Industrial Air Dryer Market Size (2024-2030)

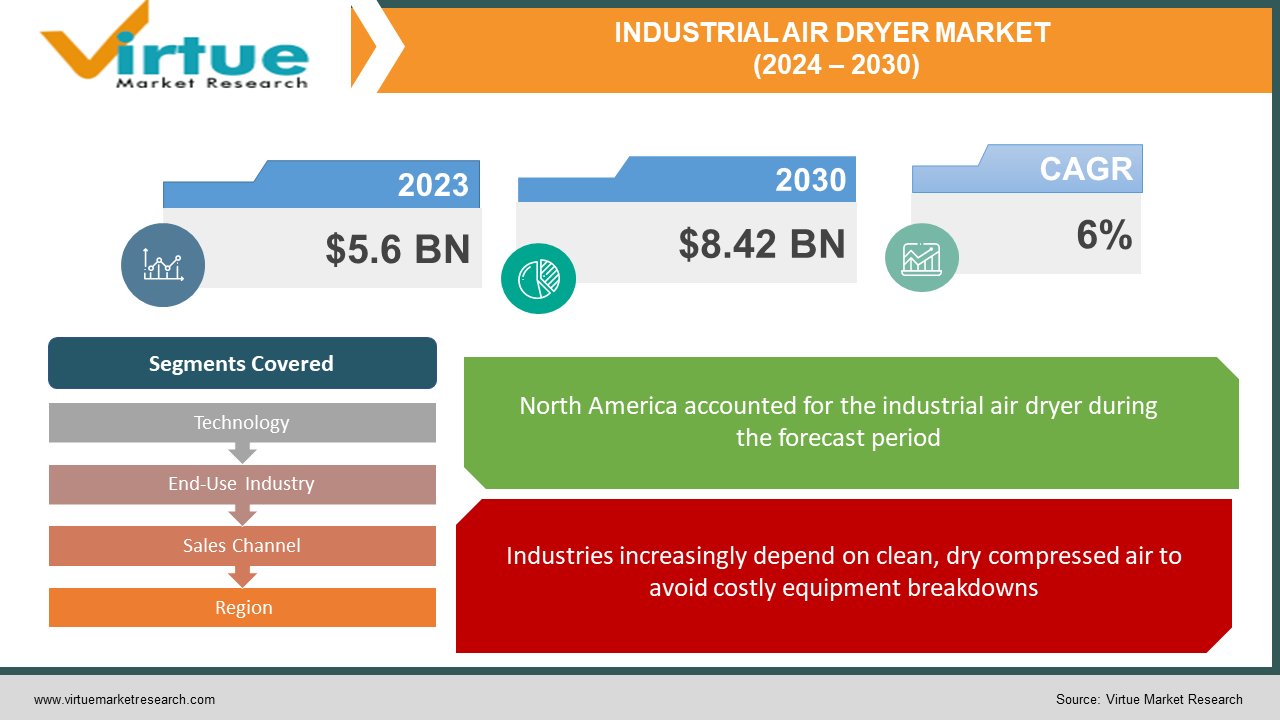

The Industrial Air Dryer Market was valued at USD 5.6 billion in 2023 and is projected to reach a market size of USD 8.42 billion by the end of 2030. Over the cast period of 2024 – 2030, the request is projected to grow at a CAGR of 6%.

The industrial air dryer market is on a steady rise, fueled by several factors. First, industries are increasingly reliant on compressed air for their processes, and clean, dry air is essential to keep equipment functioning efficiently and avoid costly breakdowns. Second, moisture in compressed air can wreak havoc, causing corrosion and rust. Air dryers ensure optimal performance and lifespan for machinery. Third, stricter government regulations on air quality are pushing industries to adopt cleaner technologies, and air dryers fit the bill perfectly. Finally, with rising energy costs, industries are seeking energy-efficient solutions, and manufacturers are responding with improved air dryer technology. While there are challenges, such as the initial investment cost and competition, the future looks bright for the industrial air dryer market as the demand for clean, dry air continues to climb.

