Industrial 3D Printing Market Size (2025 – 2030)

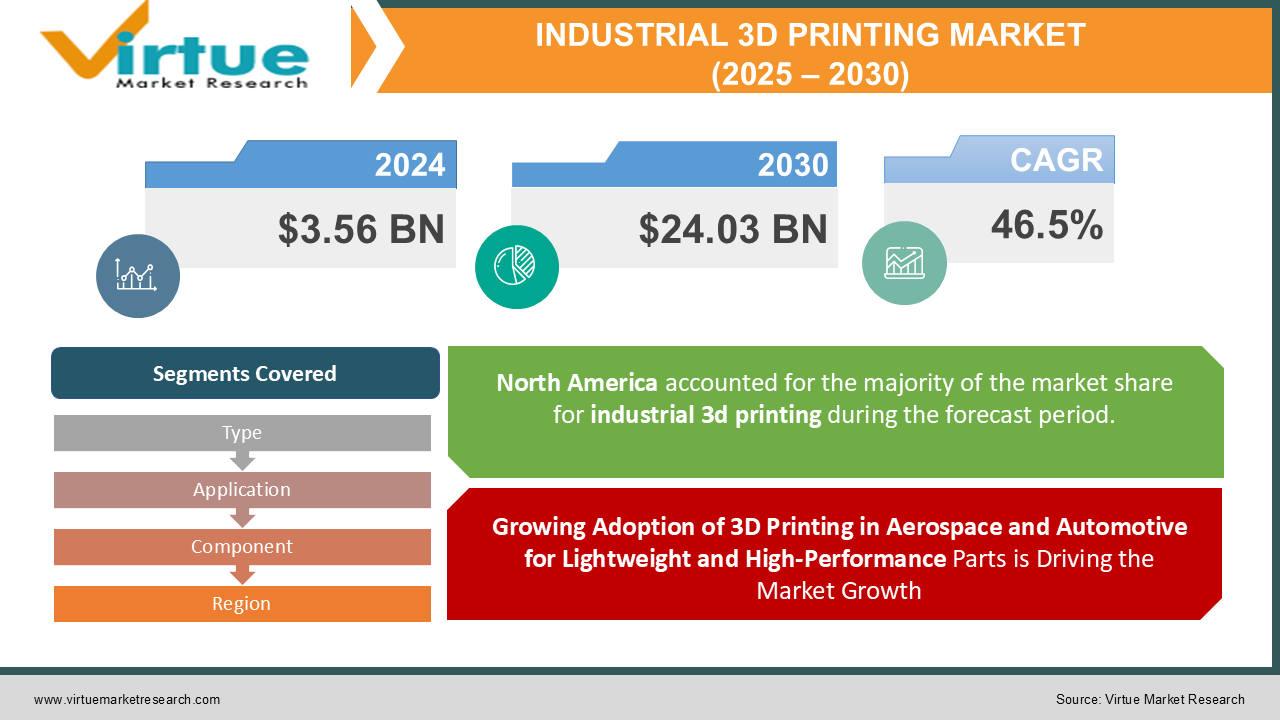

The Global Industrial 3D Priting Market was valued at USD 3.56 billion in 2024 and is projected to reach a market size of USD 24.03 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 46.5%.

The industrial 3D printing market is revolutionizing manufacturing by applying rapid prototyping, on-demand production, and cost-efficient customization across multiple industries. Utilizing advanced additive manufacturing techniques, industrial 3D printing allows for the creation of complex geometries and high-performance components with reduced material waste. Industries such as aerospace, automotive, healthcare, and consumer goods are rapidly adopting 3D printing to enhance efficiency and streamline production processes. The market is experiencing strong growth due to technological advancements, increasing adoption of Industry 4.0 practices, and rising demand for sustainable and lightweight materials. As research and development continue to push the boundaries of 3D printing capabilities, the market is set to expand significantly in the coming years.

Key Market Insights:

-

The industrial 3D printing market is experiencing a rise in adoption due to its ability to produce complex, lightweight, and durable components with minimal material waste. The automotive and aerospace industries are among the largest adopters, with an increasing focus on reducing production costs and improving efficiency.

-

In aerospace, 3D printing has enabled a weight reduction of up to 60% in certain aircraft components, leading to enhanced fuel efficiency. Meanwhile, in the healthcare sector, over 2 million medical implants and prosthetics have been produced using 3D printing technologies, showcasing its potential in patient-specific solutions.

