Industrial Absorbents Market Size (2024 – 2030)

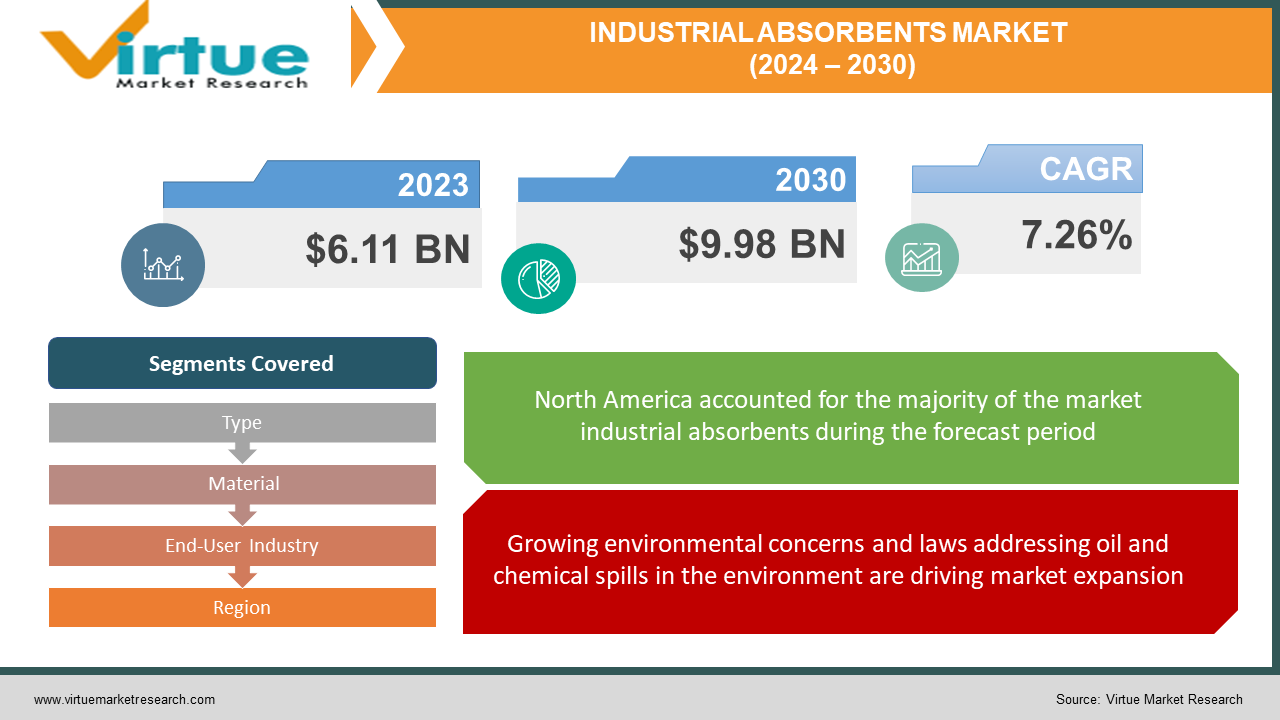

The Global Industrial Absorbents Market will grow from USD 6.11 billion in 2023 to USD 9.98 billion in 2030, recording a CAGR above 7.26% over the forecast period from 2024-2030

Industrial absorbents are essential in mitigating and addressing spills involving chemicals and oil. These hazardous substances pose significant risks to both the environment and public health when accidentally released. Typically, chemical spills occur during the transportation or storage of these substances. To prevent such incidents, chemical producers employ industrial absorbents. These absorbents, often made from natural materials, help companies in the industrial absorbents sector comply with stringent environmental regulations. They are increasingly utilized to clean up harmful hydrocarbon oil spills in an eco-friendly manner. There is a growing emphasis on research and development to create industrial absorbents that effectively absorb petroleum products.

The market for industrial absorbents is expected to grow due to regulations on oil and chemical spills and heightened environmental concerns. However, challenges such as the saturation and buoyancy issues of absorbent products, along with the potential for more cost-effective alternatives, may impede this growth. The demand in various chemical industries significantly drives the market for industrial absorbents. Additionally, their application in managing spills on land and water contributes to the global expansion of this market.