Key Market Insights:

The industrial air dryer market is flourishing due to its critical role in ensuring clean and dry compressed air. Many industries rely heavily on compressed air for their processes, but moisture can wreak havoc by causing corrosion and equipment malfunctions. Air dryers act as the solution, removing moisture and safeguarding equipment for optimal performance and lifespan. This translates to significant cost savings for businesses in the long run.

Furthermore, stricter government regulations on air quality are pushing industries to adopt cleaner technologies. Industrial air dryers perfectly align with this growing demand for clean air solutions. Additionally, the rising cost of energy is prompting industries to prioritize efficiency. Manufacturers are actively developing air dryers with improved energy-saving features, making them a more attractive option for cost-conscious businesses.

Looking ahead, the industrial air dryer market is expected to maintain its positive trajectory. Technological advancements are continuously leading to more efficient, reliable, and cost-effective dryers. Furthermore, the demand for air dryers is diversifying across various industries, each with specific drying needs. While the initial investment cost can be a factor, the long-term benefits in terms of equipment protection, energy savings, and regulatory compliance make industrial air dryers a sound investment for businesses.

The Industrial Air Dryer Market Drivers:

Industries increasingly depend on clean, dry compressed air to avoid costly equipment breakdowns.

Many industries, like food and beverage or electronics, rely heavily on compressed air. However, moisture in the air can be catastrophic. It causes corrosion in equipment, leading to malfunctions, product contamination, and costly shutdowns. Industrial air dryers remove this moisture, ensuring smooth operation, protecting equipment, and ultimately saving businesses money on repairs and replacements.

Government regulations push industries to adopt cleaner technologies, and air dryers contribute to cleaner air.

Governments are tightening regulations on air quality, pushing industries to adopt cleaner technologies. Industrial air dryers play a crucial role here. They contribute to cleaner air within facilities by removing moisture that can harbor contaminants and improve overall air quality.

Manufacturers develop air dryers with improved energy-saving features to meet industries' growing cost-reduction needs.

As energy costs soar, industries are laser-focused on optimizing their operations. Manufacturers are responding by developing air dryers with improved energy-saving features. These features, like advanced heat exchangers or variable speed drives, can significantly reduce energy consumption. This focus on efficiency makes air dryers a more attractive option for businesses looking to reduce their environmental impact and operating costs.

New desiccant materials and control systems enhance efficiency and cater to specific drying requirements.

The market is constantly evolving with new and innovative air dryer technologies. These advancements lead to several benefits. For example, new desiccant materials can achieve exceptionally dry air, perfect for sensitive applications in pharmaceuticals or electronics. Additionally, advancements in controls and remote monitoring allow for better optimization of dryer performance, further enhancing efficiency and reducing maintenance needs.

The Industrial Air Dryer Market Restraints and Challenges:

While the industrial air dryer market enjoys a positive outlook, there are challenges that need to be addressed. A significant hurdle is the initial investment cost. Industrial air dryers can be expensive to purchase and install, which can be a barrier for some businesses, particularly smaller operations. Additionally, even though air dryers offer long-term benefits in terms of equipment protection and energy savings, the upfront cost can be a deterrent.

Another challenge lies in the ongoing maintenance needs of air dryers. While regular maintenance is essential for optimal performance and lifespan, it adds to the overall operational cost. Furthermore, a lack of proper knowledge regarding proper utilization and maintenance of these dryers can lead to inefficiencies and even equipment damage.

Finally, the industrial air dryer market faces competition from alternative technologies, though not as prevalent. These alternatives might offer a lower initial cost, but they may not deliver the same level of efficiency or dryness as dedicated air dryers. In some cases, these alternatives might not be suitable for all applications due to limitations in performance or compatibility.

The Industrial Air Dryer Market Opportunities:

The future of the industrial air dryer market brims with opportunity. Firstly, the application of air dryers is reaching beyond traditional manufacturing sectors. Industries like food and beverage, pharmaceuticals, and even electronics, each with specific drying needs, are increasingly relying on air dryer solutions. This diversification opens doors to a wider customer base and fuels market growth. Secondly, with environmental concerns at the forefront, manufacturers are developing air dryers with a sustainable focus. Features like improved energy efficiency and use of recyclable materials cater to the growing demand for environmentally responsible solutions. Thirdly, rapid industrialization in developing economies creates a surge in demand for compressed air systems, and consequently, air dryers. These emerging markets present a significant opportunity for expansion. Finally, the rise of automation and Internet of Things (IoT) technologies opens doors for smarter air dryer solutions. Imagine dryers that self-monitor performance, predict maintenance needs, and optimize energy consumption. This integration with automation and IoT has the potential to revolutionize the market, offering greater efficiency and cost savings.