-

Advancements in materials and printing technologies have driven significant improvements in the industrial 3D printing sector. Metal 3D printing, especially in titanium and aluminum, has gained popularity due to its high strength-to-weight ratio.

-

Additionally, polymer-based printing is expected to grow at an accelerated rate, with the demand for high-performance thermoplastics increasing by 15% annually. The shift toward bio-based and recyclable materials is also shaping the market, as sustainability remains a key focus for manufacturers.

-

Geographically, North America and Europe continue to lead the industrial 3D printing market, with over 50% of global installations concentrated in these regions. However, the Asia-Pacific region is experiencing the fastest growth, driven by rising government investments in additive manufacturing and the rapid expansion of the automotive and electronics industries. With continuous innovation and expanding applications, industrial 3D printing is set to redefine traditional manufacturing processes across industries worldwide.

Industrial 3D Printing Market Drivers:

Growing Adoption of 3D Printing in Aerospace and Automotive for Lightweight and High-Performance Parts is Driving the Market Growth

Industrial 3D printing is revolutionizing the aerospace and automotive industries by enabling the production of lightweight yet durable components, reducing material waste, and enhancing fuel efficiency. The ability to create complex geometries and reduce the number of assembly parts enhances design flexibility and performance. Major companies like Boeing, Airbus, Tesla, and Ford are heavily investing in additive manufacturing to streamline production and reduce costs. This shift is accelerating the demand for industrial 3D printing, making it a key driver of market growth.

Increasing Use of 3D Printing in Healthcare for Patient-Specific Medical Implants and Prosthetics

The healthcare industry is leveraging 3D printing for the customization of medical implants, prosthetics, and even bioprinting of tissues, enhancing patient care and treatment outcomes. Personalized implants reduce surgery time and improve compatibility, leading to better recovery rates. Additionally, the production of 3D-printed surgical guides and anatomical models helps surgeons aim complex procedures with greater accuracy. With the rising geriatric population and increasing demand for precision medicine, the medical sector is becoming a major growth engine for industrial 3D printing.

Increased Advancements in Materials and Multi-Material Printing for Enhanced Durability and Functionality

The development of advanced materials such as high-performance polymers, metal alloys, and ceramics has significantly expanded the applications of industrial 3D printing. Multi-material printing capabilities allow for the production of functional components with different mechanical properties, electrical conductivity, and thermal resistance. This has led to increased adoption in industries such as electronics, defense, and consumer goods. Research into nanomaterials and bio-compatible substances is further driving the evolution of industrial 3D printing, making it a crucial technology for future manufacturing.

Cost Reduction and Supply Chain Optimization Through On-Demand and Localized Manufacturing

Industrial 3D printing allows companies to produce parts on demand, reducing the need for large inventories and complex supply chains. By manufacturing closer to end-users, businesses can lower transportation costs, minimize lead times, and enhance supply chain resilience. This is particularly beneficial in times of global disruptions, such as the COVID-19 pandemic, when traditional manufacturing faced delays and shortages. As more companies realize the cost-saving and efficiency benefits of additive manufacturing, the market is witnessing a surge in demand across various industries.

Industrial 3D Printing Market Restraints and Challenges:

Increasing Initial Investment, Material Costs, and Limited Scalability Pose Significant Barriers to Widespread Adoption

Despite its transformative potential, industrial 3D printing faces substantial challenges that affect its widespread adoption. One of the primary restraints is the high initial investment required for industrial-grade 3D printers, software, and skilled labor, making it cost-prohibitive for small and medium-sized enterprises (SMEs). Additionally, the cost of advanced materials such as high-performance polymers, specialized metals, and composites remains significantly higher than traditional manufacturing materials, limiting cost-effectiveness in mass production. Another major challenge is limited scalability and production speed compared to traditional manufacturing methods like injection molding or CNC machining. While 3D printing excels in prototyping and low-volume production, it struggles to compete with high-speed, large-scale production techniques.

Moreover, quality control and standardization issues remain critical challenges. Unlike traditional methods with well-established standards, industrial 3D printing still faces inconsistencies in part strength, surface finish, and repeatability. Regulatory approvals, particularly in aerospace, healthcare, and automotive applications, require strict compliance with safety and durability standards, leading to slower adoption rates.

