Industrial Alcohol Market Size (2024 – 2030)

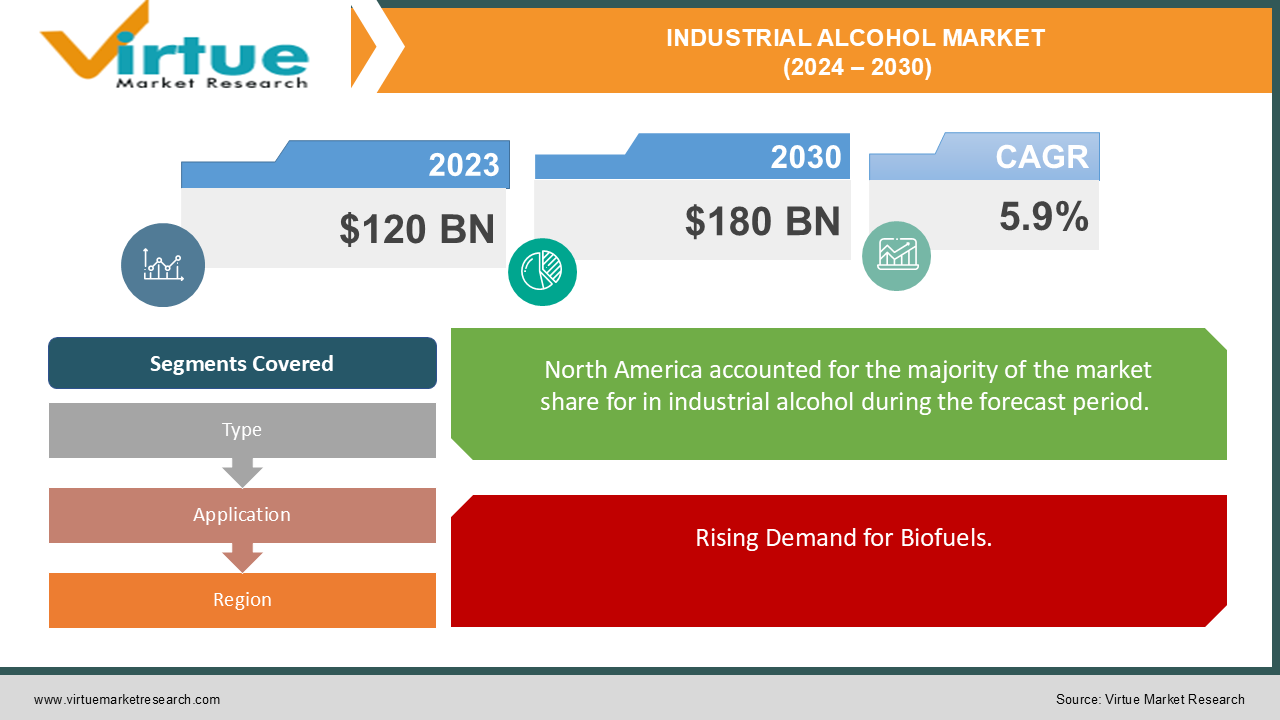

The Global Industrial Alcohol Market was valued at USD 120 billion in 2023 and is projected to reach a market size of USD 180 billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 5.9% between 2024 and 2030.

The Global Industrial Alcohol Market plays a vital role in various industries, driven by its wide range of applications in sectors such as fuel, pharmaceuticals, personal care, and chemical manufacturing. Industrial alcohol, primarily ethanol, methanol, isopropanol, and butanol, is utilized for its solvent properties, as a chemical intermediate, and as a renewable energy source. Ethanol is the most widely used type, especially in biofuel production, where it serves as a cleaner alternative to fossil fuels, significantly contributing to environmental sustainability. In the pharmaceutical sector, industrial alcohol is employed in the production of drugs, sanitizers, and antiseptics, making it crucial for healthcare applications. Furthermore, the demand for industrial alcohol is growing in the personal care and cosmetics industry due to its use in perfumes, deodorants, and other hygiene products. The rising awareness about environmental issues and the push for sustainable energy solutions are key factors boosting market growth. Additionally, advancements in fermentation technology and the increased production of bio-based alcohol are expected to further drive the market. The global industrial alcohol market is projected to continue its upward trajectory as industries increasingly adopt alcohol-based solutions for both economic and ecological benefits.