Projected to experience a steady increase in demand over the coming years, the global industrial absorbents market is bolstered by heightened environmental awareness and stricter regulations pertaining to chemical and oil spills. Nevertheless, the availability of economical alternatives to industrial absorbent products, like crushed clay and Montmorillonite, could potentially restrain the market's growth worldwide in the foreseeable future.

Key Market Insights:

Industrial absorbents are integrally tied with the chemical industry. The absorbents aid in the absorption of chemicals spilled during the manufacturing or transportation processes, hence lowering the environmental impact of these incidents. Globally, the chemical sector is expanding with higher output, which will drive market growth. The India Brand Equity Foundation (IBEF) predicts that small and medium-sized enterprises in the domestic chemical sector will grow by 18-23% in FY22. Similarly, the June 2021 Mid-Year US Chemical Industry Outlook study predicts that chemical volumes and shipments in the United States will rise by 3.2% and 8.2% in 2022, respectively.

This rapid expansion in the global chemical industry will increase demand for industrial absorbents, propelling the market ahead. Because the oil and gas industry is prone to oil and hydrocarbon product leaks, it has been a major user of industrial absorbents. Sepiolite and diatomaceous earth are two absorbents frequently utilised in the oil and gas industry for absorbing. The oil and gas industry is expanding rapidly due to refinery development, which will drive market growth.

Global Industrial Absorbents Market Drivers:

Growing environmental concerns and laws addressing oil and chemical spills in the environment are driving market expansion.

Oil and chemical spills have the ability to disrupt entire ecosystems, posing threats not only to the environment but also to human life. These spills, whether on land or in water, have far-reaching consequences, particularly for coastal habitats rich in corals, seabirds, fish, and marshlands. Leaks from production processes or pipeline ruptures can contaminate subterranean water reservoirs. The aftermath of spills also imposes huge economic costs on governments and businesses, mandating spending on healthcare for affected persons and extensive cleanup efforts. A dramatic example is BP Plc's USD 65.77 billion response, cleanup, and compensation costs following the 2010 Gulf of Mexico oil spill. As a result, governments around the world are adopting proactive measures to defend against the negative impacts of pollution by enacting environmental protection policies and regulations.

Environmental regulators closely monitor corporations' efforts to avoid and manage oil or chemical accidents. Governments around the world prepare contingency plans and have spill control resources on hand as a precaution. Media and non-governmental organisations (NGOs) play an important role in raising awareness and pressing responsible agencies and organisations to take action to reduce the environmental impact of spills. As worries about spill effects grow and environmental rules tighten, the industrial absorbents market is expected to expand significantly.

Global Industrial Absorbents Market Restraints and Challenges:

The saturation and buoyancy of industrial absorbent materials pose a hindrance to market growth.

Spill control devices made from industrial absorbents have unique absorption capacities that vary depending on their size and intended usage. These goods, which include pads, rolls, pillows, booms, and socks, become saturated when exposed to fluids while in use. Furthermore, spill control products with oleophilic or hydrophobic qualities lose their flotation ability after prolonged contact with oil, chemicals, or water, reducing their efficacy in absorbing and recovering fluid substances.

This inefficiency complicates determining the saturation level of certain spill control products. Natural organic absorbents, among other industrial absorbent materials, are combustible and lose efficiency when exposed to petroleum fluids, limiting their use in essential industries such as oil and gas and chemicals, which are major users of industrial absorbents. As a result, saturation and loss of floating capacity in spill control products appear as critical constraints on the growth of the industrial absorbents market.

Reducing large-scale oil leaks poses a challenge to the market.

Significant spills can occur during vessel operations such as loading and unloading and bunkering for a variety of reasons, including collisions, groundings, hull or equipment failures, fires, explosions, inclement weather, or human error. According to the International Tanker Owners Pollution Federation Limited, the number of large spills has fallen significantly over the last 46 years. The average number of spills per year decreased from 24.5 to 1.8 Tonnes. This decline is due to lessons learnt from previous instances.

The decreased frequency of major oil spills has resulted in lower demand for spill response or control solutions, which has impacted industrial absorbent sales. Given that oil and gas continue to be a large user of these absorbents and related products, a decrease in big oil spills may have an impact on spill response and product demand.