Industrial 3D Printing Market Opportunities:

The medical tourism market presents major opportunities driven by advancements in healthcare infrastructure, cost-effective treatments, and increasing patient mobility. Countries with state-of-the-art medical facilities and specialized treatments are attracting international patients seeking high-quality yet affordable healthcare services. Emerging markets, particularly in Asia-Pacific, the Middle East, and Latin America, are positioning themselves as global medical hubs due to lower treatment costs, shorter waiting times, and highly skilled medical professionals. Additionally, the rise of wellness tourism and demand for elective procedures, such as cosmetic surgery, fertility treatments, and dental care, are further fueling growth. Governments in various countries are actively promoting medical tourism by implementing favorable visa policies, healthcare accreditation programs, and international collaborations to enhance patient trust and streamline medical travel.

INDUSTRIAL 3D PRINTING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

46.5% |

|

Segments Covered |

By Type, Application, Component, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Stratasys Ltd., 3D Systems Corporation, EOS GmbH, GE Additive, HP Inc., Materialise NV, SLM Solutions Group AG, Renishaw PLC, ExOne Company, Voxeljet AG, Markforged, Inc., Desktop Metal, Inc.,Proto Labs, Inc. |

Industrial 3D Printing Market Segmentation: By Type

-

Polymer-Based

-

Metal-Based

-

Ceramic-Based

-

Composites

The fastest-growing segment is polymer-based 3D printing, driven by rising demand for rapid prototyping and cost-effective production. Polymers, especially high-performance thermoplastics like PEEK, ABS, and Nylon, are widely used in medical, consumer goods, and industrial manufacturing. The affordability, lightweight properties, and ease of customization make polymer-based 3D printing an attractive option, especially as innovations in multi-material printing and bio-compatible polymers drive further adoption.

The ceramic-based segment is gaining traction in electronics and biomedical applications, enhanced by its high heat resistance and biocompatibility. Ceramics are increasingly used for dental implants, aerospace components, and high-temperature-resistant parts, positioning this segment for gradual growth.

The composites segment, incorporating carbon fiber and glass fiber, is also emerging as a key player in industrial 3D printing. This segment is widely adopted in automotive and aerospace applications, offering an excellent strength-to-weight ratio and enhanced durability.

Industrial 3D Printing Market Segmentation: By Application

-

Aerospace

-

Education & Research

-

Defense

-

Industrial

-

Automotive

-

Others

The aerospace segment dominates the industrial 3D printing market, as the industry widely uses additive manufacturing for lightweight, high-strength components. Aircraft manufacturers leverage metal 3D printing for producing engine parts, brackets, and structural components, reducing material wastage and enhancing fuel efficiency. The ability to create complex geometries and custom parts without extensive tooling makes 3D printing highly valuable in aerospace applications.

The fastest-growing segment is automotive, attracted by the increasing adoption of 3D printing for rapid prototyping, tooling, and end-use part production. Automakers use polymer and metal-based 3D printing to accelerate design iterations, reduce costs, and enhance performance with lightweight, high-strength parts. With growing demand for electric vehicles (EVs) and sustainable manufacturing, 3D printing is playing a crucial role in the transformation of the automotive sector.

Industrial 3D Printing Market Segmentation: By Component

-

Material

-

Technology

-

Services

The technology segment dominates, as advancements in additive manufacturing techniques drive widespread adoption across industries. Innovations in SLA (Stereolithography), SLS (Selective Laser Sintering), FDM (Fused Deposition Modeling), and DMLS (Direct Metal Laser Sintering) have enhanced precision, scalability, and efficiency, making 3D printing a key tool for industrial production.

Meanwhile, the material segment is the fastest-growing, fueled by the increasing demand for high-performance polymers, advanced metal powders, and composite materials. The development of biodegradable, high-temperature-resistant, and aerospace-grade materials has further expanded the market's potential. Additionally, the services segment plays an important role, as companies increasingly outsource 3D printing solutions for rapid prototyping, customization, and low-volume manufacturing, reducing costs and optimizing supply chains.

Industrial 3D Printing Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America gains the largest share in the industrial 3D printing market, accounting for approximately 35% of the global revenue. This dominance is driven by the strong presence of key market players, extensive R&D investments, and the widespread adoption of additive manufacturing in the aerospace, defense, and healthcare industries. The U.S. leads in innovation, with advanced prototyping and large-scale industrial production using 3D printing.

Asia-Pacific is the fastest-growing region and is projected to expand rapidly due to increasing industrialization, government support for advanced manufacturing, and rising adoption of 3D printing in automotive and electronics industries. Countries like China, Japan, and South Korea are heavily investing in additive manufacturing technologies, with China emerging as a manufacturing hub for cost-effective 3D-printed products. This region is expected to experience the highest growth rate in the coming years.