Key Market Insights:

70% of industrial alcohol is used in fuel and energy production.

The ethanol segment accounts for more than 60% of market share.

Over 40% of industrial alcohol demand comes from the pharmaceutical sector.

Global Industrial Alcohol Market Drivers:

Rising Demand for Biofuels.

One of the key drivers of the Global Industrial Alcohol Market is the increasing demand for biofuels, particularly ethanol, as a cleaner and more sustainable energy source. Governments around the world are implementing stricter environmental regulations to reduce carbon emissions, leading to a shift away from fossil fuels. Ethanol, a type of industrial alcohol, is widely blended with gasoline to create ethanol-blended fuels, which help to lower greenhouse gas emissions. Countries like the United States and Brazil are at the forefront of adopting ethanol as a biofuel, thanks to government mandates and incentives promoting its use. This growing focus on renewable energy sources, coupled with advancements in biofuel production technologies, is expected to continue driving the demand for industrial alcohol, especially ethanol, in the coming years. As concerns over climate change intensify, biofuels will remain a key factor in shaping the market’s growth trajectory.

Expanding Pharmaceutical and Personal Care Industries.

The pharmaceutical and personal care industries are major contributors to the growth of the Global Industrial Alcohol Market. Industrial alcohol, particularly ethanol and isopropanol, is widely used in the production of antiseptics, sanitizers, disinfectants, and various pharmaceutical products. The COVID-19 pandemic accelerated the demand for hand sanitizers and disinfectants, leading to a significant spike in industrial alcohol consumption. Moreover, the personal care industry relies on alcohol as a key ingredient in products like perfumes, deodorants, and hair care items due to its solvent properties and ability to preserve product formulations. The increasing demand for hygiene and healthcare products, driven by rising health awareness and hygiene standards worldwide, has further boosted the industrial alcohol market. As these industries continue to expand and innovate, the demand for industrial alcohol is expected to remain robust.

Global Industrial Alcohol Market Restraints and Challenges:

The Global Industrial Alcohol Market faces several restraints and challenges that may hinder its growth. One significant challenge is the fluctuating prices of raw materials, particularly feedstocks such as corn, sugarcane, and other biomass used in the production of industrial alcohol, especially ethanol. Price volatility in these agricultural commodities can disrupt supply chains and increase production costs, affecting the profitability of alcohol manufacturers. Additionally, the high energy consumption involved in alcohol production processes, such as fermentation and distillation, adds to operational costs, making the production of bio-based alcohol less competitive in certain regions. Another key restraint is the increasing competition from alternative renewable energy sources, such as electric vehicles and hydrogen fuel, which could limit the demand for biofuels like ethanol. Furthermore, stringent government regulations regarding the use of alcohol in food and beverage products, as well as concerns over the environmental impact of large-scale agricultural production, present further challenges. The regulatory complexities surrounding the production and use of industrial alcohol across different regions also create barriers to entry for new players. Overcoming these restraints will require technological advancements, more sustainable practices, and strategic collaborations across industries to ensure steady growth in the market.

Global Industrial Alcohol Market Opportunities:

The Global Industrial Alcohol Market presents several growth opportunities, primarily driven by the increasing focus on sustainable and renewable energy sources. The rising adoption of bio-based alcohol, especially ethanol, as a cleaner alternative to fossil fuels, opens new avenues for market expansion. As governments worldwide set more stringent environmental regulations and promote the use of biofuels to reduce carbon emissions, the demand for industrial alcohol in the energy sector is expected to surge. Additionally, advancements in fermentation technology and the development of second-generation biofuels from non-food biomass present opportunities to overcome the limitations of traditional feedstocks like corn and sugarcane. The pharmaceutical and healthcare sectors also offer significant potential for growth, with the rising demand for sanitizers, antiseptics, and other alcohol-based medical products. Furthermore, the growing consumer preference for eco-friendly personal care and cosmetic products is driving the demand for bio-based alcohol in these industries. Expanding applications of industrial alcohol in emerging markets, particularly in the Asia-Pacific region, offer further opportunities for market players. As industries across sectors prioritize sustainability, the development of innovative, cost-effective production methods will play a crucial role in unlocking the full potential of the industrial alcohol market.