Global Industrial Absorbents Market Opportunities:

Reusable industrial absorbents have similar qualities to their non-reusable counterparts. They can be used several times before becoming saturated and losing their water-repellent properties. Only a few key market companies provide these reusable industrial absorbent goods in the industrial absorbents industry. These reusable variations have numerous applications, primarily in the oil and gas and food processing industries, specifically in the universal and oil-only categories. Furthermore, occupational safety rules that prioritise worker safety will drive the rise of reusable absorbents. They have an important role in absorbing floor moisture and reducing slips and falls. Furthermore, with significant research and development efforts, it is possible to manufacture high-quality and cost-effective reusable absorbent goods, opening the way for their increased acceptance in a variety industries.

INDUSTRIAL ABSORBENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.26% |

|

Segments Covered |

By Type, Material, End-User Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

3M Co, Ansell Ltd, Brady Corp , Decorus Europe Ltd, Meltdown Technologies Inc., Oil-Dri Corp of America , Schoeller Industries GmbH, Fentex Ltd., Complete Environmental Products Inc., Tolsa SA |

Global Industrial Absorbents Market Segmentation: By Type

-

Organic

-

Inorganic

-

Synthetic

The market is divided into three types: organic, inorganic, and synthetic. In terms of revenue, the Organic category leads the global market for industrial absorbents. The growing demand for environmentally friendly and biodegradable absorbents in a range of industries, including oil and gas, automotive, and chemicals, is one of the key drivers of organic segment growth. Organic absorbents are less hazardous to the environment than synthetic absorbents since they are made mostly from natural materials such as maize cobs, straw, sawdust, and wood chips. These absorbents are also well known for their great absorption capability, making them ideal for use in hazardous spill response situations.

Global Industrial Absorbents Market Segmentation: By Material

-

Clay

-

Diatomaceous Earth

-

Cellulose

-

Polypropylene

-

Others

The market is divided into five segments based on material: clay, diatomaceous earth, cellulose, polypropylene, and others. The clay category earns the highest revenue. One of the key drivers of this market's growth is increased demand for clay absorbents in a variety of industries, including oil and gas, chemical, and manufacturing. Clay absorbents' high absorbency makes them ideal for use in hazardous spill response situations. They are a popular alternative for businesses wanting to lessen their environmental impact because they are cost-effective, lightweight, and conveniently accessible. The diatomaceous earth sector is predicted to increase significantly over the forecast period.

Global Industrial Absorbents Market Segmentation: By End-User Industry

-

Automotive

-

Oil and Gas

-

Healthcare

-

Aerospace

-

Chemical

-

Railway

-

Others

The market is divided into end-user industries, which include automotive, oil and gas, food processing, healthcare, aerospace, and chemical, railway, and others. The chemical industry dominated the industrial absorbent market in 2023. Various absorbent materials are used to collect accidentally spilled chemicals or during transportation. Absorbents such as sepiolite and diatomaceous earth are increasingly used in chemical absorbing applications.

The global chemical sector is rapidly expanding, which will drive market growth. For example, the American Chemistry Council's June 2022 report predicts that overall US chemical production, will increase by 12.3% in 2022. Such global expansion in the chemical sector would increase the use of various absorbents, resulting in market growth over the forecast period. During the projection period, the oil and gas industry will significantly contribute to market growth.

Global Industrial Absorbents Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The North American region is predicted to dominate the global Industrial Absorbent Market. The region is home to several significant oil and gas businesses, which are among the main users of industrial absorbents. The region's increased need for industrial absorbents can be attributed to the adoption of stringent restrictions by regulatory agencies such as the Environmental Protection Agency (EPA) to prevent oil spills and ensure environmental safety. These rules have required businesses to use absorbent materials for industrial maintenance and oil spill cleanup, hence boosting the region's industrial absorbent industry. The European market is likely to rise significantly over the forecast period, owing to rising demand for industrial absorbents in the automotive industry.

COVID-19 Impact Analysis on the Global Industrial Absorbents Market:

Prior to the COVID-19 epidemic, the industrial absorbents industry was dominated by businesses like as food processing, oil and gas, chemical, automotive, and healthcare. Absorbents are substances or materials that have the ability to absorb a liquid substance. They are used to handle spills or discharges of oils, hydrocarbons, fuels, old oils, naphthalene, and acenaphthene, among other things, that can harm the environment. Various sectors were forced to slow down operations in 2020 due to supply chain disruptions caused by national and international border closures. The epidemic slowed production operations due to restrictions enforced by government officials in numerous countries. The pandemic also generated price variations in raw supplies. The epidemic resulted in an unprecedented fall in world oil demand. The oil demand-supply imbalance coincided with a decline in the demand for chemicals and refined products as a result of the pandemic's industrial slowdown and travel restrictions. Large oil and gas corporations responded by reducing capital and operating expenses. All of these issues reduced demand for industrial absorbents.