COVID-19 Impact Analysis on the Global Industrial 3D Printing Market:

The COVID-19 pandemic significantly impacted the industrial 3D printing market, initially disrupting supply chains and slowing down manufacturing activities because of lockdowns and workforce shortages. However, the crisis also highlighted the advantages of additive manufacturing, as 3D printing emerged as a critical solution for rapidly producing essential medical supplies such as ventilator parts, face shields, and nasal swabs. This demonstrated the technology’s potential for decentralized and on-demand production, leading to increased investments in industrial 3D printing solutions. Post-pandemic, industries such as healthcare, aerospace, and automotive have accelerated their adoption of 3D printing to enhance supply chain resilience and reduce reliance on traditional manufacturing processes. Companies are focusing on localized production, material innovations, and mass customization to adapt to changing market demands.

Latest Trends/ Developments:

The industrial 3D printing market is experiencing significant advancements, with increased adoption of AI and automation to enhance precision, speed, and efficiency in additive manufacturing. AI-driven design optimization and real-time monitoring are revolutionizing production workflows, reducing material waste, and improving product quality. Additionally, hybrid manufacturing, which integrates 3D printing with traditional techniques like CNC machining, is gaining traction, offering cost-effective solutions for industries such as aerospace, automotive, and healthcare.

Key Players:

-

Stratasys Ltd.

-

3D Systems Corporation

-

EOS GmbH

-

GE Additive

-

HP Inc.

-

Materialise NV

-

SLM Solutions Group AG

-

Renishaw PLC

-

ExOne Company

-

Voxeljet AG

-

Markforged, Inc.

-

Desktop Metal, Inc.

-

Proto Labs, Inc.

Chapter 1. Industrial 3D Printing Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Industrial 3D Printing Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Industrial 3D Printing Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Industrial 3D Printing Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Industrial 3D Printing Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Industrial 3D Printing Market – BY TYPE

6.1 Introduction/Key Findings

6.2 Polymer-Based

6.3 Metal-Based

6.4 Ceramic-Based

6.5 Composites

6.6 Y-O-Y Growth trend Analysis BY TYPE

6.7 Absolute $ Opportunity Analysis BY TYPE, 2025-2030

Chapter 7. Industrial 3D Printing Market – BY APPLICATION

7.1 Introduction/Key Findings

7.2 Polymer-Based

7.3 Metal-Based

7.4 Ceramic-Based

7.5 Composites

7.6 Y-O-Y Growth trend Analysis BY APPLICATION

7.7 Absolute $ Opportunity Analysis BY APPLICATION, 2025-2030

Chapter 8. Industrial 3D Printing Market – BY COMPONENT

8.1 Introduction/Key Findings

8.2 Material

8.3 Technology

8.4 Services

8.5 Y-O-Y Growth trend Analysis BY COMPONENT

8.6 Absolute $ Opportunity Analysis BY COMPONENT, 2025-2030

Chapter 9. Industrial 3D Printing Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 BY TYPE

9.1.3 BY APPLICATION

9.1.4 BY COMPONENT

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 BY TYPE

9.2.3 BY APPLICATION

9.2.4 BY COMPONENT

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 BY TYPE

9.3.3 BY APPLICATION

9.3.4 BY COMPONENT

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 BY TYPE

9.4.3 BY APPLICATION

9.4.4 BY COMPONENT

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 BY TYPE

9.5.3 BY APPLICATION

9.5.4 BY COMPONENT

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Industrial 3D Printing Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Stratasys Ltd.

10.2 3D Systems Corporation

10.3 EOS GmbH

10.4 GE Additive

10.5 HP Inc.

10.6 Materialise NV

10.7 SLM Solutions Group AG

10.8 Renishaw PLC

10.9 ExOne Company

10.10 Voxeljet AG

10.11 Markforged, Inc.

10.12 Desktop Metal, Inc.

10.13 Proto Labs, Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Global Industrial 3D Printing Market was valued at USD 3.56 billion in 2024 and is projected to reach a market size of USD 24.03 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 46.5%.

Advancements in materials, customization demand, and cost-efficient production drive industrial 3D printing growth.

Based on components, the Global Industrial 3D Printing Market is segmented into Material, Technology, and Services.

North America is the most dominant region in the global industrial 3D printing market.

Stratasys Ltd., 3D Systems Corporation, EOS GmbH, and GE Additive are the leading players in the Global Industrial 3D Printing Market.