastest-growing technology segment within the industrial autonomous-ready applications market. AI's ability to analyze vast amounts of data, recognize patterns, and make intelligent decisions is revolutionizing industrial processes. This technology empowers autonomous systems to learn from their experiences, adapt to new situations, and optimize their performance autonomously. AI applications in predictive maintenance, supply chain optimization, and operational efficiency are rapidly expanding, driven by the need for smarter and more efficient industrial operations. The continuous advancements in AI algorithms, coupled with increased computational power and the availability of big data, are propelling its rapid growth. Industries are increasingly recognizing the transformative potential of AI, leading to accelerated adoption and integration into various autonomous-ready applications.

Industrial autonomous-ready applications Market Segmentation: By Application

-

Manufacturing

-

Logistics and Warehousing

-

Oil and Gas

-

Mining

-

Agriculture

-

Healthcare

-

Aerospace and Defense

Manufacturing is the largest application segment in the industrial autonomous-ready applications market. This sector has been a pioneer in adopting automation and autonomous technologies to enhance productivity, efficiency, and quality. Autonomous systems in manufacturing include robotic arms for assembly, automated guided vehicles (AGVs) for material handling, and machine vision systems for quality control. These technologies streamline operations, reduce human error, and increase throughput. The high demand for precision, consistency, and scalability in manufacturing processes drives the extensive use of autonomous systems. As manufacturers strive to stay competitive in a global market, the integration of autonomous-ready applications becomes essential, solidifying manufacturing's position as the largest application segment.

Logistics and warehousing represent the fastest-growing application segment in the industrial autonomous-ready applications market. The rapid growth is fueled by the increasing need for efficient supply chain management and the rise of e-commerce. Autonomous systems such as drones for inventory management, autonomous mobile robots (AMRs) for picking and sorting, and AGVs for transportation within warehouses are transforming logistics operations. These technologies enhance accuracy, reduce labor costs, and speed up order fulfillment processes. The COVID-19 pandemic further accelerated the adoption of autonomous solutions in logistics, as companies sought ways to maintain operations with minimal human intervention. The ongoing demand for faster and more reliable delivery services continues to drive innovation and investment in autonomous-ready applications in this sector, making it the fastest-growing application segment.

Industrial autonomous-ready applications Market Segmentation: By End-User Industry

-

Automotive

-

Electronics and Semiconductors

-

Food and Beverage

-

Pharmaceuticals

-

Chemicals

-

Textiles

-

Utilities

The automotive industry is the largest end-user segment in the industrial autonomous-ready applications market. This sector has a long history of leveraging automation and advanced technologies to enhance manufacturing efficiency, product quality, and safety. Autonomous systems are extensively used in automotive manufacturing for tasks such as assembly line automation, welding, painting, and inspection. The industry's high production volumes and the need for precision and consistency make it a prime adopter of autonomous technologies. Additionally, the development and testing of autonomous vehicles themselves contribute to this sector's dominance, as automotive manufacturers and suppliers invest heavily in R&D and production capabilities to stay competitive in a rapidly evolving market.

Healthcare is the fastest-growing end-user industry segment in the industrial autonomous-ready applications market. The adoption of autonomous systems in healthcare has been accelerated by the need for improved efficiency, accuracy, and patient care. Autonomous robots are increasingly used for tasks such as surgery, medication dispensing, patient transportation, and facility cleaning and disinfection. The COVID-19 pandemic highlighted the importance of minimizing human contact and maximizing sanitation, driving the adoption of autonomous solutions in healthcare settings. Additionally, advancements in AI and machine learning are enabling more sophisticated diagnostic tools and personalized treatment plans, further propelling growth in this sector. As healthcare providers continue to seek innovative ways to improve outcomes and operational efficiency, the demand for autonomous-ready applications is expected to surge, making it the fastest-growing end-user industry.