Recent Trends and Developments in the Industrial Absorbents Market:

In August 2023, the prominent industrial absorbents products provider, New Pig Corporation, successfully acquired the 165,000 square foot warehouse facility in Altoona, formerly owned by US Foods. This strategic acquisition aims to facilitate the company's expansion and support ongoing initiatives in the development of industrial absorbents.

In January 2023, ANSELL Ltd. disclosed a collaborative agreement with Vizient, Inc. for the supply of room turnover products. As per the terms of this new partnership, members of Vizient will benefit from discounted prices on a diverse range of room turnover items, including absorbent floor pads, disposable linens, mops, waste bags, patient positioning straps, and turnover packs.

Key Players:

-

3M Co

-

Ansell Ltd

-

Brady Corp

-

Decorus Europe Ltd

-

Meltdown Technologies Inc.

-

Oil-Dri Corp of America

-

Schoeller Industries GmbH

-

Fentex Ltd.

-

Complete Environmental Products Inc.

-

Tolsa SA

Chapter 1. Industrial Absorbents Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Industrial Absorbents Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Industrial Absorbents Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Industrial Absorbents Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Industrial Absorbents Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Industrial Absorbents Market – By Type

6.1 Introduction/Key Findings

6.2 Organic

6.3 Inorganic

6.4 Synthetic

6.5 Y-O-Y Growth trend Analysis By Type

6.6 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Industrial Absorbents Market – By Material

7.1 Introduction/Key Findings

7.2 Clay

7.3 Diatomaceous Earth

7.4 Cellulose

7.5 Polypropylene

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Material

7.8 Absolute $ Opportunity Analysis By Material, 2024-2030

Chapter 8. Industrial Absorbents Market – By End-User Industry

8.1 Introduction/Key Findings

8.2 Automotive

8.3 Oil and Gas

8.4 Healthcare

8.5 Aerospace

8.6 Chemical

8.7 Railway

8.8 Others

8.9 Y-O-Y Growth trend Analysis By End-User Industry

8.10 Absolute $ Opportunity Analysis By End-User Industry, 2024-2030

Chapter 9. Industrial Absorbents Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type

9.1.3 By Material

9.1.4 By By End-User Industry

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type

9.2.3 By Material

9.2.4 By End-User Industry

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type

9.3.3 By Material

9.3.4 By End-User Industry

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type

9.4.3 By Material

9.4.4 By End-User Industry

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type

9.5.3 By Material

9.5.4 By End-User Industry

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Industrial Absorbents Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 3M Co

10.2 Ansell Ltd

10.3 Brady Corp

10.4 Decorus Europe Ltd

10.5 Meltdown Technologies Inc.

10.6 Oil-Dri Corp of America

10.7 Schoeller Industries GmbH

10.8 Fentex Ltd.

10.9 Complete Environmental Products Inc.

10.10 Tolsa SA

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Industrial Absorbents Market size is valued at USD 6.11 billion in 2023.

The worldwide Global Industrial Absorbents Market growth is estimated to be 7.26% from 2024 to 2030.

The Global Industrial Absorbents Market is segmented By Type (Organic, Inorganic, and Synthetic), By Material (Clay, Diatomaceous Earth, Cellulose, and Polypropylene), and By End-User Industry (Automotive, Oil and Gas, Healthcare, Aerospace).

The Global Industrial Absorbents Market is expected to develop as industry prioritise sustainability. Increasing environmental restrictions and the desire for eco-friendly solutions open up new prospects for innovative absorbent materials. Advancements in nanotechnology, as well as an emphasis on circular economy principles, are driving the market's potential growth.

The COVID-19 pandemic has impacted the Global Industrial Absorbents Market by disrupting supply chains, affecting output, and producing demand swings. Enhanced hygiene controls and an increase in healthcare-related waste have driven increasing demand for industrial absorbents, altering market dynamics and emphasising the significance of flexible supply networks.