INDUSTRIAL AIR DRYER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6% |

|

Segments Covered |

By Technology, End-Use Industry, Sales Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Atlas Copco, Ingersoll Rand, Parker Hannifin Corporation, SPX FLOW, Inc., KAeser Kompressoren SE, Donaldson Company, Inc., Fusheng, Quincy, SMC Pneumatics |

Industrial Air Dryer Market Segmentation: By Technology

-

Refrigerated Air Dryers

-

Desiccant Air Dryers

-

Membrane Dryers

-

Heatless Regenerative Dryers

The most dominant segment in the industrial air dryer market by technology is refrigerated air dryers. Their cost-effectiveness and suitability for various applications make them the popular choice. However, the fastest-growing segment is desiccant air dryers. Their ability to achieve extremely dry air caters to the rising demand in sectors like pharmaceuticals and electronics, where even trace amounts of moisture can be critical.

Industrial Air Dryer Market Segmentation: By End-Use Industry

-

Manufacturing

-

Oil & Gas

-

Food & Beverage

-

Electronics

Within the end-use industry segment, Manufacturing reigns supreme, encompassing a vast array of industries like automotive and food & beverage that all rely heavily on compressed air for processes. However, the fastest-growing segment is projected to be Food & Beverage, driven by the increasing focus on stricter quality control and the need to prevent spoilage in a wider range of products. This sector requires specific dryer types based on the application, creating a dynamic and rapidly evolving market.

Industrial Air Dryer Market Segmentation: By Sales Channel

-

Direct Sales

-

Distributors

-

Online Sales Platforms

Direct sales are currently the dominant channel in the industrial air dryer market, as manufacturers can provide technical expertise and after-sales services crucial for complex equipment. However, online sales platforms are experiencing the fastest growth. The convenience and wider reach of online marketplaces are attracting new customers, particularly for smaller capacity dryers or those with readily available technical information. This trend is likely to continue as e-commerce platforms enhance their offerings and user experience.

Industrial Air Dryer Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America has a mature market with established players and high adoption of air dryer technologies. Stringent regulations and a focus on energy efficiency are further driving growth. Like North America, Europe boasts a well-developed market with a strong presence of leading manufacturers. Strict environmental regulations are pushing European industries to adopt cleaner technologies, including air dryers. Asia Pacific is experiencing the fastest growth due to rapid industrialization and increasing demand for compressed air systems. Countries like China and India are witnessing significant growth in sectors like manufacturing and pharmaceuticals, fueling the demand for air dryers.

COVID-19 Impact Analysis on the Industrial Air Dryer Market:

The COVID-19 pandemic's impact on the industrial air dryer market was a mixed bag. Initial disruptions in global supply chains due to lockdowns and travel restrictions led to shortages of materials and delays in production and delivery of air dryers. Additionally, decreased production in certain industries, particularly those heavily impacted by shutdowns, caused a temporary dip in demand. Economic uncertainty also led businesses to postpone investments in new equipment, including air dryers.

However, there were positive aspects as well. The pandemic heightened awareness of hygiene and sanitation across industries, leading to increased demand for air dryers in sectors like food and beverage and pharmaceuticals, where clean and dry air is critical. Furthermore, the rise of e-commerce during this time benefited online sales channels for readily available air dryer models.

Looking ahead, the long-term impact of COVID-19 is expected to be positive. A resurgence in manufacturing activity as economies recover will likely increase demand for air dryers. The heightened focus on hygiene is likely to persist, driving demand in sectors with strict hygiene requirements. Additionally, the market is expected to see continued advancements in air dryer technology, leading to more efficient, cost-effective, and user-friendly solutions. In conclusion, while the pandemic brought temporary challenges, the industrial air dryer market is well-positioned for continued growth.