Industrial autonomous-ready applications Market Segmentation: By Function

-

Operational Optimization

-

Predictive Maintenance

-

Quality Assurance

-

Supply Chain Management

-

Safety and Security

Operational optimization emerges as the largest function segment in the industrial autonomous-ready applications market. This function encompasses a wide range of activities aimed at improving efficiency, productivity, and cost-effectiveness within industrial operations. Autonomous systems play a crucial role in optimizing processes such as production scheduling, resource allocation, and workflow management. By leveraging real-time data analytics, machine learning algorithms, and automation capabilities, these systems can identify inefficiencies, minimize downtime, and maximize throughput. Industries across manufacturing, logistics, energy, and others prioritize operational optimization to stay competitive in today's fast-paced market, driving the extensive adoption of autonomous-ready applications in this function segment.

Predictive maintenance emerges as the fastest-growing function segment in the industrial autonomous-ready applications market. This function focuses on using data-driven insights to anticipate equipment failures and proactively address maintenance needs before they occur. Autonomous systems equipped with sensors and AI algorithms continuously monitor the condition of machinery, analyzing patterns and trends to predict potential breakdowns or performance degradation. By implementing predictive maintenance strategies, companies can reduce unplanned downtime, extend the lifespan of assets, and optimize maintenance schedules. The increasing awareness of the cost-saving benefits and operational advantages of predictive maintenance drives its rapid growth, making it a key focus area for investment and innovation in the industrial autonomous-ready applications market.

Industrial autonomous-ready applications Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

North America stands as the largest region in the industrial autonomous-ready applications market. This dominance is attributed to several factors, including a strong presence of key market players, advanced technological infrastructure, and significant investments in research and development. The region is home to major industrial sectors such as automotive, aerospace, and electronics, which have been early adopters of autonomous technologies. Additionally, favorable government policies and initiatives aimed at promoting automation and innovation further fuel market growth in North America. With a robust economy and a culture of technological innovation, the region continues to lead in the adoption and integration of industrial autonomous-ready applications across various industries.

The Asia-Pacific region emerges as the fastest-growing segment in the industrial autonomous-ready applications market. Rapid industrialization, urbanization, and a burgeoning manufacturing sector are driving the demand for automation and autonomous technologies in countries such as China, Japan, South Korea, and India. These countries are witnessing significant investments in infrastructure development, particularly in smart factories and Industry 4.0 initiatives, which propel market growth. Moreover, the increasing focus on efficiency, safety, and sustainability in industrial operations accelerates the adoption of autonomous-ready applications in the region. With a large population, rising disposable incomes, and a growing middle class, the Asia-Pacific market offers immense opportunities for market players seeking to expand their presence and capitalize on the growing demand for industrial autonomous-ready applications.

COVID-19 Impact Analysis on Industrial autonomous-ready applications Market:

The COVID-19 pandemic has had a significant impact on the industrial autonomous-ready applications market, both in the short and long term. Initially, the outbreak led to disruptions in supply chains, manufacturing operations, and workforce availability, causing a slowdown in the adoption of autonomous technologies. Many industries postponed or scaled back investments in automation as they focused on navigating the immediate challenges posed by the pandemic, such as ensuring employee safety and maintaining business continuity. However, as the crisis unfolded, the advantages of autonomous systems became increasingly apparent. Companies realized the importance of reducing reliance on human labor to mitigate the risks associated with future disruptions. This realization has fueled a renewed interest in autonomous-ready applications, particularly in sectors where social distancing and remote operations are imperative.

Latest Trends/ Developments:

In recent times, several notable trends have emerged in the industrial autonomous-ready applications market, shaping its trajectory and driving innovation. One prominent trend is the integration of edge computing capabilities into autonomous systems. Edge computing enables data processing and analysis to occur closer to the source of data generation, reducing latency and improving real-time decision-making. This trend is particularly significant in industrial environments where low-latency responses are critical for ensuring safety and efficiency. By harnessing the power of edge computing, autonomous systems can operate more autonomously and effectively, paving the way for smarter factories and more agile supply chains.