INDUSTRIAL ALCOHOL MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.9% |

|

Segments Covered |

ByType, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Cargill, Inc., Archer Daniels Midland Company (ADM), Hindustan Alcohols Ltd., BASF SE, The Dow Chemical Company, Eastman Chemical Company, Methanex Corporation, Greenfield Global Inc., Evonik Industries AG, Royal Dutch Shell plc, INEOS Group Holdings S.A. |

Global Industrial Alcohol Market Segmentation: By Type

-

Ethanol

-

Methanol

-

Isopropyl Alcohol

In 2023, based on market segmentation by Type, Ethanol had the highest share of the Global Industrial Alcohol Market. Ethanol's versatility is a significant driver of its adoption across various industries, from automotive to pharmaceuticals. Its ability to serve as a renewable fuel source makes it an attractive alternative to fossil fuels, particularly in the transportation sector, where it is commonly blended with gasoline to enhance octane ratings and reduce emissions. Additionally, ethanol's application in the production of industrial solvents, personal care products, and food additives further underscores its multifaceted nature. The abundant availability of raw materials for ethanol production, including sugarcane, corn, and wheat, ensures a reliable supply chain, mitigating concerns related to sourcing and sustainability. Furthermore, government incentives and subsidies play a crucial role in bolstering the ethanol market. Many countries have implemented policies aimed at promoting biofuels to achieve energy independence and reduce greenhouse gas emissions. These incentives encourage both producers and consumers to transition towards greener alternatives, ultimately driving the growth of the ethanol market. As industries increasingly prioritize sustainability and eco-friendly practices, ethanol's position as a key player in the global energy landscape is expected to strengthen, paving the way for continued innovation and investment in this sector.

Global Industrial Alcohol Market Segmentation: By Application

-

Solvents

-

Chemicals

-

Pharmaceuticals

-

Biofuels

In 2023, based on market segmentation by Application, Solvents had the highest share of the Global Industrial Alcohol Market. The demand for industrial alcohol is significantly driven by its widespread use across a wide range of industries, including paints, coatings, adhesives, and cleaning products. As solvents, industrial alcohols play a critical role in dissolving and mixing various substances, making them essential in manufacturing processes. The versatility of industrial alcohol allows it to serve multiple functions within these sectors, including acting as a solvent for resins and polymers in paint formulations and providing the necessary properties for adhesives and sealants. Additionally, as urbanization and industrialization continue to rise, the need for effective and efficient solvents is expected to grow. This trend is further fueled by increasing environmental regulations that encourage the use of eco-friendly solvents, positioning industrial alcohol as a sustainable alternative to traditional, petroleum-based solvents. Moreover, advancements in technology are leading to improved formulations that enhance the performance of industrial alcohol in various applications. With these factors combined, the industrial alcohol market is poised for significant growth, as businesses increasingly seek reliable and versatile solvents to meet their production needs while adhering to sustainability standards.

Global Industrial Alcohol Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

In 2023, based on market segmentation by Region, North America had the highest share of the Global Industrial Alcohol Market. North America boasts a well-developed manufacturing base that significantly contributes to the growth of the industrial alcohol market. Key industries such as chemicals, pharmaceuticals, and coatings are major consumers of industrial alcohol, utilizing it as an essential ingredient in various applications, including solvents, coatings, and formulations. This robust demand is supported by the region's strong infrastructure, which includes efficient transportation networks and a reliable supply chain that facilitates the timely distribution of industrial alcohol to manufacturers and end-users. Furthermore, the regulatory environment in North America is favorable, with policies and incentives designed to promote the production and use of industrial alcohol as a sustainable alternative to traditional solvents. These regulatory measures not only encourage innovation and investment in the sector but also align with broader environmental goals aimed at reducing reliance on fossil fuels and minimizing carbon footprints. As industries continue to prioritize sustainability and compliance with environmental regulations, the North American industrial alcohol market is well-positioned for growth, driven by both established manufacturing sectors and evolving consumer preferences for greener alternatives. This combination of developed industries, strong infrastructure, and supportive regulatory frameworks creates a conducive environment for the continued expansion of the industrial alcohol market in the region.

COVID-19 Impact Analysis on the Global Industrial Alcohol Market.