Latest Trends/ Developments:

The industrial air dryer market is buzzing with exciting advancements. One key trend is the integration of automation and Internet of Things (IoT). Imagine air dryers that self-monitor performance, predict maintenance needs, and optimize energy use. This translates to preventative maintenance, reduced downtime, and significant cost savings. Furthermore, the concept of smart manufacturing is influencing air dryer design. Features like remote monitoring, data analysis for performance optimization, and integration with factory automation systems are becoming increasingly common. Energy efficiency remains a top priority, with manufacturers developing air dryers featuring improved heat exchangers, variable speed drives, and eco-friendly refrigerants. These features not only reduce operational costs but also contribute to environmental sustainability. The development of new desiccant materials capable of achieving exceptionally dry air is another exciting trend, particularly for sensitive applications. Research on sustainable and recyclable desiccant materials is also ongoing. Finally, manufacturers are prioritizing user experience by designing air dryers that are easier to operate and maintain. This includes user-friendly interfaces, clear instructions, and readily available diagnostic tools. These are just a few examples of how the industrial air dryer market is constantly evolving, paving the way for even more innovative and efficient solutions in the future.

Key Players:

-

Atlas Copco

-

Ingersoll Rand

-

Parker Hannifin Corporation

-

SPX FLOW, Inc.

-

KAeser Kompressoren SE

-

Donaldson Company, Inc.

-

Fusheng

-

Quincy

-

SMC Pneumatics

Chapter 1. Industrial Air Dryer Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Industrial Air Dryer Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Industrial Air Dryer Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Industrial Air Dryer Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Industrial Air Dryer Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Industrial Air Dryer Market – By Technology

6.1 Introduction/Key Findings

6.2 Refrigerated Air Dryers

6.3 Desiccant Air Dryers

6.4 Membrane Dryers

6.5 Heatless Regenerative Dryers

6.6 Y-O-Y Growth trend Analysis By Technology

6.7 Absolute $ Opportunity Analysis By Technology, 2024-2030

Chapter 7. Industrial Air Dryer Market – By End-Use Industry

7.1 Introduction/Key Findings

7.2 Manufacturing

7.3 Oil & Gas

7.4 Food & Beverage

7.5 Electronics

7.6 Y-O-Y Growth trend Analysis By End-Use Industry

7.7 Absolute $ Opportunity Analysis By End-Use Industry, 2024-2030

Chapter 8. Industrial Air Dryer Market – By Sales Channel

8.1 Introduction/Key Findings

8.2 Direct Sales

8.3 Distributors

8.4 Online Sales Platforms

8.5 Y-O-Y Growth trend Analysis By Sales Channel

8.6 Absolute $ Opportunity Analysis By Sales Channel, 2024-2030

Chapter 9. Industrial Air Dryer Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Technology

9.1.3 By End-Use Industry

9.1.4 By Sales Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Technology

9.2.3 By End-Use Industry

9.2.4 By Sales Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Technology

9.3.3 By End-Use Industry

9.3.4 By Sales Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Technology

9.4.3 By End-Use Industry

9.4.4 By Sales Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Technology

9.5.3 By End-Use Industry

9.5.4 By Sales Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Industrial Air Dryer Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Atlas Copco

10.2 Ingersoll Rand

10.3 Parker Hannifin Corporation

10.4 SPX FLOW, Inc.

10.5 KAeser Kompressoren SE

10.6 Donaldson Company, Inc.

10.7 Fusheng

10.8 Quincy

10.9 SMC Pneumatics

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Industrial Air Dryer Market was valued at USD 5.6 billion in 2023 and is projected to reach a market size of USD 8.42 billion by the end of 2030. Over the cast period of 2024 – 2030, the request is projected to grow at a CAGR of 6%.

Dependency on Clean, Dry Compressed Air, Stringent Air Quality Regulations, Energy Efficiency Focus, Technological Advancements.

Direct Sales, Distributors, Online Sales Platforms.

The Asia Pacific region reigns supreme in the industrial air dryer market, driven by rapid industrialization and a growing demand for compressed air systems.

Atlas Copco, Ingersoll Rand, Parker Hannifin Corporation, SPX FLOW, Inc., KAeser Kompressoren SE, Donaldson Company, Inc., Fusheng, Quincy, SMC Pneumatics.