Another key trend is the convergence of autonomous technologies with the Internet of Things (IoT) and 5G connectivity. The combination of autonomous systems with IoT sensors and 5G networks enables seamless communication and data exchange between machines, humans, and other devices in industrial settings. This trend facilitates the creation of interconnected ecosystems where autonomous robots, drones, and vehicles can collaborate and share information in real-time. Such advancements enhance the scalability, flexibility, and intelligence of autonomous-ready applications, unlocking new opportunities for efficiency gains and operational optimization across industries. As IoT and 5G continue to mature, their integration with autonomous technologies is expected to catalyze further advancements and drive the evolution of industrial automation.

Key Players:

-

Siemens AG (Germany)

-

ABB Ltd (Switzerland)

-

Rockwell Automation, Inc. (United States)

-

Honeywell International Inc. (United States)

-

Fanuc Corporation (Japan)

-

Yaskawa Electric Corporation (Japan)

-

KUKA AG (Germany)

-

Schneider Electric SE (France)

-

General Electric Company (United States)

-

Omron Corporation (Japan)

-

Mitsubishi Electric Corporation (Japan)

-

Bosch Rexroth AG (Germany)

-

NVIDIA Corporation (United States)

-

Intel Corporation (United States)

-

Microsoft Corporation (United States)

-

Alphabet Inc. (Google) (United States)

-

IBM Corporation (United States)

-

Amazon.com, Inc. (United States)

-

Cognex Corporation (United States)

-

DJI (China)

Chapter 1. Industrial autonomous-ready applications Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Industrial autonomous-ready applications Market– Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Industrial autonomous-ready applications Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Industrial autonomous-ready applications Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Industrial autonomous-ready applications Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Industrial autonomous-ready applications Market – By Component

6.1 Introduction/Key Findings

6.2 Hardware

6.3 Software

6.4 Services

6.5 Y-O-Y Growth trend Analysis By Component

6.6 Absolute $ Opportunity Analysis By Component, 2024-2030

Chapter 7. Industrial autonomous-ready applications Market – By Technology

7.1 Introduction/Key Findings

7.2 Machine Vision

7.3 Natural Language Processing (NLP)

7.4 Machine Learning

7.5 Edge Computing

7.6 Cloud Computing

7.7 IoT (Internet of Things)

7.8 Y-O-Y Growth trend Analysis By Technology

7.9 Absolute $ Opportunity Analysis By Technology, 2024-2030

Chapter 8. Industrial autonomous-ready applications Market – By Application

8.1 Introduction/Key Findings

8.2 Food & Beverages

8.3 Pharmaceuticals

8.4 Cosmetics & Personal Care

8.5 Chemicals

8.6 Homecare & Toiletries

8.7 Automotive & Petrochemicals

8.8 Agriculture (Fertilizers, Pesticides)

8.9 Others

8.10 Y-O-Y Growth trend Analysis End-Use Industry

8.11 Absolute $ Opportunity Analysis End-Use Industry, 2024-2030

Chapter 9. Industrial autonomous-ready applications Market – By End-User

9.1 Introduction/Key Findings

9.2 Automotive

9.3 Electronics and Semiconductors

9.4 Food and Beverage

9.5 Pharmaceuticals

9.6 Chemicals

9.7 Textiles

9.8 Utilities

9.9 Y-O-Y Growth trend Analysis End-User

9.10 Absolute $ Opportunity Analysis End-User, 2024-2030

Chapter 10. Industrial autonomous-ready applications Market – By Function

10.1 Introduction/Key Findings

10.2 Operational Optimization

10.3 Predictive Maintenance

10.4 Quality Assurance

10.5 Supply Chain Management

10.6 Safety and Security

10.7 Y-O-Y Growth trend Analysis By Function

10.8 Absolute $ Opportunity Analysis By Function, 2024-2030

Chapter 11. Industrial autonomous-ready applications Market, By Geography – Market Size, Forecast, Trends & Insights