The COVID-19 pandemic had a significant impact on the Global Industrial Alcohol Market, both positively and negatively. On one hand, the demand for industrial alcohol, especially ethanol and isopropanol, surged due to their widespread use in hand sanitizers, disinfectants, and other cleaning agents, which became essential for controlling the spread of the virus. The healthcare and personal hygiene sectors experienced unprecedented growth, driving the consumption of alcohol-based products. Manufacturers ramped up production to meet the skyrocketing demand for sanitizers and disinfectants, providing a temporary boost to the market. However, on the other hand, the pandemic also led to supply chain disruptions and labor shortages, which affected the production and distribution of industrial alcohol. The lockdown measures imposed globally resulted in decreased production of biofuels, as transportation and fuel consumption dropped sharply. The reduced demand for ethanol as a biofuel, particularly in the energy and automotive sectors, offset some of the gains made in the healthcare sector. Additionally, the economic slowdown caused a decline in industrial activities, affecting sectors like chemicals and personal care, which are major consumers of industrial alcohol. Overall, while the pandemic created short-term opportunities, it also highlighted vulnerabilities in supply chains and demand fluctuations in the market.

Latest trends / Developments:

The Global Industrial Alcohol Market is witnessing several key trends and developments that are shaping its future trajectory. One of the most prominent trends is the growing demand for bio-based alcohol, particularly ethanol, driven by the global push towards sustainability and reducing carbon footprints. Governments are implementing stricter environmental regulations, and industries are adopting greener practices, leading to increased use of biofuels. Technological advancements, such as the development of second-generation biofuels from non-food biomass, are gaining traction as they help overcome the limitations of traditional feedstocks like corn and sugarcane. Another significant trend is the rising application of industrial alcohol in the pharmaceutical and personal care sectors, spurred by increased health and hygiene awareness post-pandemic. There is also a growing demand for ethanol and isopropanol in the production of sanitizers and disinfectants. Moreover, the market is seeing innovations in fermentation and distillation processes, aiming to make production more cost-effective and energy-efficient. Companies are increasingly focusing on expanding their production capacities and exploring opportunities in emerging markets, particularly in the Asia-Pacific region. Additionally, the market is shifting towards the use of industrial alcohol in eco-friendly products, such as biodegradable plastics, further driving its growth across multiple industries.

Key Players:

-

Cargill, Inc.

-

Archer Daniels Midland Company (ADM)

-

Hindustan Alcohols Ltd.

-

BASF SE

-

The Dow Chemical Company

-

Eastman Chemical Company

-

Methanex Corporation

-

Greenfield Global Inc.

-

Evonik Industries AG

-

Royal Dutch Shell plc

-

INEOS Group Holdings S.A.

Chapter 1. Industrial Alcohol Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Industrial Alcohol Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Industrial Alcohol Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Industrial Alcohol Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Industrial Alcohol Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Industrial Alcohol Market – By Types

6.1 Introduction/Key Findings

6.2 Ethanol

6.3 Methanol

6.4 Isopropyl Alcohol

6.5 Y-O-Y Growth trend Analysis By Types

6.6 Absolute $ Opportunity Analysis By Types, 2024-2030

Chapter 7. Industrial Alcohol Market – By Application

7.1 Introduction/Key Findings

7.2 Solvents

7.3 Chemicals

7.4 Pharmaceuticals

7.5 Biofuels

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Industrial Alcohol Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Types

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Types

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Types

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Types

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Types

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Industrial Alcohol Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Cargill, Inc.

9.2 Archer Daniels Midland Company (ADM)

9.3 Hindustan Alcohols Ltd.

9.4 BASF SE

9.5 The Dow Chemical Company

9.6 Eastman Chemical Company

9.7 Methanex Corporation

9.8 Greenfield Global Inc.

9.9 Evonik Industries AG

9.10 Royal Dutch Shell plc

9.11 INEOS Group Holdings S.A.

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

By 2023, the Global Industrial Alcohol market is expected to be valued at US$ 120 billion.

Through 2030, the Global Industrial Alcohol market is expected to grow at a CAGR of 5.9%.

By 2030, Global Industrial Alcohol Market expected to grow to a value of US$ 180 billion.

North America is predicted to lead the Global Industrial Alcohol market.

The Global Industrial Alcohol Market has segments By Type , Application,and Region.