11.1 North America

11.1.1 By Country

11.1.1.1 U.S.A.

11.1.1.2 Canada

11.1.1.3 Mexico

11.1.2 By Component

11.1.2.1 By Technology

11.1.3 By Application

11.1.4 By Function

11.1.5 Countries & Segments - Market Attractiveness Analysis

11.2 Europe

11.2.1 By Country

11.2.1.1 U.K

11.2.1.2 Germany

11.2.1.3 France

11.2.1.4 Italy

11.2.1.5 Spain

11.2.1.6 Rest of Europe

11.2.2 By Component

11.2.3 By Technology

11.2.4 By Application

11.2.5 By End-User

11.2.6 By Function

11.2.7 Countries & Segments - Market Attractiveness Analysis

11.3 Asia Pacific

11.3.1 By Country

11.3.1.1 China

11.3.1.2 Japan

11.3.1.3 South Korea

11.3.1.4 India

11.3.1.5 Australia & New Zealand

11.3.1.6 Rest of Asia-Pacific

11.3.2 By Component

11.3.3 By Technology

11.3.4 By Application

11.3.5 By End-User

11.3.6 By Function

11.3.7 Countries & Segments - Market Attractiveness Analysis

11.4 South America

11.4.1 By Country

11.4.1.1 Brazil

11.4.1.2 Argentina

11.4.1.3 Colombia

11.4.1.4 Chile

11.4.1.5 Rest of South America

11.4.2 By Component

11.4.3 By Technology

11.4.4 By Application

11.4.5 By End-User

11.4.6 By Function

11.4.7 Countries & Segments - Market Attractiveness Analysis

11.5 Middle East & Africa

11.5.1 By Country

11.5.1.1 United Arab Emirates (UAE)

11.5.1.2 Saudi Arabia

11.5.1.3 Qatar

11.5.1.4 Israel

11.5.1.5 South Africa

11.5.1.6 Nigeria

11.5.1.7 Kenya

11.5.1.8 Egypt

11.5.1.9 Rest of MEA

11.5.2 By Component

11.5.3 By Technology

11.5.4 By Application

11.5.5 By End-User

11.5.6 By Function

11.5.7 Countries & Segments - Market Attractiveness Analysis

Chapter 12. Industrial autonomous-ready applications Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

12.1 Siemens AG (Germany)

12.2 ABB Ltd (Switzerland)

12.3 Rockwell Automation, Inc. (United States)

12.4 Honeywell International Inc. (United States)

12.5 Fanuc Corporation (Japan)

12.6 Yaskawa Electric Corporation (Japan)

12.7 KUKA AG (Germany)

12.8 Schneider Electric SE (France)

12.9 General Electric Company (United States)

12.10 Omron Corporation (Japan)

12.11 Mitsubishi Electric Corporation (Japan)

12.12 Bosch Rexroth AG (Germany)

12.13 NVIDIA Corporation (United States)

12.14 Intel Corporation (United States)

12.15 Microsoft Corporation (United States)

12.16 Alphabet Inc. (Google) (United States)

12.17 IBM Corporation (United States)

12.18 Amazon.com, Inc. (United States)

12.19 Cognex Corporation (United States)

12.20 DJI (China)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Industrial autonomous-ready applications Market is valued at USD 2.64 Billion and is projected to reach a market size of USD 7.24 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 15.5%.

Increasing Emphasis on Efficiency and Productivity, Technological Advancements and Innovation, Shift towards Industry 4.0 and Digital Transformation & Changing Workforce Dynamics and Skills Gap are the major drivers of the Industrial autonomous-ready applications Market.

Manufacturing, Logistics and Warehousing, Oil and Gas, Mining, Agriculture, Healthcare, Aerospace and Defense are the segments under the Industrial autonomous-ready applications Market by application.

North America is the most dominant region for the Industrial autonomous-ready applications Market.

Asia-Pacific is the fastest-growing region in the Industrial autonomous-ready applications Market.